Republican Divisions Threaten Trump's Tax Plan

Table of Contents

Internal GOP Conflicts on Tax Cuts

Disagreements within the Republican party regarding the details of the Trump tax plan are significant and multifaceted. This internal GOP conflict threatens to derail the entire initiative. Key areas of contention include the scale of proposed tax cuts, the prioritization of cuts (corporate versus individual), concerns about the long-term fiscal impact and the national debt, and differing approaches to tax simplification.

-

Disagreements on the Scale of Tax Cuts: Some Republicans advocate for sweeping, across-the-board tax cuts, while others favor a more targeted and fiscally conservative approach. This fundamental disagreement creates significant hurdles in reaching a consensus.

-

Corporate vs. Individual Tax Cuts: The debate over whether to prioritize corporate tax cuts to stimulate economic growth or focus on individual tax cuts to benefit average Americans further fuels the internal conflict. This tension reflects differing economic philosophies within the Republican party.

-

Fiscal Responsibility Concerns: A significant faction within the GOP expresses deep concern about the potential impact of large tax cuts on the national debt. These fiscally conservative Republicans are demanding spending cuts or alternative revenue sources to offset the cost of the proposed tax reductions.

-

Differing Approaches to Tax Simplification: While the overarching goal is tax simplification, Republicans disagree on the best methods to achieve this. Some prefer a complete overhaul of the tax code, while others favor a more incremental approach.

-

Specific Examples: Senator [Senator's Name] publicly voiced concerns about the plan's potential impact on the deficit, while Representative [Representative's Name] proposed an amendment to prioritize middle-class tax cuts. News sources such as [News Source 1] and [News Source 2] have highlighted these divisions extensively.

The Role of Moderate Republicans

Moderate Republicans, often seen as the swing votes in Congress, play a crucial role in determining the fate of the Trump tax plan. Their concerns regarding fiscal responsibility and the potential for increased national debt could prove pivotal in either blocking the plan or forcing significant compromises.

- Fiscal Responsibility: Moderate Republicans tend to prioritize fiscal responsibility and are wary of large tax cuts that could exacerbate the national debt. They are likely to push for more fiscally sustainable alternatives.

- Potential Compromises: To secure their support, the Trump administration might need to make concessions, potentially scaling back the proposed tax cuts or including provisions to mitigate the impact on the deficit.

- Influence on the Legislative Process: Moderate Republicans hold significant influence in the legislative process, and their votes are crucial for passing any legislation in both the House and the Senate.

The Impact of the Senate's Dynamics

Even if the Trump tax plan successfully navigates the challenges in the House, it still faces a significant hurdle in the Senate. The Senate's unique dynamics, including the potential for filibusters and the need for 60 votes to overcome a filibuster, further complicate its passage.

- Securing Enough Votes: Gaining the support of at least 50 Republican senators, plus at least 10 Democratic senators to overcome a filibuster, presents a steep challenge for the Trump administration.

- Potential Strategies: To bypass the filibuster, Republicans might employ the budget reconciliation process, which allows certain legislation to pass with a simple majority. However, this approach has its own limitations and constraints.

- Key Senate Republicans: The positions and actions of key Senate Republicans, especially those in swing states or with a history of bipartisan collaboration, will play a crucial role in determining the bill's fate.

Potential Consequences of Failure

The failure of Trump's tax plan would carry substantial consequences, impacting the economy, the Republican party's standing, and President Trump's legacy.

- Negative Economic Consequences: Depending on the specifics, failure could dampen economic growth, negatively impact investor confidence, and potentially lead to increased market volatility.

- Political Fallout for the GOP: Failure would be a significant political setback for the Republican party, potentially impacting their standing in the 2024 elections and undermining their credibility on economic policy.

- Impact on Trump's Presidency: The failure would represent a major defeat for President Trump and could damage his image as a successful dealmaker and economic reformer.

Conclusion

The Trump tax plan faces an uphill battle due to significant internal divisions within the Republican party. Moderate Republicans' concerns about fiscal responsibility, coupled with the Senate's procedural complexities, create a challenging path to passage. The potential consequences of failure are substantial, with significant economic and political ramifications. Stay tuned for updates on the fate of Trump's tax plan and the evolving dynamics of Republican divisions. Understanding these internal conflicts is crucial to comprehending the future of the American economy and the political landscape.

Featured Posts

-

Willie Nelsons New Documentary Honors His Longtime Roadie

Apr 29, 2025

Willie Nelsons New Documentary Honors His Longtime Roadie

Apr 29, 2025 -

Real Estate Agent Calls Out La Landlords For Post Fire Price Increases

Apr 29, 2025

Real Estate Agent Calls Out La Landlords For Post Fire Price Increases

Apr 29, 2025 -

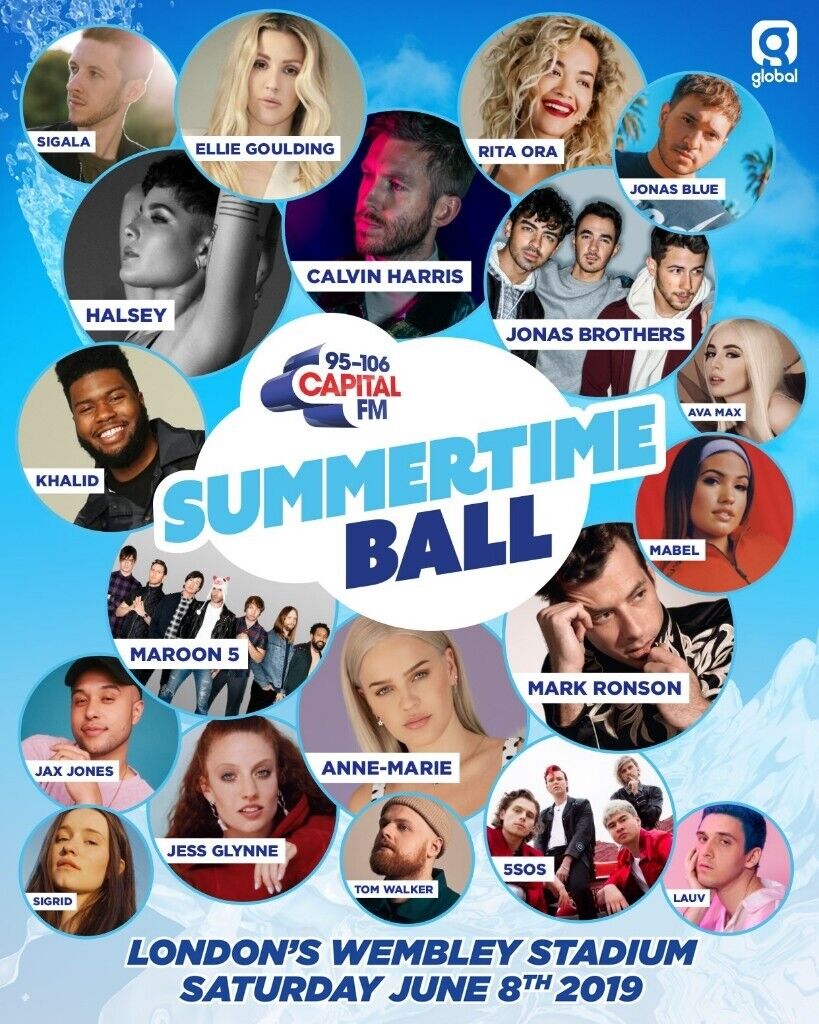

Capital Summertime Ball 2025 Wembley Stadium Date Tickets And Info

Apr 29, 2025

Capital Summertime Ball 2025 Wembley Stadium Date Tickets And Info

Apr 29, 2025 -

Parita Salariale E Sul Lavoro Quanto Siamo Lontani Dall Uguaglianza

Apr 29, 2025

Parita Salariale E Sul Lavoro Quanto Siamo Lontani Dall Uguaglianza

Apr 29, 2025 -

Test Porsche Cayenne Gts Coupe Plusy I Minusy Sportowego Suv A

Apr 29, 2025

Test Porsche Cayenne Gts Coupe Plusy I Minusy Sportowego Suv A

Apr 29, 2025

Latest Posts

-

De Vernedering Van Kompany Analyse Van De Mislukking

May 12, 2025

De Vernedering Van Kompany Analyse Van De Mislukking

May 12, 2025 -

Kompanys Team Lijdt Vernederende Verlies

May 12, 2025

Kompanys Team Lijdt Vernederende Verlies

May 12, 2025 -

Bitter Einde Voor Bayern Muenchen Het Vertrek Van Thomas Mueller

May 12, 2025

Bitter Einde Voor Bayern Muenchen Het Vertrek Van Thomas Mueller

May 12, 2025 -

Thomas Muellers Framtid Oevergang Till En Av Tva Klubbar

May 12, 2025

Thomas Muellers Framtid Oevergang Till En Av Tva Klubbar

May 12, 2025 -

Zware Teleurstelling Kompany Krijgt De Schuld

May 12, 2025

Zware Teleurstelling Kompany Krijgt De Schuld

May 12, 2025