Ryanair's Growth Outlook: Tariff Wars And Planned Share Buyback

Table of Contents

The Impact of Tariff Wars on Ryanair's Operations

Tariff wars and geopolitical instability create significant headwinds for Ryanair's operations, impacting both costs and route planning.

Increased Fuel Costs

Rising fuel prices, a direct consequence of global geopolitical events and potential trade disputes, significantly impact Ryanair's operating costs. This is a critical factor influencing the Ryanair growth outlook.

- Increased fuel costs necessitate higher ticket prices or reduced profit margins. To maintain profitability, Ryanair may be forced to increase airfares, potentially impacting passenger numbers, or accept lower profit margins, reducing shareholder returns. This delicate balancing act is crucial for the Ryanair growth outlook.

- Hedging strategies and fuel-efficient aircraft are crucial for mitigating these risks. Ryanair employs sophisticated hedging strategies to protect against fuel price volatility. Furthermore, its investment in fuel-efficient aircraft is a long-term strategy to improve cost efficiency and strengthen its Ryanair growth outlook.

- Analysis of Ryanair's fuel hedging strategy and its effectiveness in navigating price volatility. The effectiveness of Ryanair's hedging strategy will be a key determinant of its ability to withstand future fuel price shocks and maintain a positive Ryanair growth outlook. Independent analysis of their hedging practices is crucial for investors.

Disruptions to Air Travel Routes

Tariff wars can lead to trade restrictions and reduced international travel, directly affecting Ryanair's flight routes and passenger numbers.

- Potential impact on Ryanair's expansion plans in affected regions. New route openings and expansion into new markets could be delayed or cancelled if geopolitical tensions escalate and impact travel. This directly influences the Ryanair growth outlook.

- Strategic adjustments Ryanair might make to optimize routes and minimize losses. Ryanair may need to adjust its route network, focusing on less affected regions or prioritizing high-demand routes to mitigate losses and maintain a positive Ryanair growth outlook.

- Analysis of passenger numbers on key routes and their sensitivity to geopolitical events. Monitoring passenger numbers on key routes affected by geopolitical instability is crucial for understanding the impact of tariff wars on Ryanair's overall performance and shaping the Ryanair growth outlook.

Ryanair's Planned Share Buyback: A Sign of Confidence or Financial Prudence?

Ryanair's announcement of a share buyback program is a significant event influencing the Ryanair growth outlook.

Buyback Rationale

The share buyback program signals Ryanair's belief in its long-term prospects and potentially indicates strong financial health.

- Discussion of the size and timing of the buyback. The magnitude of the buyback and its timing relative to market conditions provide insights into Ryanair's confidence levels and the outlook for its future performance. This significantly impacts the Ryanair growth outlook.

- Analysis of the impact on earnings per share (EPS). A share buyback can artificially increase EPS, making the company appear more profitable. Understanding this impact is key to evaluating the true picture of the Ryanair growth outlook.

- Comparison of this buyback with previous capital allocation strategies. Analyzing past capital allocation decisions will help assess whether this buyback is a consistent strategy or a deviation, offering further insight into the Ryanair growth outlook.

Alternative Investment Opportunities

The funds used for the buyback could have been allocated to other areas, such as fleet expansion or technological upgrades.

- Evaluation of the opportunity cost associated with the share buyback. Investing in fleet upgrades or new technologies could yield higher returns in the long run than a share buyback, impacting the long-term Ryanair growth outlook.

- Comparison of the returns from share buybacks versus other investments. A thorough cost-benefit analysis is needed to determine whether the buyback is the most optimal use of capital, directly impacting the Ryanair growth outlook.

- Long-term strategic implications of this capital allocation choice. The decision reflects management's priorities and will shape the company's future direction, hence directly impacting the long-term Ryanair growth outlook.

Overall Growth Outlook for Ryanair

Considering the various factors, what is the future for Ryanair?

Projected Passenger Numbers

Analyzing Ryanair's passenger growth projections for the coming years is crucial for understanding the Ryanair growth outlook.

- Market share analysis and competition within the low-cost airline sector. Ryanair's competitive position within the low-cost airline sector significantly impacts its future passenger numbers and overall Ryanair growth outlook.

- Expansion into new markets and routes. Ryanair's expansion plans and ability to penetrate new markets directly influence future passenger growth and the Ryanair growth outlook.

- Impact of seasonal variations on passenger demand. Understanding seasonal fluctuations in demand is crucial for accurate passenger number projections and a realistic Ryanair growth outlook.

Financial Projections and Investor Sentiment

Assessing analyst forecasts and investor confidence provides a complete picture of the Ryanair growth outlook.

- Stock price analysis and market valuation. The stock price reflects investor sentiment and market expectations regarding Ryanair's future performance. This is a key indicator of the Ryanair growth outlook.

- Debt levels and credit ratings. Ryanair's financial health, measured by its debt levels and credit ratings, is crucial for assessing its long-term sustainability and influencing the Ryanair growth outlook.

- Overall risk assessment for investors. A thorough risk assessment is essential for investors to make informed decisions and gauge their own perspectives on the Ryanair growth outlook.

Conclusion

Ryanair's growth outlook is a complex interplay of external pressures (like tariff wars and fuel price volatility) and internal strategies (such as the share buyback). While challenges exist, Ryanair's actions suggest confidence in its long-term prospects. To stay informed on the latest developments impacting the Ryanair growth outlook, continue to monitor financial news and company announcements. Understanding the complexities surrounding the Ryanair growth outlook is crucial for both investors and those interested in the future of European low-cost air travel.

Featured Posts

-

Investigation Launched Into Racial Slurs Targeting Angel Reese In Wnba

May 20, 2025

Investigation Launched Into Racial Slurs Targeting Angel Reese In Wnba

May 20, 2025 -

Michael Schumacher Grand Pere Pour La Premiere Fois D Une Petite Fille

May 20, 2025

Michael Schumacher Grand Pere Pour La Premiere Fois D Une Petite Fille

May 20, 2025 -

Enquete Sur Les Allegations De Maltraitance Et D Abus Sexuels A La Fieldview Care Home

May 20, 2025

Enquete Sur Les Allegations De Maltraitance Et D Abus Sexuels A La Fieldview Care Home

May 20, 2025 -

Drugo Dijete Jennifer Lawrence Je Li To Istina

May 20, 2025

Drugo Dijete Jennifer Lawrence Je Li To Istina

May 20, 2025 -

Fenerbahce Nin Yeni Yildizi Tadic Beklentileri Karsilayacak Mi

May 20, 2025

Fenerbahce Nin Yeni Yildizi Tadic Beklentileri Karsilayacak Mi

May 20, 2025

Latest Posts

-

Will Trent Actor Ramon Rodriguezs Unexpected Scorpion Encounter

May 20, 2025

Will Trent Actor Ramon Rodriguezs Unexpected Scorpion Encounter

May 20, 2025 -

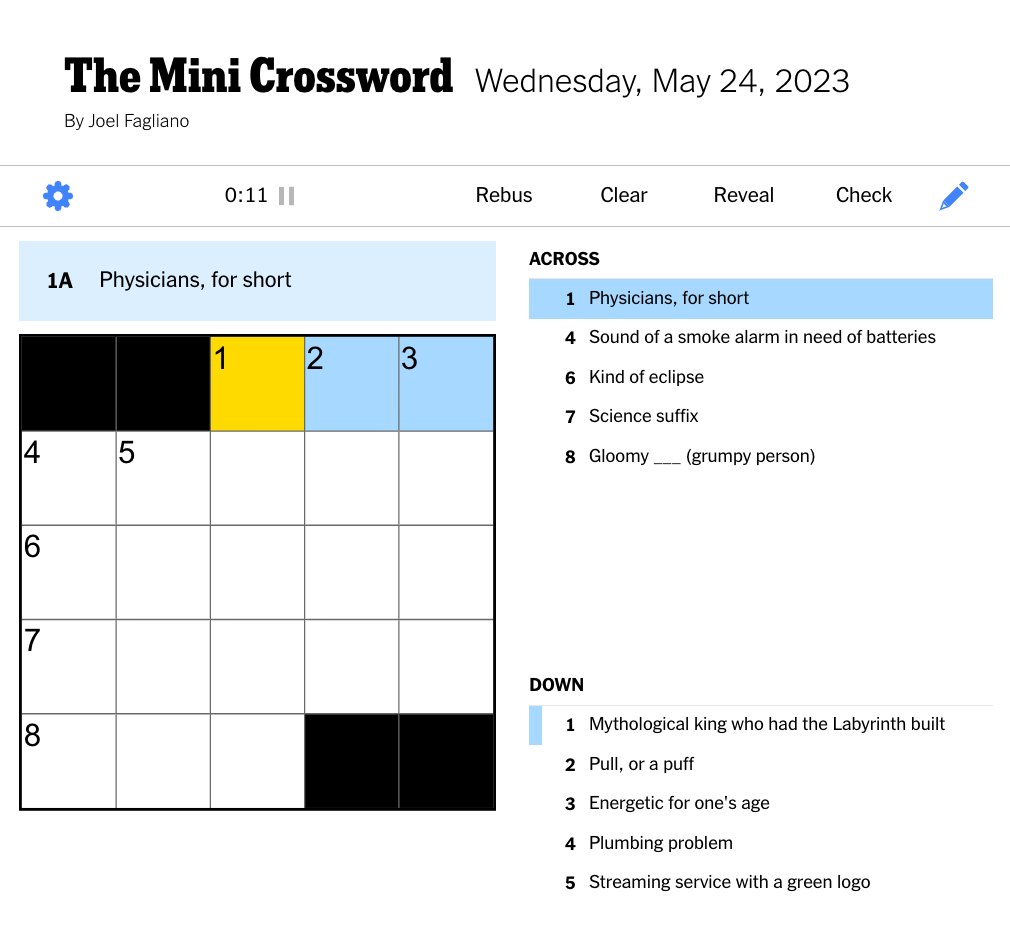

Nyt Mini Crossword April 26 2025 Helpful Hints

May 20, 2025

Nyt Mini Crossword April 26 2025 Helpful Hints

May 20, 2025 -

Good Morning America Robin Roberts Announces Addition To Her Family

May 20, 2025

Good Morning America Robin Roberts Announces Addition To Her Family

May 20, 2025 -

April 26 2025 Nyt Mini Crossword Puzzle Hints

May 20, 2025

April 26 2025 Nyt Mini Crossword Puzzle Hints

May 20, 2025 -

Robin Roberts Shares Joyful Family News On Good Morning America

May 20, 2025

Robin Roberts Shares Joyful Family News On Good Morning America

May 20, 2025