Sasol (SOL) Strategy Update: Investors Demand Answers

Table of Contents

Profitability Concerns and the Impact of Commodity Prices

Sasol's profitability is heavily influenced by volatile commodity prices, creating uncertainty for investors. Understanding the dynamics between commodity prices and Sasol's financial performance is crucial for assessing the Sasol (SOL) strategy.

Volatile Earnings and Dependence on Commodity Markets:

- Recent earnings reports: Recent financial results have shown significant fluctuations, impacting investor confidence in the long-term viability of the current Sasol (SOL) strategy. Periods of high oil and gas prices have boosted profits, while downturns have significantly impacted earnings.

- Correlation with energy prices: Sasol's financial performance is strongly correlated with the prices of oil, gas, and other petrochemicals. Price volatility in these markets directly impacts the company's revenue and profitability, making long-term financial forecasting challenging.

- Hedging strategies: Sasol employs various hedging strategies to mitigate the impact of commodity price fluctuations. However, the effectiveness of these strategies has been debated, particularly during periods of extreme price volatility. The effectiveness of these hedges is a key component of assessing the broader Sasol (SOL) strategy.

Operational Efficiency and Cost-Cutting Measures:

Sasol has implemented various cost-cutting measures and efficiency improvements to enhance profitability. However, the success of these initiatives is an ongoing point of investor concern regarding the future Sasol (SOL) strategy.

- Cost-cutting success: While some cost reductions have been achieved, further improvements are needed to sustainably enhance margins and improve the overall efficiency of the Sasol (SOL) strategy.

- Areas for cost optimization: Opportunities for further cost optimization exist across the value chain, including streamlining operations, improving supply chain management, and leveraging technological advancements.

- Technological advancements: Investing in and adopting new technologies can significantly enhance operational efficiency, reduce waste, and improve profitability. This is a key aspect of a modern Sasol (SOL) strategy.

High Debt Levels and Financial Sustainability

Sasol's high debt levels are a major concern for investors, raising questions about the company's long-term financial sustainability and the effectiveness of its current Sasol (SOL) strategy.

Debt Reduction Strategies and Investor Sentiment:

- Effectiveness of debt reduction: While Sasol has implemented several debt reduction strategies, investor sentiment remains cautious. The pace of debt reduction and its impact on future investment capabilities are key elements of the current Sasol (SOL) strategy discussions.

- Impact on credit rating: High debt levels have negatively impacted Sasol's credit rating, increasing borrowing costs and potentially hindering future growth opportunities. A more conservative debt management approach is a necessary component of a successful Sasol (SOL) strategy.

- Long-term financial sustainability: Investor concerns center on the company's ability to balance debt reduction with investments necessary for long-term growth and the successful execution of its Sasol (SOL) strategy.

Capital Expenditure and Investment Priorities:

Sasol's capital expenditure (CAPEX) plans and investment priorities are crucial for achieving its strategic goals. A balanced approach between debt reduction and growth-oriented investments is paramount.

- Planned investments: Investments across various business segments must align with the long-term Sasol (SOL) strategy and offer attractive returns to justify the financial risk.

- Debt reduction vs. growth: Balancing debt reduction with investments in growth opportunities is critical. The allocation of capital should reflect the priorities outlined in the overall Sasol (SOL) strategy.

- Potential divestments: Divesting non-core assets could free up capital for debt reduction or investment in higher-growth areas. This strategic approach is a crucial consideration for the long-term effectiveness of the Sasol (SOL) strategy.

The Transition to a Lower-Carbon Future and ESG Concerns

The transition to a lower-carbon economy presents both challenges and opportunities for Sasol. Investors are demanding greater transparency and accountability regarding the company's ESG performance and the sustainability of its Sasol (SOL) strategy.

Sasol's Sustainability Initiatives and Investor Expectations:

- Progress towards targets: Sasol's progress toward its sustainability targets is closely monitored by investors. Meeting these targets is crucial for maintaining a positive ESG profile and attracting responsible investments.

- Investor pressure on ESG: Investors are increasingly focused on ESG factors, putting pressure on companies to improve their environmental and social performance. This pressure will influence the evolution of the Sasol (SOL) strategy.

- Impact of climate change regulations: Stringent climate change regulations could significantly impact Sasol's operations and profitability. Adapting to these regulations is crucial for long-term viability, influencing the future Sasol (SOL) strategy.

Investment in Renewable Energy and Diversification Strategies:

Sasol is exploring investments in renewable energy sources and other diversification strategies to reduce its carbon footprint and enhance its long-term resilience.

- Long-term viability of investments: The long-term viability and profitability of investments in renewable energy and other diversification initiatives are key aspects of the company's evolving Sasol (SOL) strategy.

- Enhancement of long-term value: Successful diversification can enhance the company's long-term value and reduce its dependence on fossil fuels. This is a key element of a sustainable Sasol (SOL) strategy.

- Alignment with investor expectations: Demonstrating a commitment to a greener future aligns with investor expectations and fosters greater confidence in the long-term sustainability of the Sasol (SOL) strategy.

Conclusion:

Sasol's strategic direction is under intense scrutiny from investors, who are demanding greater clarity on profitability, debt management, and the company's transition to a lower-carbon future. Addressing concerns regarding commodity price volatility, high debt levels, and ESG factors is crucial for regaining investor confidence. The company's ability to implement effective strategies to improve operational efficiency, reduce debt, and demonstrate a commitment to sustainable practices will be key determinants of its future success. To stay informed on the latest developments and crucial updates regarding the company's strategic adjustments, continue to monitor future announcements and analysis concerning the Sasol (SOL) Strategy.

Featured Posts

-

Voice Recognition Revolutionizing Hmrcs Customer Service

May 20, 2025

Voice Recognition Revolutionizing Hmrcs Customer Service

May 20, 2025 -

Agatha Christie And Sir David Suchet A Travel Documentary Review

May 20, 2025

Agatha Christie And Sir David Suchet A Travel Documentary Review

May 20, 2025 -

Avoid Hmrc Penalties Guide For Uk Households

May 20, 2025

Avoid Hmrc Penalties Guide For Uk Households

May 20, 2025 -

South China Sea Dispute China Demands Philippines Withdraw Missile System

May 20, 2025

South China Sea Dispute China Demands Philippines Withdraw Missile System

May 20, 2025 -

Leclercs Frustration The Full Story On The Ferrari Team Orders And Hamilton

May 20, 2025

Leclercs Frustration The Full Story On The Ferrari Team Orders And Hamilton

May 20, 2025

Latest Posts

-

Ginger Zees Sharp Reply To Aging Comment

May 20, 2025

Ginger Zees Sharp Reply To Aging Comment

May 20, 2025 -

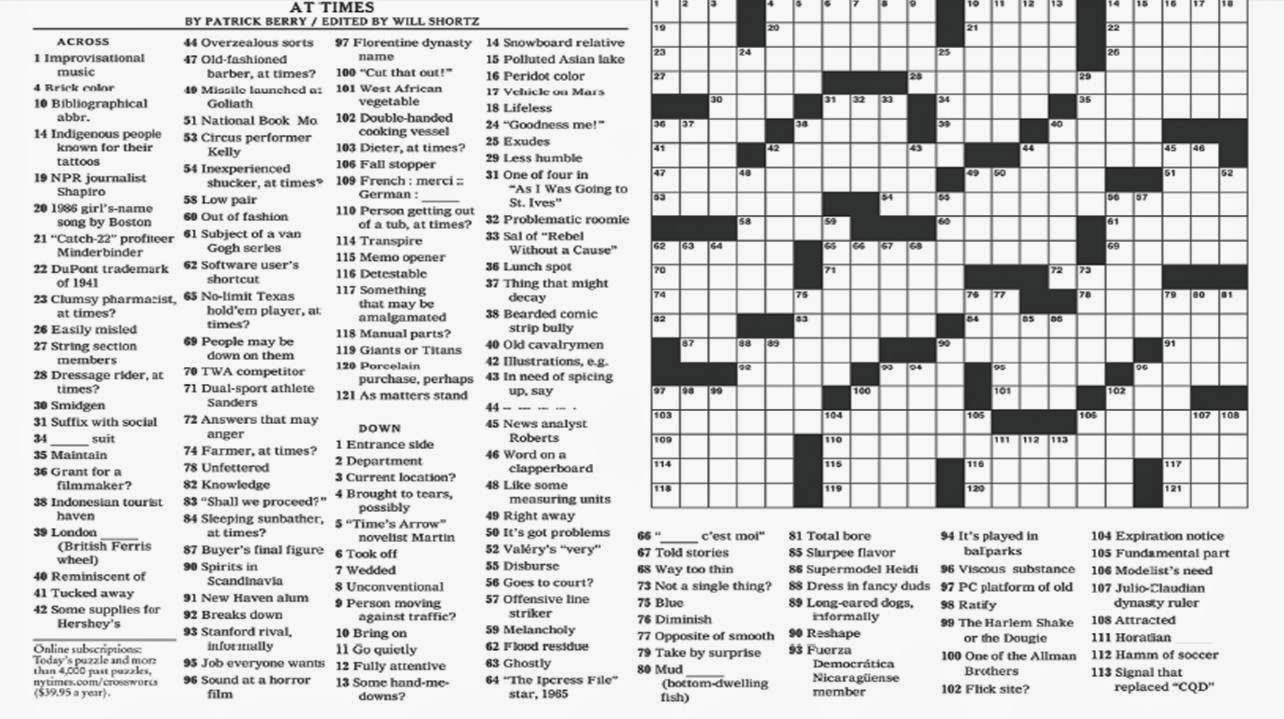

April 25 2025 New York Times Crossword Answers

May 20, 2025

April 25 2025 New York Times Crossword Answers

May 20, 2025 -

Ginger Zee Responds To Aging Criticism

May 20, 2025

Ginger Zee Responds To Aging Criticism

May 20, 2025 -

Nyt Crossword April 25 2025 All Clues And Answers

May 20, 2025

Nyt Crossword April 25 2025 All Clues And Answers

May 20, 2025 -

Bucharest Open Flavio Cobolli Secures Maiden Atp Victory

May 20, 2025

Bucharest Open Flavio Cobolli Secures Maiden Atp Victory

May 20, 2025