Retirement Portfolio Diversification: Should You Avoid This New Investment?

Table of Contents

Understanding Retirement Portfolio Diversification

Retirement portfolio diversification is the practice of spreading your investments across various asset classes to reduce risk. This core principle of risk management involves strategic asset allocation—determining the optimal proportion of each asset class in your portfolio based on your risk tolerance, time horizon, and retirement goals. The benefits are multifaceted:

- Reduced Risk: By diversifying, you don't put all your eggs in one basket. If one investment underperforms, others might offset those losses.

- Potential for Higher Returns: A well-diversified portfolio can potentially generate higher returns over the long term by capturing growth opportunities across different market sectors.

- Protection Against Market Volatility: Diversification helps cushion the blow from market downturns. When one asset class falls, others may rise, stabilizing your overall portfolio value.

Traditionally, a diversified portfolio includes:

- Stocks: Equities offer growth potential but come with higher risk.

- Bonds: Fixed-income securities provide stability and income but generally offer lower returns.

- Real Estate: Tangible assets like property can provide diversification and potentially strong returns, although liquidity can be an issue.

- Mutual Funds and ETFs: These provide instant diversification across various asset classes.

Keywords: retirement planning, investment strategy, risk management, asset allocation, portfolio diversification strategy

Cryptocurrencies in Retirement Portfolios: A Risky Addition?

Cryptocurrencies, like Bitcoin and Ethereum, represent a relatively new asset class characterized by decentralized blockchain technology and digital scarcity. Their potential benefits are undeniable:

- High Growth Potential: Cryptocurrencies have demonstrated periods of explosive growth, offering the potential for significant returns.

- Decentralization: Unlike traditional assets, cryptocurrencies are not controlled by central banks or governments.

- Technological Innovation: The underlying blockchain technology is driving innovation across various industries.

However, the risks are equally significant:

- Extreme Volatility: Cryptocurrency prices can fluctuate wildly in short periods, leading to substantial losses.

- Regulatory Uncertainty: The regulatory landscape for cryptocurrencies is still evolving, posing legal and compliance risks.

- Security Risks: Cryptocurrency exchanges and wallets can be vulnerable to hacking and theft.

Analyzing the Risk-Reward Profile

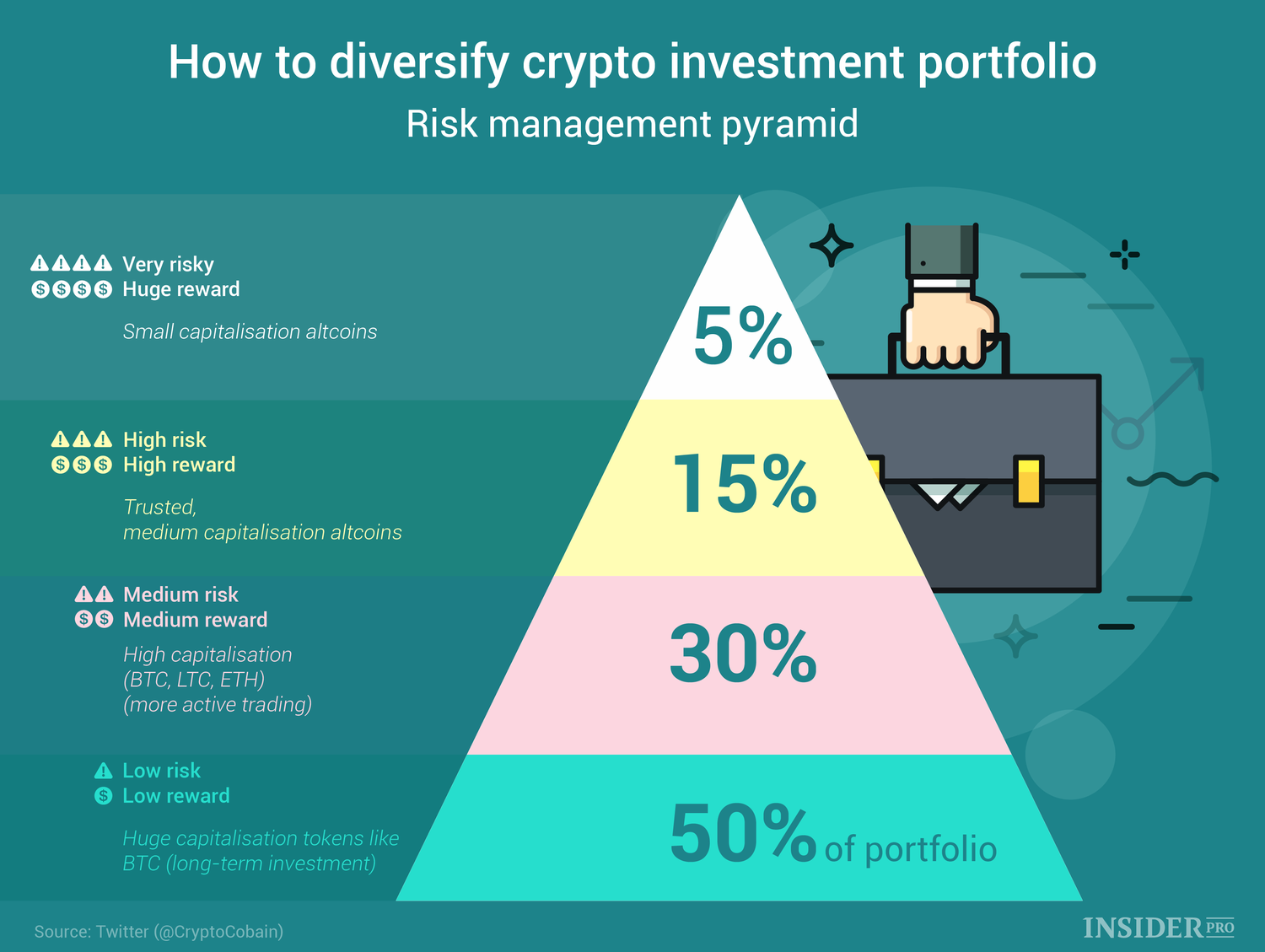

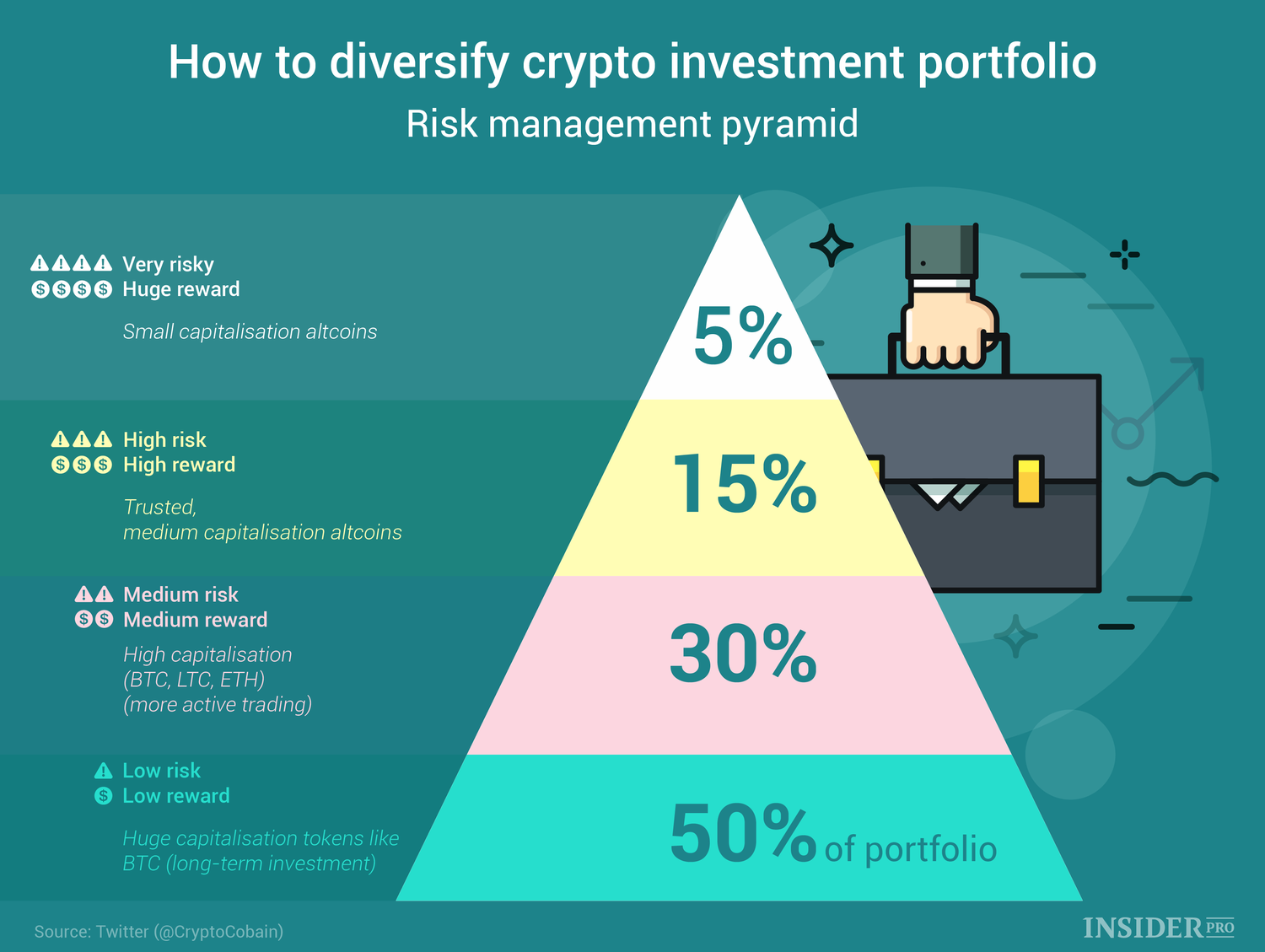

Comparing cryptocurrencies to traditional assets reveals a stark difference in risk-reward profiles. While stocks and bonds offer varying degrees of risk and return, cryptocurrencies sit at the extreme end of the risk spectrum, with the potential for both massive gains and catastrophic losses. This high volatility can significantly impact your overall portfolio's volatility and returns. A small allocation to crypto might boost returns during bull markets but could heavily impact performance during bear markets.

Keywords: risk tolerance, return on investment, volatility, risk assessment

Strategically Integrating Crypto into Your Retirement Plan

If you're considering adding cryptocurrencies to your retirement portfolio, a cautious approach is essential. Strategies like dollar-cost averaging (investing a fixed amount at regular intervals) can help mitigate some of the risks associated with volatility. Diversification within the cryptocurrency market itself is also crucial—avoid placing all your crypto investments in a single coin.

Remember to align your cryptocurrency allocation with your risk tolerance and retirement goals. Younger investors with longer time horizons might be able to tolerate higher risk associated with cryptocurrency investments. However, those nearing retirement should exercise extreme caution.

Keywords: investment strategy, asset allocation, portfolio management, retirement goals

Alternatives and Considerations

Before jumping into crypto, explore alternative investment options with similar risk-reward profiles. These could include:

- Venture Capital: Investing in early-stage companies carries high risk but also the potential for substantial returns.

- Alternative Investments: This broad category encompasses various assets, including commodities, private equity, and hedge funds.

Ultimately, seeking professional financial advice is paramount. A qualified financial advisor can assess your individual circumstances, risk tolerance, and retirement goals to help you create a tailored investment strategy that aligns with your needs. Factors like your age, risk tolerance, and investment time horizon will all heavily influence your decisions.

Keywords: financial advisor, retirement planning services, investment consulting

Making Informed Decisions About Retirement Portfolio Diversification

Incorporating cryptocurrencies into your retirement portfolio diversification strategy involves a careful balancing act between the potential for high returns and the inherent risks. While diversification is crucial for mitigating risk, it's equally crucial to understand the specific characteristics of each asset class. Cryptocurrencies represent a highly volatile investment that requires thorough research and a well-defined risk management plan.

Remember, diversification is a cornerstone of sound retirement planning, but it's not a magic bullet. Personalized financial planning and professional advice are essential to achieving your retirement goals. Consult a financial advisor to determine if incorporating cryptocurrencies into your retirement portfolio diversification strategy is right for you.

Featured Posts

-

Luxors Ancient Egypt Themed Buffet To Close Impact And Future Plans

May 18, 2025

Luxors Ancient Egypt Themed Buffet To Close Impact And Future Plans

May 18, 2025 -

Peran Jusuf Kalla Sebagai Mediator Konflik Israel Palestina Sebuah Apresiasi Dari Gaza

May 18, 2025

Peran Jusuf Kalla Sebagai Mediator Konflik Israel Palestina Sebuah Apresiasi Dari Gaza

May 18, 2025 -

Where To Watch Easy A Your Bbc Three Hd Guide

May 18, 2025

Where To Watch Easy A Your Bbc Three Hd Guide

May 18, 2025 -

Eurovisions Most Controversial Acts A Look Back As The Uk Unveils Its 2025 Entry

May 18, 2025

Eurovisions Most Controversial Acts A Look Back As The Uk Unveils Its 2025 Entry

May 18, 2025 -

Uber Kenya Announces Cashback Program And Increased Order Volume For Partners

May 18, 2025

Uber Kenya Announces Cashback Program And Increased Order Volume For Partners

May 18, 2025