Safeguarding Investments: The Rise Of Gold And Cash-Equivalent ETFs

Table of Contents

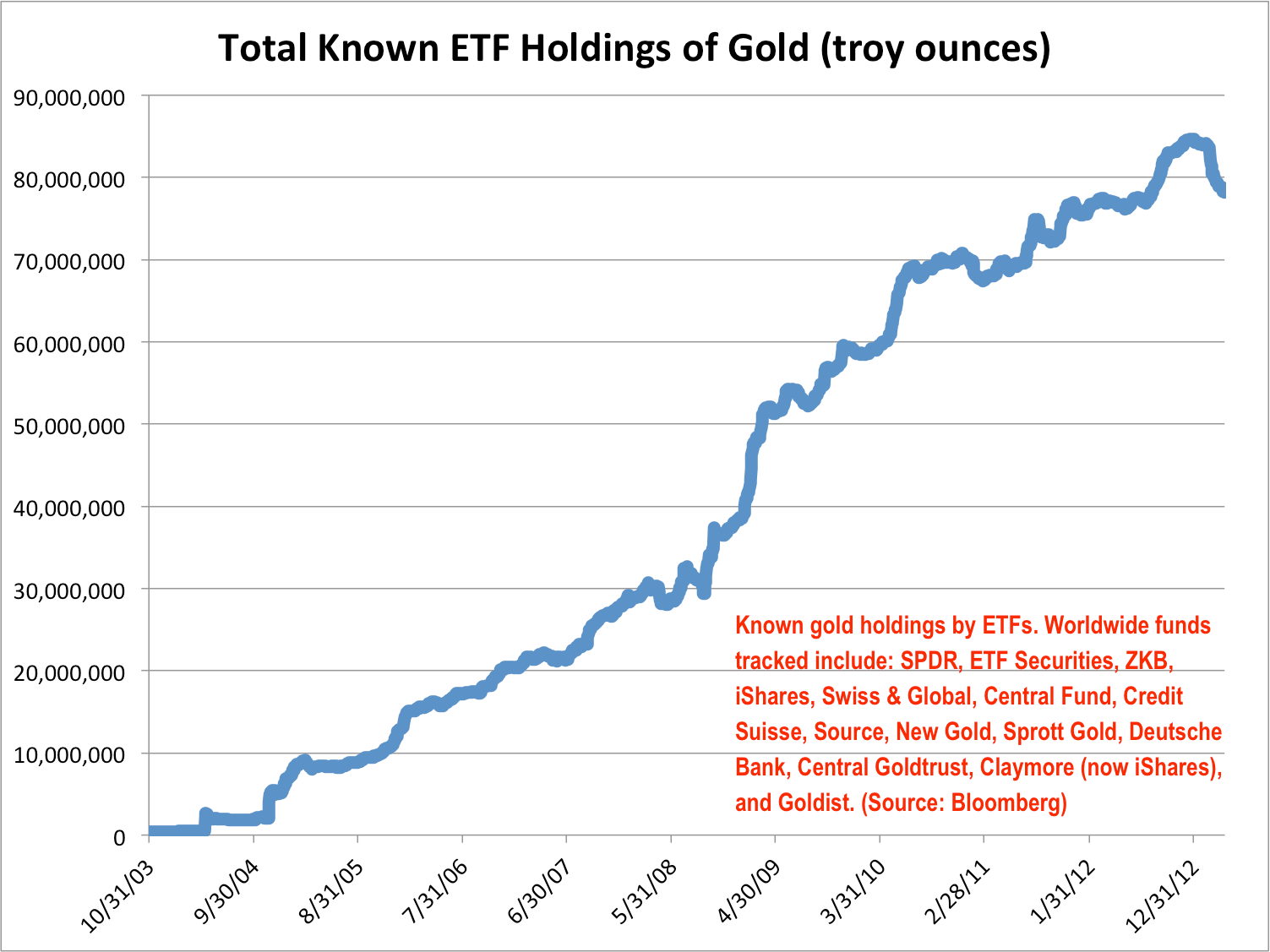

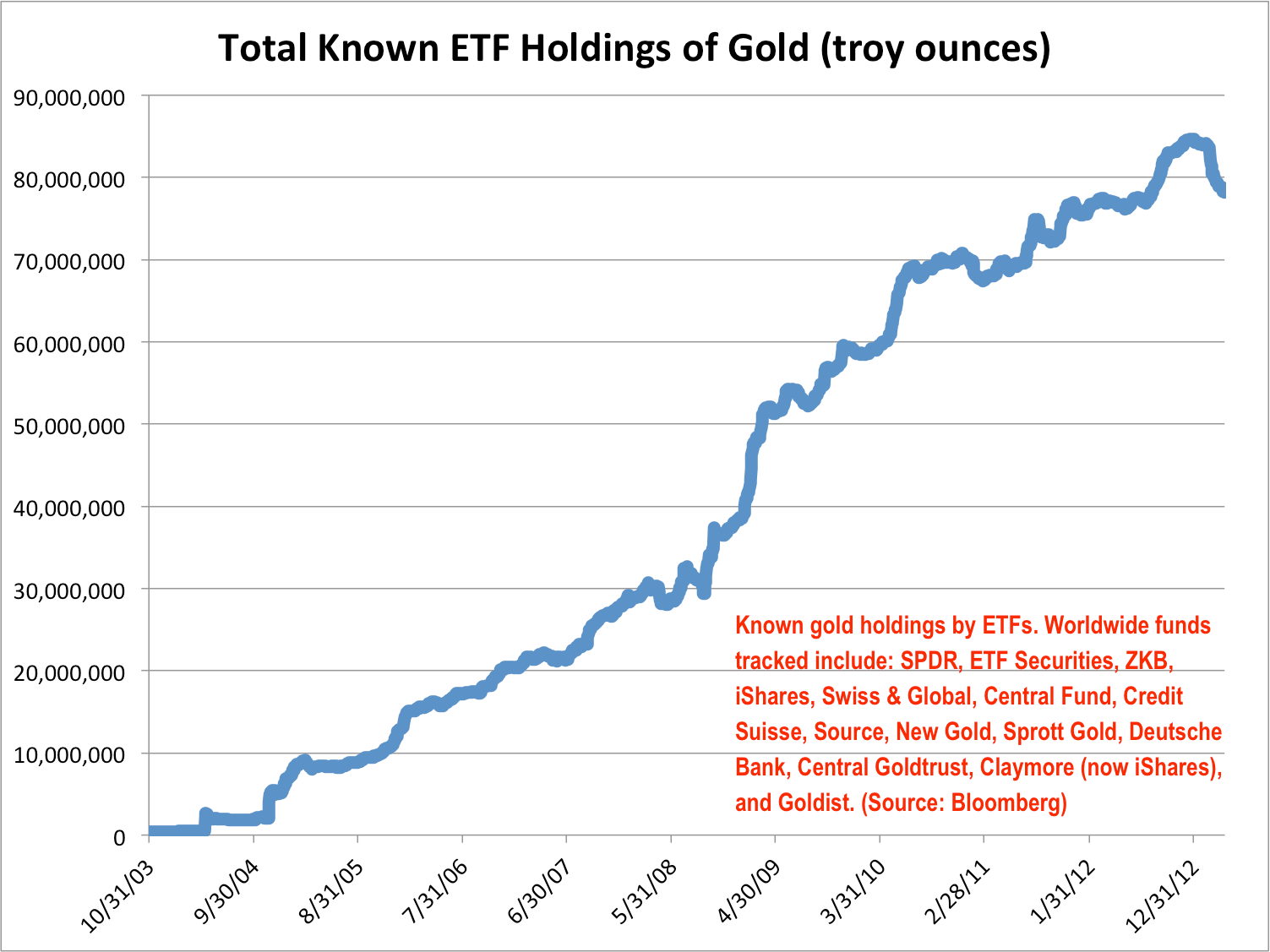

Gold ETFs: A Hedge Against Inflation and Market Uncertainty

Understanding Gold's Role as a Safe Haven Asset

Gold has historically served as a reliable safe haven asset during times of economic uncertainty. Its value often rises during periods of inflation and market downturns, offering a hedge against portfolio losses. This is largely due to its negative correlation with stocks; when stock markets decline, investors often flock to gold as a store of value, driving up its price. Inflation also plays a crucial role, as gold's value tends to increase when the purchasing power of fiat currencies diminishes.

- Benefits of Gold ETFs:

- Diversification: Reduces overall portfolio risk by offering exposure to an asset class that typically behaves differently from stocks and bonds.

- Liquidity: Allows for relatively easy buying and selling, providing access to your investment when needed.

- Accessibility: Gold ETFs offer convenient access to gold investment without the need for physical storage or handling.

Choosing the Right Gold ETF

Selecting the right gold ETF requires careful consideration of several factors. The expense ratio, reflecting the annual cost of managing the ETF, is crucial. A lower expense ratio translates to higher returns for the investor. Tracking error, which measures how closely the ETF tracks the price of gold, should also be considered; a lower tracking error indicates better performance alignment. Finally, understanding the underlying assets of the ETF—whether physically backed by gold bullion or unbacked—is essential for transparency and security.

- Examples of Popular Gold ETFs: (Note: Specific examples should be replaced with currently relevant and reputable ETFs. Avoid endorsement.) [Insert examples here. Include ticker symbols where applicable.]

- Physically Backed Gold ETF

- Unbacked Gold ETF

Cash-Equivalent ETFs: Preserving Capital and Maximizing Liquidity

Defining Cash-Equivalent ETFs and Their Purpose

Cash-equivalent ETFs invest in highly liquid, short-term debt instruments, such as Treasury bills and commercial paper. They aim to provide returns closely mirroring the yield on a short-term benchmark, such as the US Treasury bill. Holding cash equivalents within an ETF structure offers several advantages compared to individual accounts, including diversification across multiple issuers and simplified management. Cash equivalents play a vital role in portfolio risk management, acting as a buffer against market volatility.

- Advantages of Cash-Equivalent ETFs:

- Liquidity: Offers instant access to funds, making them ideal for short-term needs.

- Low Risk: Minimizes the risk of capital loss due to their investment in highly stable, short-term instruments.

- Diversification: Provides a level of diversification within the fixed-income space.

Strategies for Utilizing Cash-Equivalent ETFs

Cash-equivalent ETFs are valuable tools for implementing tactical asset allocation strategies. They can serve as a buffer during market corrections, allowing investors to deploy capital when opportunities arise. Furthermore, they play a key role in rebalancing a portfolio, helping to maintain the desired asset allocation mix over time.

- Examples of Popular Cash-Equivalent ETFs: (Note: Specific examples should be replaced with currently relevant and reputable ETFs. Avoid endorsement.) [Insert examples here. Include ticker symbols where applicable.]

- Short-Term Treasury ETF

- Money Market ETF

Comparing Gold and Cash-Equivalent ETFs: A Balanced Approach

Risk Tolerance and Investment Goals

The choice between gold and cash-equivalent ETFs hinges on individual risk tolerance and investment goals. Investors with a higher risk tolerance may allocate a larger portion of their portfolio to gold, recognizing its potential for higher returns but also its inherent volatility. Those seeking capital preservation and liquidity might prefer cash equivalents. Investment time horizons also play a significant role; long-term investors may have greater flexibility to withstand gold's price fluctuations, while short-term investors might prioritize the stability of cash equivalents. Ultimately, investment decisions should align with broader financial objectives, whether retirement planning, education funding, or other goals.

- Considerations for a Diversified Portfolio:

- Assess your risk tolerance.

- Define your investment timeline.

- Align investments with your financial goals.

Diversification Strategies for Enhanced Portfolio Protection

Combining gold and cash-equivalent ETFs offers a powerful diversification strategy, reducing overall portfolio risk. This approach mitigates the impact of market downturns, as gold often acts as a safe haven while cash equivalents preserve liquidity. Alternative strategies for portfolio protection include investing in other safe-haven assets or diversifying across different asset classes, like real estate or infrastructure.

- Examples of Diversified Portfolios: (Note: These are examples only and not financial advice. Consult with a professional.)

- Portfolio A: 60% Stocks, 20% Bonds, 10% Gold ETF, 10% Cash-Equivalent ETF

- Portfolio B: 50% Stocks, 25% Bonds, 15% Gold ETF, 10% Cash-Equivalent ETF

Conclusion: Making Informed Decisions About Safeguarding Investments

Gold and cash-equivalent ETFs provide valuable tools for safeguarding investments in uncertain markets. Gold offers a hedge against inflation and market downturns, while cash equivalents ensure liquidity and capital preservation. By considering your risk tolerance, investment goals, and time horizon, you can strategically incorporate both asset classes into a diversified portfolio. Remember to conduct thorough research and consult with a financial advisor before making investment decisions. Consider investing in gold and cash-equivalent ETFs as part of a broader strategy for safeguarding investments and building a resilient financial future. [Insert link to relevant resources or investment platforms here]

Featured Posts

-

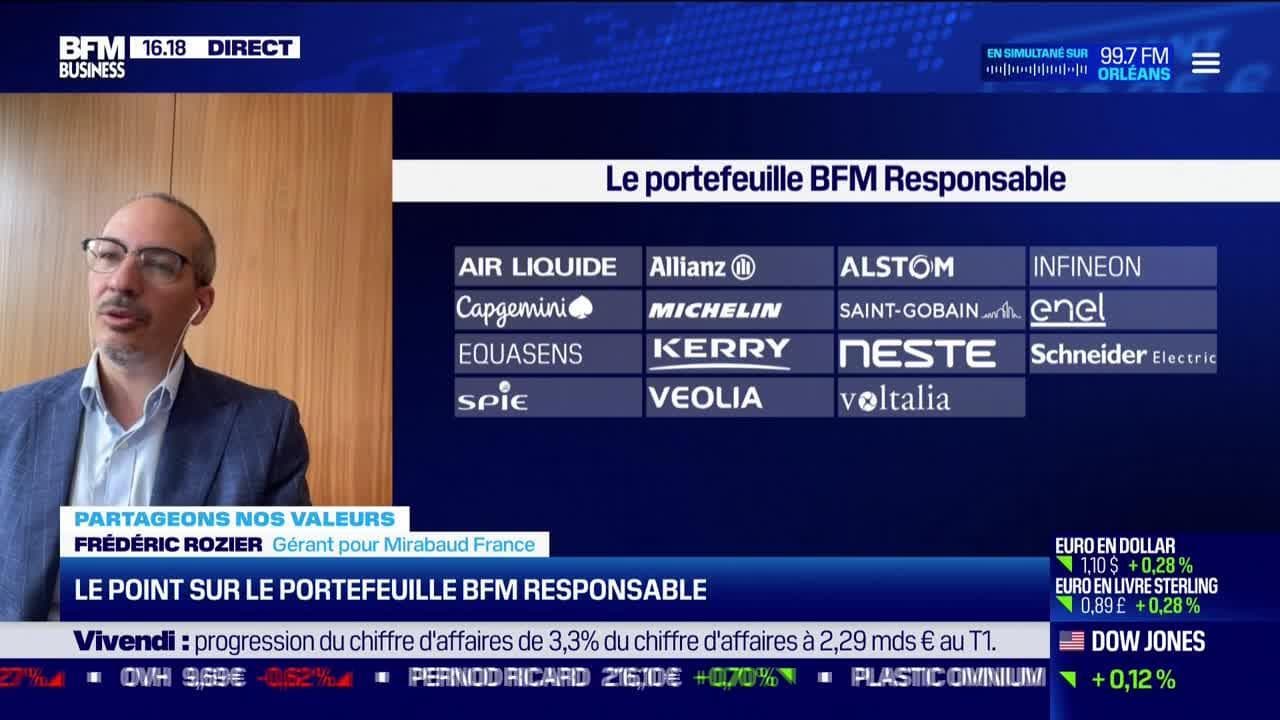

Le Portefeuille Bfm Decryptage De L Arbitrage De La Semaine 17 02

Apr 23, 2025

Le Portefeuille Bfm Decryptage De L Arbitrage De La Semaine 17 02

Apr 23, 2025 -

The Ftc V Meta Case Current Status And Future Outlook For Instagram And Whats App

Apr 23, 2025

The Ftc V Meta Case Current Status And Future Outlook For Instagram And Whats App

Apr 23, 2025 -

Tensions Usa Russie L Augmentation Des Budgets De Defense Analysee Par John Plassard

Apr 23, 2025

Tensions Usa Russie L Augmentation Des Budgets De Defense Analysee Par John Plassard

Apr 23, 2025 -

Akhr Thdyth Asear Aldhhb Alywm Balsaght

Apr 23, 2025

Akhr Thdyth Asear Aldhhb Alywm Balsaght

Apr 23, 2025 -

Tensions Flare South Carolina Voter Challenges Rep Nancy Mace

Apr 23, 2025

Tensions Flare South Carolina Voter Challenges Rep Nancy Mace

Apr 23, 2025

Latest Posts

-

First Hand Accounts Nottingham Attack Survivors Tell Their Stories

May 10, 2025

First Hand Accounts Nottingham Attack Survivors Tell Their Stories

May 10, 2025 -

Nottingham Survivors Recount Experiences After Devastating Attacks

May 10, 2025

Nottingham Survivors Recount Experiences After Devastating Attacks

May 10, 2025 -

Nottingham Attack Inquiry Appointment Of Retired Judge Announced

May 10, 2025

Nottingham Attack Inquiry Appointment Of Retired Judge Announced

May 10, 2025 -

Former Judge To Head Nottingham Attack Inquiry

May 10, 2025

Former Judge To Head Nottingham Attack Inquiry

May 10, 2025 -

Judge Who Jailed Becker To Chair Nottingham Attacks Investigation

May 10, 2025

Judge Who Jailed Becker To Chair Nottingham Attacks Investigation

May 10, 2025