Revised CoreWeave IPO Price: $40 Per Share

Table of Contents

CoreWeave's Business Model and Market Position

CoreWeave's success hinges on its specialized approach to cloud computing.

Understanding CoreWeave's Cloud Computing Services

CoreWeave distinguishes itself through its focus on GPU-accelerated cloud computing. This specialization caters to the burgeoning demands of artificial intelligence (AI), machine learning (ML), and high-performance computing (HPC) applications. Unlike general-purpose cloud providers, CoreWeave provides optimized infrastructure specifically designed for these computationally intensive workloads, offering significant performance advantages. This "GPU cloud computing" expertise is a key differentiator in a competitive market.

- Key clients and partnerships: CoreWeave boasts a growing roster of clients across diverse industries, including prominent names in AI research and development, fintech, and gaming. Strategic partnerships amplify its reach and credibility.

- Competitive advantages: CoreWeave leverages its efficient infrastructure and specialized expertise to deliver superior performance and cost-effectiveness compared to general-purpose cloud providers. Their focus on sustainability is also a growing competitive advantage.

- Market share and growth projections: While precise market share figures are still emerging, industry analysts predict significant growth for CoreWeave, positioning it as a key player in the rapidly expanding GPU cloud computing market.

Factors Influencing the Revised IPO Price of $40

The $40 per share price tag for the CoreWeave IPO is the result of a complex interplay of factors.

Market Conditions and Investor Sentiment

The current IPO market is characterized by volatility.

- Impact of recent interest rate hikes: Rising interest rates have dampened investor enthusiasm for riskier assets, impacting IPO valuations across various sectors.

- Overall performance of the tech sector: The tech sector's recent performance has also influenced investor sentiment, impacting the perceived risk associated with the CoreWeave IPO.

- Comparison to similar IPOs: Comparing CoreWeave's IPO valuation to similar companies in the cloud computing space helps contextualize the $40 price point, considering both successes and failures of recent offerings.

Company Performance and Financial Projections

CoreWeave's financial performance and future projections have played a pivotal role in determining its IPO price.

- Key financial metrics (revenue, EBITDA, etc.): Strong revenue growth and positive EBITDA are key indicators that have likely contributed positively to the IPO valuation.

- Growth trajectory and projected market capitalization: Analysts' predictions about CoreWeave's future growth and market capitalization directly impact investor confidence and, subsequently, the IPO price.

- Risk factors and potential challenges: Potential risks, such as competition from established players and the inherent volatility of the tech sector, are also considered. The $40 price likely reflects a balance between optimism and cautious assessment of these risks.

Implications of the $40 per Share IPO Price for Investors

The $40 per share price presents both opportunities and risks for investors.

Potential Returns and Risks

Determining the potential returns requires careful analysis.

- Price-to-earnings ratio (P/E) analysis: Analyzing the P/E ratio in relation to other cloud computing stocks helps assess whether the $40 price reflects an overvaluation or undervaluation.

- Long-term growth potential: The long-term growth potential of GPU-accelerated cloud computing, coupled with CoreWeave's market positioning, is a crucial factor in determining potential returns.

- Comparison to other cloud computing stocks: Comparing CoreWeave's valuation to established players in the cloud computing market provides a benchmark for assessing its potential returns and risks.

Strategies for Investing in the CoreWeave IPO

Potential investors should employ prudent strategies.

- Allocate a portion of the investment portfolio: Diversification is key; avoid putting all your eggs in one basket. Allocate only a portion of your portfolio to CoreWeave.

- Diversify investment to mitigate risk: Diversifying your investments across different asset classes and sectors reduces overall risk.

- Conduct thorough due diligence before investing: Before investing in any IPO, conduct thorough due diligence, understanding the company's business model, financials, and competitive landscape.

Conclusion: Investing in the Revised CoreWeave IPO at $40 per Share

The revised CoreWeave IPO price of $40 per share reflects a complex interplay of market conditions, company performance, and investor sentiment. CoreWeave's specialization in GPU-accelerated cloud computing, coupled with its strong growth trajectory, presents a potentially lucrative investment opportunity. However, investors must carefully consider the associated risks, including market volatility and competition. Understanding the implications of this Revised CoreWeave IPO Price is vital.

With a thorough understanding of the revised CoreWeave IPO price and the company's prospects, investors can now make informed decisions about participating in this exciting investment opportunity. Conduct your own research and consider the risks and potential rewards before investing in the CoreWeave IPO. Further investigation into CoreWeave stock and the broader CoreWeave IPO outlook is strongly advised before making any investment decisions. Consider the CoreWeave investment opportunities carefully and weigh them against your overall investment strategy.

Featured Posts

-

The Blake Lively Allegation Fact Or Fiction

May 22, 2025

The Blake Lively Allegation Fact Or Fiction

May 22, 2025 -

College De Clisson Le Port De La Croix Catholique Remis En Question

May 22, 2025

College De Clisson Le Port De La Croix Catholique Remis En Question

May 22, 2025 -

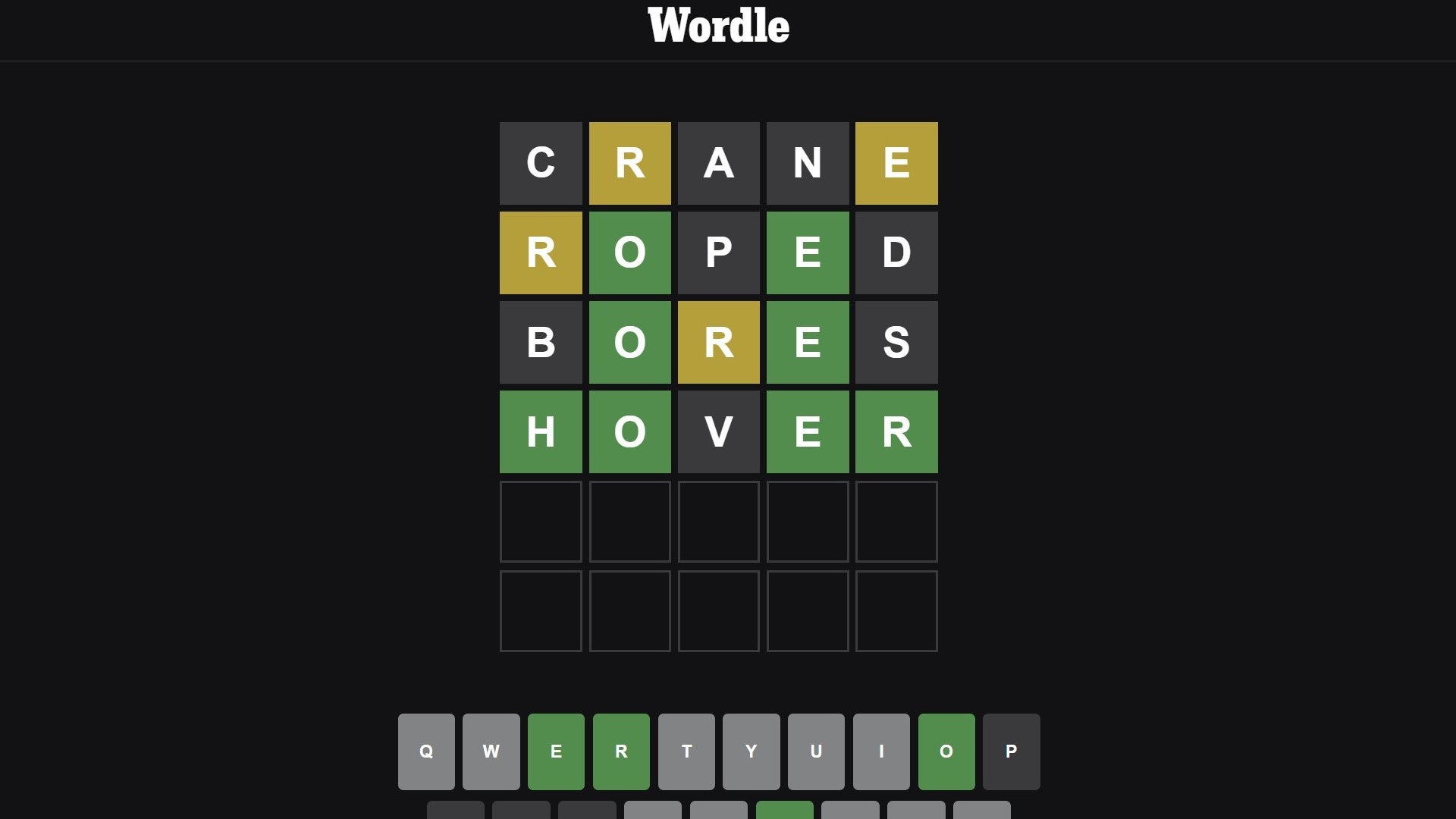

Wordle 1408 April 27th Hints And Solution

May 22, 2025

Wordle 1408 April 27th Hints And Solution

May 22, 2025 -

Echo Valley First Images Reveal Sydney Sweeney And Julianne Moores Intense Thriller

May 22, 2025

Echo Valley First Images Reveal Sydney Sweeney And Julianne Moores Intense Thriller

May 22, 2025 -

Fortnite Back On Us I Phones A Complete Guide

May 22, 2025

Fortnite Back On Us I Phones A Complete Guide

May 22, 2025

Latest Posts

-

Solve Wordle 1356 Hints Clues And The Answer For March 6th

May 22, 2025

Solve Wordle 1356 Hints Clues And The Answer For March 6th

May 22, 2025 -

Wordle 1408 Answer And Clues April 27th Sunday

May 22, 2025

Wordle 1408 Answer And Clues April 27th Sunday

May 22, 2025 -

Wordle Hints And Solution Thursday March 6th Wordle 1356

May 22, 2025

Wordle Hints And Solution Thursday March 6th Wordle 1356

May 22, 2025 -

Solve Wordle 1408 April 27th Clues And Answer

May 22, 2025

Solve Wordle 1408 April 27th Clues And Answer

May 22, 2025 -

Wordle 1408 April 27th Hints And Solution

May 22, 2025

Wordle 1408 April 27th Hints And Solution

May 22, 2025