Rethinking QE: Greene's Call For A Smaller-Scale Response By The BOE

Table of Contents

The Bank of England's (BOE) use of Quantitative Easing (QE) has been a cornerstone of its monetary policy response to recent economic crises. However, growing concerns are prompting a reassessment of its scale and long-term effects. This article examines arguments for a smaller-scale QE response, analyzing its potential benefits and drawbacks in the context of current economic challenges. While specific critics haven't been identified, general arguments against large-scale QE programs are considered.

Greene's Critique of Large-Scale QE

Concerns about Inflation

Large-scale QE programs can contribute significantly to inflationary pressures. The mechanism is relatively straightforward:

- Increased Money Supply: QE injects new money into the financial system by purchasing assets from commercial banks and other financial institutions. This increases the overall money supply.

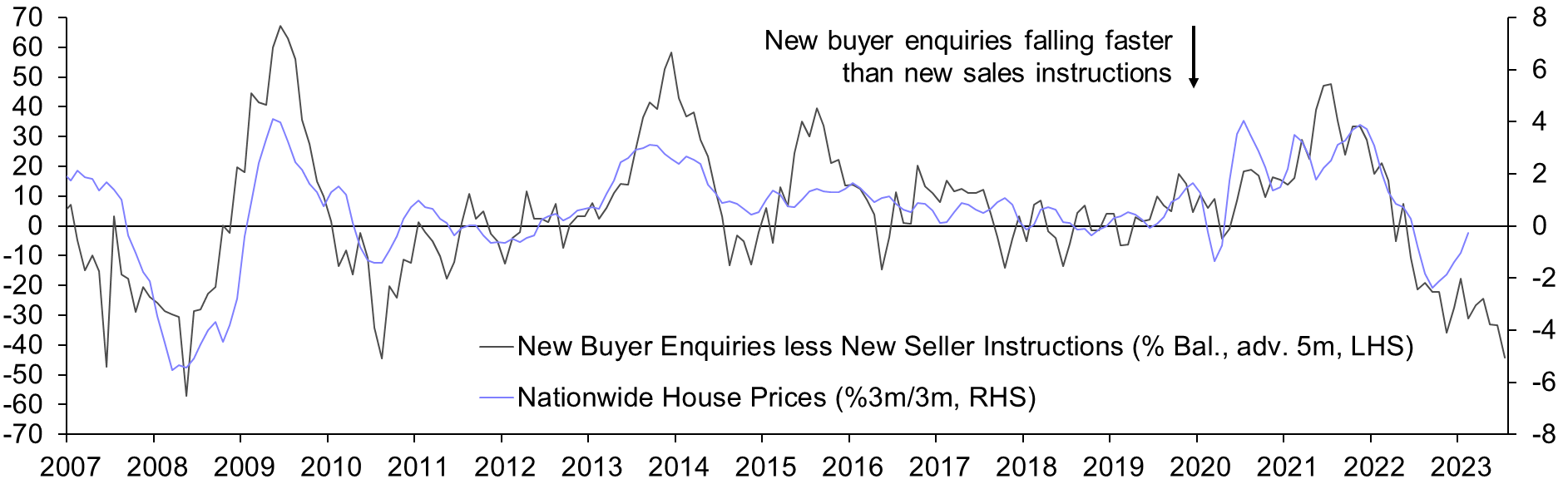

- Asset Price Inflation: The increased money supply doesn't always translate directly into higher consumer prices immediately. Instead, it can initially inflate asset prices, such as stocks and real estate. This is because the additional liquidity flows into these markets, driving up demand and prices. Eventually, this asset price inflation can feed into broader consumer price inflation through various channels.

Recent data, particularly concerning [insert relevant economic indicator like CPI or RPI and cite source with a hyperlink], suggests a correlation between QE expansion and subsequent rises in inflation. For example, [Insert example of a specific time period and country showing correlation between QE and inflation increase. Cite source with a hyperlink].

Ineffectiveness beyond a Certain Threshold

The effectiveness of QE diminishes after a certain scale is reached – a concept known as diminishing marginal returns.

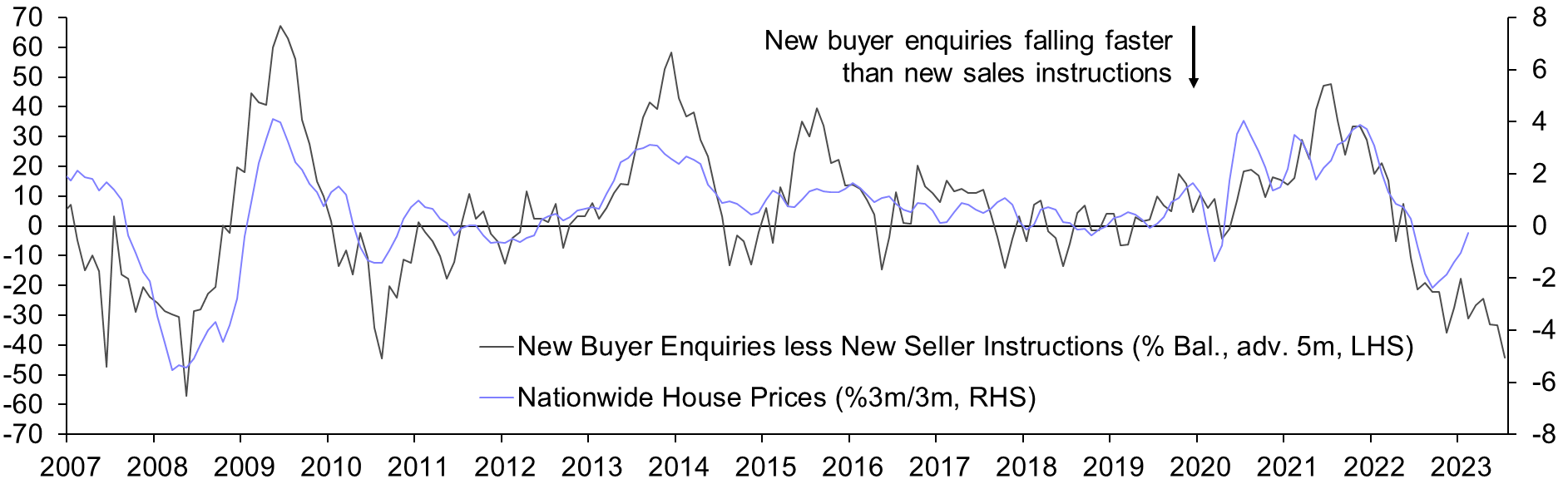

- Diminishing Marginal Returns: Each additional unit of QE intervention provides progressively smaller incremental benefits to the economy. This is because once the financial system has absorbed a significant amount of liquidity, further injections have less impact on lending, investment, and overall economic activity.

- Limited Impact Examples: [Insert examples of instances where large-scale QE had limited impact on stimulating economic growth. Cite sources with hyperlinks]. These cases suggest that, beyond a certain point, QE may not be the most effective tool for stimulating demand or boosting economic growth.

- Alternative Monetary Policy Tools: When QE's effectiveness wanes, the BOE should consider alternative tools, such as targeted lending programs, adjustments to interest rates, or forward guidance. These strategies might be more effective in addressing specific economic challenges.

Arguments for a Smaller-Scale QE Approach

Targeted Interventions

Smaller, more targeted QE programs offer several potential advantages:

- Supporting Specific Industries: Instead of broad-based asset purchases, targeted QE could focus on specific sectors in need of support, such as green technologies or small and medium-sized enterprises (SMEs). This ensures that the stimulus is directed where it is most needed.

- Reducing Inequality: By focusing on specific sectors or regions, targeted QE can potentially reduce economic inequality by supporting struggling communities or industries.

- Successful Examples (If Applicable): [Include examples of successful targeted QE programs with hyperlinks to source material].

Reduced Risk of Asset Bubbles

A smaller-scale QE approach can mitigate the risk of creating unsustainable asset bubbles.

- Link between Large-Scale QE and Asset Bubbles: Large injections of liquidity can lead to excessive speculation and inflated asset prices, creating bubbles that eventually burst with devastating consequences.

- Historical Examples: [Insert examples of historical asset bubbles potentially linked to QE, such as the dot-com bubble or the housing bubble. Cite sources with hyperlinks]. The creation of asset bubbles can lead to financial instability and economic downturns.

Improved Long-Term Economic Stability

A more cautious approach to QE may lead to improved long-term economic stability and sustainable growth.

- Negative Long-Term Consequences of Large-Scale QE: Large-scale QE can lead to unsustainable levels of debt, distortions in capital markets, and misallocation of resources. Long-term consequences include increased debt burdens, higher interest rates, and reduced economic productivity.

- Benefits of a Measured Approach: A more measured approach to QE can promote more sustainable economic growth by reducing the risk of financial instability and avoiding the negative long-term consequences of excessive liquidity injections.

Counterarguments and Rebuttals

Insufficient Stimulus

Some argue that smaller-scale QE might be insufficient to stimulate economic activity during a severe downturn.

- Proponents of Large-Scale QE: Advocates of large-scale QE contend that only substantial interventions can provide the necessary boost to demand and prevent a deeper recession.

- Rebuttals: However, the effectiveness of large-scale QE is debatable, particularly in cases with diminishing marginal returns. A well-designed and targeted smaller-scale program, combined with other complementary policy measures, could achieve similar results with fewer risks.

Political Feasibility

Implementing a smaller-scale QE program can face significant political challenges.

- Navigating Political Landscapes: Nuanced monetary policy decisions often encounter political resistance. Smaller-scale interventions may be perceived as insufficient by certain groups, leading to pressure for larger, potentially riskier, interventions.

- Examples of Political Hurdles: [Include examples of instances where political considerations affected the design or implementation of monetary policy. Cite sources with hyperlinks]. Understanding and addressing these political challenges are crucial for effective policymaking.

Conclusion

The arguments for and against smaller-scale QE raise important questions about the appropriate scale and scope of future BOE interventions. While large-scale QE can provide significant stimulus, it carries substantial risks, including inflation and asset bubbles. A more measured approach, possibly incorporating targeted interventions, may offer a more sustainable path to economic recovery. The potential for insufficient stimulus with a smaller approach needs further consideration. However, a smaller scale might ultimately provide better long-term economic stability.

Further research and open discussion are needed to find the optimal balance between economic stimulus and risk mitigation. The debate on effectively utilizing quantitative easing remains critical for navigating future economic uncertainty. Let's continue the conversation on refining and improving quantitative easing strategies.

Featured Posts

-

Hakkari De Okullar Yarin Tatil Mi 24 Subat Pazartesi Guencel Durum

Apr 23, 2025

Hakkari De Okullar Yarin Tatil Mi 24 Subat Pazartesi Guencel Durum

Apr 23, 2025 -

Blue Origin Rocket Launch Cancelled Vehicle Subsystem Issue

Apr 23, 2025

Blue Origin Rocket Launch Cancelled Vehicle Subsystem Issue

Apr 23, 2025 -

Actualites Economiques Du 14 Avril Le Journal Du 18h Eco

Apr 23, 2025

Actualites Economiques Du 14 Avril Le Journal Du 18h Eco

Apr 23, 2025 -

The Economic Data Doesnt Reflect Trumps Presence

Apr 23, 2025

The Economic Data Doesnt Reflect Trumps Presence

Apr 23, 2025 -

Solutions 30 Pourquoi Le Cours De L Action Est Il En Hausse

Apr 23, 2025

Solutions 30 Pourquoi Le Cours De L Action Est Il En Hausse

Apr 23, 2025

Latest Posts

-

Unian Makron I Tusk Gotovyatsya K Podpisaniyu Vazhnogo Dogovora

May 10, 2025

Unian Makron I Tusk Gotovyatsya K Podpisaniyu Vazhnogo Dogovora

May 10, 2025 -

Dogovor Frantsii I Polshi Chto Ozhidat Ot Sotrudnichestva Makrona I Tuska

May 10, 2025

Dogovor Frantsii I Polshi Chto Ozhidat Ot Sotrudnichestva Makrona I Tuska

May 10, 2025 -

Frantsiya Polsha Soglashenie Makrona I Tuska Klyuchevye Punkty

May 10, 2025

Frantsiya Polsha Soglashenie Makrona I Tuska Klyuchevye Punkty

May 10, 2025 -

Makron I Tusk Podpisanie Dogovora Mezhdu Frantsiey I Polshey

May 10, 2025

Makron I Tusk Podpisanie Dogovora Mezhdu Frantsiey I Polshey

May 10, 2025 -

Frantsiya Polsha Podpisanie Oboronnogo Soglasheniya I Ego Geopoliticheskie Posledstviya

May 10, 2025

Frantsiya Polsha Podpisanie Oboronnogo Soglasheniya I Ego Geopoliticheskie Posledstviya

May 10, 2025