Securing A Personal Loan With Bad Credit: A Guide To Direct Lenders

Table of Contents

Understanding Direct Lenders and Their Advantages

Direct lenders are financial institutions that provide loans directly to borrowers without involving third-party intermediaries like brokers or loan matching services. This eliminates the middleman, often resulting in a faster loan process, potentially more favorable interest rates, and greater transparency. Let's explore the key advantages:

- Avoids extra fees: Intermediaries often charge fees for their services, increasing the overall cost of your loan. Direct lenders typically avoid these extra charges, saving you money.

- Streamlined application process: Applying directly to the lender means a more efficient application process, often completed entirely online. You interact directly with the decision-makers, making communication clear and simple.

- Potentially better interest rates: By eliminating intermediary fees and overhead, direct lenders can sometimes offer more competitive interest rates on personal loans, even for those with bad credit.

- More transparent loan terms and conditions: Direct lenders provide clear and concise loan agreements, making it easier to understand the terms, repayment schedules, and any associated fees.

- Easier communication: Direct communication with the lender simplifies the process of addressing questions, resolving issues, and managing your loan.

Improving Your Chances of Loan Approval with Bad Credit

While a low credit score presents challenges when applying for a personal loan, proactive steps can significantly improve your chances of approval. Here’s how:

- Check your credit report: Request your free credit report from the major credit bureaus (Equifax, Experian, and TransUnion) and review it thoroughly for any errors. Dispute any inaccuracies promptly. Addressing errors can boost your credit score.

- Lower your debt-to-income ratio: Paying down existing debts, like credit cards and other loans, reduces your debt-to-income ratio (DTI), a crucial factor in loan approval. A lower DTI demonstrates improved financial responsibility.

- Consider a secured loan: If you have assets like a car or savings account, explore secured loan options. Using collateral reduces the risk for the lender and can lead to better interest rates. However, remember that you risk losing the collateral if you default on the loan.

- Explore credit-building options: Consider obtaining a secured credit card. Responsible use of a secured credit card can help rebuild your credit score over time.

- Be transparent: Be honest and upfront about your financial situation in your loan application. Lenders appreciate transparency and will be more likely to work with you if you're open about your circumstances.

Finding Reputable Direct Lenders for Bad Credit Loans

Finding a reputable direct lender is crucial when seeking a personal loan with bad credit. Avoid predatory lenders by conducting thorough research:

- Compare interest rates and fees: Don’t settle for the first offer. Compare interest rates, fees, and repayment terms from multiple lenders to secure the best deal. Use online loan comparison tools to simplify this process.

- Check online reviews and reputation: Research the lender's reputation on websites like the Better Business Bureau (BBB) and read online reviews from previous borrowers. This helps you gauge their customer service and overall reliability.

- Look for lenders specializing in bad credit: Some direct lenders focus on providing loans to individuals with less-than-perfect credit. Targeting these lenders increases your approval odds.

- Understand the loan terms: Carefully review the loan agreement before signing. Pay close attention to the repayment schedule, late payment penalties, and any other fees associated with the loan.

- Beware of guaranteed approval: Be wary of lenders who promise guaranteed loan approval. No reputable lender can guarantee approval, as each application is assessed individually based on creditworthiness.

Types of Personal Loans for Bad Credit

Understanding the different types of personal loans available can help you choose the best option for your situation:

- Secured Loans: These loans require collateral, reducing the lender's risk and often leading to lower interest rates. However, defaulting on a secured loan could result in the loss of your collateral.

- Unsecured Loans: These loans don't require collateral, making them more accessible but often coming with higher interest rates due to the increased risk for the lender.

- Payday Loans: These short-term, high-interest loans should generally be avoided due to their extremely high cost and potential for creating a cycle of debt.

- Installment Loans: These loans are repaid in fixed monthly installments over a predetermined period, offering a manageable repayment structure.

Conclusion

Securing a personal loan with bad credit requires careful planning and research. By understanding the advantages of direct lenders, proactively improving your financial health, and diligently researching reputable lenders, you can significantly increase your chances of loan approval. Remember to compare various offers from different direct lenders before making a decision. Don't let a less-than-perfect credit score prevent you from accessing the financial assistance you need. Start your search for a reliable direct lender today and take control of your financial future.

Featured Posts

-

Bon Plan Samsung Galaxy S25 Ultra 256 Go 256 Go Vente Flash

May 28, 2025

Bon Plan Samsung Galaxy S25 Ultra 256 Go 256 Go Vente Flash

May 28, 2025 -

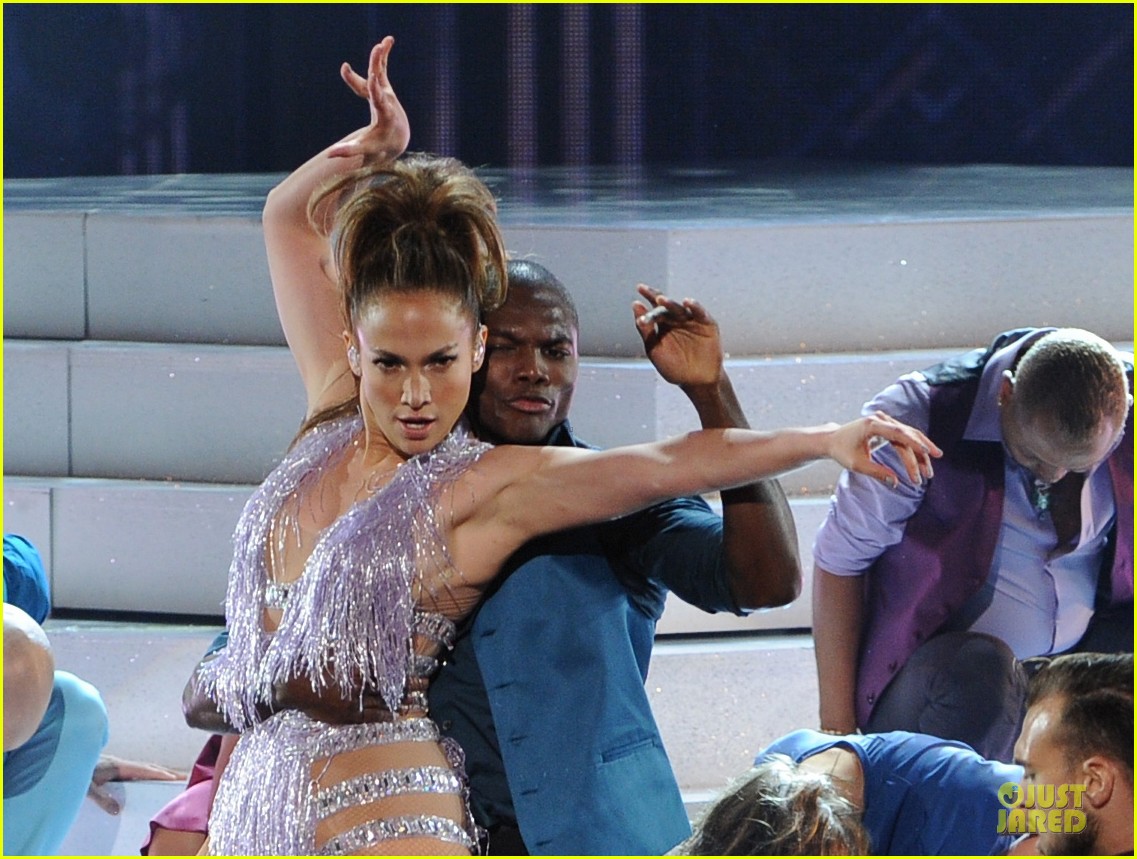

Amas 2025 Jennifer Lopez As Host Official Announcement

May 28, 2025

Amas 2025 Jennifer Lopez As Host Official Announcement

May 28, 2025 -

Raih Satu Kursi Senayan Nas Dem Bali Tunda Pembangunan Kedai Kopi

May 28, 2025

Raih Satu Kursi Senayan Nas Dem Bali Tunda Pembangunan Kedai Kopi

May 28, 2025 -

Nadals Emotional Roland Garros Farewell Sabalenkas Triumphant Win

May 28, 2025

Nadals Emotional Roland Garros Farewell Sabalenkas Triumphant Win

May 28, 2025 -

Novinata Za Khyu Dzhakman Bleyk Layvli Dzhstin Baldoni I Teylr Suift Kakvo Se Sluchva

May 28, 2025

Novinata Za Khyu Dzhakman Bleyk Layvli Dzhstin Baldoni I Teylr Suift Kakvo Se Sluchva

May 28, 2025

Latest Posts

-

Evaluation De Deux Sites D Ingenierie Castor En Drome

May 31, 2025

Evaluation De Deux Sites D Ingenierie Castor En Drome

May 31, 2025 -

Analyse Comparative De L Ingenierie Castor Dans Deux Cours D Eau Dromois

May 31, 2025

Analyse Comparative De L Ingenierie Castor Dans Deux Cours D Eau Dromois

May 31, 2025 -

Performance De L Ingenierie Des Castors Cas D Etude En Drome

May 31, 2025

Performance De L Ingenierie Des Castors Cas D Etude En Drome

May 31, 2025 -

Impact De L Ingenierie Castor Sur Les Cours D Eau De La Drome Une Analyse Comparative

May 31, 2025

Impact De L Ingenierie Castor Sur Les Cours D Eau De La Drome Une Analyse Comparative

May 31, 2025 -

Ingenierie Castor Et Restauration Fluviale Experience Dans La Drome

May 31, 2025

Ingenierie Castor Et Restauration Fluviale Experience Dans La Drome

May 31, 2025