Saudi Arabia Investment Drive: Deutsche Bank's Strategy For Global Investors

Table of Contents

Understanding Saudi Arabia's Investment Landscape

Vision 2030 and its Impact on Investment

Vision 2030, Saudi Arabia's blueprint for economic diversification and societal transformation, is creating a wealth of opportunities for foreign direct investment (FDI). The plan aims to reduce the country's reliance on oil, fostering growth in sectors such as tourism, renewable energy, technology, and entertainment. This diversification strategy presents a compelling proposition for global investors seeking high-growth potential and long-term stability.

- Tourism: Development of world-class tourism infrastructure, including Neom and the Red Sea Project, offers significant investment opportunities in hospitality, leisure, and related industries.

- Renewable Energy: Massive investments in solar and wind power generation are creating opportunities in renewable energy infrastructure development and technology.

- Technology: The Kingdom is actively developing its technological infrastructure and digital economy, attracting investment in fintech, e-commerce, and data centers.

These initiatives create a fertile ground for Saudi Arabia investment opportunities, driving economic transformation and diversification.

Regulatory Framework and Investment Incentives

The Saudi Arabian government has implemented a series of reforms to enhance its regulatory framework and attract foreign investment. These include streamlining business registration processes, reducing bureaucratic hurdles, and offering attractive tax incentives. The government is committed to creating a transparent and investor-friendly environment.

- Simplified Business Registration: Online registration portals and reduced processing times make it easier for foreign investors to establish businesses in Saudi Arabia.

- Tax Benefits: Various tax incentives and exemptions are available for investments in priority sectors, as defined by Vision 2030.

- Government Support Programs: Several government initiatives provide financial and logistical support to foreign investors, facilitating easier market entry and reducing initial investment risks.

These measures make Saudi Arabia an increasingly attractive destination for foreign direct investment (FDI).

Deutsche Bank's Strategic Approach to Attracting Global Investors

Specialized Investment Banking Services

Deutsche Bank provides a comprehensive suite of investment banking services tailored to the needs of investors in Saudi Arabia. Our expertise spans various areas, ensuring a seamless and efficient investment process.

- Mergers & Acquisitions (M&A) Advisory: We advise clients on cross-border M&A transactions, facilitating strategic partnerships and acquisitions within the Kingdom.

- Equity Capital Markets: We assist companies in raising capital through initial public offerings (IPOs) and other equity financing solutions.

- Debt Financing: We provide a range of debt financing options, including syndicated loans and bonds, to support investment projects in Saudi Arabia.

These specialized investment banking services are designed to streamline the Saudi Arabia investment process for our clients.

Risk Management and Due Diligence

Deutsche Bank understands the importance of mitigating investment risks in emerging markets. We employ rigorous due diligence processes and risk assessment methodologies to protect our clients’ investments.

- Comprehensive Due Diligence: We conduct thorough due diligence on all investment opportunities, assessing legal, financial, and operational risks.

- Risk Mitigation Strategies: We develop tailored risk mitigation strategies for each investment, considering various factors such as political, economic, and regulatory risks.

- Ongoing Monitoring: We provide ongoing monitoring and support to our clients throughout the investment lifecycle.

Networking and Relationship Building

Deutsche Bank leverages its extensive network of contacts to connect global investors with key stakeholders in Saudi Arabia. We facilitate introductions to government officials, local businesses, and other relevant parties.

- Networking Events: We organize exclusive networking events to connect investors with potential partners and collaborators.

- Strategic Partnerships: We have established strategic partnerships with key players in the Saudi Arabian market.

- Government Liaison: We maintain close relationships with relevant government agencies to ensure seamless regulatory compliance.

Case Studies of Successful Investments Facilitated by Deutsche Bank

Deutsche Bank has a proven track record of successfully facilitating investments in Saudi Arabia. We have assisted numerous clients in capitalizing on the Kingdom's growth opportunities, resulting in significant returns and positive economic impact. Specific examples and quantifiable results will be shared upon request due to confidentiality agreements. These success stories highlight our expertise and commitment to supporting investors in Saudi Arabia.

Conclusion: Investing in Saudi Arabia's Future with Deutsche Bank

Deutsche Bank's strategic approach to the Saudi Arabia investment drive combines specialized financial services, robust risk management, and extensive networking capabilities. The Kingdom's ambitious Vision 2030 plan presents substantial opportunities for global investors seeking high-growth potential and long-term returns. We encourage you to contact Deutsche Bank to explore the numerous Saudi Arabia investment opportunities and learn how we can support your investment strategy. Invest in Saudi Arabia's future with Deutsche Bank's proven expertise and unparalleled access to this dynamic market. Contact us today at [insert contact information/link here] to discuss your investment needs.

Featured Posts

-

Trump Minimizes Potential For Further Russia Sanctions

May 30, 2025

Trump Minimizes Potential For Further Russia Sanctions

May 30, 2025 -

Deutsche Bank Analyse D Une Histoire Moderne Tumultueuse

May 30, 2025

Deutsche Bank Analyse D Une Histoire Moderne Tumultueuse

May 30, 2025 -

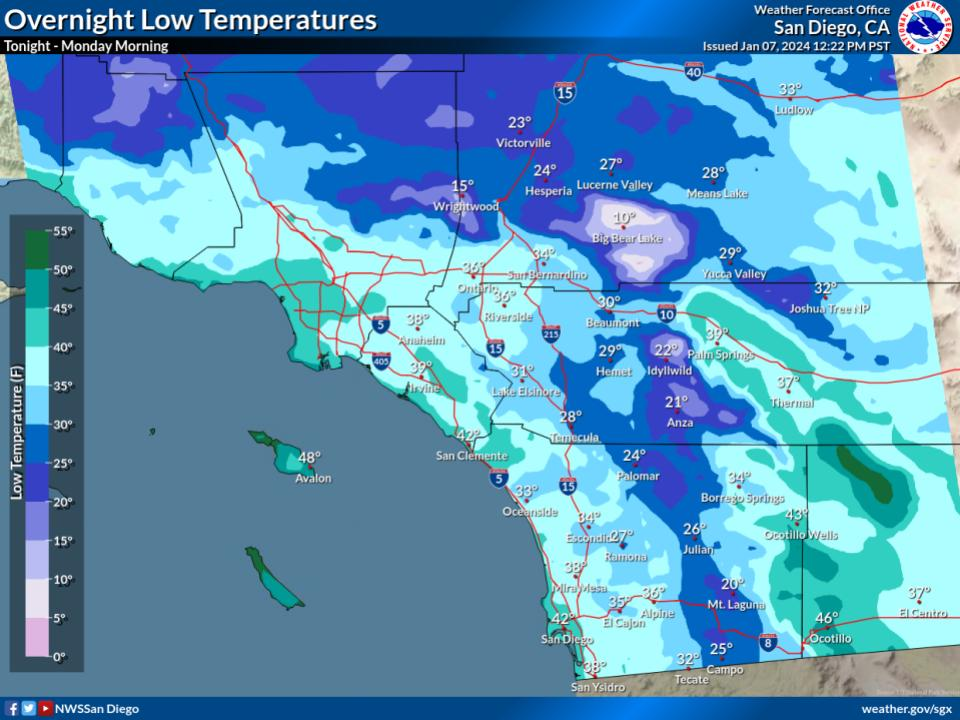

Cool Wet And Windy Weather Alert For San Diego County

May 30, 2025

Cool Wet And Windy Weather Alert For San Diego County

May 30, 2025 -

Ticketmasters Oasis Tour Ticket Sales A Legal Audit Of Consumer Protection

May 30, 2025

Ticketmasters Oasis Tour Ticket Sales A Legal Audit Of Consumer Protection

May 30, 2025 -

Ticketmaster Y Setlist Fm Nueva Era En La Experiencia Del Concierto

May 30, 2025

Ticketmaster Y Setlist Fm Nueva Era En La Experiencia Del Concierto

May 30, 2025