Saudi Arabia's PIF Bans PwC From Advisory Roles For A Year

Table of Contents

The Details of the PIF's Ban on PwC

Duration and Scope of the Ban

The PIF's ban explicitly prohibits PwC from any advisory roles for a full year. This isn't a minor restriction; it encompasses a broad spectrum of services crucial to the fund's operations. The ban covers:

- Financial Consulting: Advising on financial strategies, risk management, and investment performance.

- Strategic Advisory: Providing guidance on long-term investment strategies, portfolio diversification, and market entry.

- Due Diligence: Conducting thorough investigations and assessments before major investments or acquisitions.

- Mergers and Acquisitions (M&A) Advisory: Supporting the PIF in deal structuring, negotiations, and integration.

- Valuation Services: Determining the fair market value of assets for investment decisions.

The geographic scope of the ban remains unclear. While it undoubtedly affects PwC's operations within Saudi Arabia, the extent to which it impacts globally affiliated PwC subsidiaries requires further clarification.

Reasons Behind the Ban (Speculation and Analysis)

The PIF’s silence on the reasons behind the ban fuels speculation. Several possibilities exist:

- Breach of Contract: PwC may have violated a contractual agreement with the PIF, perhaps related to confidentiality, deliverables, or performance metrics.

- Ethical Violations: Potential conflicts of interest or breaches of professional ethics could have triggered the ban.

- Unsatisfactory Performance: Disappointing results on previous advisory projects may have led the PIF to seek alternative partners.

- Regulatory Non-Compliance: Failure to adhere to Saudi Arabian regulations governing financial auditing or advisory services could be a contributing factor.

The lack of transparency surrounding the decision raises concerns about the PIF’s operational transparency and its commitment to accountability. Further clarity is needed to rebuild trust and confidence in the fund’s processes.

Impact on PwC's Business in Saudi Arabia

The ban represents a considerable blow to PwC's operations in Saudi Arabia. The financial implications are substantial, potentially leading to:

- Significant Revenue Loss: The loss of PIF-related contracts will undoubtedly impact PwC's revenue streams and profitability. Accurate figures are difficult to obtain without official disclosures.

- Damage to Reputation: The ban tarnishes PwC's reputation, potentially impacting its ability to win new contracts not only from the PIF but also other Saudi Arabian entities.

- Employee Morale: The suspension could negatively impact employee morale and lead to potential talent attrition.

- Challenges in Securing Future Contracts: The ban creates a significant hurdle for PwC's future prospects in securing prominent contracts within the Saudi Arabian market.

Broader Implications for the Saudi Arabian Investment Landscape

Increased Scrutiny of Auditing Firms

The PIF's decision signals a stricter regulatory environment for auditing and advisory firms operating in Saudi Arabia. The consequences include:

- Heightened Scrutiny of Other Firms: Other international auditing firms operating in Saudi Arabia will likely face increased scrutiny and more rigorous audits.

- Enhanced Compliance Requirements: Expect stricter compliance requirements, leading to more comprehensive internal controls and risk management frameworks for advisory firms.

- More Stringent Due Diligence: The PIF and other Saudi Arabian entities are likely to implement more stringent due diligence procedures before awarding future contracts.

Impact on Foreign Investment in Saudi Arabia

Although the ban is specific to PwC, it might raise concerns amongst international investors about regulatory risks and the stability of the Saudi Arabian business environment. This could potentially:

- Reduce Foreign Direct Investment (FDI): Uncertainty surrounding regulatory actions might deter foreign investment, particularly in high-value projects requiring significant advisory support.

- Increase Investment Scrutiny: International investors might increase their due diligence, leading to delays and increased costs in investment projects.

- Government Efforts to Reassure Investors: The Saudi Arabian government might need to undertake steps to reassure international investors about the stability and reliability of its regulatory framework.

The Future of PIF's Relations with Auditing Firms

The PIF's action signals a shift in its approach to selecting and managing partnerships with external advisory firms. This may result in:

- Changes in Procurement Procedures: The PIF might implement more rigorous procurement processes, including enhanced transparency and due diligence.

- Revised Selection Criteria: Future selection criteria for advisory partners will likely prioritize firms with demonstrable compliance records, robust ethical standards, and a proven track record of success.

Conclusion

The PIF's one-year ban on PwC from advisory roles is a significant event with far-reaching implications. While the precise reasons remain undisclosed, the decision underscores the increasing scrutiny of auditing and advisory firms operating in Saudi Arabia. The ramifications extend to foreign investment, regulatory oversight, and the evolving dynamics between sovereign wealth funds and their external partners. Staying informed about developments surrounding Saudi Arabia's PIF ban on PwC and its wider implications is crucial for anyone engaged with the Saudi Arabian financial landscape. To stay updated, continue following reputable financial news outlets.

Featured Posts

-

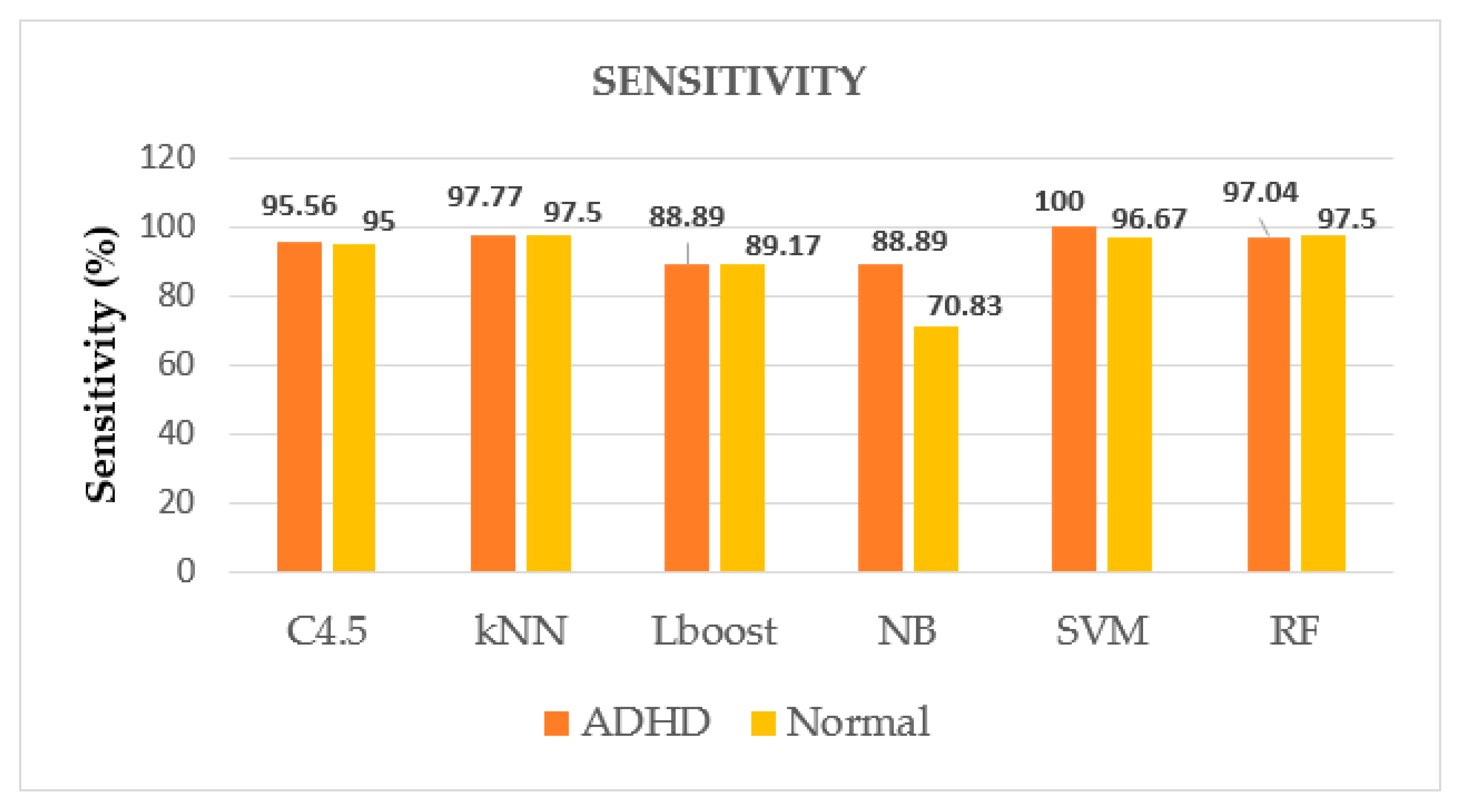

Research Indicates Elevated Adhd Prevalence Among Adults With Autism And Intellectual Disability

Apr 29, 2025

Research Indicates Elevated Adhd Prevalence Among Adults With Autism And Intellectual Disability

Apr 29, 2025 -

Akeso Stock Drops After Cancer Drug Trial Fails To Meet Expectations

Apr 29, 2025

Akeso Stock Drops After Cancer Drug Trial Fails To Meet Expectations

Apr 29, 2025 -

Stock Market Valuation Concerns Bof A Offers A Different Perspective

Apr 29, 2025

Stock Market Valuation Concerns Bof A Offers A Different Perspective

Apr 29, 2025 -

Section 230 And Banned Chemicals A Recent E Bay Ruling

Apr 29, 2025

Section 230 And Banned Chemicals A Recent E Bay Ruling

Apr 29, 2025 -

Anthony Edwards Injury Update Will He Play Lakers Vs Timberwolves

Apr 29, 2025

Anthony Edwards Injury Update Will He Play Lakers Vs Timberwolves

Apr 29, 2025

Latest Posts

-

Wbc Final Eliminator Cissokho Meets Kavaliauskas

May 12, 2025

Wbc Final Eliminator Cissokho Meets Kavaliauskas

May 12, 2025 -

The Future Of The Papacy Examining The Leading Contenders To Succeed Pope Francis

May 12, 2025

The Future Of The Papacy Examining The Leading Contenders To Succeed Pope Francis

May 12, 2025 -

Cissokho And Kavaliauskas Clash In Crucial Wbc Eliminator Bout

May 12, 2025

Cissokho And Kavaliauskas Clash In Crucial Wbc Eliminator Bout

May 12, 2025 -

Analyzing The Next Papal Election Potential Candidates And Their Platforms

May 12, 2025

Analyzing The Next Papal Election Potential Candidates And Their Platforms

May 12, 2025 -

Possible Successors To Pope Francis Leading Cardinals And Their Prospects

May 12, 2025

Possible Successors To Pope Francis Leading Cardinals And Their Prospects

May 12, 2025