Ryanair's Growth Outlook: Tariff Conflicts And The Planned Share Repurchase Program

Table of Contents

The Impact of Tariff Conflicts on Ryanair's Operations

Trade disputes and resulting tariffs present significant headwinds for Ryanair's operational efficiency and strategic ambitions.

Increased Operational Costs

Tariffs on essential resources directly increase Ryanair's operational costs. These include:

- Fuel Costs: Fluctuations in fuel prices, exacerbated by international trade tensions and potential tariffs on imported fuel, significantly impact profitability. Even small percentage increases can translate into substantial losses over the airline's massive flight volume.

- Aircraft Parts: Tariffs on imported aircraft parts, including engines and components, add to maintenance expenses and potentially delay necessary repairs.

- Other Essential Resources: This includes everything from ground handling services to catering supplies, all potentially subject to import tariffs depending on their origin.

To mitigate these increased costs, Ryanair may employ several strategies:

- Hedging: Implementing hedging strategies to mitigate fuel price volatility is crucial. This involves purchasing fuel contracts at predetermined prices to limit exposure to price swings.

- Route Adjustments: Shifting flight routes to utilize airports in regions less affected by tariffs could offer short-term cost savings, though this may involve logistical complexities.

Keywords: tariffs, operational costs, fuel costs, aircraft parts, hedging strategies

Effects on Flight Routes and Expansion Plans

Tariffs create significant barriers to market entry and expansion.

- Trade Barriers: New or increased tariffs can make it economically unviable to establish new routes to or from tariff-affected regions.

- Market Access Restrictions: Trade disputes often lead to retaliatory measures, which can restrict market access for airlines.

- Route Optimization Challenges: Ryanair's route optimization strategies, vital for maximizing profitability, are complicated by the need to navigate tariff-imposed costs and limitations.

These challenges may force Ryanair to:

- Delay expansion plans: Postponing expansion into new markets until tariff situations stabilize.

- Re-evaluate existing routes: Assessing the viability of continuing operations on routes significantly impacted by tariffs.

- Prioritize high-demand routes: Focusing resources and capital on less tariff-sensitive, high-demand routes.

Keywords: flight routes, market expansion, trade barriers, route optimization

Competition and Market Share

Increased operational costs due to tariffs directly impact Ryanair's competitive position.

- Price Increases: Ryanair might be forced to increase ticket prices to offset rising costs, potentially losing price-sensitive customers to competitors.

- Reduced Profit Margins: Higher operational costs squeeze profit margins, hindering Ryanair's ability to reinvest in growth and innovation.

- Competitive Disadvantage: If competitors are less affected by tariffs, they gain a competitive advantage, potentially capturing market share.

Ryanair needs to adapt strategically to counter this:

- Strengthening its low-cost model: Further optimizing its operations to minimize costs in other areas to compensate for tariff impacts.

- Strategic Partnerships: Collaborating with other airlines or businesses to access resources at more favorable prices.

- Aggressive marketing: Focusing on marketing and advertising campaigns to emphasize its value proposition despite price pressures.

Keywords: market share, competition, competitive advantage, airline competition

Analyzing Ryanair's Share Repurchase Program and its Growth Implications

Ryanair's share repurchase program represents a significant strategic decision with considerable implications for future growth.

The Rationale Behind the Repurchase

Ryanair's decision to repurchase shares likely stems from:

- Strong Financial Health: The company's robust financial position and considerable cash flow allow for capital returns to shareholders.

- Shareholder Value Enhancement: Repurchases can increase earnings per share (EPS), boosting shareholder returns.

- Undervaluation Belief: Management might believe the company's shares are undervalued in the market, making repurchase a cost-effective investment.

Keywords: share repurchase program, shareholder value, financial health, cash flow

Impact on Future Investments and Expansion

The share repurchase program diverts capital that could otherwise be invested in growth initiatives.

- Fleet Expansion: Reduced investment in new aircraft could limit Ryanair's ability to expand its network and capacity.

- Technological Upgrades: Investing in new technologies is crucial for efficiency and customer experience; this might be impacted.

- New Routes: The allocation of resources to share repurchases could affect the development of new routes and market penetration strategies.

This creates a trade-off between:

- Short-term shareholder returns: Returning capital to investors through share buybacks.

- Long-term growth investments: Reinvesting capital to fuel expansion and innovation.

Keywords: capital investment, fleet expansion, technological upgrades, reinvestment

Investor Sentiment and Stock Price

The market's reaction to Ryanair's share repurchase program will be a key indicator of its success.

- Positive Signal: The announcement could signal confidence in the company's future prospects, potentially boosting the stock price.

- Concerns about Growth: Some investors might view the repurchase as a sign that Ryanair is prioritizing short-term gains over long-term growth, negatively impacting the stock price.

- Impact on Investor Confidence: The overall impact on investor confidence will depend on how the market interprets the strategic rationale behind the repurchase.

Keywords: investor sentiment, stock price, market reaction, investor confidence

Conclusion: A Look Ahead at Ryanair's Future: Balancing Challenges and Opportunities

Ryanair faces a complex future, navigating the headwinds of tariff conflicts while simultaneously managing the strategic implications of its share repurchase program. The impact of tariffs on operational costs and expansion plans is undeniable, while the decision to repurchase shares creates a trade-off between short-term shareholder returns and long-term growth investments. The success of Ryanair's future will depend on its ability to strategically balance these competing factors. To stay updated on Ryanair's progress in addressing these challenges and capitalizing on emerging opportunities, follow further developments regarding Ryanair’s growth outlook, the impact of tariff conflicts, and the outcome of the share repurchase program. Check back for updates or subscribe to receive future analyses. Understanding Ryanair's ongoing performance requires close monitoring of its financial reports and strategic announcements.

Featured Posts

-

Investigating The Sound Perimeter Music And Collective Identity

May 21, 2025

Investigating The Sound Perimeter Music And Collective Identity

May 21, 2025 -

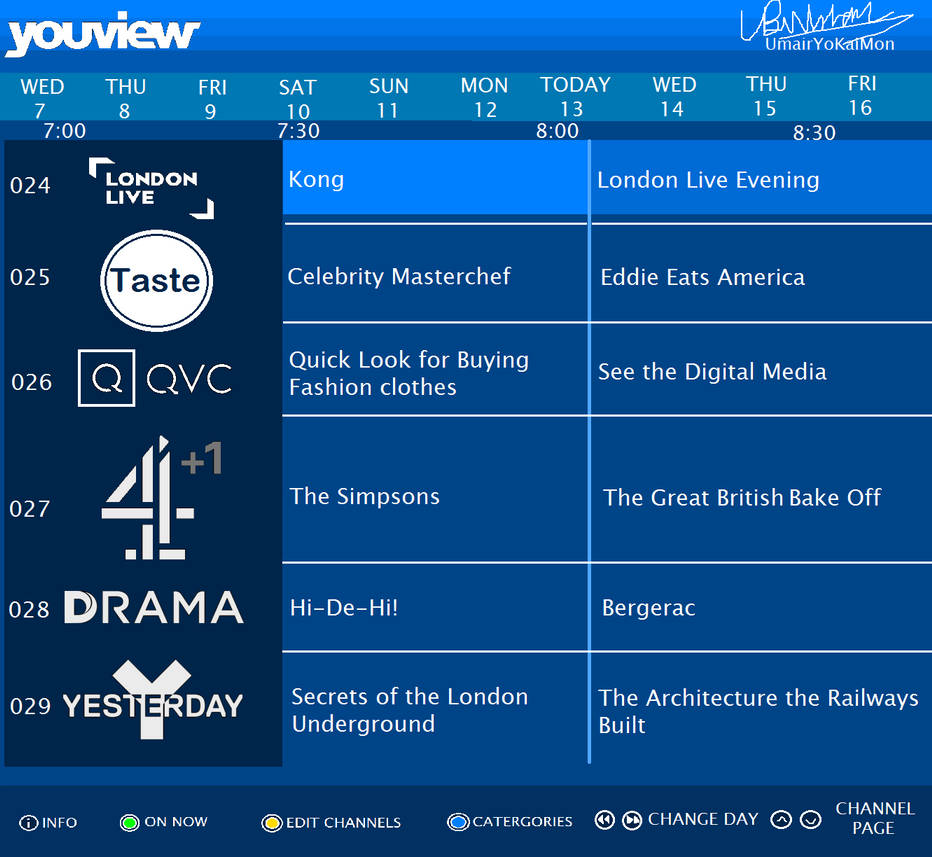

Your Guide To Sandylands U Tv Showtimes

May 21, 2025

Your Guide To Sandylands U Tv Showtimes

May 21, 2025 -

Peppa Pig Meets The Baby A 10 Episode Cinema Experience This May

May 21, 2025

Peppa Pig Meets The Baby A 10 Episode Cinema Experience This May

May 21, 2025 -

Le Metier De Cordiste A Nantes Une Profession En Plein Essor

May 21, 2025

Le Metier De Cordiste A Nantes Une Profession En Plein Essor

May 21, 2025 -

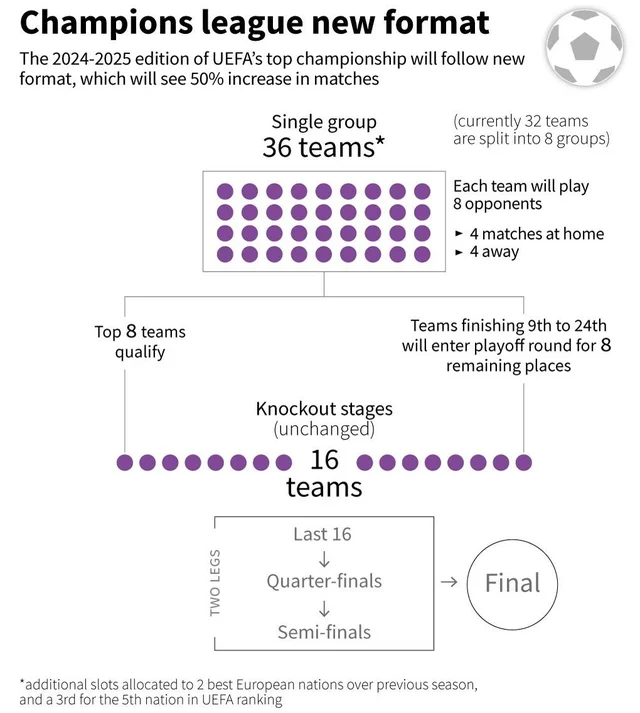

Premier League 2024 25 Champions Images And Highlights

May 21, 2025

Premier League 2024 25 Champions Images And Highlights

May 21, 2025

Latest Posts

-

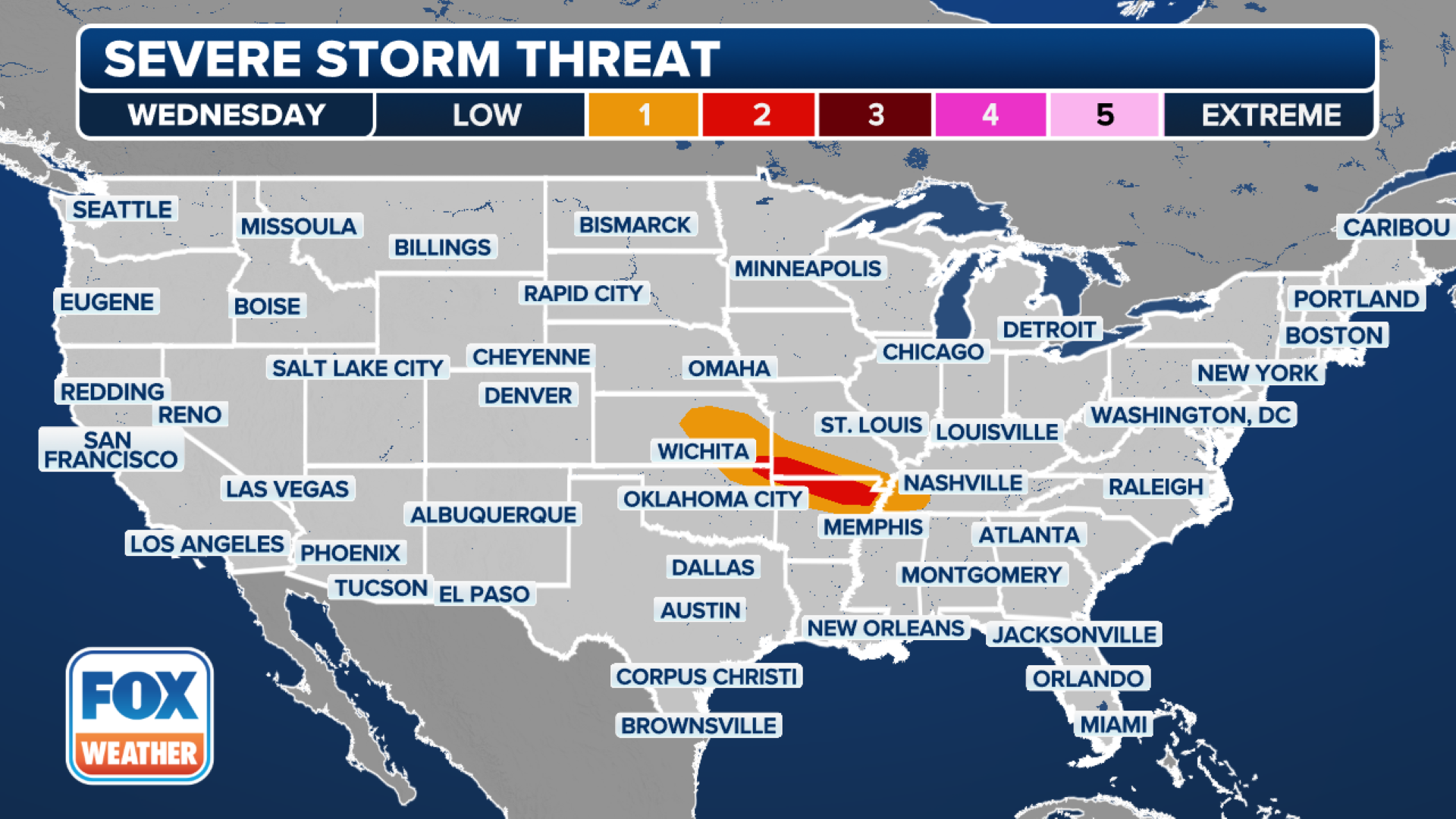

Monday Severe Weather Overnight Storm Chances And Impacts

May 21, 2025

Monday Severe Weather Overnight Storm Chances And Impacts

May 21, 2025 -

Overnight Storm Potential Severe Weather Risk Monday

May 21, 2025

Overnight Storm Potential Severe Weather Risk Monday

May 21, 2025 -

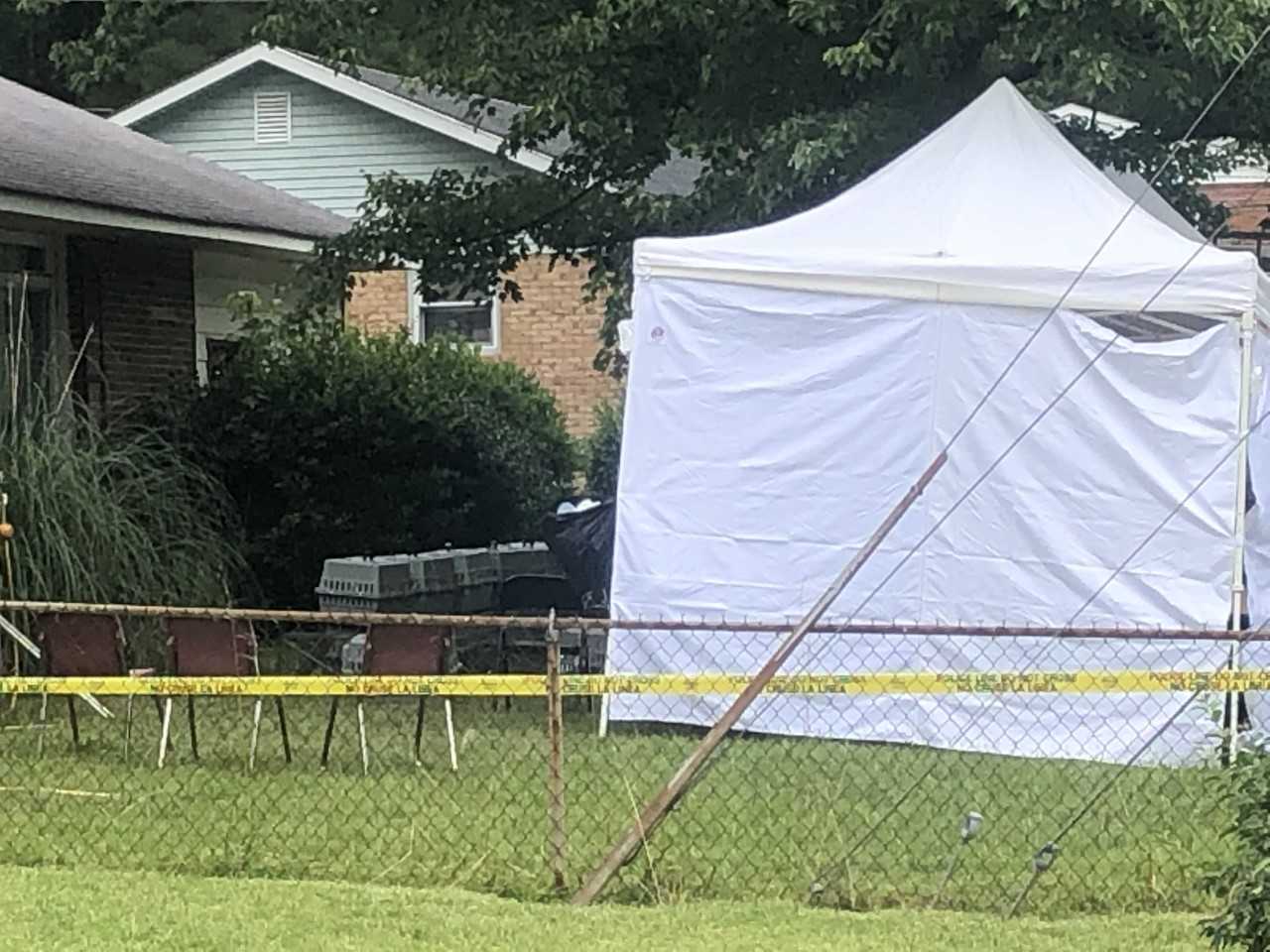

Animal Welfare Investigation 49 Dogs Removed From Washington County Facility

May 21, 2025

Animal Welfare Investigation 49 Dogs Removed From Washington County Facility

May 21, 2025 -

Wintry Mix Of Rain And Snow Impacts And Safety Precautions

May 21, 2025

Wintry Mix Of Rain And Snow Impacts And Safety Precautions

May 21, 2025 -

Driving Safely During A Wintry Mix Of Rain And Snow

May 21, 2025

Driving Safely During A Wintry Mix Of Rain And Snow

May 21, 2025