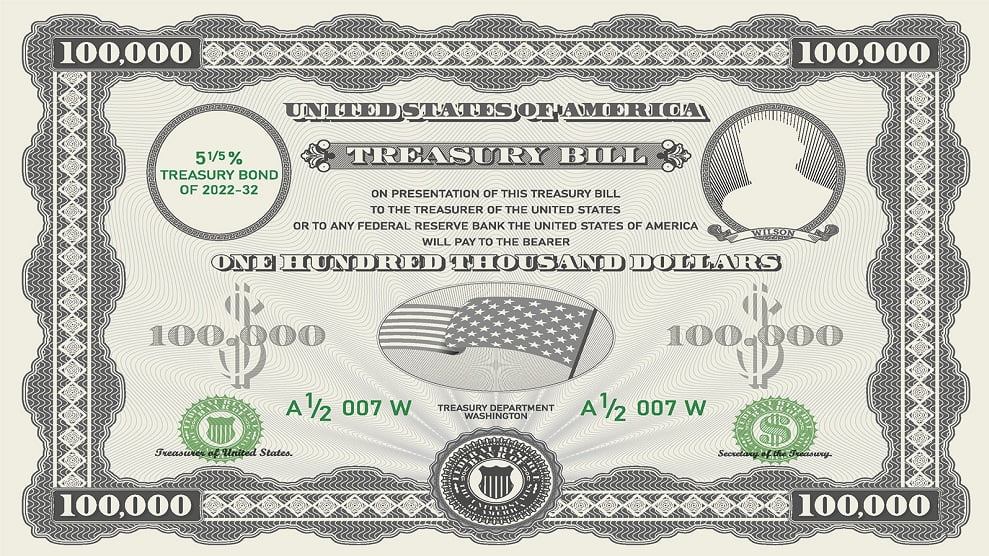

Rising Yields: A Strategic Guide To Selling US Treasury Bonds

Table of Contents

Understanding the Impact of Rising Yields on Bond Prices

The Inverse Relationship

Rising yields and falling bond prices share an inverse relationship. This means that as yields increase, bond prices decrease, and vice versa. This occurs because higher yields attract investors to newer bonds offering better returns. Consequently, the demand for older, lower-yielding bonds diminishes. This decreased demand directly translates to lower prices for existing bonds in the secondary market.

- Higher yields attract investors to newer bonds offering better returns. New bond issuances often reflect the current market interest rates, making them more appealing to investors.

- Demand for older, lower-yielding bonds decreases. Investors seek higher returns, making older bonds less attractive.

- Decreased demand leads to lower prices for existing bonds. Basic supply and demand principles dictate that lower demand pushes prices down.

- Illustrative example: Imagine a bond with a 2% yield. If a new bond is issued with a 4% yield, the demand for the 2% bond will likely decrease, lowering its price to make it more competitive.

This inverse relationship highlights the importance of understanding bond price volatility and interest rate risk when investing in bonds. Careful consideration of the yield curve, which illustrates the relationship between interest rates and maturities, is essential for informed decision-making.

Assessing Your Investment Goals and Time Horizon

Short-Term vs. Long-Term Strategies

Your investment strategy when faced with rising yields heavily depends on your investment time horizon. Short-term and long-term investors will have vastly different approaches.

- Short-term investors might sell to lock in profits before prices fall further or to avoid potential losses. Their primary concern is capital preservation in the short term.

- Long-term investors might choose to hold onto their bonds, riding out the fluctuations in bond prices, believing that the long-term value will eventually appreciate. Their focus is on long-term growth.

- Risk tolerance and financial goals are key considerations. An investor with a lower risk tolerance might prefer to sell and avoid further price drops, while a more risk-tolerant investor might hold onto the bonds for potential long-term gains.

Understanding your investment horizon and effectively managing risk is crucial for making sound decisions. This includes properly assessing your portfolio diversification to ensure a balanced approach to investing.

Strategic Approaches to Selling US Treasury Bonds

Timing the Market

Successfully timing the market is notoriously difficult. While some might attempt to predict the peak of rising yields to sell at the most opportune moment, it’s often a risky endeavor. Individual circumstances should always guide selling decisions rather than speculative market timing.

Tax Implications

Selling bonds can trigger capital gains taxes. Understanding the tax implications is vital, as capital gains taxes can significantly reduce your net profit. Consult with a qualified financial advisor or tax professional to understand the specific implications related to your situation.

Utilizing Brokerage Services

Brokerage accounts facilitate the sale of bonds. Different brokers offer varying levels of service and charge different fees and commissions. Researching and comparing different platforms is crucial to find one that aligns with your needs and budget.

- Consider laddering your bonds to mitigate risk. This strategy involves purchasing bonds with different maturity dates, reducing your exposure to interest rate fluctuations.

- Consult a financial advisor for personalized advice. A financial advisor can help you create a strategy tailored to your specific needs and risk tolerance.

- Understand the tax implications of capital gains. This will help you plan and optimize your investment strategy accordingly.

- Research different brokerage platforms and their fee structures. This ensures you choose a platform that is both convenient and cost-effective.

Careful consideration of bond trading practices, understanding capital gains tax, and selecting the right platform with reasonable brokerage fees are essential elements of a successful selling strategy. This process is greatly enhanced by proactive financial planning.

Alternatives to Selling

Holding Until Maturity

For long-term investors, holding bonds until maturity offers a guaranteed return of the face value of the bond, regardless of market fluctuations. This strategy eliminates the risks associated with selling in a volatile market.

Rebalancing Your Portfolio

Instead of selling bonds outright, consider rebalancing your portfolio. This involves adjusting your asset allocation to maintain your desired investment mix. If your bond holdings have become too large relative to other asset classes, you might sell a portion to reallocate funds into other areas of your portfolio potentially offering better returns in a rising yield environment.

- Holding until maturity guarantees the face value of the bond. This provides certainty and stability in uncertain market conditions.

- Rebalancing can help maintain a desired asset allocation. This contributes to long-term stability and reduces overall portfolio risk.

- Explore other investment options that better align with the rising yield environment. This could involve shifting towards higher-yielding investments or alternative asset classes.

Successful portfolio rebalancing and effective asset allocation are key strategies for long-term investors aiming to mitigate the risks of rising yields. Maintaining a strong long-term investment strategy is crucial for navigating market changes effectively.

Conclusion

Rising yields significantly impact US Treasury bond prices. Understanding this inverse relationship and its implications is crucial for making informed investment decisions. A strategic approach, considering your individual investment goals, time horizon, and risk tolerance, is essential. Whether you choose to sell, hold until maturity, or rebalance your portfolio, careful planning and consultation with financial professionals are highly recommended. To effectively navigate rising yields, developing a comprehensive investment strategy tailored to your individual circumstances is paramount. Consider exploring resources like reputable financial websites and consulting with a financial advisor to effectively manage your US Treasury bonds and optimize your bond portfolio in a rising yield environment.

Featured Posts

-

Asbh Deplacement A Biarritz En Pro D2 Analyse Du Facteur Mental

May 20, 2025

Asbh Deplacement A Biarritz En Pro D2 Analyse Du Facteur Mental

May 20, 2025 -

Porsches Brand Evolution The Impact Of Trade Wars On Its Ferrari Mercedes Strategy

May 20, 2025

Porsches Brand Evolution The Impact Of Trade Wars On Its Ferrari Mercedes Strategy

May 20, 2025 -

Fenerbahce De Tadic Unutulmaz Bir Baslangic

May 20, 2025

Fenerbahce De Tadic Unutulmaz Bir Baslangic

May 20, 2025 -

Understanding Lou Galas Rise To Fame In The Decameron

May 20, 2025

Understanding Lou Galas Rise To Fame In The Decameron

May 20, 2025 -

Romes Glory Jasmine Paolini Makes History

May 20, 2025

Romes Glory Jasmine Paolini Makes History

May 20, 2025

Latest Posts

-

50 Years Of Gma A Paley Center Tribute

May 20, 2025

50 Years Of Gma A Paley Center Tribute

May 20, 2025 -

Paley Center To Honor Gmas 50th Anniversary

May 20, 2025

Paley Center To Honor Gmas 50th Anniversary

May 20, 2025 -

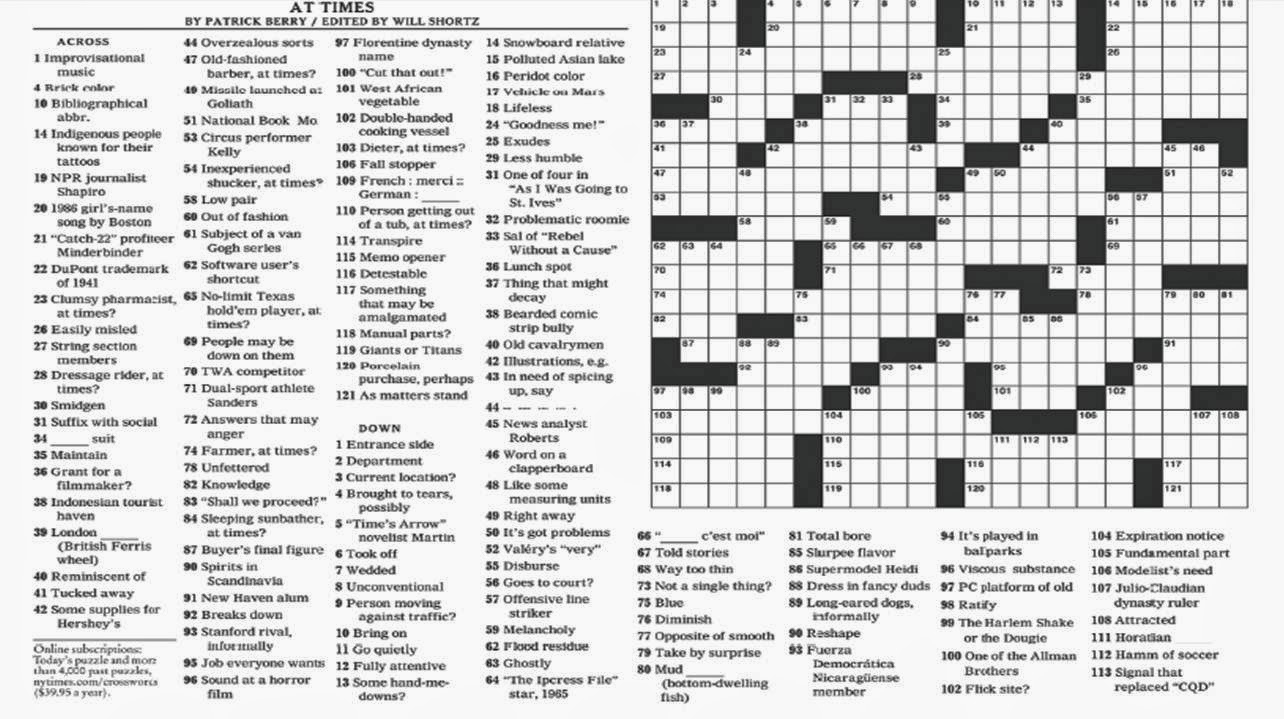

Nyt Mini Crossword Answers And Hints April 26 2025

May 20, 2025

Nyt Mini Crossword Answers And Hints April 26 2025

May 20, 2025 -

Unlock The Nyt Mini Crossword April 26 2025 Hints

May 20, 2025

Unlock The Nyt Mini Crossword April 26 2025 Hints

May 20, 2025 -

Will Trents Ramon Rodriguez Recounts Unlikely Scorpion Sting Incident

May 20, 2025

Will Trents Ramon Rodriguez Recounts Unlikely Scorpion Sting Incident

May 20, 2025