Rising Temperatures, Falling Credit Scores: The Link Between Climate And Homeownership

Table of Contents

Climate Change's Direct Impact on Home Value

Climate change is directly impacting home values through increased frequency and severity of extreme weather events and the vulnerability of our aging infrastructure.

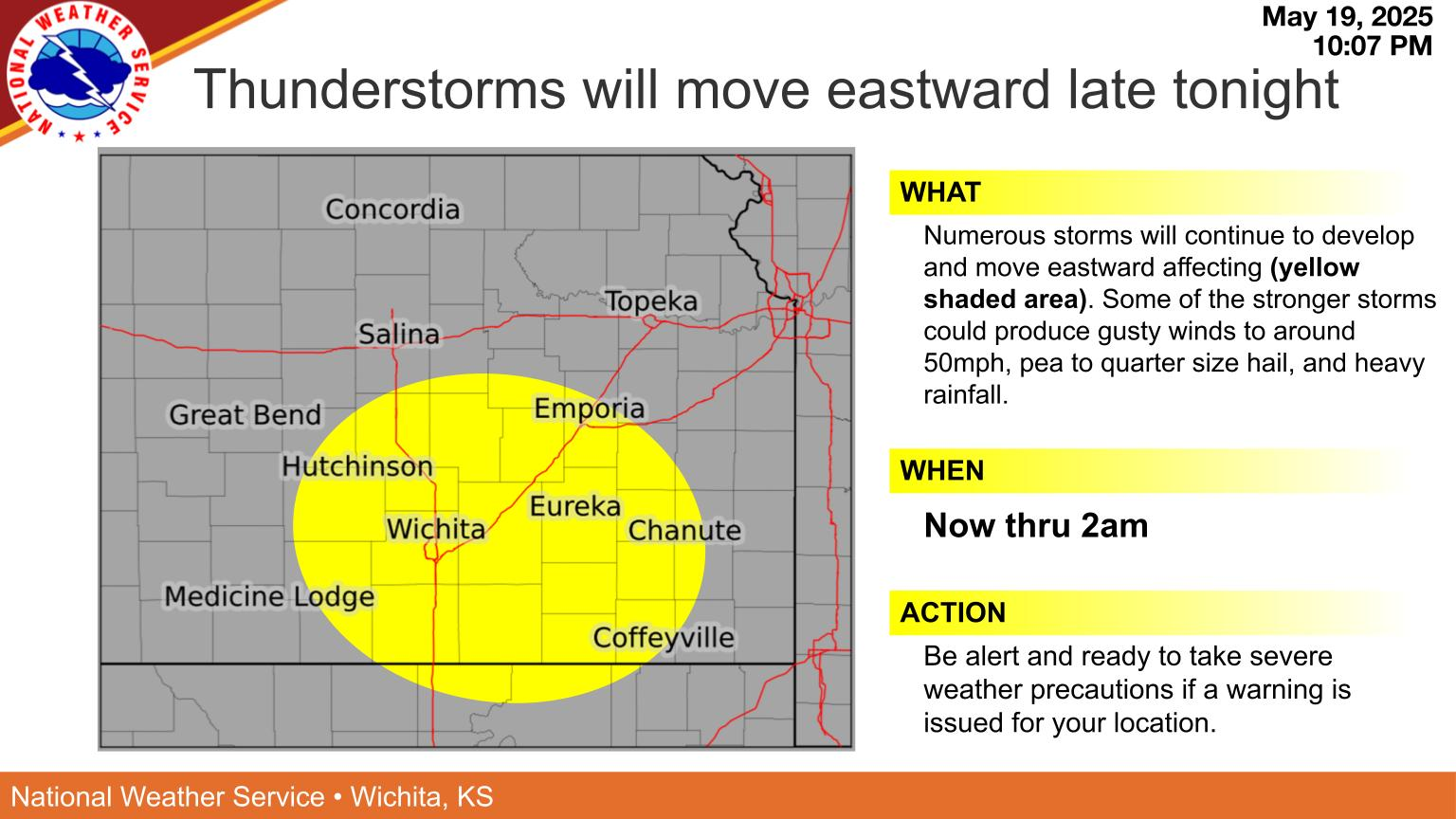

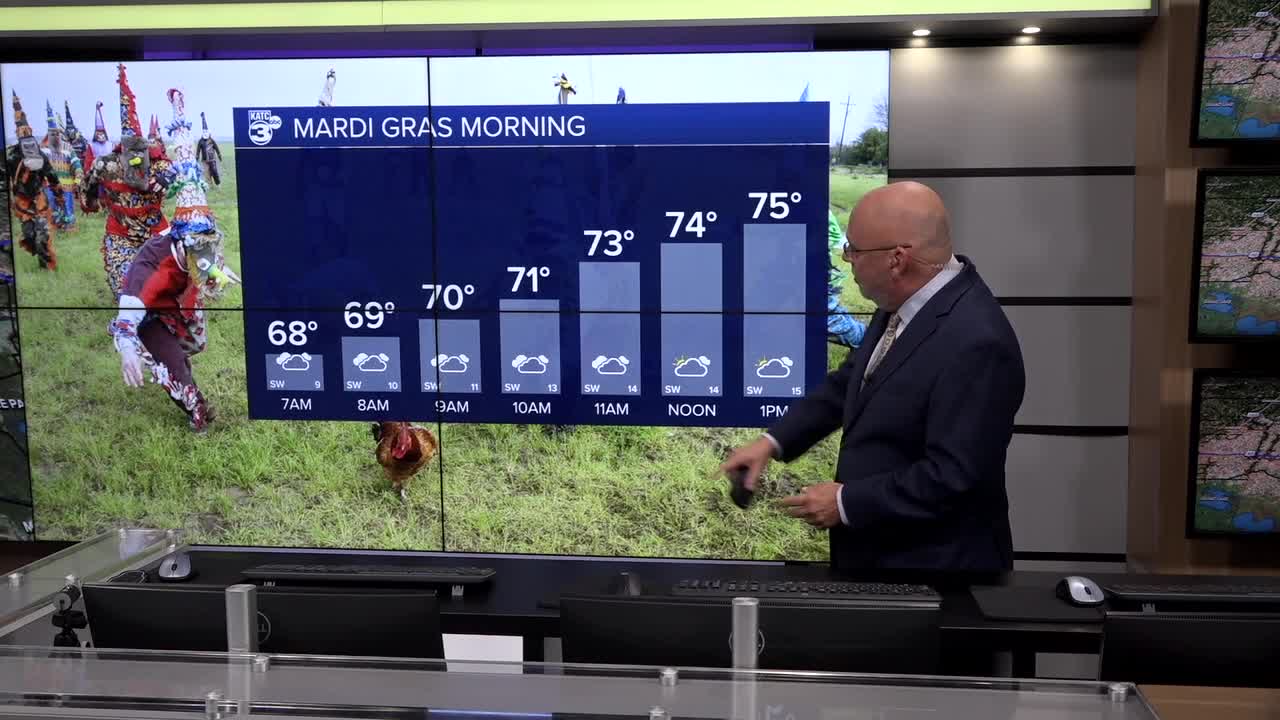

Increased Frequency of Extreme Weather Events

Hurricanes, floods, wildfires, and unprecedented heatwaves are becoming more common and intense, causing significant property damage. The financial repercussions for homeowners are substantial.

- Hurricane Katrina (2005): Caused over $100 billion in damages, leaving countless homeowners with destroyed properties and crippling debt.

- California Wildfires (ongoing): Repeated wildfires have devastated communities, leading to massive property losses and soaring insurance premiums.

- Texas Freeze (2021): The unprecedented cold snap caused widespread power outages and burst pipes, resulting in billions of dollars in damage and impacting home values across the state. Many homeowners faced substantial repair costs and struggles to obtain adequate insurance coverage.

- The resulting increase in insurance claims and the difficulty in obtaining insurance post-disaster further contribute to the devaluation of properties in high-risk areas. This directly impacts the "extreme weather events" and "property damage" associated with climate change.

Infrastructure Vulnerability and Rising Repair Costs

Aging infrastructure, struggling to cope with increasingly extreme weather, exacerbates the problem. Repair and replacement costs are skyrocketing, placing a significant financial burden on homeowners.

- Failing sewer systems: Overwhelmed by intense rainfall, leading to basement flooding and costly repairs.

- Damaged roads and bridges: Compromised by extreme weather, leading to increased transportation costs and reduced property accessibility.

- Aging power grids: Vulnerable to extreme heat and storms, resulting in power outages and the need for costly upgrades. These infrastructure issues directly contribute to "infrastructure damage," escalating "repair costs," and "home maintenance" challenges, all leading to "property devaluation."

Indirect Impacts on Credit Scores

The financial strain from climate-related damages has significant indirect impacts on credit scores.

Financial Strain from Climate-Related Damages

Uninsured or underinsured damages from climate-related events can lead to significant debt, negatively affecting credit scores.

- Homeowners may take out loans or max out credit cards to cover repair costs, increasing their debt-to-income ratio and credit utilization ratio.

- Missed payments due to financial hardship further damage credit scores. These events directly relate to the accumulation of "debt," impacting "credit utilization," "debt-to-income ratio," and overall "credit score," ultimately resulting in "financial hardship" for affected homeowners.

Difficulty Obtaining Loans and Mortgages After Climate Events

Lenders assess risk more carefully after climate-related events, leading to higher interest rates or loan denials.

- Properties in high-risk areas may be deemed less desirable, leading to lower appraisals and difficulty securing mortgages.

- Lenders may implement stricter lending criteria and higher premiums, making it harder for homeowners to refinance or obtain new loans. This increased "credit risk assessment" and stricter "lending criteria" directly impact the ability to obtain "mortgage applications" and can lead to "loan denials."

Mitigating the Risks: Strategies for Homeowners

Proactive measures can help homeowners mitigate the risks to their homes and protect their credit scores.

Investing in Climate-Resilient Home Improvements

Investing in home improvements that enhance climate resilience can protect property value and reduce vulnerability to extreme weather.

- Installing flood barriers or elevating homes in flood-prone areas.

- Reinforcing roofs to withstand high winds and heavy snow.

- Implementing drought-resistant landscaping to reduce water consumption and wildfire risk. These "home improvements" contribute directly to "climate resilience" and "property protection," acting as valuable "home upgrades."

Securing Comprehensive Insurance Coverage

Adequate insurance coverage is crucial to protect against financial loss due to climate-related events.

- Flood insurance, wildfire insurance, and comprehensive homeowners insurance are vital in mitigating financial risks.

- Regularly review and update insurance policies to ensure sufficient coverage. Securing comprehensive "insurance coverage" is critical for "risk mitigation" and offers essential "financial protection" through well-structured "insurance policies."

Conclusion

Rising temperatures are undeniably linked to increased property damage, financial strain, and consequently, falling credit scores. The direct impact of extreme weather events on home values and the indirect consequences on homeowners' financial stability cannot be ignored. Understanding the relationship between climate change and homeownership is crucial for financial well-being. Don't let rising temperatures lead to falling credit scores. Take control of your financial future by understanding the link between climate change and homeownership and taking proactive steps to protect your investment. Invest in climate-resilient home improvements and secure adequate insurance coverage to safeguard your property and credit score.

Featured Posts

-

The Goldbergs Exploring The Humor And Heart Of A Classic Sitcom

May 21, 2025

The Goldbergs Exploring The Humor And Heart Of A Classic Sitcom

May 21, 2025 -

Trans Australia Run A Race Against The Clock And The Record Books

May 21, 2025

Trans Australia Run A Race Against The Clock And The Record Books

May 21, 2025 -

The Future Of Canada Post A Reports Recommendation To Phase Out Residential Mail Delivery

May 21, 2025

The Future Of Canada Post A Reports Recommendation To Phase Out Residential Mail Delivery

May 21, 2025 -

Wtt Star Contender Chennai A Close Victory For Oh Jun Sung

May 21, 2025

Wtt Star Contender Chennai A Close Victory For Oh Jun Sung

May 21, 2025 -

Peppa Pigs Mum Welcomes Another Baby The Gender Reveal

May 21, 2025

Peppa Pigs Mum Welcomes Another Baby The Gender Reveal

May 21, 2025

Latest Posts

-

Mild Temperatures And Little Rain Chance A Perfect Week Ahead

May 21, 2025

Mild Temperatures And Little Rain Chance A Perfect Week Ahead

May 21, 2025 -

Scott Savilles Dedication Years Of Cycling Ragbrai And Daily Rides

May 21, 2025

Scott Savilles Dedication Years Of Cycling Ragbrai And Daily Rides

May 21, 2025 -

Understanding Breezy And Mild Weather Patterns A Practical Overview

May 21, 2025

Understanding Breezy And Mild Weather Patterns A Practical Overview

May 21, 2025 -

Planning Your Week Expect Mild Temperatures And Little Rain Chance

May 21, 2025

Planning Your Week Expect Mild Temperatures And Little Rain Chance

May 21, 2025 -

Breezy And Mild Destinations Where To Find The Perfect Climate

May 21, 2025

Breezy And Mild Destinations Where To Find The Perfect Climate

May 21, 2025