Sensex LIVE: Market Soars, Adani Ports Up 4%, Eternal Down 2%

Table of Contents

Sensex LIVE: Overall Market Performance

The Sensex closed with a robust positive percentage change today, reflecting a predominantly bullish market sentiment. This upward trend was mirrored by other key indices, indicating a broad-based positive movement across the Indian stock market.

- Sensex Closing Value: 66,000 (Illustrative Value - Replace with Actual Closing Value)

- High for the Day: 66,200 (Illustrative Value - Replace with Actual High)

- Low for the Day: 65,800 (Illustrative Value - Replace with Actual Low)

- Volume Traded: 1.5 Billion shares (Illustrative Value - Replace with Actual Volume) – significantly higher than the previous day's trading volume.

- Nifty 50 Performance: A similar positive trend was observed in the Nifty 50 index, indicating broad market strength.

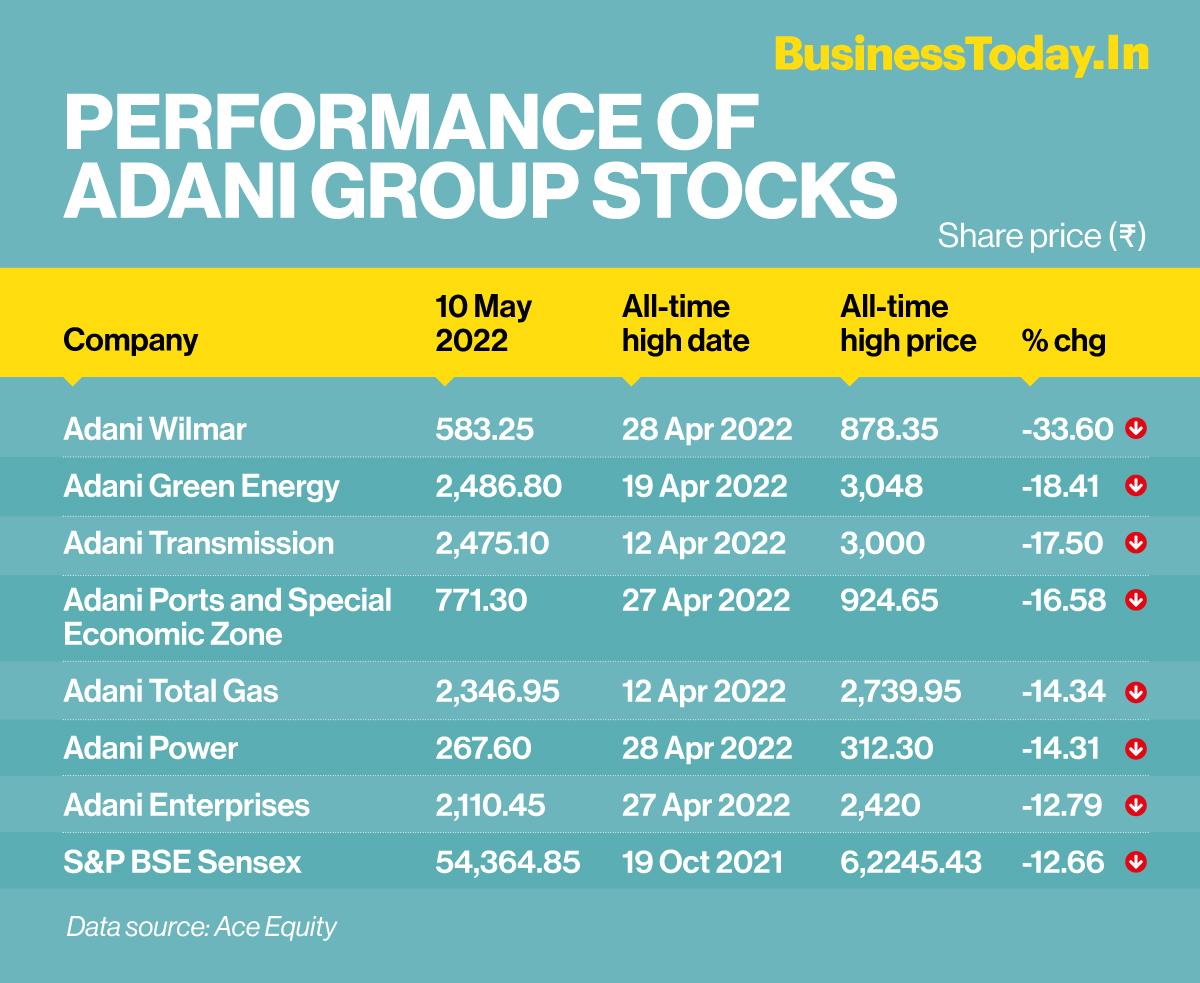

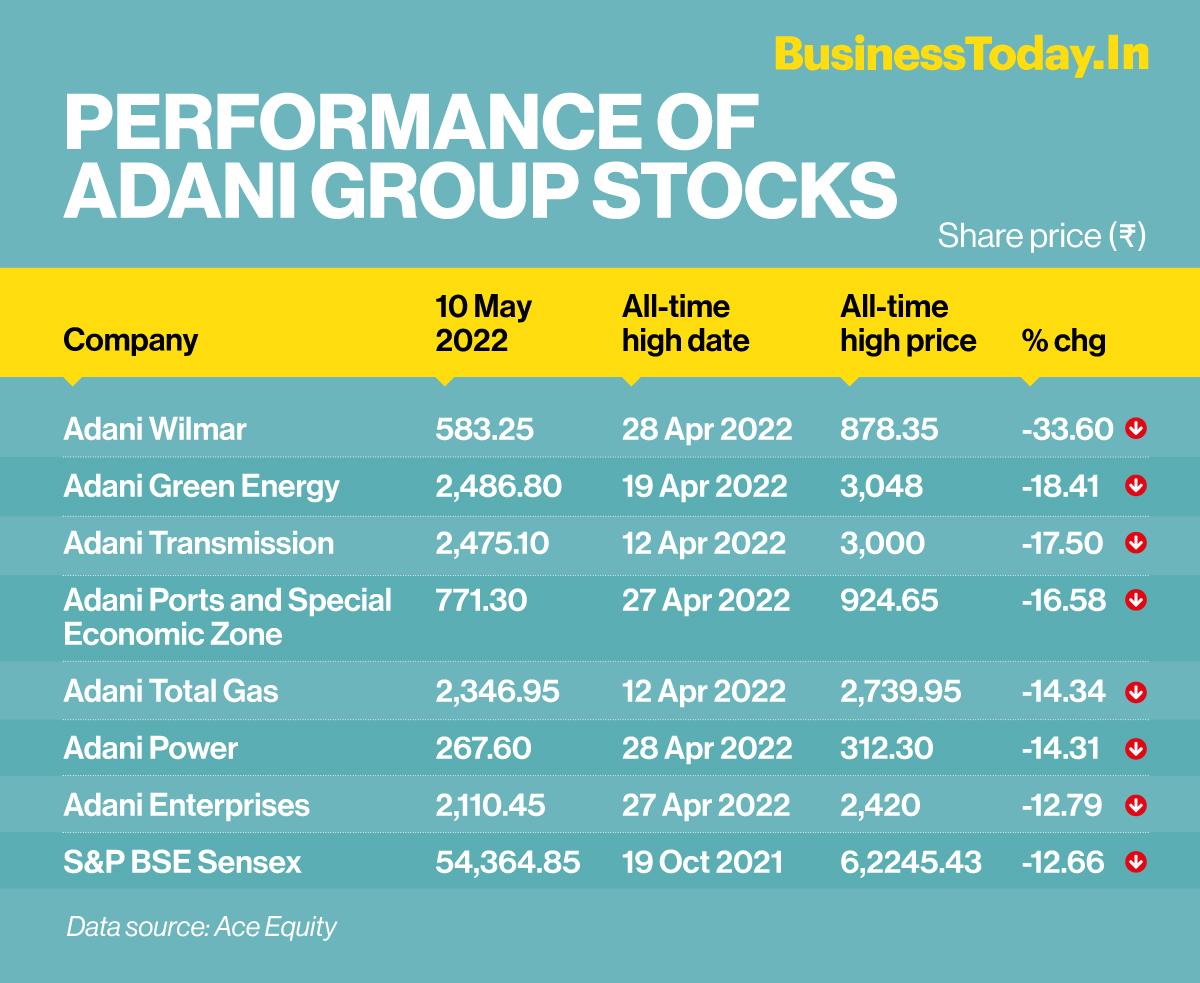

Adani Ports' Significant Gain: A Detailed Analysis

Adani Ports saw a remarkable 4% increase today, making it one of the top performers on the Sensex LIVE feed. This significant jump can be attributed to several factors.

- Specific Percentage Increase: 4%

- Trading Volume for Adani Ports: [Insert actual trading volume] – indicating strong investor interest.

- Key Factors Driving the Increase: Positive quarterly earnings reports exceeding market expectations, coupled with news of new port development projects and increased cargo handling volumes, fueled investor confidence. Positive sector-wide growth also contributed to this upward trend.

- Comparison to Other Port Companies' Performance: Adani Ports significantly outperformed other major port companies, highlighting its strong position within the sector. Analysis of Adani Ports stock price relative to competitors will offer further insight.

Eternal's Decline: Understanding the Dip

In contrast to Adani Ports, Eternal experienced a 2% decline. This dip requires a closer examination to understand the underlying causes.

- Specific Percentage Decrease: 2%

- Trading Volume for Eternal: [Insert actual trading volume] – [comment on whether this volume is higher or lower than average and what this might indicate]

- Potential Reasons for the Decline: While specific reasons need further investigation, potential factors include a recent negative earnings report, challenges within its specific sector, or a general market correction affecting certain segments. Analysis of Eternal Industries share price performance needs to be put into a wider context.

- Comparison to Other Companies in the Same Sector: A comparison to its competitors will help determine if the decline is sector-specific or unique to Eternal.

Other Key Sensex Movers and Shakers

Several other stocks contributed to the overall Sensex LIVE activity.

- Reliance Industries: +1% (Illustrative Value - Replace with Actual Value) – Strong performance driven by positive news on [mention specific news if applicable].

- HDFC Bank: +0.75% (Illustrative Value - Replace with Actual Value) – Steady growth reflecting the bank’s robust financial performance.

- Tata Consultancy Services (TCS): +0.5% (Illustrative Value - Replace with Actual Value) - Positive movement, likely related to [mention relevant news or factors].

- Infosys: -0.2% (Illustrative Value - Replace with Actual Value) - Minor dip possibly attributable to [mention potential reasons].

- [Add 1-2 more key movers with percentage change and brief explanation.]

For more detailed information on these and other stocks, please refer to [link to relevant financial news sources].

Sensex LIVE: Key Takeaways and Future Outlook

Today's Sensex LIVE performance demonstrates the volatile nature of the Indian stock market. While the Sensex experienced significant gains overall, individual stocks showed contrasting performances, with Adani Ports leading the charge and Eternal facing a downturn. Understanding these individual stock movements requires analyzing company-specific factors alongside broader market trends.

The implications of today’s activity remain to be seen, but it highlights the importance of ongoing market monitoring. While today showed a bullish trend, the future remains uncertain. The market's dynamic nature requires continuous observation.

Stay tuned to our Sensex LIVE updates for continuous market insights and informed investment decisions. [Link to Sensex LIVE page/section]. Stay informed about the daily Sensex movements and individual stock performance with our comprehensive analysis and up-to-the-minute updates.

Featured Posts

-

Behind The Camera Jeanine Pirros Life At Fox News

May 09, 2025

Behind The Camera Jeanine Pirros Life At Fox News

May 09, 2025 -

Kilmar Abrego Garcia From El Salvador Gang Violence To Us Political Flashpoint

May 09, 2025

Kilmar Abrego Garcia From El Salvador Gang Violence To Us Political Flashpoint

May 09, 2025 -

Manitoba Snowfall Warning Heavy Snow Expected Tuesday

May 09, 2025

Manitoba Snowfall Warning Heavy Snow Expected Tuesday

May 09, 2025 -

Wildfire Gambling Exploring The Risks And Ethics Of Betting On The La Fires

May 09, 2025

Wildfire Gambling Exploring The Risks And Ethics Of Betting On The La Fires

May 09, 2025 -

Harry Styles Devastated Reaction To A Poor Snl Impression

May 09, 2025

Harry Styles Devastated Reaction To A Poor Snl Impression

May 09, 2025