RTL Group's Streaming Business: The Road To Profitability

Table of Contents

RTL Group's Streaming Portfolio: A Diverse Landscape

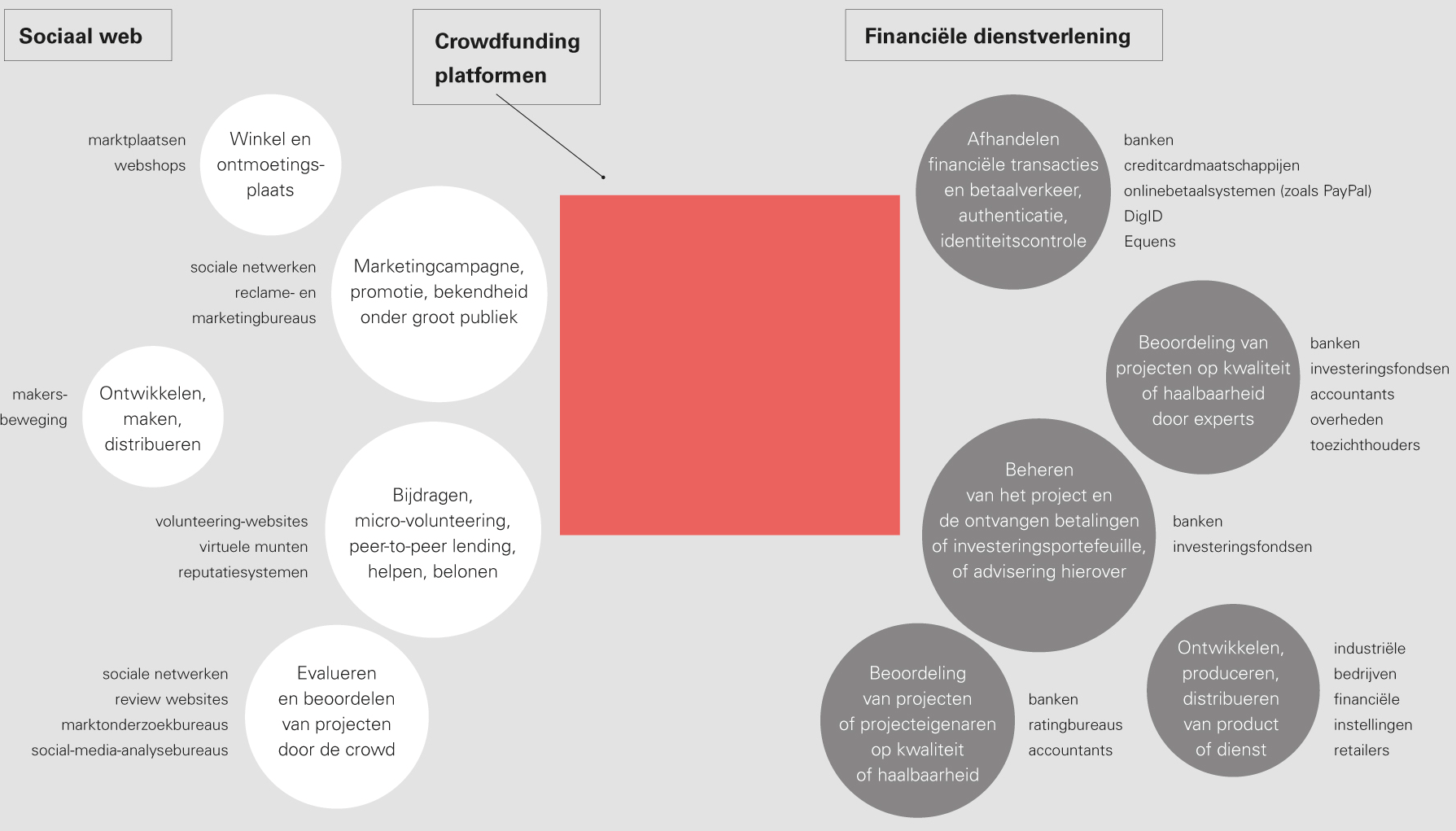

RTL Group boasts a diverse portfolio of streaming platforms, each tailored to specific geographical markets and target audiences. This strategic approach allows for localized content and better engagement with viewers. Key players include TVNow in Germany and Videoland in the Netherlands. These platforms showcase a mix of content strategies, balancing original programming with licensed content to cater to varying viewer preferences.

- Overview of key streaming platforms and their market positions: TVNow, for example, holds a significant position in the German market, while Videoland dominates in the Netherlands. Their market share fluctuates based on content offerings and competition.

- Analysis of content strategies: original vs. licensed content: Both services leverage a mix of original productions and licensed content. The balance between these two varies, reflecting the specific demands of each market and the cost-effectiveness of each strategy.

- Geographic reach and target audience demographics: The geographical reach is primarily focused on specific European countries. Target audiences are carefully segmented based on demographics, viewing habits, and preferred genres.

- Discussion on the effectiveness of geo-targeting strategies: Geo-targeting enables RTL Group to offer highly relevant content to each market, increasing user engagement and subscriber retention. However, effective geo-targeting requires understanding local preferences and cultural nuances.

Revenue Models: Balancing Subscriptions and Advertising

RTL Group's streaming business employs a variety of revenue models, aiming to strike a balance between subscription-based revenue (SVOD) and advertising-supported video on demand (AVOD). A freemium model, combining free, ad-supported content with premium subscription tiers, may be explored to broaden its reach and increase revenue streams. This strategic blend of monetization approaches is crucial for long-term financial sustainability.

- Detailed explanation of RTL Group's current revenue model breakdown: The precise breakdown of subscription versus advertising revenue isn't publicly available in detail, but it is likely a mix of both, reflecting the industry trend.

- Comparative analysis of subscription vs. advertising revenue: Subscription models offer predictable revenue streams but require a significant subscriber base. AVOD generates revenue based on ad impressions but is often dependent on viewership numbers.

- Discussion on the potential benefits and drawbacks of a hybrid model: A hybrid model offers flexibility, potentially attracting a wider audience, but managing the balance between ad experience and subscriber satisfaction is key.

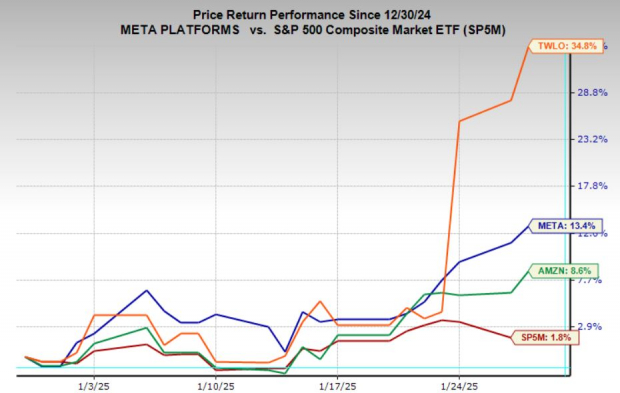

- Examples of successful monetization strategies from competitors: Analyzing competitors like Netflix (primarily SVOD) and YouTube (primarily AVOD) provides valuable insights into best practices and potential pitfalls.

Content Strategy: The Key to Subscriber Acquisition and Retention

A compelling content strategy is paramount to attracting and retaining subscribers in the competitive streaming landscape. RTL Group must invest in high-quality original programming while strategically acquiring rights to popular licensed content. Securing exclusive content is crucial for differentiation and subscriber acquisition. The challenge lies in balancing content acquisition costs with the return on investment.

- Evaluation of the effectiveness of RTL Group's current content strategy: This requires analyzing audience engagement metrics, subscriber growth rates, and market share in comparison to competitors.

- Analysis of the success (or failure) of original programming initiatives: Identifying successful original shows and analyzing the factors contributing to their success (or failure) provides valuable data for future content decisions.

- Discussion on the importance of securing exclusive content deals: Exclusive content acts as a significant draw, setting RTL Group's offerings apart from competitors.

- Comparison with competitor content strategies: Analyzing the strategies of competitors like Netflix, Disney+, and Amazon Prime Video helps to benchmark RTL Group's performance and identify opportunities for improvement.

Competition and Market Dynamics: Navigating a Crowded Field

The European streaming market is intensely competitive, with established giants like Netflix, Disney+, and Amazon Prime Video vying for market share. RTL Group faces the challenge of differentiating its offerings and securing its position in this saturated market. Understanding market saturation and predicting future trends is essential for long-term success.

- Overview of major competitors in the European streaming market: This includes identifying key players, their market share, and their content strategies.

- Analysis of RTL Group's competitive strengths and weaknesses: RTL Group's strengths might include its local market expertise and established brand recognition. Weaknesses might be its smaller content library compared to global giants.

- Discussion on market saturation and the potential for future growth: The European market is rapidly approaching saturation, requiring RTL Group to innovate and adapt to maintain growth.

- Prediction of future market trends and their impact on RTL Group: This involves considering potential trends like the rise of niche streaming services or the increasing importance of personalized content recommendations.

Conclusion

RTL Group's journey to profitability in the streaming market presents significant challenges and opportunities. Success hinges on a robust content strategy, effective monetization through a balanced approach to SVOD and AVOD, and adept navigation of the fiercely competitive landscape. Further analysis of RTL Group's long-term strategies is crucial for understanding its future trajectory. Follow our future articles for ongoing insights into RTL Group's streaming business and the road to profitability.

Featured Posts

-

Abn Amros Investering In Transferz Toekomst Van Digitale Betalingen

May 21, 2025

Abn Amros Investering In Transferz Toekomst Van Digitale Betalingen

May 21, 2025 -

Top 12 Ai Stocks To Buy Reddits Most Popular Choices

May 21, 2025

Top 12 Ai Stocks To Buy Reddits Most Popular Choices

May 21, 2025 -

Tony Hinchcliffes Wwe Segment A Backstage Report Of Disappointment

May 21, 2025

Tony Hinchcliffes Wwe Segment A Backstage Report Of Disappointment

May 21, 2025 -

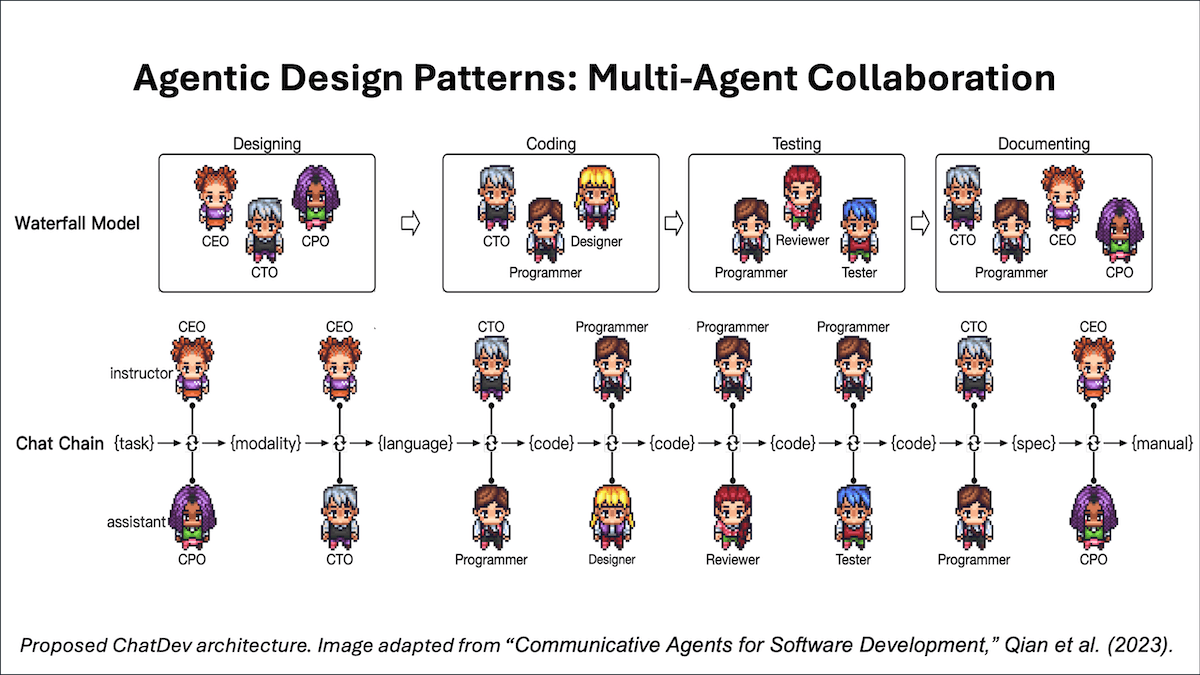

Chat Gpts Ai Coding Agent Features Benefits And Use Cases

May 21, 2025

Chat Gpts Ai Coding Agent Features Benefits And Use Cases

May 21, 2025 -

Peppa Pigs Big Screen Adventure 10 Episodes This May

May 21, 2025

Peppa Pigs Big Screen Adventure 10 Episodes This May

May 21, 2025

Latest Posts

-

Roger Daltreys Health The Who Singer Battles Hearing And Vision Loss At 81

May 23, 2025

Roger Daltreys Health The Who Singer Battles Hearing And Vision Loss At 81

May 23, 2025 -

The North State Wolf Issue Current Challenges And Future Solutions

May 23, 2025

The North State Wolf Issue Current Challenges And Future Solutions

May 23, 2025 -

Life After 80 The Whos Unfiltered Perspective

May 23, 2025

Life After 80 The Whos Unfiltered Perspective

May 23, 2025 -

Wolves And Humans Finding Solutions In The North State

May 23, 2025

Wolves And Humans Finding Solutions In The North State

May 23, 2025 -

The Who At 80 A Realistic Look At Rock Star Life

May 23, 2025

The Who At 80 A Realistic Look At Rock Star Life

May 23, 2025