Rising Gold Prices: A Direct Result Of Trump's Trade War Rhetoric?

Table of Contents

The Safe-Haven Effect of Gold During Economic Uncertainty

Gold has historically served as a safe-haven asset, a reliable store of value during times of economic and geopolitical instability. When uncertainty grips markets, investors often flock to gold, perceiving it as a hedge against potential losses. This behavior is driven by gold's inherent properties: its limited supply, its historical value retention, and its lack of counterparty risk.

Throughout history, periods of heightened uncertainty – be it financial crises like the 2008 global financial meltdown or geopolitical conflicts – have consistently witnessed significant gold price increases. Investor sentiment plays a crucial role; fear and uncertainty translate into increased demand, pushing prices upward.

- Increased demand for gold during trade wars: Trade disputes create market instability, fueling demand for safe assets like gold.

- Gold as a hedge against inflation: During periods of inflation, gold's value tends to hold up better than fiat currencies, making it an attractive investment.

- Gold as a protection against currency devaluation: Currency fluctuations resulting from trade wars can make gold a more appealing investment than potentially weakening currencies.

Trump's Trade War Rhetoric and its Impact on Market Volatility

The Trump administration's trade policies, characterized by aggressive tariffs and trade disputes with major economic partners, significantly impacted market sentiment and volatility. Announcements of new tariffs, escalating trade tensions, and retaliatory measures from other countries created a climate of uncertainty that unsettled investors.

This uncertainty eroded investor confidence, triggering market volatility across various asset classes. As fear and uncertainty increased, investors sought refuge in gold, driving up demand and consequently, prices.

- Impact of tariffs on global trade: Tariffs disrupted established supply chains, increasing costs and creating uncertainty for businesses.

- Market reactions to trade war announcements: Announcements of new tariffs often led to immediate market sell-offs and increased demand for safe haven assets.

- Uncertainty and investor behavior: The heightened uncertainty fueled risk aversion, pushing investors towards less volatile assets like gold.

Alternative Factors Influencing Gold Prices

While Trump's trade war rhetoric undoubtedly played a role, it's crucial to acknowledge other factors influencing gold prices. These include:

- Global inflation rates: Higher inflation rates generally increase the demand for gold as a hedge against eroding purchasing power.

- Changes in interest rates: Lower interest rates can make gold more attractive relative to interest-bearing assets.

- Currency fluctuations (e.g., the US dollar): The US dollar's strength or weakness significantly influences gold prices, as gold is typically priced in US dollars.

- Geopolitical events unrelated to trade wars: Global political instability and conflicts can also impact gold prices due to increased uncertainty.

It's important to consider the relative weight of these factors compared to the impact of trade war rhetoric. While a definitive quantification is challenging, the significant market volatility coinciding with trade policy announcements suggests a substantial contribution.

Analyzing the Correlation Between Trump's Policies and Gold Price Increases

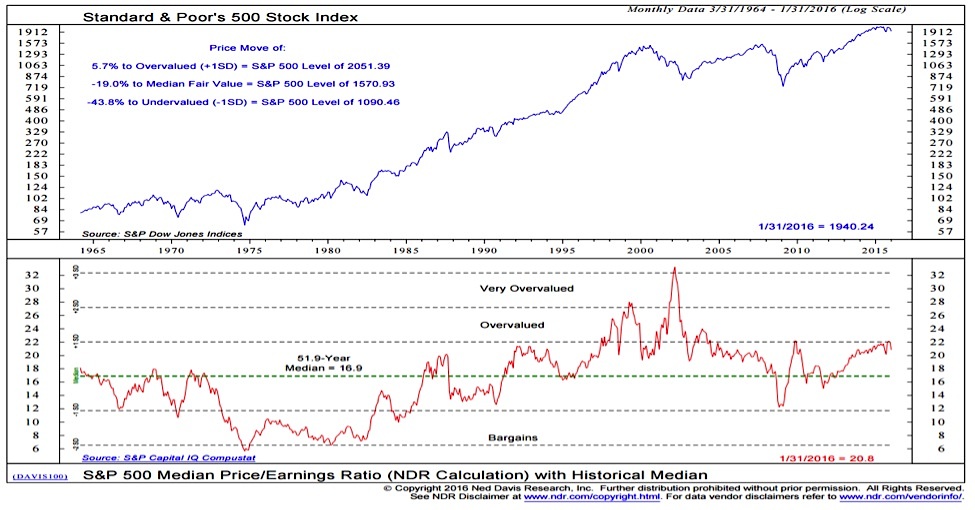

Analyzing the correlation between Trump's trade policies and gold price movements requires a careful examination of historical data. A chart showing gold price fluctuations alongside key trade policy announcements would reveal a notable correlation. Ideally, a more rigorous statistical analysis could quantify the strength of this correlation, though isolating the impact of trade wars from other factors is inherently complex.

- Chart showing gold price fluctuations alongside key trade policy announcements: Visual representation would highlight periods of increased gold prices coinciding with escalating trade tensions.

- Statistical analysis of correlation between trade war rhetoric and gold prices: Quantitative analysis can help establish the strength of the relationship.

- Acknowledgment of limitations and confounding factors: It's crucial to acknowledge that other economic and geopolitical factors also influence gold prices.

Conclusion: Understanding the Complex Relationship Between Trade Wars and Gold Prices

In summary, while various factors influence gold prices, Trump's trade war rhetoric and policies likely played a significant role in the gold price surge by increasing market uncertainty and boosting gold's safe-haven appeal. The interplay between geopolitical events and investment decisions is complex, but understanding these dynamics is crucial for making informed investment choices. Stay informed about future trade developments and their potential impact on rising gold prices – your investment strategy depends on it!

Featured Posts

-

Teylor Svift Absolyutniy Lider Prodazh Vinila Za Poslednie 10 Let

May 27, 2025

Teylor Svift Absolyutniy Lider Prodazh Vinila Za Poslednie 10 Let

May 27, 2025 -

Atlantas Ron Clark Hosts Epic Survivor Party For Students

May 27, 2025

Atlantas Ron Clark Hosts Epic Survivor Party For Students

May 27, 2025 -

Klyuch K Miru Mozhet Li Tramp Nadavit Na Putina

May 27, 2025

Klyuch K Miru Mozhet Li Tramp Nadavit Na Putina

May 27, 2025 -

Retail Sector Strength Could Stall Bank Of Canada Rate Cuts

May 27, 2025

Retail Sector Strength Could Stall Bank Of Canada Rate Cuts

May 27, 2025 -

Navigating High Stock Market Valuations Expert Analysis From Bof A

May 27, 2025

Navigating High Stock Market Valuations Expert Analysis From Bof A

May 27, 2025

Latest Posts

-

Epiloges Tiletheasis Gia To Savvato 10 5

May 30, 2025

Epiloges Tiletheasis Gia To Savvato 10 5

May 30, 2025 -

Plires Programma Tileorasis Gia Tin Kyriaki 11 5

May 30, 2025

Plires Programma Tileorasis Gia Tin Kyriaki 11 5

May 30, 2025 -

Savvatiatiko Tileoptiko Programma 10 Maioy

May 30, 2025

Savvatiatiko Tileoptiko Programma 10 Maioy

May 30, 2025 -

Kyriakatikes Tileoptikes Metadoseis 11 5

May 30, 2025

Kyriakatikes Tileoptikes Metadoseis 11 5

May 30, 2025 -

Olokliromenos Odigos Tileoptikon Metadoseon 10 5

May 30, 2025

Olokliromenos Odigos Tileoptikon Metadoseon 10 5

May 30, 2025