Rising Federal Debt: How Mortgage Borrowers Will Feel The Pinch

Table of Contents

The Relationship Between Federal Debt and Interest Rates

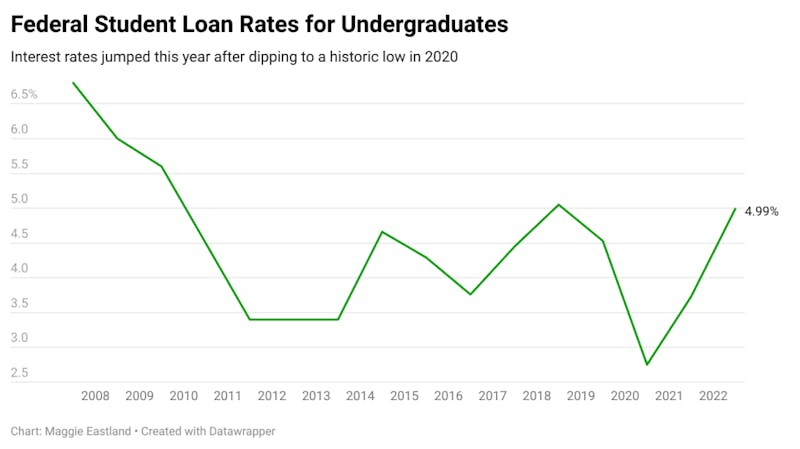

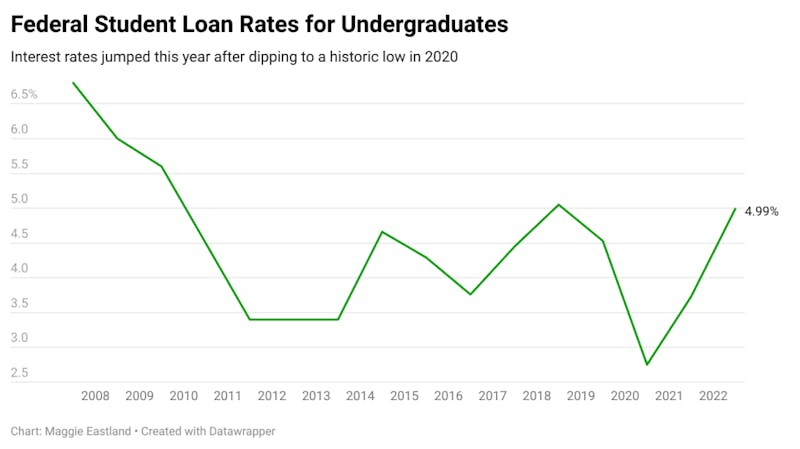

Increased federal debt often leads to higher interest rates. As the government borrows more money to cover its expenses, it increases the overall demand for loanable funds. This increased demand, in a market with a finite supply, drives up borrowing costs across the board, directly impacting mortgage rates.

- Increased government borrowing competes with private sector borrowing: When the government borrows heavily, it competes with businesses and individuals for available capital, pushing interest rates higher.

- The Federal Reserve may raise interest rates to combat inflation fueled by government spending: To control inflation potentially exacerbated by increased government spending, the Federal Reserve often raises interest rates, further impacting mortgage rates.

- Higher interest rates make mortgages more expensive: Higher interest rates translate directly into higher monthly mortgage payments, making homeownership less affordable.

- Rising debt can lead to decreased investor confidence, further impacting rates: Concerns about the nation's long-term fiscal health can lead to decreased investor confidence, potentially causing interest rates to rise further. This uncertainty makes lenders more cautious and less willing to offer lower rates.

Keywords: Federal debt, interest rates, mortgage rates, borrowing costs, inflation, government spending, Federal Reserve.

Impact on Mortgage Affordability

Higher mortgage interest rates significantly reduce affordability, making homeownership a more challenging prospect for many potential buyers. The increased cost of borrowing directly impacts the size of the mortgage a borrower can qualify for, and consequently, the price range of homes they can afford.

- Higher monthly payments strain household budgets: Increased interest rates lead to substantially higher monthly mortgage payments, potentially straining household budgets and limiting the amount of disposable income available for other essential expenses.

- Reduced purchasing power limits the types of homes buyers can afford: With higher mortgage payments, potential homebuyers find their purchasing power reduced, limiting their choices to smaller or less desirable properties.

- Increased competition among buyers in a tighter market: Higher interest rates can cool the housing market, reducing the number of buyers. However, those who can still afford to buy face increased competition for the available properties.

- Potential for slower housing market growth due to decreased demand: The combination of reduced affordability and decreased demand can lead to a slowdown in housing market growth.

Keywords: Mortgage affordability, homeownership, monthly payments, purchasing power, housing market, home prices, buyer competition.

Potential for Inflation and its Effect on Mortgages

A large national debt can contribute to inflation, eroding the purchasing power of borrowers' income and potentially increasing mortgage payments. This is because increased government spending, often financed by borrowing, can stimulate demand and outpace the supply of goods and services.

- Government spending can fuel inflation: Increased government borrowing and spending can contribute to inflationary pressures, reducing the real value of money.

- Inflation reduces the real value of mortgage payments: While the nominal value of your mortgage payment remains the same, inflation reduces its real value, meaning you’re effectively paying less in terms of purchasing power over time.

- Lenders might adjust rates to account for inflation: Lenders may adjust interest rates to protect against the erosion of the value of their loans due to inflation.

- Higher inflation can lead to higher home prices, further impacting affordability: Inflationary pressures can also contribute to increased home prices, making it even more challenging for buyers to enter the housing market.

Keywords: Inflation, purchasing power, mortgage payments, home prices, lender adjustments, interest rate adjustments, economic growth.

Long-Term Implications for Mortgage Borrowers

The sustained growth of federal debt presents long-term risks to the housing market and the financial stability of mortgage borrowers. The uncertainty surrounding future economic conditions and interest rates introduces significant risks for those with long-term mortgage obligations.

- Potential for future interest rate shocks: Unexpected increases in interest rates due to rising federal debt can severely impact borrowers, potentially leading to financial hardship.

- Uncertainty in the housing market’s long-term trajectory: The impact of rising federal debt on the housing market is uncertain, creating risk for those who have invested heavily in real estate.

- Increased risk of mortgage defaults: Higher interest rates and reduced affordability can increase the likelihood of mortgage defaults, leading to foreclosure and financial ruin for borrowers.

- Impact on retirement planning and financial security: The economic uncertainty associated with rising federal debt can negatively affect retirement planning and overall financial security, especially for those nearing retirement.

Keywords: Long-term implications, interest rate risk, housing market stability, mortgage defaults, financial security, retirement planning, economic uncertainty.

Conclusion

The rising federal debt poses a significant threat to mortgage borrowers. Higher interest rates, reduced affordability, and potential inflation are all consequences that can severely impact homeownership. Understanding this connection is vital for responsible financial planning. Stay informed about changes in interest rates and the national debt, and proactively adjust your financial strategy to navigate the challenges of a rising federal debt. Monitor the impact of rising federal debt on your mortgage and plan accordingly. Take steps to improve your financial health and mitigate the risks associated with rising federal debt and its impact on mortgage rates.

Featured Posts

-

Uber And Waymos Robotaxi Launch In Austin A New Era Of Ridesharing

May 19, 2025

Uber And Waymos Robotaxi Launch In Austin A New Era Of Ridesharing

May 19, 2025 -

Kyriaki Toy Antipasxa Sta Ierosolyma Istoria Paradosi Kai Latreia

May 19, 2025

Kyriaki Toy Antipasxa Sta Ierosolyma Istoria Paradosi Kai Latreia

May 19, 2025 -

Pargs Eurovision In Concert 2025 Participation Confirmed

May 19, 2025

Pargs Eurovision In Concert 2025 Participation Confirmed

May 19, 2025 -

Orlando Healths Brevard County Hospital Closure What We Know

May 19, 2025

Orlando Healths Brevard County Hospital Closure What We Know

May 19, 2025 -

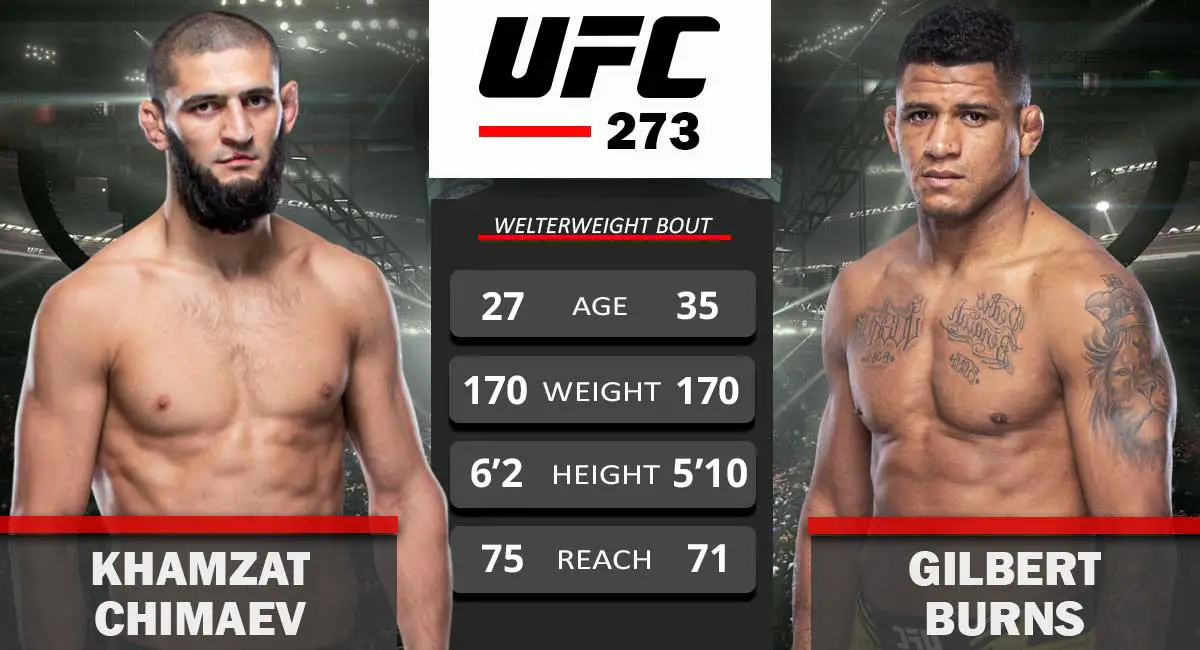

Ufc Vegas 106 Burns Vs Morales Fight Card Odds And Predictions

May 19, 2025

Ufc Vegas 106 Burns Vs Morales Fight Card Odds And Predictions

May 19, 2025