Sensex Rise Fuels Stock Market Surge: Key Gainers On BSE

Table of Contents

The BSE Sensex roared to life today, closing with a remarkable [Insert Percentage]% increase, reaching a value of [Insert Closing Sensex Value]. This significant surge signifies a positive shift in the Indian stock market, leaving investors eager to understand the key drivers behind this impressive rally. This article delves into the top-performing sectors and individual stocks that fueled this Sensex rise, providing valuable insights into the current market dynamics.

Top Performing Sectors Driving the Sensex Surge

Several sectors played a pivotal role in propelling the Sensex to new heights. Strong quarterly earnings, positive industry outlooks, and positive investor sentiment contributed significantly to these sectoral gains. Analyzing the best-performing sectors provides a clearer picture of the overall market momentum.

- Information Technology (IT): The IT sector led the charge, witnessing a [Insert Percentage]% surge. Strong demand for technology services globally and positive future projections contributed to this impressive performance. The Sensex sectoral performance in IT reflects a bullish outlook for the sector.

- Banking: The banking sector also experienced substantial growth, with a [Insert Percentage]% increase. Positive interest rate hikes and improved credit growth fueled this performance. This reflects improved investor confidence in the financial sector.

- Fast-Moving Consumer Goods (FMCG): The FMCG sector showed resilience, recording a [Insert Percentage]% rise. Strong consumer spending and a stable macroeconomic environment contributed to the positive performance.

- Pharmaceuticals: The pharmaceutical sector saw a [Insert Percentage]% gain, driven by strong export demand and positive clinical trial results for several key players. This highlights the resilience of this sector.

- Energy: The energy sector also recorded a significant [Insert Percentage]% increase, driven by rising global oil prices and increasing domestic demand.

Key Gainers on the BSE: Individual Stock Performance

Beyond sectoral gains, specific stocks shone brightly, contributing significantly to the overall Sensex rise. Analyzing the best-performing stocks provides granular insight into the market's trajectory. These top BSE gainers represent a mix of sectors, underscoring broad-based market strength.

- Reliance Industries (RELIANCE.NS): [Insert Closing Price] +[Insert Percentage]%

- HDFC Bank (HDFCBANK.NS): [Insert Closing Price] +[Insert Percentage]%

- Infosys (INFY.NS): [Insert Closing Price] +[Insert Percentage]%

- ICICI Bank (ICICIBANK.NS): [Insert Closing Price] +[Insert Percentage]%

- Tata Consultancy Services (TCS.NS): [Insert Closing Price] +[Insert Percentage]%

- Hindustan Unilever (HINDUNILVR.NS): [Insert Closing Price] +[Insert Percentage]%

- (Add 2-3 more top gainers with their BSE ticker symbols, closing prices, and percentage gains.)

These top BSE gainers reflect a combination of factors including strong quarterly results, positive investor sentiment, and overall market optimism.

Market Analysis and Future Outlook

The Sensex rise sparks debate about its sustainability. Experts are divided on the short-term and long-term outlook. While the current market conditions are positive, several factors could influence future market movements.

- Global Economic Conditions: Global economic uncertainty could dampen investor sentiment and impact future Sensex performance.

- Upcoming Policy Changes: Government policies and regulatory changes can affect various sectors, impacting the Sensex forecast.

- Inflation Rates: High inflation can negatively affect investor confidence and trigger market corrections.

Short-term outlook: Many analysts predict continued growth, while others anticipate a period of consolidation. The Sensex forecast for the next quarter remains cautiously optimistic.

Long-term outlook: The long-term outlook remains positive, with experts citing India's strong economic fundamentals and growth potential as key drivers. However, global uncertainties remain a factor to consider in BSE future predictions.

Factors Contributing to the Sensex Rise

The Sensex's upward trajectory is a result of several interconnected factors, acting as market catalysts. Understanding these Sensex drivers is crucial for navigating the market effectively.

- Strong Global Cues: Positive global market trends and increased foreign investment fueled the rally.

- Positive Domestic Economic Indicators: Improved economic data boosted investor confidence.

- Strong Corporate Earnings: Positive quarterly earnings from several key companies reinforced market optimism.

- Increased Investor Confidence: Improved investor sentiment contributed to increased market participation.

- Government Policies: Supportive government policies played a role in strengthening market sentiment.

These factors, acting in synergy, contributed significantly to the impressive Sensex rise.

Conclusion

Today's significant Sensex rise, marked by impressive sectoral gains and individual stock performance, reflects a positive shift in the Indian stock market. The top-performing sectors, including IT, Banking, and FMCG, clearly demonstrate the diverse forces driving this surge. Understanding the factors contributing to this rise—from strong global cues to robust domestic economic indicators—is crucial for navigating the market successfully. To stay updated on the Sensex, track Sensex performance closely, and monitor BSE stock market trends, consider subscribing to our newsletter or following us on social media for regular updates. Stay informed to make informed investment decisions.

Featured Posts

-

Improving Transgender Mental Health Exploring The Benefits Of A Gender Euphoria Scale

May 15, 2025

Improving Transgender Mental Health Exploring The Benefits Of A Gender Euphoria Scale

May 15, 2025 -

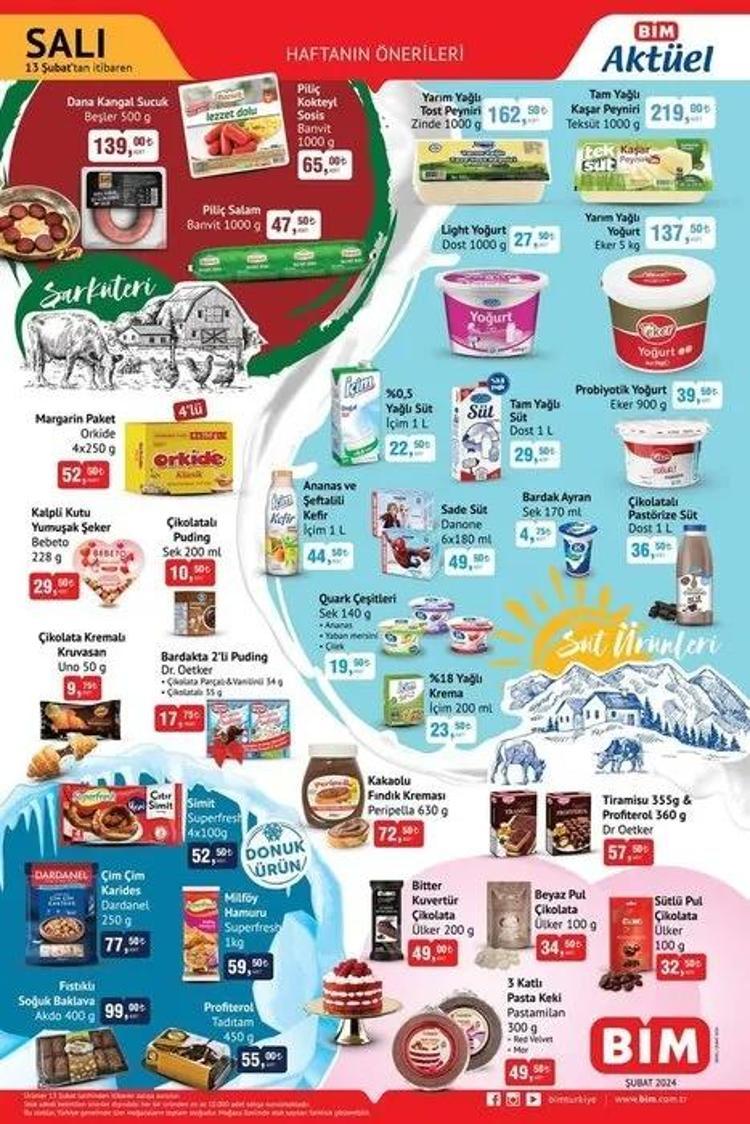

Bim Aktueel Ueruen Katalogu 25 26 Subat Indirimli Ueruenler

May 15, 2025

Bim Aktueel Ueruen Katalogu 25 26 Subat Indirimli Ueruenler

May 15, 2025 -

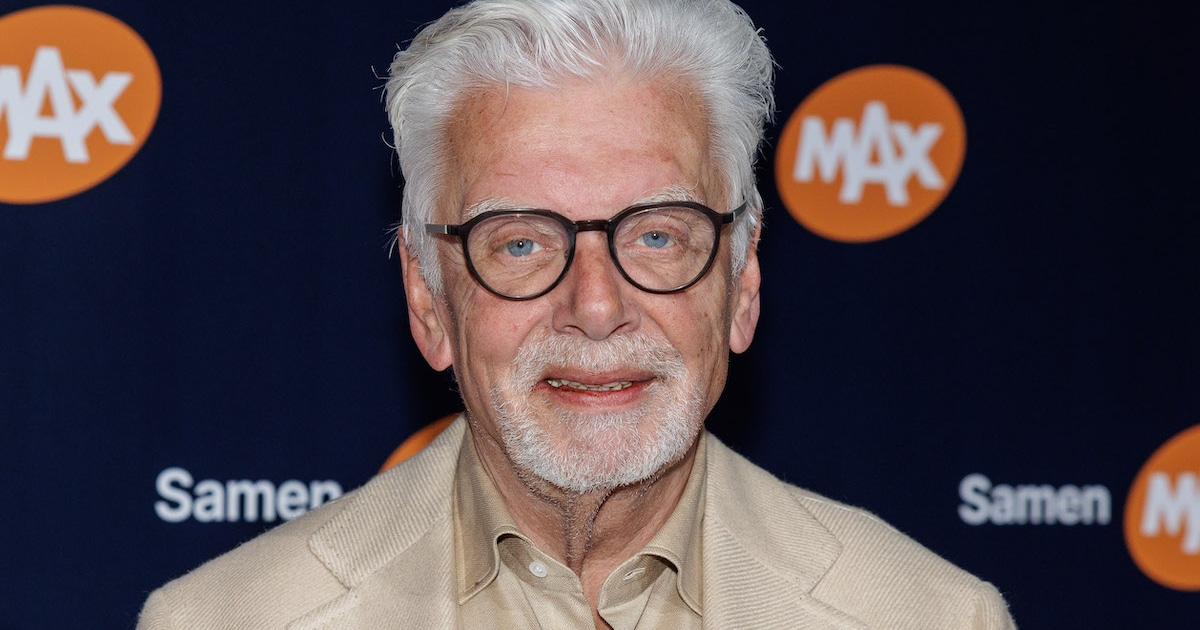

College Van Omroepen Hoe Vertrouwen Bij De Npo Te Herstellen

May 15, 2025

College Van Omroepen Hoe Vertrouwen Bij De Npo Te Herstellen

May 15, 2025 -

Npo Betrouwbaarheid Plan Van Aanpak College Van Omroepen

May 15, 2025

Npo Betrouwbaarheid Plan Van Aanpak College Van Omroepen

May 15, 2025 -

Dreigende Actie Tegen Npo Directeur Frederieke Leeflang

May 15, 2025

Dreigende Actie Tegen Npo Directeur Frederieke Leeflang

May 15, 2025

Latest Posts

-

Analyse De Actie Tegen Npo Baas Frederieke Leeflang En De Gevolgen

May 15, 2025

Analyse De Actie Tegen Npo Baas Frederieke Leeflang En De Gevolgen

May 15, 2025 -

Is Dit Het Begin Van Het Einde Actie Tegen Npo Directeur Frederieke Leeflang

May 15, 2025

Is Dit Het Begin Van Het Einde Actie Tegen Npo Directeur Frederieke Leeflang

May 15, 2025 -

Verdere Escalatie Verwacht Actie Tegen Frederieke Leeflang En De Npo

May 15, 2025

Verdere Escalatie Verwacht Actie Tegen Frederieke Leeflang En De Npo

May 15, 2025 -

Reacties Op De Dreigende Actie Tegen Npo Baas Frederieke Leeflang

May 15, 2025

Reacties Op De Dreigende Actie Tegen Npo Baas Frederieke Leeflang

May 15, 2025 -

Nieuwe Ontwikkelingen In De Actie Tegen Npo Directeur Frederieke Leeflang

May 15, 2025

Nieuwe Ontwikkelingen In De Actie Tegen Npo Directeur Frederieke Leeflang

May 15, 2025