Revolutionizing Your Finances: A Podcast On Money Management

Table of Contents

Mastering the Art of Budgeting: A Foundation for Financial Success

A solid budget is the cornerstone of successful money management. Without understanding where your money goes, achieving financial goals becomes significantly harder. Our podcast dives deep into creating and maintaining a realistic budget that works for your lifestyle.

Creating a Realistic Budget:

Learning to track your income and expenses effectively is crucial. This isn't about restrictive deprivation; it's about informed spending. Utilizing budgeting apps and spreadsheets can streamline the process and provide valuable insights into your spending habits.

- Identify your income sources: This includes your salary, any side hustles, investments, and other sources of revenue. Be thorough and include all income streams.

- Categorize your expenses: Track your spending across key categories: housing, transportation, food, utilities, entertainment, debt payments, and more. Detailed categorization allows you to pinpoint areas for potential savings.

- Utilize the 50/30/20 rule or other budgeting methods: The 50/30/20 rule suggests allocating 50% of your after-tax income to needs, 30% to wants, and 20% to savings and debt repayment. Explore other methods like the zero-based budget or envelope system to find what best suits your needs.

- Regularly review and adjust your budget: Your financial situation changes. Regularly review your budget (monthly is ideal) to ensure it aligns with your current income and expenses.

Automating Savings and Expenses:

Automation is your secret weapon for consistent financial management. By automating savings and bill payments, you eliminate the risk of forgetting or procrastinating, making progress towards your financial goals effortless.

- Automate savings contributions: Set up automatic transfers to your savings accounts each payday. Even small, consistent contributions add up over time.

- Set up automatic payments for bills: Avoid late fees and the stress of remembering due dates by automating bill payments.

- Explore different savings accounts: Consider high-yield savings accounts or money market accounts to maximize your returns.

- Use budgeting apps with automation features: Many budgeting apps offer automated savings and bill payment features, simplifying the process.

Conquering Debt: Strategies for Reducing Financial Burden

Debt can be a significant obstacle to financial freedom. Our podcast provides actionable strategies to manage and reduce your debt burden effectively.

Understanding Different Debt Types:

Not all debt is created equal. Understanding the difference between good debt (like a mortgage) and bad debt (high-interest credit cards) is crucial for developing a targeted repayment plan.

- Analyze your debt: List all your debts, including the balance, interest rate, and minimum payment.

- Prioritize high-interest debt: Use methods like the debt snowball (paying off the smallest debt first for motivation) or the debt avalanche (paying off the highest-interest debt first to save money) to strategically tackle your debts.

- Explore debt consolidation options: Consolidating multiple debts into a single loan can simplify repayment and potentially lower your interest rate.

- Negotiate with creditors: Contact your creditors to negotiate lower interest rates or more manageable payment plans.

Building Good Credit:

A good credit score is essential for securing loans, mortgages, and even some rental agreements. Our podcast provides tips for improving and maintaining your credit health.

- Pay bills on time: On-time payments are the most significant factor influencing your credit score.

- Keep credit utilization low: Aim to keep your credit card balances below 30% of your credit limit.

- Monitor your credit report regularly: Check your credit report for errors and ensure its accuracy.

- Consider secured credit cards: If you have limited or damaged credit, a secured credit card can help you rebuild your credit history.

Investing for the Future: Growing Your Wealth Wisely

Investing is a crucial aspect of long-term financial success. Our podcast demystifies investing, providing you with the knowledge and confidence to start building your wealth.

Understanding Investment Basics:

Investing can feel daunting, but understanding the basics is the first step. Our podcast introduces you to different investment vehicles and helps you define your investment strategy.

- Define your investment goals: Establish short-term and long-term goals to guide your investment decisions.

- Determine your risk tolerance: Understand your comfort level with potential investment losses.

- Diversify your investments: Spread your investments across different asset classes to reduce risk.

- Consider seeking professional financial advice: A financial advisor can provide personalized guidance and support.

Building a Diversified Investment Portfolio:

Diversification is key to mitigating risk. Our podcast explores various investment options and strategies for building a well-diversified portfolio.

- Invest in index funds or ETFs: These offer instant diversification across a wide range of stocks or bonds.

- Consider individual stocks or bonds: If you have the knowledge and time, you can build a portfolio of individual investments.

- Rebalance your portfolio regularly: Periodically adjust your portfolio to maintain your desired asset allocation.

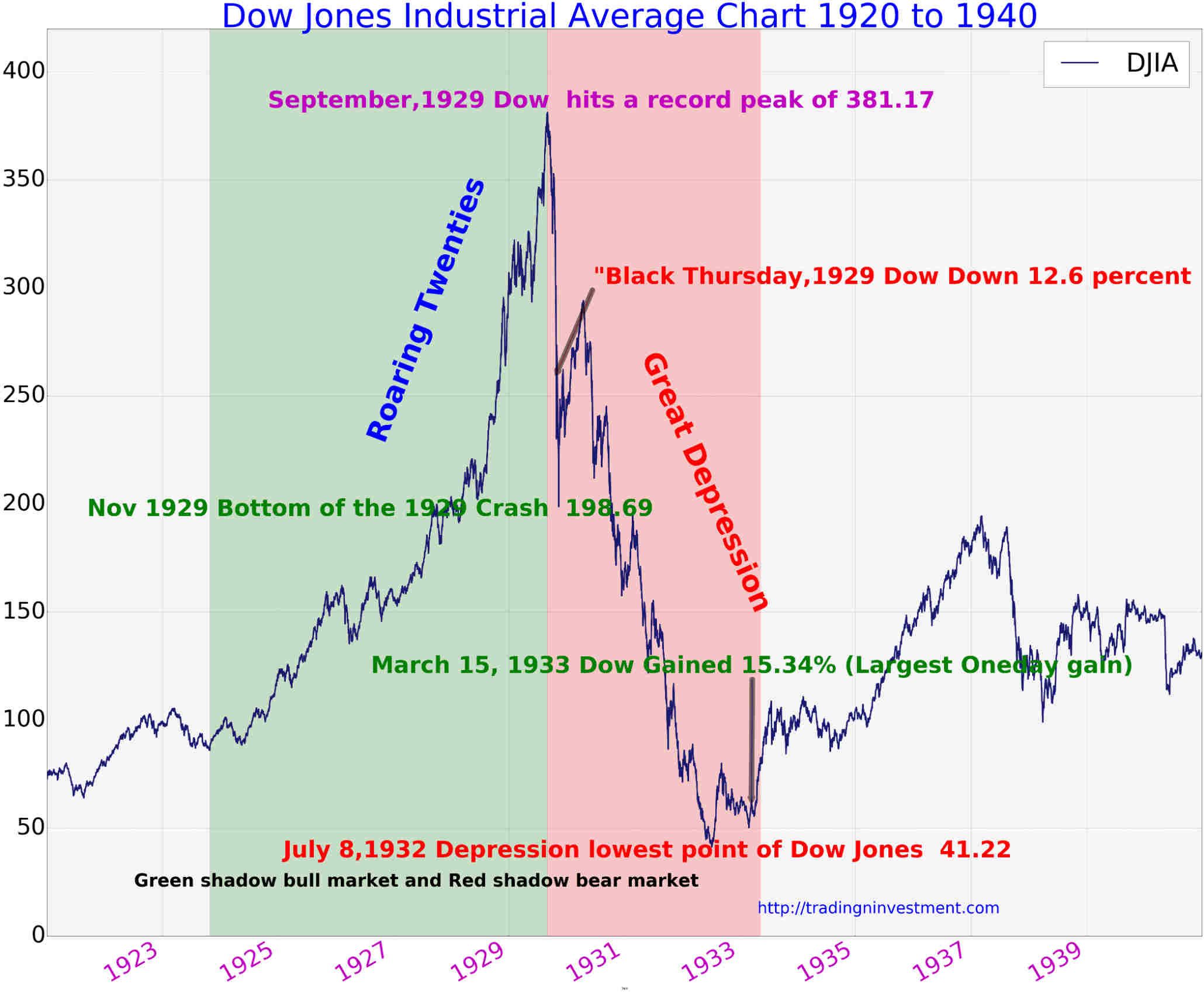

- Stay updated on market trends: Keep informed about market conditions to make informed investment decisions.

Conclusion

Taking control of your finances can seem daunting, but with the right knowledge and tools, it's entirely achievable. Our podcast on money management provides practical strategies and actionable steps to help you revolutionize your financial life. By mastering budgeting, conquering debt, and investing wisely, you can build a secure financial future. Subscribe to our podcast today to begin your journey towards financial freedom and start revolutionizing your finances! Learn more about effective money management techniques and gain valuable insights by listening to our comprehensive episodes on budgeting, debt management, and investing strategies. Don't delay – start listening now and transform your relationship with money!

Featured Posts

-

Legal Battle Erupts Dragon Den Alum Claims Puppy Toilet Idea Infringement

May 31, 2025

Legal Battle Erupts Dragon Den Alum Claims Puppy Toilet Idea Infringement

May 31, 2025 -

Real Time Stock Quotes Dow And S And P 500 For May 30

May 31, 2025

Real Time Stock Quotes Dow And S And P 500 For May 30

May 31, 2025 -

Lavender Milk Nails Der Sanfte Nageltrend Fuer Den Fruehling

May 31, 2025

Lavender Milk Nails Der Sanfte Nageltrend Fuer Den Fruehling

May 31, 2025 -

Banksys Broken Heart Wall Up For Auction

May 31, 2025

Banksys Broken Heart Wall Up For Auction

May 31, 2025 -

Nu Cau Thu Cau Long Viet Nam Khat Vong Top 20 The Gioi Tai Giai Dong Nam A

May 31, 2025

Nu Cau Thu Cau Long Viet Nam Khat Vong Top 20 The Gioi Tai Giai Dong Nam A

May 31, 2025