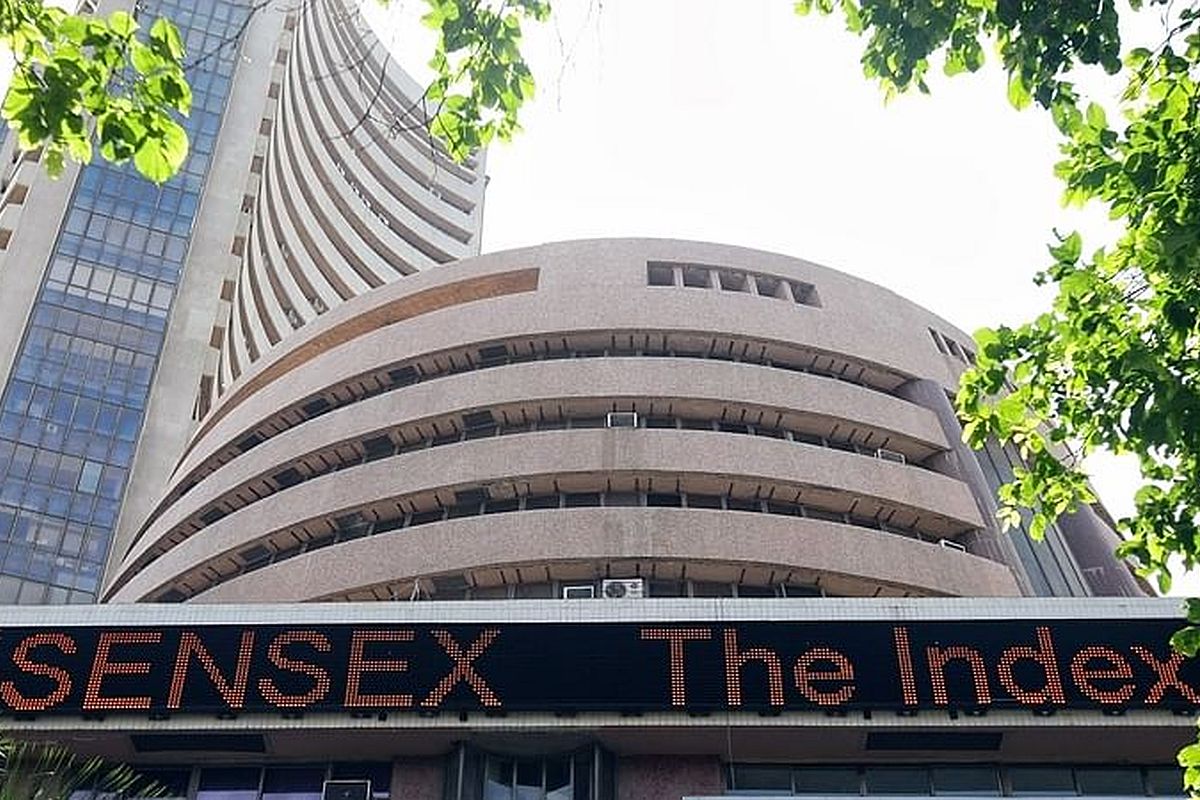

Sensex Jumps 200 Points, Nifty Hits 22,600: Stock Market Update

Table of Contents

Key Drivers Behind the Sensex and Nifty Surge

Several factors contributed to this remarkable upswing in the Indian stock market. The combined effect of positive global cues and strong domestic economic indicators created a perfect storm for a market rally.

Positive Global Cues

Positive developments in the global economic landscape significantly impacted the Indian market. This positive sentiment spilled over into Indian markets, boosting investor confidence.

- Strong US economic data boosted investor confidence. Resilient US economic indicators lessened fears of a global recession, encouraging foreign investment flows into emerging markets like India.

- Positive global growth forecasts fueled market optimism. International organizations' positive projections for global growth fueled a sense of optimism, encouraging investors to increase their exposure to riskier assets, including Indian stocks.

- Easing inflation worries reduced investor anxiety. Signs of easing inflation in major economies globally reduced concerns about aggressive interest rate hikes, creating a more favorable environment for stock market growth. This positive sentiment directly translated into increased buying activity in the Indian stock market.

Strong Domestic Economic Indicators

Robust domestic economic data also played a crucial role in driving the Sensex and Nifty surge. Positive indicators showcased the strength and resilience of the Indian economy.

- Robust GDP growth in the last quarter. Strong GDP growth figures demonstrated the Indian economy's sustained growth trajectory, attracting both domestic and international investors.

- Increased industrial production signifies economic strength. Higher industrial production numbers indicated a surge in economic activity, further bolstering investor confidence in the Indian market.

- Positive consumer spending data indicates a healthy economy. Healthy consumer spending figures suggested a robust domestic demand, a crucial factor for sustained economic growth and a positive signal for the stock market.

Sector-Specific Performances

The market rally wasn't uniform across all sectors. Certain sectors experienced more significant gains than others, contributing disproportionately to the overall surge.

- IT sector witnessed strong gains due to positive global tech outlook. The IT sector benefited from positive global technology trends and strong earnings reports, leading to significant gains in many IT stocks.

- Banking sector benefited from improved credit growth. Increased credit growth in the banking sector signaled a healthy economy and fueled investor confidence in financial stocks.

- Pharma sector saw increased investor interest due to new drug approvals and positive clinical trial results. Positive news within the pharmaceutical sector regarding new drug approvals and successful clinical trials attracted significant investor interest and drove up stock prices. Specific stocks like [mention example stocks if appropriate] showed exceptional performance.

Analysis of Nifty's Performance and its Impact

The Nifty hitting 22,600 is a significant milestone, reflecting considerable growth in the Indian stock market.

Nifty 22,600 Milestone

Reaching 22,600 marks a substantial increase from previous highs, indicating a strong bullish trend and substantial investor confidence in the Indian economy. This milestone underscores the potential for further growth and attracts new investments.

Impact on Investor Sentiment

This market surge has significantly boosted investor sentiment, encouraging increased participation and investment in the Indian stock market. The positive momentum is likely to attract both domestic and foreign institutional investors (FIIs).

Volatility and Future Predictions

While the current trend is positive, it's important to acknowledge the inherent volatility of the stock market. Predicting future market movements with certainty is impossible. While the short-term outlook appears bullish, investors should remain cautious and diversify their portfolios to mitigate potential risks. Long-term prospects remain positive, contingent on continued strong economic fundamentals and global stability.

Expert Opinions and Market Forecasts

Several market analysts have offered their perspectives on the recent market surge and its implications.

- Expert A predicts continued growth in the next quarter, driven by strong domestic demand. [Source]

- Expert B believes that the banking and IT sectors will continue to outperform other sectors. [Source]

- The general market consensus points towards a sustained positive trend, albeit with potential short-term corrections. [Source - cite a reputable financial news source]

Conclusion

The Sensex's jump of over 200 points and the Nifty hitting 22,600 are testaments to the strong positive investor sentiment and the robust performance of the Indian stock market. This surge is driven by a combination of positive global cues, strong domestic economic indicators, and sector-specific performances. While future predictions remain uncertain, the current trend suggests a positive outlook, albeit with inherent market volatility.

Call to Action: Stay updated on the latest developments in the Indian stock market by regularly checking for updates on Sensex and Nifty movements. Monitor the market closely for further insights and make informed investment decisions based on the latest stock market updates. Learn more about investing in the Indian stock market to capitalize on opportunities presented by the Sensex and Nifty. Remember to conduct thorough research and consider professional financial advice before making any investment decisions.

Featured Posts

-

Government And Commercial Business Drive Palantir Stock Performance In Q1 2024

May 10, 2025

Government And Commercial Business Drive Palantir Stock Performance In Q1 2024

May 10, 2025 -

Soyuzniki Ukrainy I 9 Maya Ozhidaemye I Neozhidannye Gosti V Kieve

May 10, 2025

Soyuzniki Ukrainy I 9 Maya Ozhidaemye I Neozhidannye Gosti V Kieve

May 10, 2025 -

Historic Broad Street Diner Demolition Hyatt Hotel Development

May 10, 2025

Historic Broad Street Diner Demolition Hyatt Hotel Development

May 10, 2025 -

To Buy Or Not To Buy Palantir Stock Before May 5th Wall Streets View

May 10, 2025

To Buy Or Not To Buy Palantir Stock Before May 5th Wall Streets View

May 10, 2025 -

Ghetto Fears Rise As Caravans Flood Uk City

May 10, 2025

Ghetto Fears Rise As Caravans Flood Uk City

May 10, 2025