Retail Sales Growth Impacts Bank Of Canada Interest Rate Decision

Table of Contents

Understanding the Connection Between Retail Sales and Interest Rates

Robust retail sales figures are a strong signal of a healthy and expanding economy. Increased consumer spending translates to higher demand for goods and services, which can fuel inflationary pressures. Conversely, weak retail sales can signal a slowing economy, potentially indicating a need for intervention. The Bank of Canada, responsible for maintaining price stability and fostering sustainable economic growth, carefully monitors retail sales data as a key input into its monetary policy decisions. This data helps the Bank assess the overall health of the economy and gauge the potential for inflation or deflation.

- Strong retail sales = potential inflation = likely interest rate hike: When consumer spending is robust, the Bank of Canada may respond by raising interest rates to cool down the economy and prevent runaway inflation.

- Weak retail sales = potential economic slowdown = possible interest rate cut or hold: Conversely, weak sales might indicate a weakening economy, prompting the Bank to potentially lower interest rates to stimulate economic activity.

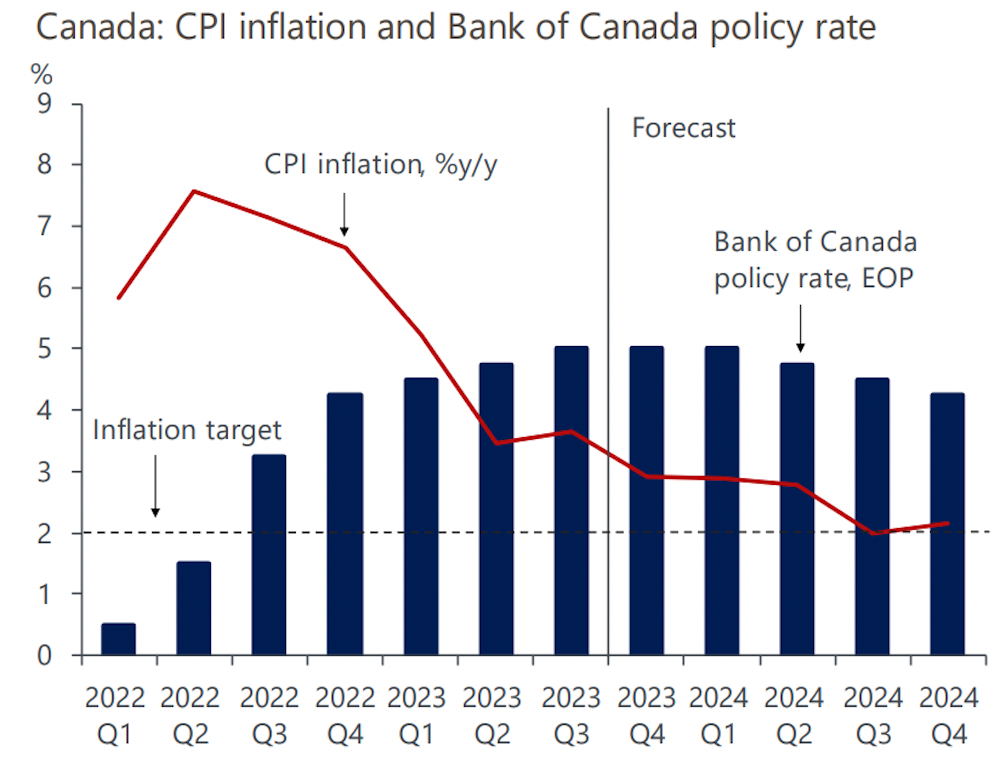

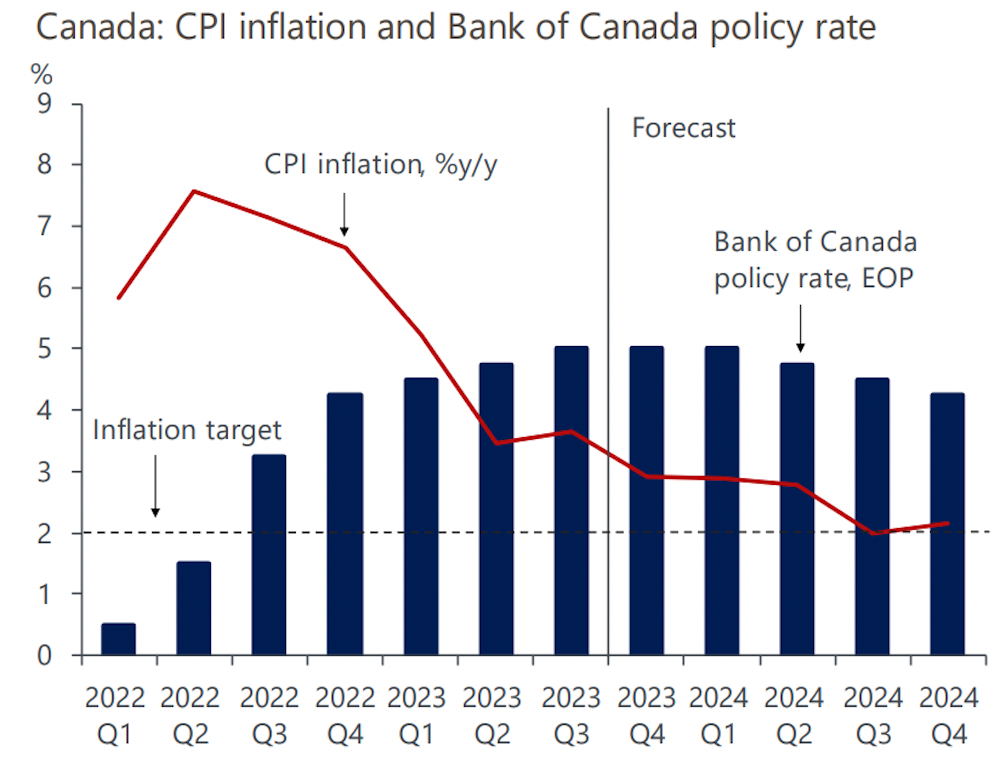

- The Bank of Canada's mandate includes price stability; retail sales are a key indicator of price stability. The target inflation rate is typically around 2%, and retail sales data provides insights into how close the economy is to achieving this target.

- The Bank of Canada's target inflation rate is a crucial benchmark. Deviations from this target influence the Bank's decisions on interest rate adjustments.

How the Bank of Canada Analyzes Retail Sales Data

The Bank of Canada's analysis of retail sales data goes beyond simply looking at the headline number. They employ sophisticated statistical methods and economic modeling to gain a comprehensive understanding of the underlying trends. This involves:

- Analysis of different retail sectors (e.g., durable goods vs. non-durable goods): Understanding spending patterns across various sectors provides a more nuanced picture of economic health. Spending on durable goods (e.g., cars, appliances) often reflects consumer confidence in the long term.

- Comparison with other economic indicators (e.g., employment data, consumer confidence): Retail sales data is considered alongside other economic metrics to paint a complete picture of the economic landscape. Employment data, for instance, offers insights into consumer income levels and spending potential.

- Discussion of potential biases and limitations in the data: The Bank acknowledges that the data may contain inherent biases and limitations, such as seasonal variations or reporting lags. Adjustments are made to account for these.

- Explanation of the difference between monthly and annualized retail sales figures: Understanding the difference between monthly fluctuations and annualized growth rates is essential for accurate interpretation.

The Impact of External Factors on Retail Sales and Interest Rate Decisions

Global economic conditions significantly impact Canadian retail sales and, consequently, the Bank of Canada's interest rate decisions.

- Example: How a global recession might lead to weaker retail sales and a potential interest rate cut: A downturn in the global economy can reduce demand for Canadian exports and impact consumer confidence, resulting in weaker retail sales. The Bank might respond with interest rate cuts to stimulate growth.

- Example: How supply chain issues might temporarily distort retail sales figures: Disruptions to global supply chains can lead to shortages and price increases, potentially distorting retail sales data in the short term. The Bank considers these external factors when analyzing the data.

- Explain how the Bank of Canada takes these external factors into account during its analysis: The Bank’s analytical process is robust and accounts for various external shocks and their potential impact on the Canadian economy.

Predicting Future Interest Rate Changes Based on Retail Sales

While retail sales growth is a valuable indicator, it's crucial to avoid relying on it solely to predict future interest rate changes. Numerous other factors, including inflation rates, employment numbers, and global economic conditions, influence the Bank of Canada's decisions.

- Retail sales data is one piece of a larger puzzle: It's essential to consider the broader economic context.

- Other important factors include inflation rates, employment numbers, and global economic conditions: A holistic approach is necessary for accurate forecasting.

- Where to find reliable economic forecasts and analyses: Reputable sources such as the Bank of Canada's website, Statistics Canada, and major financial news outlets provide valuable insights and forecasts.

Conclusion

Retail sales growth is a crucial factor influencing the Bank of Canada's interest rate decisions. Strong sales suggest potential inflation, prompting potential rate hikes, while weak sales indicate potential economic slowdown, potentially leading to rate cuts or holds. However, the Bank considers many factors beyond retail sales when making its monetary policy decisions. Staying informed about upcoming retail sales figures and Bank of Canada announcements is vital for businesses and consumers alike to understand the implications for their financial well-being. Regularly monitor the Bank of Canada's website and other reputable economic news sources for updates on retail sales growth and its impact on interest rate decisions.

Featured Posts

-

Le Cyclisme Vu Par Laurence Melys Une Perspective Feminine Sur Rtl

May 26, 2025

Le Cyclisme Vu Par Laurence Melys Une Perspective Feminine Sur Rtl

May 26, 2025 -

Cybercriminals Office365 Intrusion Results In Millions In Stolen Funds

May 26, 2025

Cybercriminals Office365 Intrusion Results In Millions In Stolen Funds

May 26, 2025 -

Bila Tunika Naomi Kempbell Detali Obrazu Z Londonskogo Zakhodu

May 26, 2025

Bila Tunika Naomi Kempbell Detali Obrazu Z Londonskogo Zakhodu

May 26, 2025 -

Flash Flood Warning Issued For Bradford And Wyoming Counties Through Tuesday Evening

May 26, 2025

Flash Flood Warning Issued For Bradford And Wyoming Counties Through Tuesday Evening

May 26, 2025 -

Meta Israels 2024 Holocaust Remembrance Day Instagram Project Israeli Celebrities Participate

May 26, 2025

Meta Israels 2024 Holocaust Remembrance Day Instagram Project Israeli Celebrities Participate

May 26, 2025

Latest Posts

-

Pacers Mathurin Explodes For 28 Points In Overtime Win Against Nets

May 29, 2025

Pacers Mathurin Explodes For 28 Points In Overtime Win Against Nets

May 29, 2025 -

Nba Mathurins 28 Points Power Pacers Past Nets In Overtime Thriller

May 29, 2025

Nba Mathurins 28 Points Power Pacers Past Nets In Overtime Thriller

May 29, 2025 -

Indiana Pacers Injury News Mathurin Downgraded Before Kings Matchup

May 29, 2025

Indiana Pacers Injury News Mathurin Downgraded Before Kings Matchup

May 29, 2025 -

Indiana Pacers Defeat Brooklyn Nets In Overtime Mathurins Impact

May 29, 2025

Indiana Pacers Defeat Brooklyn Nets In Overtime Mathurins Impact

May 29, 2025 -

Bennedict Mathurin Injury Impact On Pacers Vs Kings

May 29, 2025

Bennedict Mathurin Injury Impact On Pacers Vs Kings

May 29, 2025