Rockwell Automation Earnings Surprise: Stock Soars With Other Market Leaders

Table of Contents

Exceeding Expectations: Key Financial Highlights

Rockwell Automation's Q[Insert Quarter] 2024 earnings report showcased exceptional financial performance, surpassing even the most optimistic predictions. Let's examine the key highlights:

Revenue Growth

Rockwell Automation revenue experienced a significant jump compared to the previous quarter and the same period last year. This impressive growth can be attributed to several factors, including robust demand across various sectors and successful new product launches.

- Specific Revenue Figures: [Insert precise revenue figures for the current quarter, comparing them to the previous quarter and the same quarter last year. Example: Revenue increased by 15% to $2 billion compared to Q[Previous Quarter] 2024 and 20% compared to Q[Current Quarter] 2023].

- Revenue Breakdown by Sector: Strong performance was observed across multiple sectors. The automotive sector, fueled by the ongoing shift towards electric vehicles and automation, showed particularly strong growth. The food and beverage industry also contributed significantly, driven by increasing demand for automated production lines. [Insert percentage contribution from key sectors].

- Significant Contracts: Rockwell Automation secured several large contracts during the quarter, further boosting its revenue. [Provide details about notable contracts if available].

This robust Rockwell Automation revenue growth firmly positions the company as a leader in industrial automation revenue growth.

Profitability and Earnings Per Share (EPS)

The impressive revenue growth translated into significantly improved profitability and earnings per share (EPS). Rockwell Automation EPS exceeded analyst predictions by a considerable margin.

- Precise EPS Figures: [Insert precise EPS figures, comparing them to analyst predictions and previous periods. Example: EPS rose to $2.50, exceeding analyst expectations of $2.00 and representing a 30% increase year-over-year].

- Improved Margins: The company also reported improved profit margins, indicating enhanced operational efficiency and cost management. [Insert details about margin improvements].

- Factors Contributing to Increased Profitability: Rockwell Automation's success is largely attributable to a combination of factors, including strategic cost-cutting measures and ongoing efforts to optimize its operational efficiency.

The significant increase in Rockwell Automation EPS underscores the company's strong financial health and its ability to translate revenue growth into substantial profits.

Strong Order Backlog

The company's robust order backlog further reinforces its positive outlook. This significant backlog indicates a strong pipeline of future projects and revenue streams.

- Size of the Backlog: [Insert the size of the backlog, possibly broken down by sector].

- Sectors Contributing to Backlog: A substantial portion of the backlog comes from the automotive, food and beverage, and semiconductor sectors, reflecting the continued growth in these key markets.

- Implications for Future Revenue Streams: This healthy backlog suggests continued strong revenue growth in the coming quarters. The future revenue projections are exceptionally positive based on this order book strength.

The substantial Rockwell Automation backlog is a clear indicator of sustained future growth in the industrial automation market.

Factors Contributing to the Positive Surprise

Several key factors contributed to Rockwell Automation's positive earnings surprise:

Increased Demand in Key Industries

Strong demand across several key industries played a pivotal role in driving Rockwell Automation's exceptional performance.

- Industry-Specific Trends: The ongoing trend of automation in the automotive industry, driven by the rise of electric vehicles, is a significant contributor. Similarly, increasing demand for efficient and automated production processes in the food and beverage sector bolstered revenue. The semiconductor industry also saw significant growth, fueling demand for advanced automation solutions.

- Significant Industry-Specific Projects: [Mention any significant projects that contributed to increased demand].

The increased industrial automation demand across these crucial sectors directly translates to higher revenue and profitability for Rockwell Automation.

Successful Product Launches and Innovation

Rockwell Automation's commitment to innovation and the successful launch of new products also contributed significantly to the positive results.

- New Product Offerings: [Detail any recently launched products that have contributed to revenue growth].

- Innovative Features: These products often feature cutting-edge technologies and functionalities, addressing the evolving needs of customers in the industrial automation market.

- Market Reception and Customer Feedback: The positive market reception of these new offerings reflects their value proposition and effective address of industry needs.

Rockwell Automation's focus on innovation and new product launches underpins its success in the competitive industrial automation technology landscape.

Effective Supply Chain Management

In a challenging global environment marked by supply chain disruptions, Rockwell Automation’s effective supply chain management proved crucial.

- Strategies to Mitigate Disruptions: [Detail strategies employed to overcome supply chain challenges, perhaps including diversification of suppliers or strategic inventory management].

- Successes in Procurement and Logistics: The company successfully navigated potential bottlenecks, ensuring timely delivery of products and services to its customers.

The resilience of Rockwell Automation's supply chain demonstrates its ability to operate effectively even amidst significant global challenges.

Market Impact and Future Outlook

The Rockwell Automation earnings surprise had a significant impact on the market:

Stock Price Reaction

The announcement of the impressive earnings results led to a notable increase in Rockwell Automation's stock price.

- Percentage Change in Stock Price: [Insert the percentage change in stock price following the earnings announcement].

- Comparison to Other Market Indices: [Compare the stock price performance to broader market indices].

- Analyst Upgrades and Ratings: [Mention any upgrades or changes in analyst ratings].

The market’s positive reaction reflects strong investor confidence in Rockwell Automation's future prospects.

Analyst Predictions and Future Guidance

Analysts are generally positive about Rockwell Automation's future performance, with several upgrading their earnings predictions.

- Consensus Estimates for Future Earnings: [Summarize consensus estimates for future earnings].

- Cautionary Statements: [Mention any cautionary statements issued by the company regarding future performance].

While the future outlook is positive, it's important to acknowledge that market conditions can change rapidly.

Conclusion

Rockwell Automation’s recent earnings report significantly exceeded expectations, driving a substantial increase in its stock price. This positive surprise stems from a combination of factors, including strong demand in key industries, successful product launches, and effective supply chain management. The company’s robust order backlog further points towards continued growth. While future performance is always subject to market fluctuations, the current results provide a strong indication of Rockwell Automation’s resilience and potential within the industrial automation sector. Stay informed on future Rockwell Automation earnings announcements and related news to track the company's ongoing success. Investing in companies like Rockwell Automation can offer a promising avenue for growth in the dynamic world of industrial automation.

Featured Posts

-

Canadas Tariff Cuts On Us Products Exemptions And Their Economic Impact

May 17, 2025

Canadas Tariff Cuts On Us Products Exemptions And Their Economic Impact

May 17, 2025 -

Is The Doctor Who Christmas Special On Hold

May 17, 2025

Is The Doctor Who Christmas Special On Hold

May 17, 2025 -

Recuperacion De Capital El Descongelamiento De Cuentas De Koriun

May 17, 2025

Recuperacion De Capital El Descongelamiento De Cuentas De Koriun

May 17, 2025 -

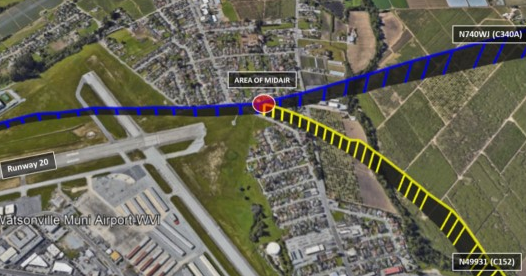

This Air Traffic Controllers Exclusive Account Of Preventing A Midair Collision

May 17, 2025

This Air Traffic Controllers Exclusive Account Of Preventing A Midair Collision

May 17, 2025 -

Reduce Student Loan Burden A Financial Planners Guide

May 17, 2025

Reduce Student Loan Burden A Financial Planners Guide

May 17, 2025

Latest Posts

-

Erdogan Al Nahyan Telefon Goeruesmesi Detaylar Ve Oenemli Noktalar

May 17, 2025

Erdogan Al Nahyan Telefon Goeruesmesi Detaylar Ve Oenemli Noktalar

May 17, 2025 -

10 Great Tv Shows Cancelled Too Soon A Tragic Waste Of Talent

May 17, 2025

10 Great Tv Shows Cancelled Too Soon A Tragic Waste Of Talent

May 17, 2025 -

Upstairs Downstairs Star Jean Marsh Dies At 90 A Tribute

May 17, 2025

Upstairs Downstairs Star Jean Marsh Dies At 90 A Tribute

May 17, 2025 -

Cumhurbaskani Erdogan Ve Birlesik Arap Emirlikleri Devlet Baskani Nin Telefon Goeruesmesi

May 17, 2025

Cumhurbaskani Erdogan Ve Birlesik Arap Emirlikleri Devlet Baskani Nin Telefon Goeruesmesi

May 17, 2025 -

10 Excellent Tv Shows That Ended Too Early

May 17, 2025

10 Excellent Tv Shows That Ended Too Early

May 17, 2025