Rising Yields And The Resurgence Of The "Sell America" Trade

Table of Contents

The Allure of Rising US Yields

The primary driver behind the resurgence of the "Sell America" trade is the attractiveness of rising US yields. Higher interest rates make US Treasury bonds and other dollar-denominated assets more appealing to foreign investors seeking higher returns compared to their home countries.

Attracting Foreign Capital

The mechanics are straightforward: when US interest rates increase, the potential return on US assets increases proportionally. This makes them more competitive against investments in other countries with lower yields. This leads to a significant foreign capital inflow.

- Capital Flows: Foreign investors sell assets in their home countries, converting their currency into US dollars to purchase higher-yielding US assets. This increases demand for the dollar, strengthening its value.

- Impact on the US Dollar: The increased demand for dollars leads to dollar appreciation, making US imports cheaper and exports more expensive.

- Benefiting Assets: This trend isn't limited to US Treasury bonds. It extends to other US assets like corporate bonds, stocks, and real estate, boosting their prices and attracting foreign investment across various sectors. This creates a positive feedback loop strengthening the "Sell America" trade.

- Keyword integration: US Treasury bonds, higher returns, foreign capital inflow, dollar appreciation.

The Role of the Federal Reserve

The Federal Reserve's monetary policy plays a pivotal role in shaping interest rates and, consequently, the "Sell America" trade. The Fed's actions, particularly regarding quantitative easing (QE) and its subsequent reversal, directly impact the yield curve.

- Quantitative Tightening (QT): The reversal of QE, often called QT, involves the Fed selling off its holdings of US Treasury bonds and other securities. This reduces the money supply, increasing interest rates and making US assets more attractive to foreign investors.

- Inflation Targeting: The Fed's commitment to controlling inflation through interest rate hikes further contributes to the attractiveness of US yields. Investors seek a safe haven for their capital in times of uncertainty, particularly when their home economies face higher inflation rates.

- Future Rate Hikes: Anticipations of future interest rate hikes also influence the "Sell America" trade. Speculation about the Fed's future actions can drive further capital inflows.

- Keyword integration: Federal Reserve policy, monetary policy, interest rate hikes, quantitative tightening.

Potential Downsides of the "Sell America" Trade

While the "Sell America" trade offers benefits, it also presents considerable downsides with global implications.

Increased Dollar Strength and its Global Impact

A strong US dollar, fueled by the "Sell America" trade, creates challenges for emerging markets and global trade.

- Impact on Imports and Exports: A stronger dollar makes US imports cheaper, potentially dampening domestic production, and makes US exports more expensive, reducing competitiveness in global markets.

- Debt Servicing Difficulties: Emerging market nations with dollar-denominated debt face higher repayment costs when the dollar strengthens. This can trigger currency crises and economic instability in vulnerable countries.

- Global Trade Imbalances: The influx of capital into the US can exacerbate existing global trade imbalances, potentially leading to trade tensions and protectionist measures.

- Keyword integration: Strong dollar, currency volatility, global trade imbalances, emerging market debt.

Increased Inflationary Pressures

The "Sell America" trade can contribute to inflationary pressures within the US economy.

- Imported Inflation: While a strong dollar lowers the price of imports, increased demand fueled by the capital inflow can raise domestic prices, creating imported inflation.

- Wage-Price Spiral: Increased demand can lead to higher wages, which businesses may pass on to consumers as increased prices, resulting in a wage-price spiral.

- Domestic Price Increases: The increased demand for goods and services driven by the stronger dollar and economic activity can push domestic prices upwards.

- Keyword integration: Imported inflation, inflationary pressures, wage-price spiral, domestic price increases.

Financial Market Volatility

The "Sell America" trade increases the risk of financial market volatility.

- Capital Flight: If interest rate expectations change, or if there's a sudden shift in investor sentiment, there’s a risk of rapid capital flight, causing significant market fluctuations.

- Asset Price Fluctuations: Rapid inflows and outflows of capital can cause dramatic swings in asset prices across various sectors, increasing investment risk.

- Market Corrections: Periods of strong growth often precede corrections. The "Sell America" trade can accelerate this natural cycle, increasing the frequency and magnitude of market corrections.

- Keyword integration: Market volatility, capital flight, asset price fluctuations, investment risk.

Conclusion

The resurgence of the "Sell America" trade, driven by rising US yields, presents a complex economic scenario. While higher yields attract significant foreign investment, boosting the US dollar and certain asset classes, it also carries the potential for increased inflationary pressures, global trade imbalances, and increased financial market volatility. Understanding the interplay between rising yields and the "Sell America" trade is crucial for navigating the current economic landscape. Continue researching the impacts of rising yields on your investment portfolio and stay updated on Federal Reserve policy for a more informed approach. Conducting yield curve analysis and understanding the impact of rising yields on different asset classes will help you manage the "Sell America" trade risk effectively.

Featured Posts

-

Top Gbr News Best Grocery Buys Lucky 2000 Quarter And Doge Poll Update

May 21, 2025

Top Gbr News Best Grocery Buys Lucky 2000 Quarter And Doge Poll Update

May 21, 2025 -

New Attempt To Break The Trans Australia Run Record

May 21, 2025

New Attempt To Break The Trans Australia Run Record

May 21, 2025 -

Ex Tory Councillors Wife Awaits Racial Hatred Tweet Appeal Ruling

May 21, 2025

Ex Tory Councillors Wife Awaits Racial Hatred Tweet Appeal Ruling

May 21, 2025 -

Nyt Mini Crossword Hints And Answers April 26 2025

May 21, 2025

Nyt Mini Crossword Hints And Answers April 26 2025

May 21, 2025 -

Bwtshytynw Yetmd Ela Thlathy Jdyd Fy Tshkylt Mntkhb Amryka

May 21, 2025

Bwtshytynw Yetmd Ela Thlathy Jdyd Fy Tshkylt Mntkhb Amryka

May 21, 2025

Latest Posts

-

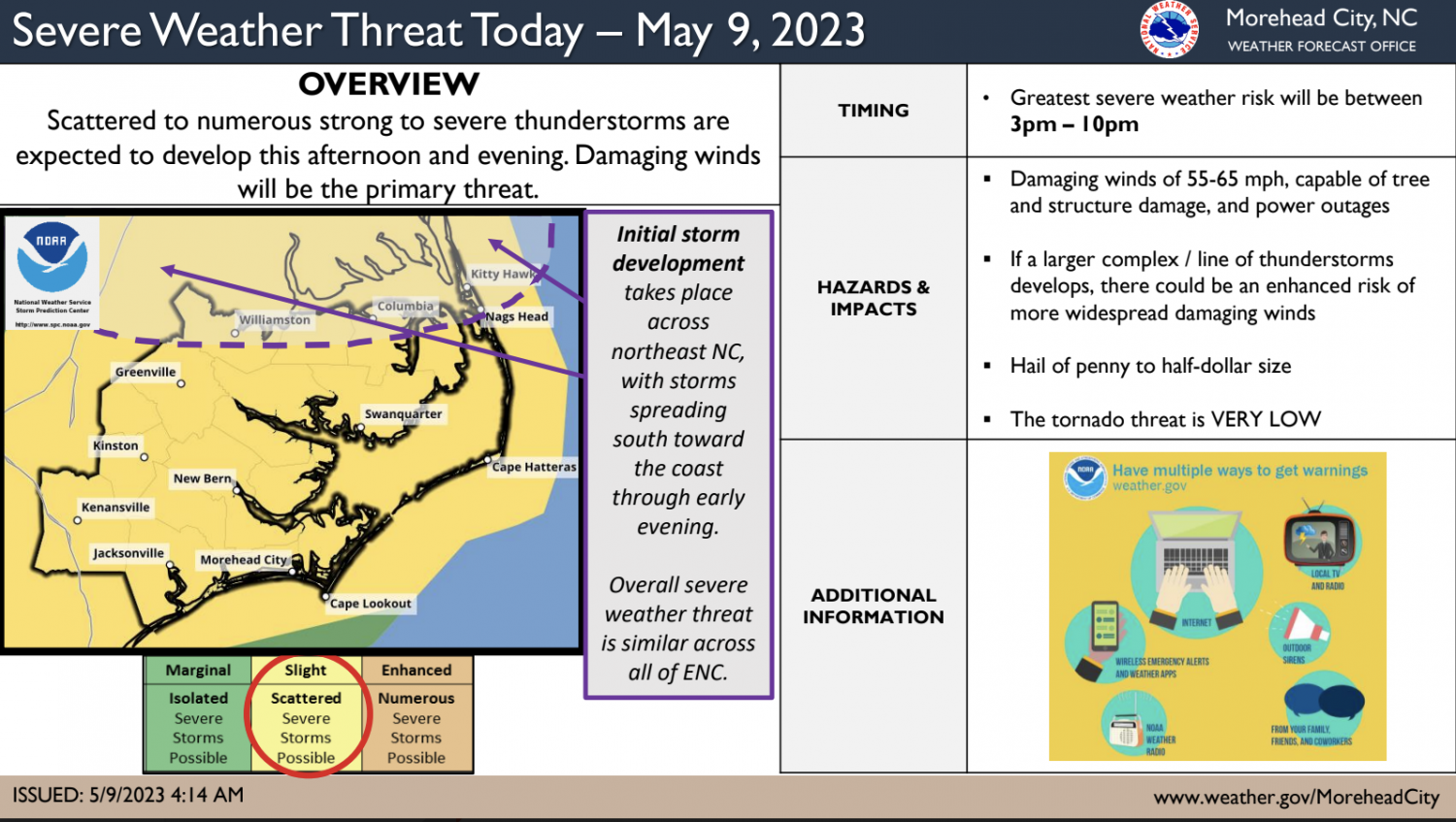

Fast Moving Storms Understanding The Dangers Of High Winds

May 21, 2025

Fast Moving Storms Understanding The Dangers Of High Winds

May 21, 2025 -

Damaging Winds How Fast Moving Storms Impact Your Area

May 21, 2025

Damaging Winds How Fast Moving Storms Impact Your Area

May 21, 2025 -

Goretzka In Nations League Squad Nagelsmanns Selection

May 21, 2025

Goretzka In Nations League Squad Nagelsmanns Selection

May 21, 2025 -

Goretzkas Nations League Call Up A Nagelsmann Decision

May 21, 2025

Goretzkas Nations League Call Up A Nagelsmann Decision

May 21, 2025 -

Dissecting A Hell Of A Run A Critical Look At Ftv Live

May 21, 2025

Dissecting A Hell Of A Run A Critical Look At Ftv Live

May 21, 2025