Resistance Grows: Car Dealers Challenge EV Sales Quotas

Table of Contents

Financial Hurdles and Investment Costs

The transition to selling and servicing EVs presents considerable financial burdens for car dealerships. The high upfront investment and uncertain return on investment are major factors contributing to dealer pushback against EV sales quotas.

High Initial Investment

Dealerships face substantial upfront costs to prepare for EV sales. These include significant investments in crucial infrastructure and employee training.

- Cost of installing high-powered chargers: Installing the necessary charging infrastructure, especially high-powered chargers capable of rapid charging, represents a substantial capital expenditure. The cost varies widely depending on location, electricity grid capacity, and the number of chargers installed.

- Employee retraining expenses: EVs require specialized knowledge and skills for both sales and service. Retraining existing staff and hiring EV-trained technicians involves significant training costs and potentially lost productivity during the transition.

- Increased inventory holding costs: EV sales, in some markets, are slower compared to internal combustion engine (ICE) vehicles. This leads to increased inventory holding costs due to longer storage times and potential obsolescence risks.

- Lack of government support for infrastructure upgrades: While some government incentives exist, many dealers report insufficient support for infrastructure upgrades and employee training, making the initial investment even more challenging.

Uncertainty in Return on Investment

The profitability of EV sales remains uncertain for many dealerships. Several factors contribute to this uncertainty, further fueling the resistance to mandatory EV sales quotas.

- Lower profit margins on EVs compared to gasoline-powered cars: Profit margins on EVs are often lower than on gasoline-powered cars, impacting the overall return on investment for dealerships.

- Dependence on government subsidies: Dealerships are heavily reliant on government subsidies and incentives to boost EV sales, creating uncertainty as these programs can change or be discontinued.

- Unpredictable consumer demand in the short term: The market for EVs is still developing, and unpredictable consumer demand makes it difficult for dealerships to accurately forecast sales and manage inventory effectively.

Logistical Challenges and Infrastructure Limitations

Beyond the financial hurdles, dealerships grapple with significant logistical challenges, many stemming from inadequate infrastructure and specialized service requirements.

Lack of Charging Infrastructure

The limited availability of reliable and convenient charging infrastructure is a significant barrier to EV adoption and a major concern for dealerships facing EV sales quotas.

- Limited public charging stations: The density of public charging stations, particularly fast-charging stations, is still insufficient in many areas, leading to range anxiety among consumers.

- Long charging times: Even with fast chargers, charging times for EVs are significantly longer than refueling gasoline cars, impacting consumer convenience and potentially affecting sales.

- Range anxiety among consumers: The fear of running out of battery power before reaching a charging station remains a substantial barrier to EV adoption.

- Inconsistent charging standards: The lack of standardization across different charging systems adds to the complexity and cost of charging infrastructure.

Specialized Service and Repair Needs

Servicing and repairing EVs require specialized tools, training, and parts, creating additional logistical and financial burdens for dealerships.

- High cost of specialized EV repair equipment: Investing in the specialized tools and equipment needed for EV repair can be extremely expensive for dealerships.

- Need for trained EV mechanics: Dealerships need to train their mechanics on the intricacies of EV technology, which requires time and resources.

- Longer repair times for certain EV components: Repairing certain EV components, such as battery packs, can take significantly longer than repairing comparable parts in gasoline vehicles.

- Potential supply chain issues for EV parts: The supply chain for EV parts is still developing, leading to potential delays in repairs and increased costs.

Consumer Resistance and Market Dynamics

Dealer resistance to EV sales quotas is also influenced by consumer behavior and the broader competitive landscape within the automotive industry.

Consumer Preferences and Perceptions

Consumer hesitancy towards EVs remains a significant challenge to meeting aggressive sales quotas. Several factors contribute to this resistance.

- Concerns about battery life and degradation: Consumers are often concerned about the longevity of EV batteries and their performance over time.

- Limited availability of used EVs: The used EV market is still relatively small, limiting consumer options and potentially impacting resale values.

- Higher initial cost of EVs compared to gasoline vehicles: The upfront cost of EVs is often higher than comparable gasoline-powered cars, deterring some consumers.

- Lack of consumer awareness: Many consumers are still unfamiliar with the benefits and features of EVs, hindering their adoption.

Competition from other Dealerships and Direct Sales

Dealerships are facing increased competition from various sources, adding pressure to already challenging EV sales targets.

- Manufacturers bypassing traditional dealerships: Some automakers are adopting direct-to-consumer sales models, bypassing traditional dealerships and further reducing their market share.

- Reduced market share for dealers: The shift towards direct sales and the rise of online car retailers are impacting the market share of traditional car dealerships.

- Price competition eroding profit margins: Increased competition, particularly from manufacturers' direct sales, leads to price wars and reduced profit margins for dealers.

- Difficulty managing inventory in a changing market: Dealerships face challenges in managing inventory effectively in a rapidly evolving market, with shifting consumer preferences and unpredictable demand for EVs.

Conclusion

The growing resistance to EV sales quotas underscores the considerable challenges inherent in the rapid transition to electric vehicles. While the push for widespread EV adoption is crucial for environmental sustainability, automakers must address the significant financial, logistical, and market-related obstacles faced by dealerships. A collaborative approach, involving enhanced government support for infrastructure development, ensuring fair profit margins for dealers, and increased consumer education, is essential for a smooth and successful transition to an electric vehicle-dominated future. Ignoring this dealer pushback against EV sales quotas could severely hamper the widespread adoption of EVs. Addressing the concerns raised by dealers is paramount to accelerating the shift towards a sustainable automotive future. Finding a balance between environmental goals and the economic realities faced by dealerships is critical for the success of EV adoption.

Featured Posts

-

Littleton Dining 33 Of The Best Restaurants To Visit

May 11, 2025

Littleton Dining 33 Of The Best Restaurants To Visit

May 11, 2025 -

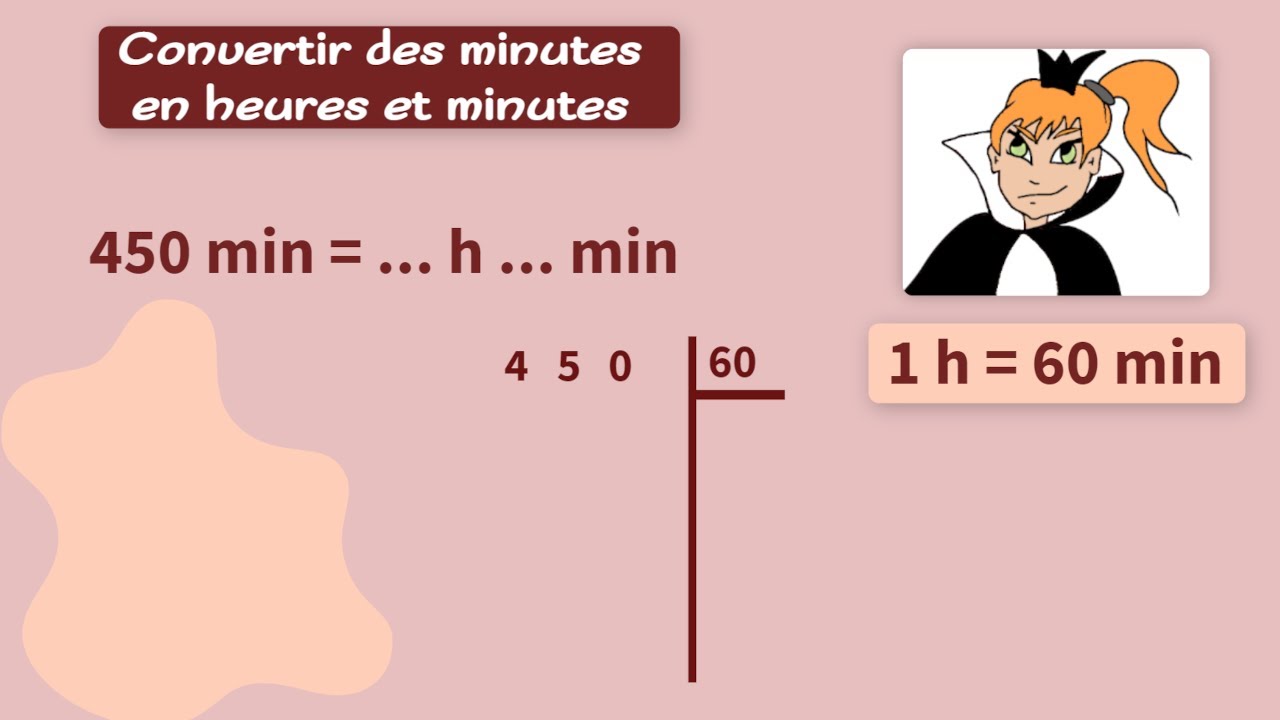

Mma Torchs Top 3 Fights 5 10 And 25 Minute Matchups

May 11, 2025

Mma Torchs Top 3 Fights 5 10 And 25 Minute Matchups

May 11, 2025 -

The Boateng Kruse Rift Impact On Hertha Bscs Performance

May 11, 2025

The Boateng Kruse Rift Impact On Hertha Bscs Performance

May 11, 2025 -

Premiere Parisienne D Eric Antoine Presence Remarquee D Une Ancienne Miss Meteo

May 11, 2025

Premiere Parisienne D Eric Antoine Presence Remarquee D Une Ancienne Miss Meteo

May 11, 2025 -

Tam Krwz Ke Jwte Pr Pawn Rkhne Waly Khatwn Mdah Awr Adakar Ka Rdeml

May 11, 2025

Tam Krwz Ke Jwte Pr Pawn Rkhne Waly Khatwn Mdah Awr Adakar Ka Rdeml

May 11, 2025