Rising Inflation And Unemployment: Elevated Uncertainty In The Economy

Table of Contents

Understanding the Current Inflationary Pressures

Several factors are driving current inflation rates to levels not seen in decades. These inflation drivers are interconnected and contribute to a challenging economic environment. Keywords used in this section include: inflation drivers, supply chain disruptions, energy prices, commodity prices, monetary policy, demand-pull inflation, and cost-push inflation.

- Supply chain bottlenecks and disruptions: The COVID-19 pandemic exposed vulnerabilities in global supply chains, leading to shortages of goods and increased transportation costs. This cost-push inflation impacts production and consumer prices.

- Increased energy and commodity prices: Soaring oil, gas, and food prices are significant contributors to inflation. Geopolitical instability and increased demand further exacerbate these price increases. This directly impacts consumer purchasing power and business input costs.

- Strong consumer demand exceeding supply: Pent-up demand following lockdowns, coupled with robust government stimulus in some countries, has fueled strong consumer spending. This demand-pull inflation puts upward pressure on prices as supply struggles to keep pace.

- Government spending and monetary policy impacts: Government spending programs and expansionary monetary policies, while intended to stimulate economic growth, can contribute to inflationary pressures if not managed carefully. The balance between supporting economic activity and controlling inflation is a delicate one.

- Global geopolitical instability's role: International conflicts and political tensions disrupt trade, impact energy supplies, and increase uncertainty, contributing to inflationary pressures. This uncertainty further impacts investor confidence and business planning.

The Impact of Inflation on Consumers and Businesses

High inflation significantly impacts both consumers and businesses. Understanding these effects is crucial for navigating the current economic climate.

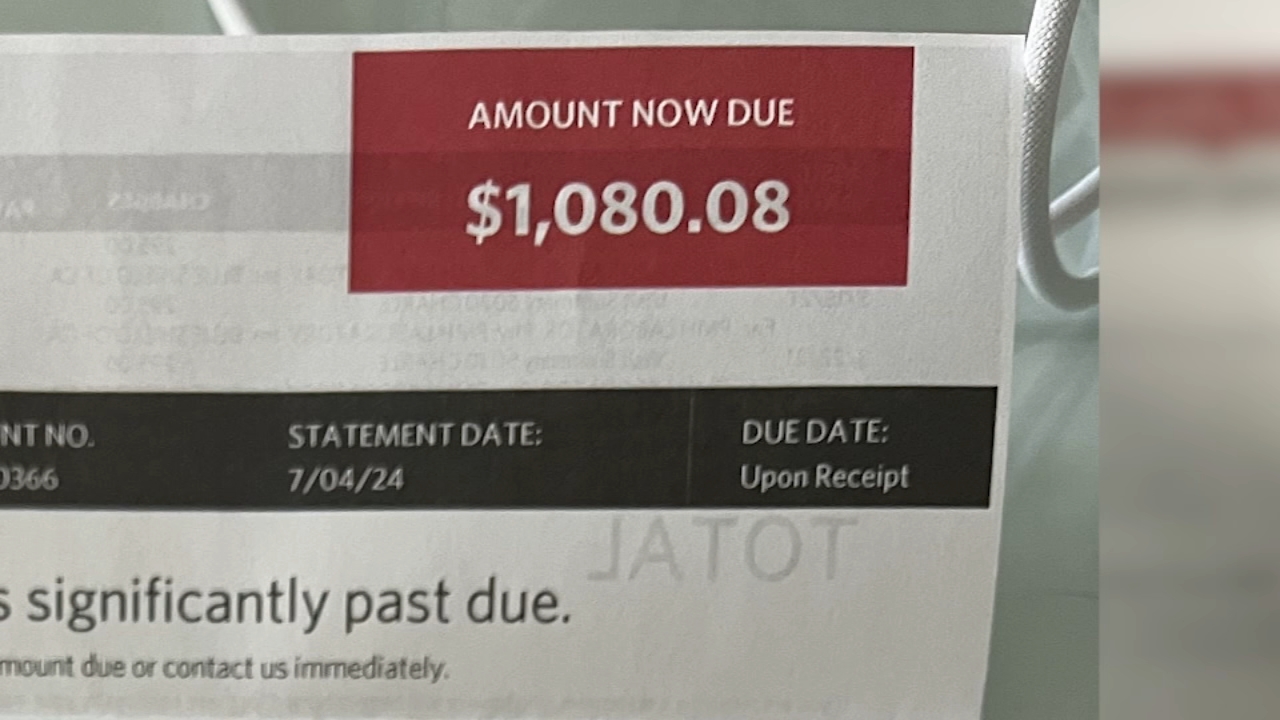

- Reduced consumer spending due to increased prices: As prices rise, consumers' purchasing power diminishes, leading to a reduction in overall spending. This can trigger a slowdown in economic growth.

- Increased production costs for businesses, impacting profitability: Businesses face higher costs for raw materials, energy, and labor, squeezing profit margins and potentially leading to job losses or reduced investment.

- Uncertainty in investment decisions due to unpredictable economic conditions: High inflation creates uncertainty, making it difficult for businesses to make long-term investment decisions. This can hinder economic growth and job creation.

- Erosion of savings and real wages: Inflation erodes the real value of savings and wages, impacting individuals' financial well-being and potentially leading to social unrest.

The Rise in Unemployment: A Concerning Parallel

The rise in unemployment runs parallel to the surge in inflation, creating a double-edged sword for the economy. Keywords for this section include: unemployment rate, job losses, labor market, recessionary fears, automation, skills gap, and workforce participation rate.

- Economic slowdown and reduced business activity: As inflation rises and consumer spending slows, businesses may reduce production, leading to job losses. This is a classic sign of a potential economic downturn.

- Automation and technological advancements leading to job displacement: Automation continues to transform the job market, leading to job displacement in some sectors. This requires workers to adapt and acquire new skills to remain competitive.

- Skills gap and mismatch between available jobs and worker skills: A skills gap exists where the skills possessed by the workforce don't match the demands of available jobs. This mismatch can lead to unemployment even in times of economic growth.

- Increased competition for jobs in a tighter labor market (in certain sectors): While overall unemployment may rise, certain sectors might experience intense competition for a limited number of jobs, especially those requiring specialized skills.

- Impact of inflation on hiring decisions: High inflation can make businesses hesitant to hire, as increased costs impact their ability to absorb additional labor expenses.

The Interplay Between Inflation and Unemployment: Stagflationary Risks

The simultaneous occurrence of high inflation and high unemployment presents the risk of stagflation – a period of slow economic growth, high unemployment, and high inflation. Keywords for this section: stagflation, economic stagnation, inflationary pressures, unemployment, economic policies, fiscal policy, and monetary policy.

- Definition and characteristics of stagflation: Stagflation is characterized by a stagnant economy, rising prices, and rising joblessness, making it particularly challenging to address.

- Historical examples of stagflationary periods: The 1970s provide a stark example of stagflation, highlighting the difficulty in managing this economic phenomenon.

- Challenges in implementing effective economic policies to address both inflation and unemployment simultaneously: Policymakers face a difficult trade-off. Policies to curb inflation can exacerbate unemployment, while policies to boost employment can worsen inflation.

- The role of fiscal and monetary policy in mitigating the risks: Careful coordination of fiscal (government spending and taxation) and monetary (interest rates and money supply) policies is crucial in attempting to mitigate the risks of stagflation.

Strategies for Navigating Economic Uncertainty

Individuals and businesses need to adapt to the economic uncertainties created by rising inflation and unemployment. Keywords for this section include: financial planning, investment strategies, risk management, diversification, budgeting, savings, and economic outlook.

- Developing a robust financial plan: A well-defined budget, emergency fund, and long-term savings plan are crucial for weathering economic storms.

- Diversifying investment portfolios to mitigate risk: Spreading investments across different asset classes reduces the impact of any single investment performing poorly.

- Implementing effective budgeting and savings strategies: Careful budgeting and saving habits help to manage expenses and build financial resilience.

- Upskilling and reskilling to adapt to changing job market demands: Investing in education and training enhances employability in a dynamic job market.

- Seeking professional financial advice: Consulting a financial advisor can provide personalized guidance on managing finances and investments during times of economic uncertainty.

Conclusion

This article highlighted the interconnected challenges of rising inflation and unemployment, emphasizing the heightened economic uncertainty. The interplay of these factors presents significant risks, including the potential for stagflation. Understanding the drivers of inflation and unemployment is crucial for navigating this complex economic environment. Staying informed about the latest developments regarding rising inflation and unemployment is essential for making informed financial decisions and adapting to the changing economic landscape. Develop a comprehensive strategy to manage the challenges posed by rising inflation and unemployment; your proactive approach will be key to navigating these uncertain times.

Featured Posts

-

Dringend Gesucht 13 Jaehrige Vermisst Seit Sonnabend

May 30, 2025

Dringend Gesucht 13 Jaehrige Vermisst Seit Sonnabend

May 30, 2025 -

Emission Europe 1 Week End Aurelien Veron And Laurent Jacobelli

May 30, 2025

Emission Europe 1 Week End Aurelien Veron And Laurent Jacobelli

May 30, 2025 -

London Klub Jagter Kasper Dolberg Seneste Nyt

May 30, 2025

London Klub Jagter Kasper Dolberg Seneste Nyt

May 30, 2025 -

Hadir Dengan Sentuhan Klasik Inilah Kawasaki W800 My 2025

May 30, 2025

Hadir Dengan Sentuhan Klasik Inilah Kawasaki W800 My 2025

May 30, 2025 -

Increased Us Solar Tariffs How Hanwha And Oci Plan To Benefit

May 30, 2025

Increased Us Solar Tariffs How Hanwha And Oci Plan To Benefit

May 30, 2025

Latest Posts

-

World Health Organization Warns Of New Covid 19 Variant Driving Case Increases

May 31, 2025

World Health Organization Warns Of New Covid 19 Variant Driving Case Increases

May 31, 2025 -

Who Alert Potential New Covid 19 Variant Linked To Increased Case Numbers

May 31, 2025

Who Alert Potential New Covid 19 Variant Linked To Increased Case Numbers

May 31, 2025 -

Indian Wells 2024 Tsitsipas Defeats Berrettini Medvedev Advances

May 31, 2025

Indian Wells 2024 Tsitsipas Defeats Berrettini Medvedev Advances

May 31, 2025 -

Is A New Covid 19 Variant Behind The Recent Surge In Cases

May 31, 2025

Is A New Covid 19 Variant Behind The Recent Surge In Cases

May 31, 2025 -

Rising Covid 19 Cases A New Variant Is The Likely Culprit Says Who

May 31, 2025

Rising Covid 19 Cases A New Variant Is The Likely Culprit Says Who

May 31, 2025