Sasol (SOL): Unpacking The 2023 Strategy Update For Investors

Table of Contents

Key Highlights from Sasol's 2023 Strategy Update:

Sasol's 2023 strategy update offered significant insights into the company's performance and future direction. The update revealed a refined approach to operational efficiency and capital allocation, reflecting a commitment to long-term value creation for Sasol investors. Key takeaways from the update include:

-

Revised Production Targets: Sasol announced adjusted production targets for key products, reflecting both market demand and internal operational improvements. These revisions showcase a more realistic and data-driven approach to production planning within their chemical and energy operations. Specific numbers and product details would be found in the official Sasol Investor Relations reports.

-

Capital Expenditure Updates: Significant updates were provided on capital expenditure plans, demonstrating a focus on optimizing investments in high-return projects. This includes details on the progress of major projects and potentially the allocation of resources to enhance existing facilities for improved operational efficiency.

-

Enhanced Operational Efficiency and Cost Reduction: Sasol highlighted several initiatives designed to boost operational efficiency and reduce costs. These might include streamlining processes, technology upgrades, and improved supply chain management across its diverse chemical and energy operations. The details of these initiatives would be found in the official Sasol 2023 Strategy Update report.

-

Strategic Focus Shifts: The strategy update might have indicated a shift in strategic focus, potentially emphasizing certain energy sectors or product lines over others. This reflects Sasol's adaptability to evolving market dynamics and demonstrates their commitment to aligning their business with future energy demands.

-

Strengthened Sustainability Initiatives and ESG Goals: Sasol's commitment to Environmental, Social, and Governance (ESG) factors was a prominent theme in the update. The company likely outlined new targets for reducing emissions, improving community relations, and enhancing corporate governance practices. Details on these specific ESG commitments for Sasol can be found in their sustainability reports.

Financial Performance Analysis: Deciphering Sasol's 2023 Results:

Analyzing Sasol's 2023 financial performance requires a close examination of key metrics. The following provides a framework for understanding the company's financial health:

-

Revenue Growth: Assessing the growth (or decline) in Sasol's revenue provides a crucial indicator of overall market performance and the success of their sales strategies. This number is vital for understanding the financial position of Sasol stock.

-

Profitability (Margins, Earnings Per Share): Examining profit margins and earnings per share (EPS) offers insights into Sasol's profitability and efficiency. These metrics highlight the company's ability to generate profits from its operations.

-

Debt Levels and Credit Ratings: Sasol's debt levels and credit ratings are essential indicators of its financial stability and risk profile. Higher debt levels may pose a risk, particularly if interest rates rise. This is a critical factor when considering the value of Sasol stock.

-

Free Cash Flow and Dividend Payouts: Analyzing Sasol's free cash flow and dividend payouts provides crucial information about its ability to generate cash and return value to shareholders. A consistent dividend policy is often attractive to income-seeking investors.

Comparing these metrics against previous years and industry benchmarks reveals valuable insights into Sasol's performance relative to its peers and its historical trends. Any notable deviations need to be considered in any Sasol stock valuation.

Long-Term Growth Prospects and Outlook for Sasol (SOL):

Sasol's long-term success depends on navigating several key factors:

-

Global Energy Market Dynamics and Geopolitical Factors: The global energy market is inherently volatile, subject to geopolitical events and shifts in energy demand. Sasol's ability to adapt to these changes will significantly impact its future performance.

-

Competition from Other Energy and Chemical Companies: Sasol faces strong competition from other major players in the energy and chemical sectors. Maintaining a competitive edge through innovation and efficient operations is vital for sustainable growth.

-

Technological Advancements and Their Impact on Sasol’s Operations: Technological advancements, particularly in renewable energy and sustainable chemical processes, present both opportunities and challenges. Sasol needs to invest in and adapt to these changes to stay relevant.

-

Regulatory Changes and Environmental Policies: Stringent environmental regulations and policies are increasingly influencing the energy and chemical industries. Sasol must comply with these regulations and incorporate sustainable practices into its operations.

The overall risk profile of investing in Sasol stock involves evaluating these factors and their potential impact on the company's future performance. Thorough due diligence and an understanding of the energy market are crucial for potential investors.

Sasol's Commitment to ESG (Environmental, Social, and Governance):

Sasol's commitment to ESG factors is crucial for long-term sustainability and attracts investors who prioritize responsible investing. Their initiatives are likely to include:

-

Environmental Sustainability: This may encompass targets for reducing greenhouse gas emissions, improving energy efficiency, and adopting sustainable production practices.

-

Social Responsibility: Sasol's social responsibility initiatives likely focus on community engagement, employee well-being, and ethical business practices.

-

Corporate Governance: Robust corporate governance structures, transparency, and accountability are key components of Sasol's ESG strategy. Strong governance is beneficial for long-term sustainability and investor confidence.

Conclusion:

Sasol's 2023 strategy update reveals a company adapting to a changing energy landscape. While financial performance analysis requires careful scrutiny of key metrics, Sasol's commitment to operational efficiency, strategic adjustments, and strengthened ESG initiatives suggest a focus on long-term value creation. However, investors must remain aware of the inherent risks associated with investing in the energy and chemical sectors, including market volatility and regulatory changes.

Stay informed about Sasol's future performance by regularly reviewing their investor relations materials. Understanding the Sasol (SOL) strategy is crucial for making sound investment choices in the dynamic energy and chemical markets. [Link to Sasol Investor Relations Website]

Featured Posts

-

Blockbusters On Bgt Highlights And Performances

May 21, 2025

Blockbusters On Bgt Highlights And Performances

May 21, 2025 -

World Cup Quarterfinal Germanys Path To Victory Against Italy

May 21, 2025

World Cup Quarterfinal Germanys Path To Victory Against Italy

May 21, 2025 -

Ancelotti Nin Ayriliginin Ardindan Real Madrid In Yeni Teknik Direktoerue Kim Olacak

May 21, 2025

Ancelotti Nin Ayriliginin Ardindan Real Madrid In Yeni Teknik Direktoerue Kim Olacak

May 21, 2025 -

Analysis Abc News Shows Fate Following Recent Layoffs

May 21, 2025

Analysis Abc News Shows Fate Following Recent Layoffs

May 21, 2025 -

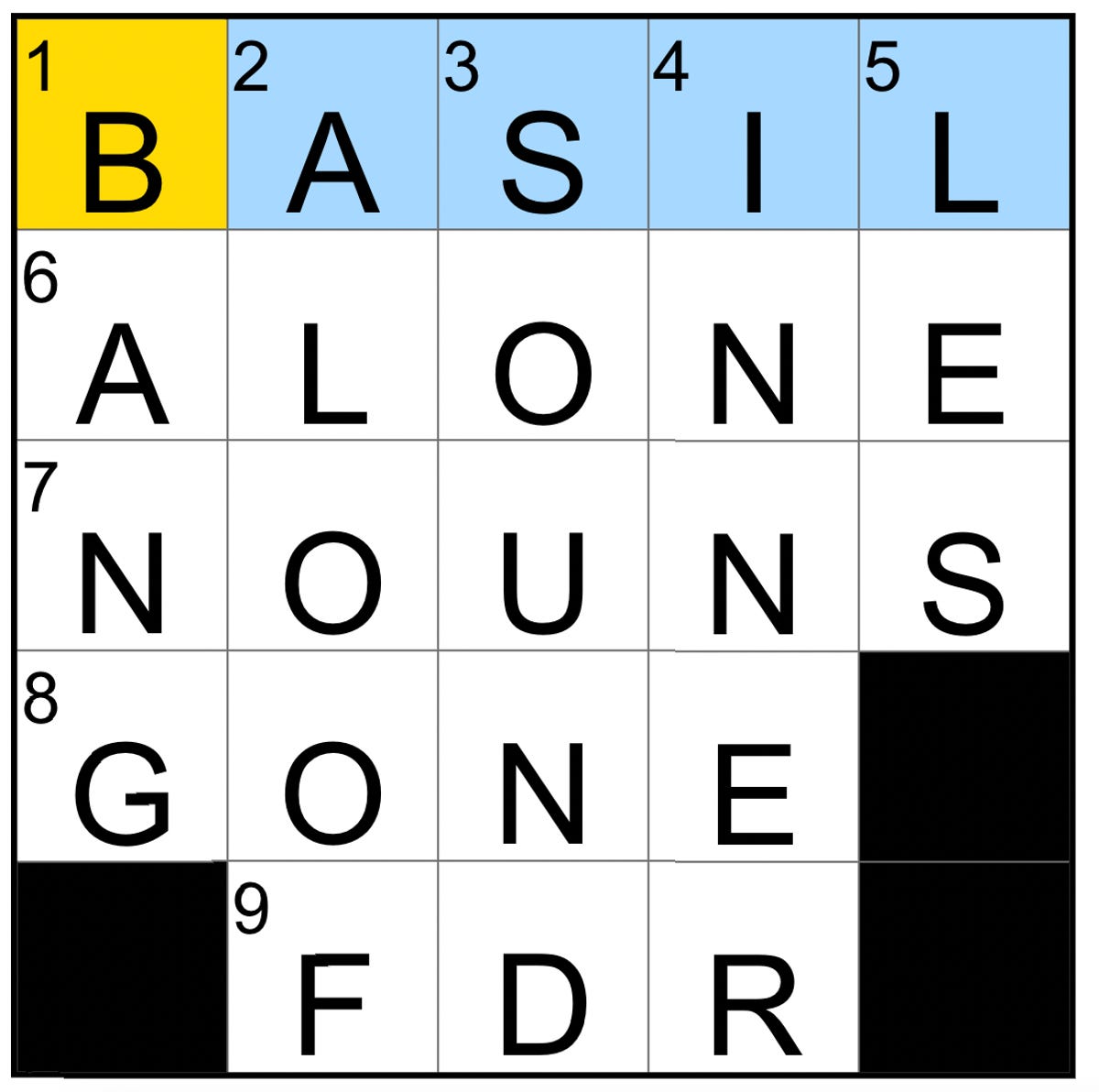

Get The Nyt Mini Crossword Answers For March 26 2025

May 21, 2025

Get The Nyt Mini Crossword Answers For March 26 2025

May 21, 2025

Latest Posts

-

Seth Rollins And Bron Breakkers Attack On Sami Zayn On Wwe Raw

May 21, 2025

Seth Rollins And Bron Breakkers Attack On Sami Zayn On Wwe Raw

May 21, 2025 -

Kaempig Bortaseger I Malta Jacob Friis Inleder Sin Era

May 21, 2025

Kaempig Bortaseger I Malta Jacob Friis Inleder Sin Era

May 21, 2025 -

Hinchcliffes Wwe Appearance Behind The Scenes Reaction And Analysis

May 21, 2025

Hinchcliffes Wwe Appearance Behind The Scenes Reaction And Analysis

May 21, 2025 -

Wwe Backstage Buzz Hinchcliffes Reportedly Poorly Received Segment

May 21, 2025

Wwe Backstage Buzz Hinchcliffes Reportedly Poorly Received Segment

May 21, 2025 -

Bortaseger I Maltas Kamp Mot Jacob Friis Nya Era

May 21, 2025

Bortaseger I Maltas Kamp Mot Jacob Friis Nya Era

May 21, 2025