Sell America Bonds: Moody's 30-Year Yield Surge To 5%

Table of Contents

Understanding the 30-Year Treasury Yield Surge

The 30-year Treasury yield represents the return an investor receives on a US government bond maturing in 30 years. This yield is directly influenced by interest rates. A rise in the 30-year Treasury yield, as we've seen recently hitting 5%, indicates that investors are demanding a higher return for lending their money to the government for an extended period. Several factors contribute to this increase:

- Inflationary Pressures and Federal Reserve Policy: Persistent inflation forces the Federal Reserve to consider raising interest rates to cool down the economy. Higher interest rates make existing bonds less attractive, pushing their yields up.

- Economic Growth Projections: Strong economic growth projections can lead to higher interest rates as investors anticipate increased demand for borrowing. This increased demand drives up bond yields.

- Global Economic Uncertainties: Global uncertainties often push investors towards safe-haven assets like US Treasury bonds. However, if these uncertainties intensify, it could trigger a sell-off, impacting yields.

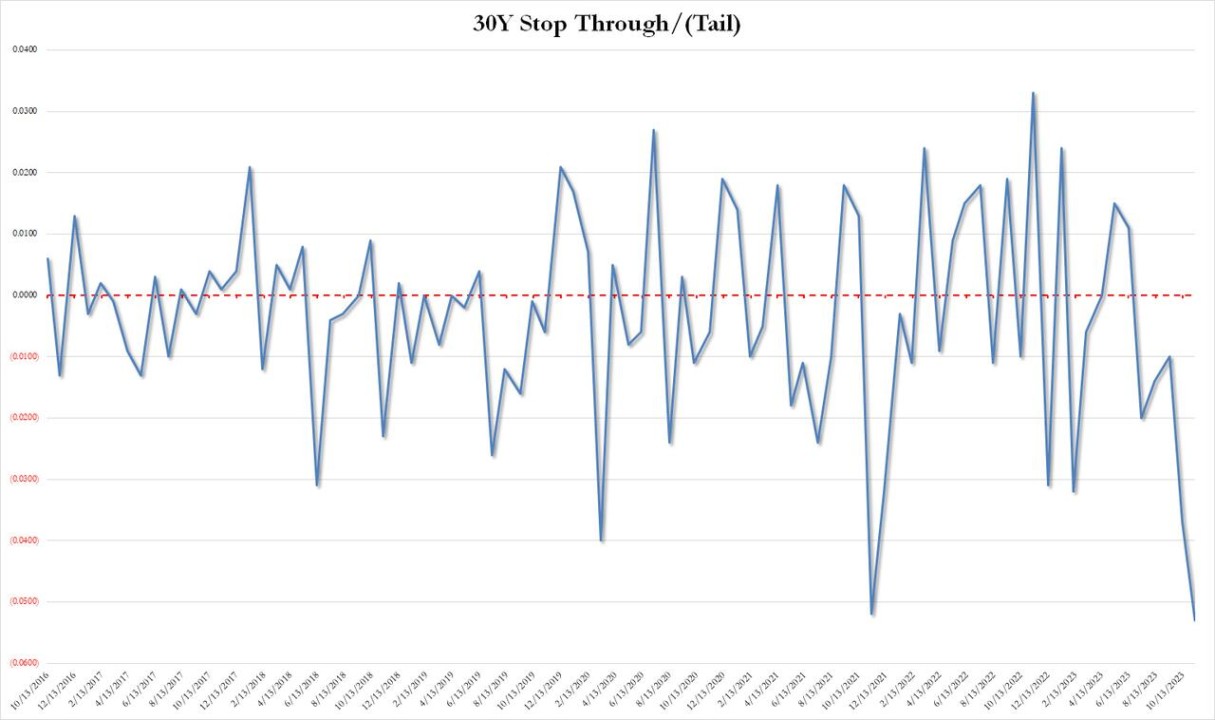

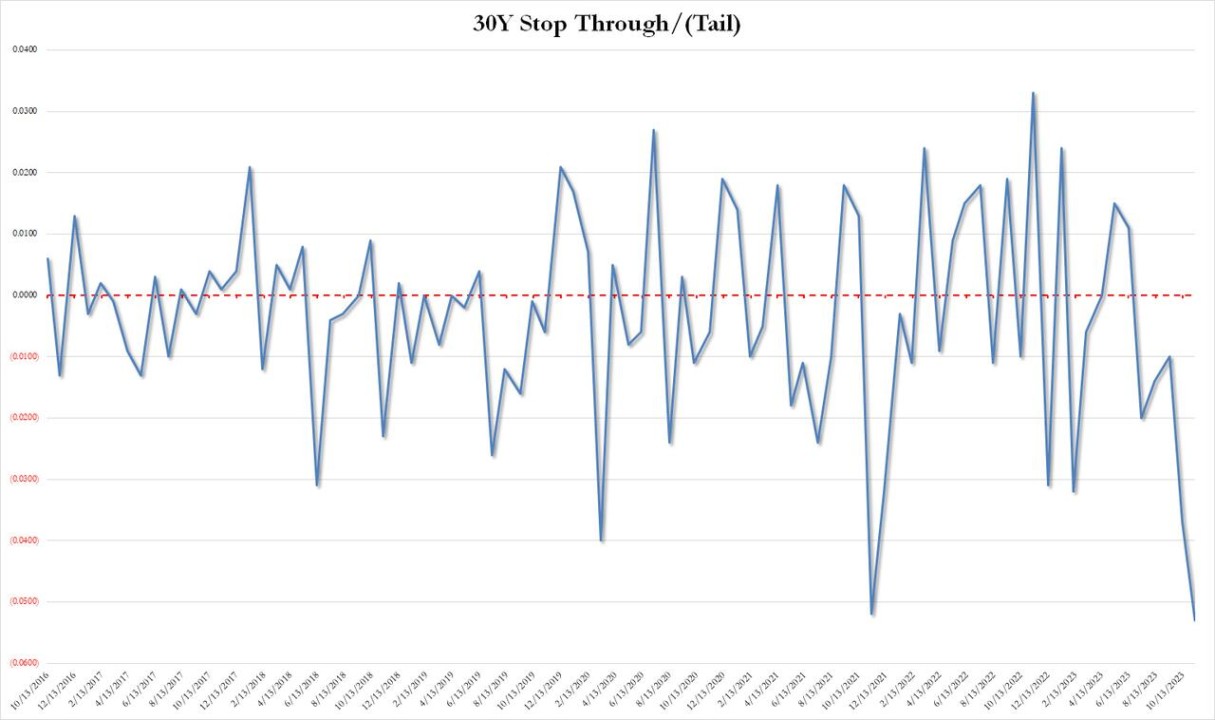

[Insert a chart or graph here visually depicting the 30-year Treasury yield's movement over the past year, clearly showing the recent surge to 5%].

Moody's Rating and its Impact on Bond Market Sentiment

Moody's, a leading credit rating agency, plays a vital role in assessing the creditworthiness of US government bonds. Their rating reflects the perceived risk of default. While the US government has historically enjoyed a AAA rating, any perceived weakening in its fiscal position could impact Moody's assessment. A downgrade, or even a negative outlook from Moody's, could significantly impact investor confidence and demand for US Treasury bonds. This reduced demand would likely result in higher yields as investors demand a greater premium to compensate for increased risk. The relationship between credit ratings and bond yields is inverse; a lower credit rating generally corresponds to higher yields.

Strategic Implications for Investors Considering Selling America Bonds

The recent 30-year Treasury yield surge presents distinct strategic implications for investors considering selling America bonds, varying depending on their individual risk tolerance and investment horizon.

Conservative Investors: May consider reducing their bond holdings gradually to rebalance their portfolio and lock in some profits.

Aggressive Investors: Might see opportunities to sell and invest in higher-yielding assets, though this carries increased risk.

Potential strategies include:

- Diversification: Spreading investments across different asset classes (e.g., stocks, real estate) to reduce risk.

- Portfolio Rebalancing: Adjusting the allocation of assets to maintain the desired risk profile in light of the changing yield environment.

- Short-Term vs. Long-Term Strategies: Short-term investors might be more inclined to sell, while long-term investors may prefer to ride out the market fluctuations.

Selling bonds at this juncture carries inherent risks, including potential capital losses if yields continue to rise. Careful consideration and potentially professional financial advice are crucial.

Alternative Investment Opportunities in the Current Market

Given the current bond market conditions, several alternative investment opportunities might prove attractive:

- High-Yield Corporate Bonds: Offer potentially higher returns than government bonds but carry greater default risk.

- Municipal Bonds: Generally offer tax advantages, but their yields can fluctuate.

- Equities (Stocks): Offer growth potential but are subject to market volatility.

- Real Estate: Can provide diversification and potential for long-term appreciation but involves higher transaction costs and illiquidity.

Each of these alternatives presents different risk and reward profiles. Thorough research and professional guidance are essential before making any investment decisions.

Conclusion: Making Informed Decisions About Selling America Bonds

The recent surge in the 30-year Treasury yield to 5%, potentially influenced by factors like inflation and Moody's rating outlook, creates significant considerations for investors holding America bonds. Understanding the mechanics of bond yields, the implications of credit ratings, and alternative investment opportunities is critical. Before making any decisions about selling US Treasury bonds or managing your bond portfolio, carefully weigh your risk tolerance, investment timeline, and financial goals. Conduct thorough research, consult with a qualified financial advisor, and make informed decisions based on your unique circumstances and the current America bond market outlook. Don't hesitate to seek professional advice before significantly altering your bond holdings.

Featured Posts

-

Le Projet D Adressage D Abidjan Un Bilan Positif

May 20, 2025

Le Projet D Adressage D Abidjan Un Bilan Positif

May 20, 2025 -

Z94 Suki Waterhouses Hilarious Twinks Tik Tok Goes Viral

May 20, 2025

Z94 Suki Waterhouses Hilarious Twinks Tik Tok Goes Viral

May 20, 2025 -

Ex Munster Prop James Cronin Appointed Highfield Head Coach

May 20, 2025

Ex Munster Prop James Cronin Appointed Highfield Head Coach

May 20, 2025 -

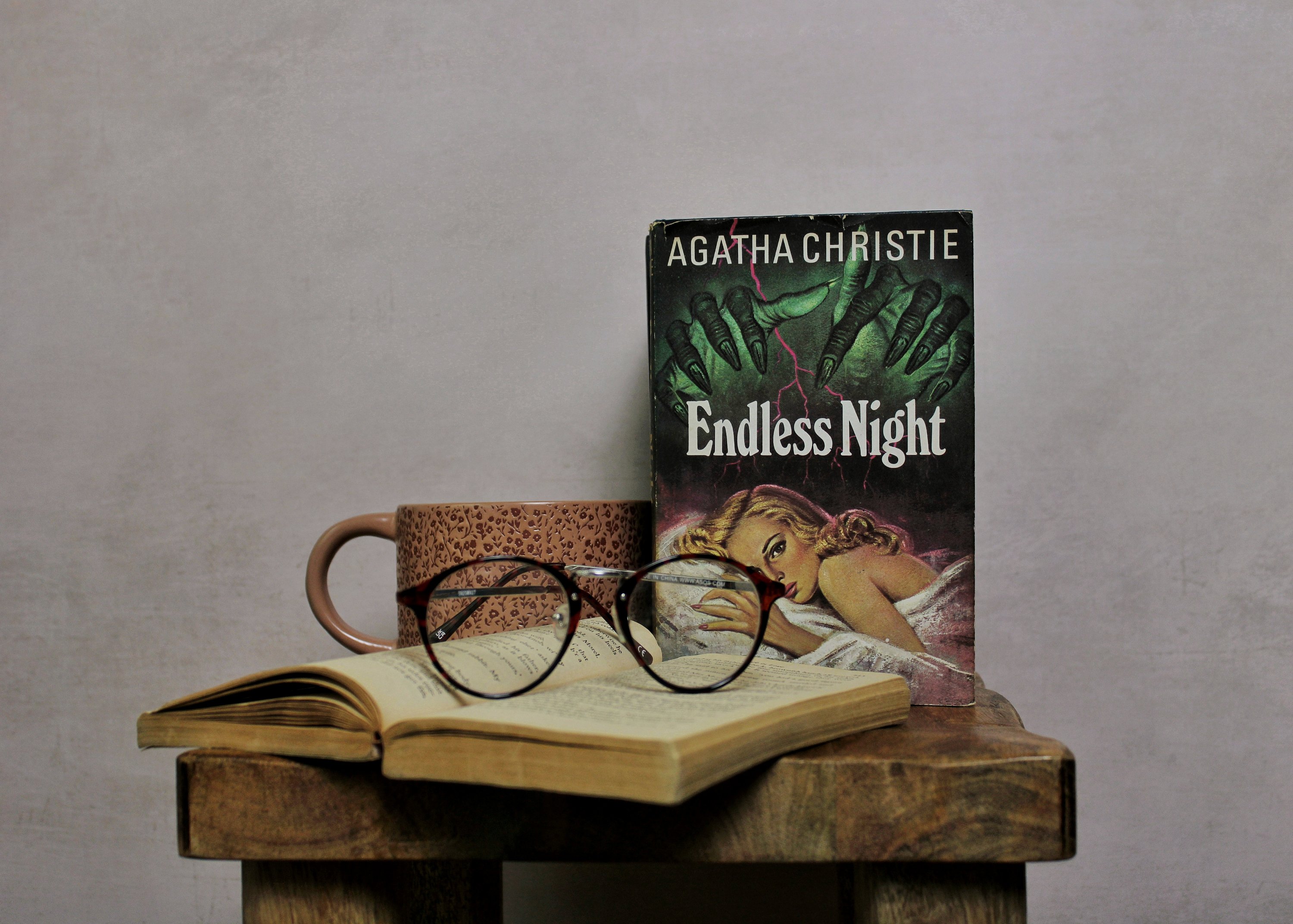

Bbcs Endless Night A New Agatha Christie Adaptation

May 20, 2025

Bbcs Endless Night A New Agatha Christie Adaptation

May 20, 2025 -

New Online Archive Showcases Burnham And Highbridges Past

May 20, 2025

New Online Archive Showcases Burnham And Highbridges Past

May 20, 2025

Latest Posts

-

Wayne Gretzkys Legacy The Controversy Surrounding His Trump Relationship

May 20, 2025

Wayne Gretzkys Legacy The Controversy Surrounding His Trump Relationship

May 20, 2025 -

The Gretzky Trump Connection Impact On The Hockey Legends Image

May 20, 2025

The Gretzky Trump Connection Impact On The Hockey Legends Image

May 20, 2025 -

Wayne Gretzky And Donald Trump A Legacy Under Scrutiny

May 20, 2025

Wayne Gretzky And Donald Trump A Legacy Under Scrutiny

May 20, 2025 -

Gretzkys Loyalty Examining The Legacy Amid Trump Ties

May 20, 2025

Gretzkys Loyalty Examining The Legacy Amid Trump Ties

May 20, 2025 -

Wayne Gretzky And The Trump Tariff Controversy A National Conversation

May 20, 2025

Wayne Gretzky And The Trump Tariff Controversy A National Conversation

May 20, 2025