SEC Crypto Broker Rules Facing Major Revision: Chairman Atkins' Statement

Table of Contents

Key Aspects of Chairman Atkins' Proposed Revisions

Chairman Atkins' statement outlines sweeping changes to how the SEC regulates crypto brokers. The core proposals aim to enhance investor protection, increase transparency, and strengthen the overall integrity of the digital asset market. These revisions focus heavily on three key areas: registration requirements, compliance burdens, and operational standards.

- Specific changes to registration processes: The proposed revisions may include stricter requirements for registration, potentially increasing the burden on smaller firms seeking to operate as crypto brokers. This could involve more stringent background checks, financial audits, and detailed business plans.

- Updated requirements for custody of digital assets: The SEC might mandate stricter security protocols and insurance requirements for crypto brokers holding client assets. This aims to mitigate risks associated with hacks, theft, and operational failures, enhancing investor protection.

- New rules concerning anti-money laundering (AML) and know-your-customer (KYC) protocols: Expect more robust AML/KYC compliance measures, potentially involving enhanced due diligence procedures and real-time transaction monitoring. This is crucial for combating illicit activities and maintaining the integrity of the financial system.

- Potential impact on smaller crypto businesses: The increased compliance costs and regulatory hurdles associated with these revisions could disproportionately affect smaller crypto businesses. Many may face challenges in meeting the new standards, potentially leading to consolidation within the sector.

Implications for Crypto Exchanges and Broker-Dealers

The proposed revisions will have profound implications for existing crypto exchanges and broker-dealers. They will likely require significant restructuring and substantial investments in compliance infrastructure.

- Increased compliance costs and operational complexities: Meeting the new regulatory demands will necessitate significant financial investments in technology, personnel, and legal expertise. This will increase operational costs and potentially reduce profit margins.

- Potential changes to fee structures and trading offerings: Exchanges might adjust their fee structures to offset increased compliance costs. Some less profitable or high-risk trading offerings might be discontinued to minimize regulatory exposure.

- Impact on market liquidity and trading volumes: Increased regulatory scrutiny could temporarily dampen market liquidity and trading volumes as businesses adapt to the new requirements. Uncertainty could lead to some investors withdrawing from the market.

- Potential for consolidation within the crypto brokerage sector: Smaller exchanges and broker-dealers may struggle to meet the new compliance standards, potentially leading to mergers, acquisitions, or even exits from the market.

Potential Impact on Investors and Consumers

While the primary goal is investor protection, the revisions will undoubtedly impact individual investors and consumers.

- Enhanced investor protections (e.g., improved custody practices): Stricter custody requirements should increase the safety and security of investors' digital assets, reducing the risk of loss due to hacks or operational failures.

- Increased transparency and reporting requirements: Improved transparency could lead to greater confidence in the market, encouraging more participation. However, increased reporting requirements might also create a higher administrative burden for investors.

- Potential changes to access and ease of use for retail investors: Some changes could potentially make accessing and trading cryptocurrencies more difficult for retail investors, potentially acting as a barrier to entry for less technologically savvy individuals.

- Impact on the overall adoption of cryptocurrencies: The overall impact on cryptocurrency adoption is uncertain. While increased investor protection could boost confidence, stricter regulations could also hinder wider adoption.

The Broader Regulatory Landscape for Cryptocurrencies

Chairman Atkins' statement is part of a broader global effort to regulate the cryptocurrency market.

- Comparison with regulatory approaches in other jurisdictions: The SEC's approach will be compared to those taken by regulators in other countries, potentially influencing global standards for crypto regulation.

- Ongoing debates regarding the classification of crypto assets (securities vs. commodities): The ongoing debate regarding whether certain crypto assets are securities or commodities will significantly influence the specific regulatory framework applied.

- Potential future developments in crypto regulation: Expect further regulatory developments in the coming years as regulators grapple with the complexities of the crypto market and its evolving technologies.

Industry Response and Future Outlook

The crypto industry's response to Chairman Atkins' statement has been mixed. Some exchanges welcome the move towards greater regulatory clarity, while others express concern about the potential for excessive burdens. The timeline for implementation remains uncertain, but the process is expected to involve public consultation and potentially lengthy deliberations. Challenges include ensuring the rules are appropriately balanced between protecting investors and fostering innovation within the crypto sector.

The Future of SEC Crypto Broker Rules

Chairman Atkins' proposed revisions to SEC crypto broker rules represent a significant step in shaping the future of the digital asset market. These changes will impact crypto exchanges, broker-dealers, investors, and the broader regulatory landscape. Understanding the implications of these revisions is crucial for anyone involved in or interested in the cryptocurrency industry. To stay informed about the evolving regulatory landscape for crypto, follow the latest updates on SEC crypto broker rules and learn more about the impact of these revisions on the digital asset market. Stay informed about the evolving regulatory landscape for crypto and its impact on the future of digital assets.

Featured Posts

-

K 80 Letiyu Pobedy Veterany Eao Poluchat Edinovremennye Vyplaty

May 13, 2025

K 80 Letiyu Pobedy Veterany Eao Poluchat Edinovremennye Vyplaty

May 13, 2025 -

Luxury Presence Unveils New Platform For Discreet Home Sales

May 13, 2025

Luxury Presence Unveils New Platform For Discreet Home Sales

May 13, 2025 -

Jan 6th Falsehoods Ray Epps Defamation Case Against Fox News

May 13, 2025

Jan 6th Falsehoods Ray Epps Defamation Case Against Fox News

May 13, 2025 -

Gibraltar Et Le Royaume Uni Etat Des Negociations Post Brexit

May 13, 2025

Gibraltar Et Le Royaume Uni Etat Des Negociations Post Brexit

May 13, 2025 -

Spoznajmo Romske Muzikante Prekmurja

May 13, 2025

Spoznajmo Romske Muzikante Prekmurja

May 13, 2025

Latest Posts

-

Todays News Air Traffic Controller Crisis Major Court Cases And The Rise Of Thc Beverages

May 13, 2025

Todays News Air Traffic Controller Crisis Major Court Cases And The Rise Of Thc Beverages

May 13, 2025 -

Self Defense Insurance Protecting Yourself After A Shooting Incident

May 13, 2025

Self Defense Insurance Protecting Yourself After A Shooting Incident

May 13, 2025 -

Townhouse Hit By Three Separate Car Crashes In Two Years Cnn

May 13, 2025

Townhouse Hit By Three Separate Car Crashes In Two Years Cnn

May 13, 2025 -

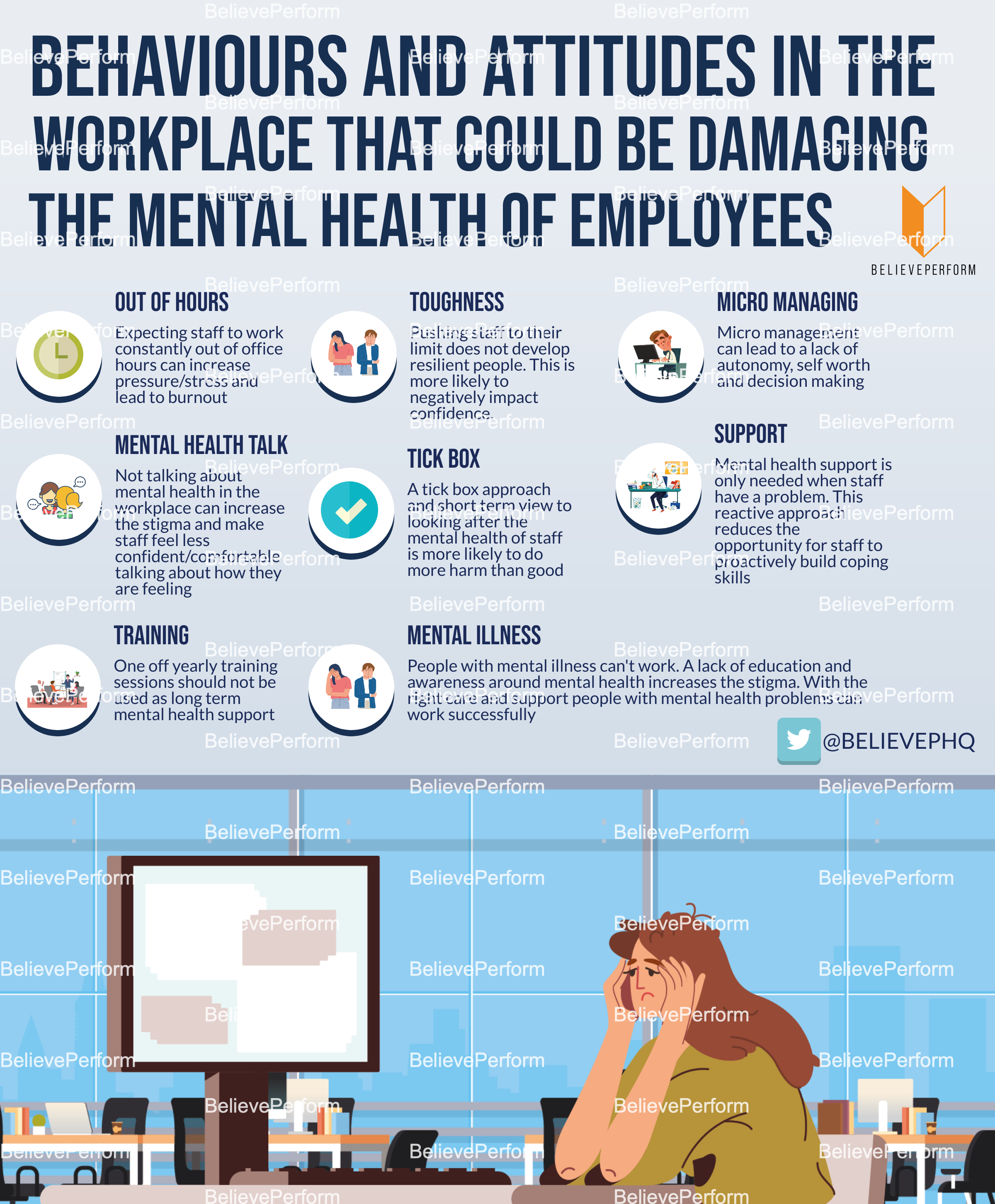

Power Shift In The Workplace How Bosses Attitudes Impact Employees

May 13, 2025

Power Shift In The Workplace How Bosses Attitudes Impact Employees

May 13, 2025 -

India Pakistan Tensions Ease A Delicate Ceasefire Holds

May 13, 2025

India Pakistan Tensions Ease A Delicate Ceasefire Holds

May 13, 2025