S&P 500 Soars: 3%+ Gain On Trade War Tariff Relief

Table of Contents

Main Points:

2.1. Trade War Tariff Relief: The Catalyst for the S&P 500 Rally

H3: Specific Tariff Reductions/Suspensions: The recent surge in the S&P 500 can be largely attributed to specific actions taken to alleviate trade tensions. For example, on [Insert Date], the US announced a significant reduction in tariffs on [Specific Goods/Sectors affected, e.g., certain types of steel imported from country X]. Furthermore, planned tariffs on [Specific Goods/Sectors affected, e.g., consumer electronics from country Y], scheduled for implementation on [Insert Date], were suspended indefinitely. This unexpected shift in trade policy immediately impacted market sentiment.

- Impact on Technology Sector: Reduced tariffs on imported components led to a significant boost in the technology sector, with companies like [Example Company 1] and [Example Company 2] seeing shares rise by [Percentage] and [Percentage], respectively.

- Impact on Manufacturing Sector: The suspension of tariffs on imported raw materials provided a much-needed relief for the manufacturing sector, boosting production and potentially leading to job creation.

- Official statements from the [Relevant Government Body, e.g., Office of the US Trade Representative] confirmed these changes and highlighted the administration's commitment to finding mutually beneficial trade solutions.

H3: Investor Sentiment Shift: The news of tariff relief triggered a palpable shift in investor sentiment. Pessimism, which had dominated the market for months due to trade war uncertainty, quickly gave way to cautious optimism.

- Increased Trading Volume: Trading volumes surged significantly following the announcement, indicating a renewed interest and confidence in the market.

- Shift in Investment Strategies: Investors, previously hesitant to commit to long-term investments, began shifting their strategies, allocating more capital to equities.

- Expert analysts at [Financial Institution Name] noted that the "risk-on" sentiment was primarily driven by the perceived easing of trade tensions.

H3: Impact on Key Economic Indicators: The tariff relief is expected to positively impact several key economic indicators.

- GDP Growth: Economists forecast a [Percentage]% increase in GDP growth for the next quarter due to increased consumer spending and business investment.

- Consumer Spending: Reduced prices on imported goods are anticipated to boost consumer spending, potentially mitigating inflationary pressures.

- Business Investment: Businesses, relieved from the burden of high tariffs, are more likely to increase investment in expansion and job creation. Sources like [Economic Forecasting Agency Name] predict a [Percentage]% rise in business investment.

2.2. S&P 500 Sectoral Performance Following Tariff Relief

H3: Winning Sectors: The technology and consumer discretionary sectors were among the biggest winners following the tariff relief.

- Technology Sector Gains: The tech sector experienced a [Percentage]% increase, outperforming the overall S&P 500 growth. This is due to the reduced cost of imported components and increased consumer demand.

- Consumer Discretionary Sector Gains: The consumer discretionary sector also saw significant gains, as reduced prices on imported goods boosted consumer confidence and spending.

- Reasons for outperformance: The sectors most directly affected by the tariff changes (reduced tariffs on imported components, raw materials) saw immediate and substantial gains.

H3: Lagging Sectors: Not all sectors benefited equally. Some sectors showed minimal gains or even slight declines.

- Energy Sector Performance: The energy sector, for example, showed only marginal gains, as its performance is often tied to global geopolitical factors beyond the immediate effects of tariff adjustments.

- Reasons for less impact: Sectors less reliant on imported goods or those facing other headwinds (e.g., regulatory changes) experienced limited gains from the tariff relief.

2.3. Long-Term Implications and Uncertainties

H3: Sustainability of the Rally: While the recent S&P 500 surge is impressive, its long-term sustainability remains uncertain.

- Sustaining Factors: Continued de-escalation of trade tensions and strong economic fundamentals could support sustained growth.

- Hinderance Factors: Any resurgence of trade disputes or unexpected economic shocks could trigger a market correction.

- Potential Risks: Geopolitical instability or unforeseen economic slowdowns could pose significant risks to the market's continued upward trajectory.

H3: Geopolitical Considerations: The ongoing geopolitical landscape plays a significant role in shaping the future performance of the S&P 500.

- International Tensions: Ongoing tensions between the US and other countries could reintroduce uncertainty and volatility into the market.

- Global Economic Slowdown: A global economic slowdown could negatively affect corporate earnings and dampen investor sentiment.

- These geopolitical factors necessitate a cautious approach to long-term investment strategies.

Conclusion: Navigating the S&P 500 After Trade War Tariff Relief

The recent 3%+ surge in the S&P 500 is largely attributable to the positive impact of trade war tariff relief. While the gains are significant, their sustainability depends on several factors, including continued de-escalation of trade tensions and the overall global economic environment. The different sectors within the S&P 500 responded variably to the news, with some significantly outperforming others. Geopolitical considerations also remain key factors to monitor closely. Stay informed about the ongoing developments affecting the S&P 500 and consult with a financial advisor to create a personalized investment strategy that navigates the complexities of the global trade landscape. Understanding the interplay between trade war tariff relief and the S&P 500 is crucial for making informed investment decisions.

Featured Posts

-

Efl Highlights Key Moments And Talking Points

May 13, 2025

Efl Highlights Key Moments And Talking Points

May 13, 2025 -

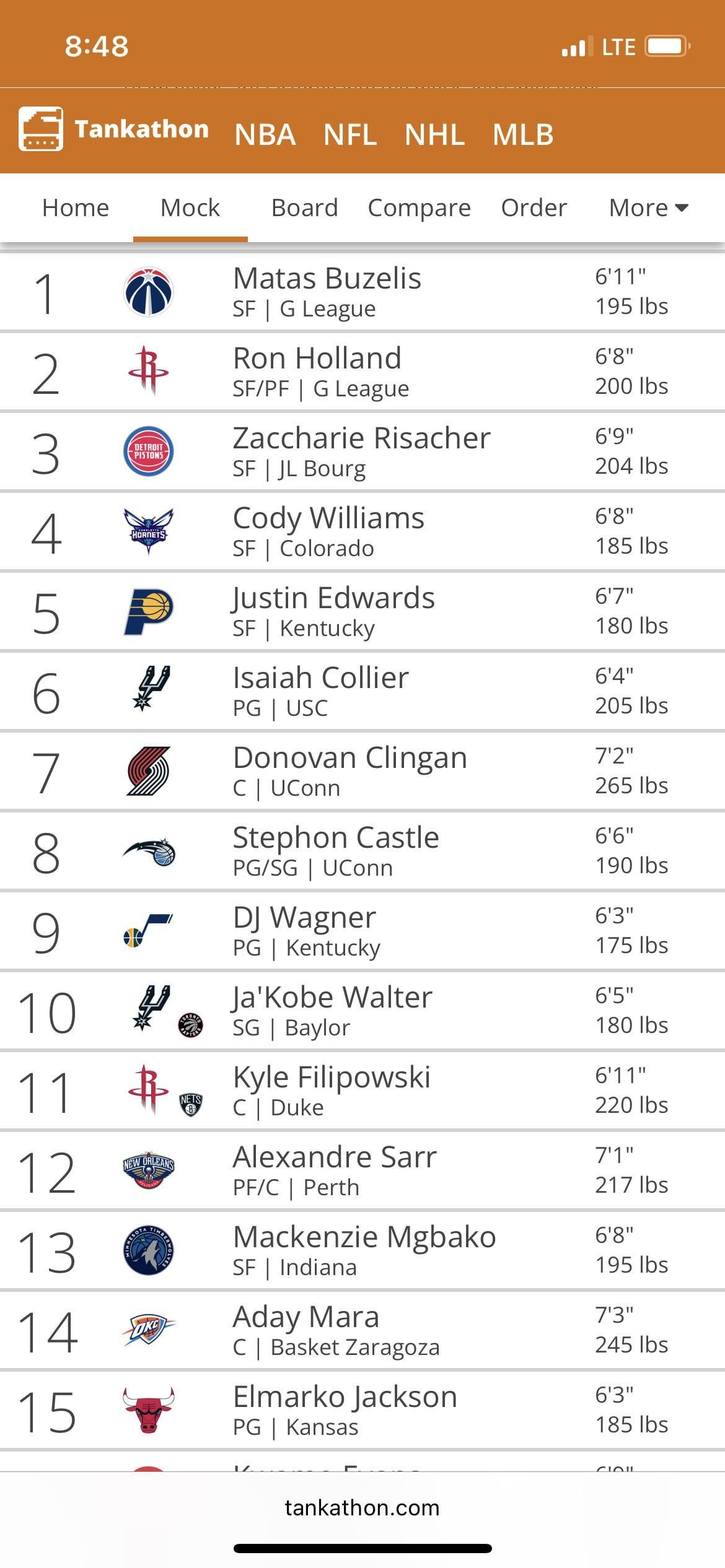

Nba Tankathon Miami Heat Fans New Favorite Off Season Activity

May 13, 2025

Nba Tankathon Miami Heat Fans New Favorite Off Season Activity

May 13, 2025 -

The Return Of Trump Tariffs Implications For European Businesses

May 13, 2025

The Return Of Trump Tariffs Implications For European Businesses

May 13, 2025 -

Novela Zakona O Romski Skupnosti Kljucne Tocke Javne Obravnave

May 13, 2025

Novela Zakona O Romski Skupnosti Kljucne Tocke Javne Obravnave

May 13, 2025 -

Earth Series 1 Inferno A Deep Dive Into Volcanic Activity

May 13, 2025

Earth Series 1 Inferno A Deep Dive Into Volcanic Activity

May 13, 2025

Latest Posts

-

The Traitors Zdrajcy Sezon 2 Odcinek 1 Analiza Konfliktow I Materialy Za Kulisy

May 14, 2025

The Traitors Zdrajcy Sezon 2 Odcinek 1 Analiza Konfliktow I Materialy Za Kulisy

May 14, 2025 -

Zdrajcy 2 Odcinek 1 Spory Graczy Po Pierwszym Wyzwaniu I Materialy Dodatkowe

May 14, 2025

Zdrajcy 2 Odcinek 1 Spory Graczy Po Pierwszym Wyzwaniu I Materialy Dodatkowe

May 14, 2025 -

The Traitors Sezon 2 Odcinek 1 Analiza Konfliktow Po Pierwszym Wyzwaniu

May 14, 2025

The Traitors Sezon 2 Odcinek 1 Analiza Konfliktow Po Pierwszym Wyzwaniu

May 14, 2025 -

Zdrada 2 Odcinek 1 Konflikty Graczy Po Pierwszym Zadaniu Materialy Dodatkowe

May 14, 2025

Zdrada 2 Odcinek 1 Konflikty Graczy Po Pierwszym Zadaniu Materialy Dodatkowe

May 14, 2025 -

Mlb Power Rankings Winners And Losers At The 30 Game Mark 2025

May 14, 2025

Mlb Power Rankings Winners And Losers At The 30 Game Mark 2025

May 14, 2025