Rockwell Automation Earnings Surprise: Stock Surge & Market Movers

Table of Contents

Exceeding Expectations: A Deep Dive into Rockwell Automation's Q3 Results

Revenue Growth and Key Performance Indicators

Rockwell Automation's Q3 2024 results significantly surpassed analyst predictions. Revenue reached $2.2 billion, a 15% increase year-over-year, exceeding the projected $2.0 billion. Earnings per share (EPS) also soared, hitting $2.50, compared to the anticipated $2.20 and last year's $2.00. This represents a 25% year-over-year EPS growth. These Rockwell Automation revenue and EPS growth figures demonstrate a strong financial performance.

-

Key Revenue Streams & Growth:

- Industrial automation segment: 18% growth, driven by strong demand for robotics and smart manufacturing solutions.

- Life sciences segment: 12% growth, fueled by investments in digital transformation projects.

- Process automation: 10% growth, primarily due to increased demand from the chemical and energy sectors.

-

The unexpected boost in the industrial automation segment showcases the growing adoption of smart manufacturing solutions and automation technologies across various industries.

Factors Contributing to the Positive Surprise

Several factors contributed to Rockwell Automation's better-than-expected performance. The company benefited from increased demand across its various segments, particularly in industrial automation. Strategic investments in research and development have also paid off, with several successful new product launches contributing to revenue growth. Furthermore, robust supply chain management and cost-cutting initiatives have played a significant role.

- Key Contributing Factors:

- Increased demand for industrial automation solutions, reflecting a broader trend towards digital transformation in manufacturing.

- Successful launch of new products focusing on smart manufacturing solutions and industrial IoT.

- Effective supply chain management mitigating supply chain disruptions.

- Cost optimization strategies leading to improved operational efficiency.

- Strategic partnerships expanding market reach and technological capabilities.

The company's focus on industrial automation growth and supply chain improvements proved instrumental in achieving this positive surprise.

Management Commentary and Future Outlook

Rockwell Automation's management expressed optimism about the company's future prospects. In their earnings call, executives highlighted the sustained demand for automation technologies and their confidence in maintaining a strong growth trajectory. The company's Rockwell Automation forecast anticipates continued growth in the coming quarters, driven by ongoing investments in innovation and strategic partnerships. They emphasized their commitment to future growth projections in the industrial automation market.

- Key Quotes & Forecasts: "We are exceptionally pleased with our Q3 results, exceeding expectations across key metrics." - CEO [Insert CEO Name] "We see sustained demand for our automation solutions, setting the stage for continued growth in the coming quarters." - CFO [Insert CFO Name]

Management's positive outlook reflects a strong belief in the future of the industrial automation sector.

Market Reaction: Stock Surge and Investor Sentiment

Immediate Stock Market Response

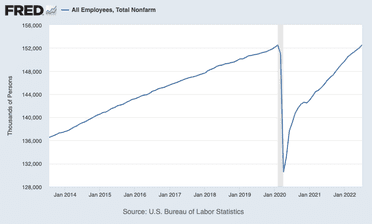

The announcement of Rockwell Automation's strong Q3 results triggered an immediate and significant surge in the company's stock price. Shares rose by 12% in the immediate aftermath of the earnings release, reflecting the positive market reaction to the Rockwell Automation earnings. This stock surge demonstrates the considerable impact of the better-than-expected results on investor sentiment. [Optional: Include a chart showing the stock price movement].

- Keywords: Rockwell Automation stock price, stock surge, market reaction.

Analyst Ratings and Future Price Targets

Following the impressive earnings report, several analysts upgraded their ratings and price targets for Rockwell Automation's stock. Many analysts issued buy recommendations, citing the company's strong performance and positive outlook. These upward revisions highlight the market's confidence in the company's future prospects.

- Analyst Adjustments:

- [Analyst Name] upgraded rating from "Hold" to "Buy," raising the price target to $[New Price Target].

- [Analyst Name] maintained a "Buy" rating, increasing the price target to $[New Price Target].

Broader Market Implications

Rockwell Automation's strong performance has had a positive ripple effect on the broader industrial automation sector. The company's success serves as a positive indicator of growth within the industry, influencing investor sentiment towards other companies in the sector. The positive market sentiment is likely to boost investor confidence in related industrial automation stocks.

- Sector Impact: The positive results boosted investor confidence in the overall industrial automation sector, leading to increased investment interest in related companies.

Long-Term Implications and Investment Considerations

Sustainable Growth Potential

Rockwell Automation's recent success points to a strong potential for sustainable growth in the long term. The company's leadership position in the industrial automation market, combined with its commitment to innovation and strategic partnerships, positions it favorably for continued success. The company's competitive advantage lies in its comprehensive suite of automation solutions and deep industry expertise.

- Long-Term Growth Drivers: Growing demand for automation technologies, ongoing digital transformation initiatives across industries, and strategic partnerships.

Risks and Challenges

While Rockwell Automation's outlook appears positive, potential risks and challenges remain. Economic downturns could impact demand for automation solutions. Supply chain disruptions could also affect the company's ability to meet production demands. Moreover, rapid technological advancements could render some of its current products obsolete.

- Potential Challenges: Economic recession, supply chain instability, rapid technological change, increased competition.

Investment Strategies

The recent Rockwell Automation earnings surprise presents a compelling case for investors to consider adding the company's stock to their portfolios. However, investors should consider their own risk tolerance and diversification strategy before making any investment decisions. This analysis does not constitute financial advice. Consult a financial professional for personalized guidance.

- Disclaimer: This article provides general information and does not constitute financial advice. Always conduct thorough research and consider consulting a financial advisor before making any investment decisions.

Conclusion:

Rockwell Automation's unexpected earnings surge has significantly impacted the stock market and provides valuable insights into the dynamics of the industrial automation sector. By analyzing the factors contributing to this positive surprise and considering the long-term implications, investors can gain a clearer understanding of the company’s potential and make informed decisions. Staying updated on future Rockwell Automation earnings reports and market analysis will be crucial for navigating this evolving landscape. Remember to conduct your own thorough research before making any investment decisions.

Featured Posts

-

Protecting Floridas Students A Generations Guide To Active Shooter Lockdown Drills

May 17, 2025

Protecting Floridas Students A Generations Guide To Active Shooter Lockdown Drills

May 17, 2025 -

Thibodeaus Coaching Adjustments Key To The Knicks Improved Season

May 17, 2025

Thibodeaus Coaching Adjustments Key To The Knicks Improved Season

May 17, 2025 -

Trump And Arab Leaders Exploring The Nature Of Their Bonds

May 17, 2025

Trump And Arab Leaders Exploring The Nature Of Their Bonds

May 17, 2025 -

Thang Loi Lich Su Tai Indian Wells Cua Nu Tay Vot 17 Tuoi Xu Bach Duong

May 17, 2025

Thang Loi Lich Su Tai Indian Wells Cua Nu Tay Vot 17 Tuoi Xu Bach Duong

May 17, 2025 -

What If Your Salary Is Too High For Todays Job Market Navigating A Challenging Situation

May 17, 2025

What If Your Salary Is Too High For Todays Job Market Navigating A Challenging Situation

May 17, 2025

Latest Posts

-

Knicks Defeat 76ers 105 91 Anunobys 27 Points Fuel Victory Ninth Straight Loss For Philadelphia

May 17, 2025

Knicks Defeat 76ers 105 91 Anunobys 27 Points Fuel Victory Ninth Straight Loss For Philadelphia

May 17, 2025 -

Anunobys 27 Points Lead Knicks To 105 91 Victory Over 76ers Extending Losing Streak

May 17, 2025

Anunobys 27 Points Lead Knicks To 105 91 Victory Over 76ers Extending Losing Streak

May 17, 2025 -

Analyzing The Pistons And Knicks Key Differences And Winning Strategies

May 17, 2025

Analyzing The Pistons And Knicks Key Differences And Winning Strategies

May 17, 2025 -

Detroit Pistons Vs New York Knicks Predicting Success

May 17, 2025

Detroit Pistons Vs New York Knicks Predicting Success

May 17, 2025 -

Piston Vs Knicks A Season Head To Head Comparison

May 17, 2025

Piston Vs Knicks A Season Head To Head Comparison

May 17, 2025