Sensex Soars 500 Points, Nifty Above 17400: Adani Ports, Eternal Industries Lead Market Movers

Table of Contents

Sensex Gains 500+ Points: A Deep Dive into the Rally

The Sensex's 500+ point gain represents a significant jump, marking a substantial percentage increase compared to its previous closing value. This surge underscores the positive sentiment prevailing in the market. The closing values of both the Sensex and Nifty reflect this robust market performance. This positive momentum suggests a renewed confidence in the Indian economy.

- Magnitude of the Gain: The exact point gain and percentage increase should be clearly stated here (e.g., "The Sensex closed at X, up Y points, representing a Z% increase").

- Significance: The context of this increase should be explained. Is this the largest single-day gain in recent months? How does it compare to average daily fluctuations?

- Closing Values: Clearly state the final closing values for both the Sensex and Nifty indices.

- Visual Representation: Include a chart or graph visually displaying the Sensex's movement throughout the day, highlighting the significant upward trend.

Nifty Above 17400: Analyzing the Key Factors

The Nifty index crossing the 17400 milestone is a significant achievement, signifying strong growth and stability in the Indian stock market. Several factors contributed to this remarkable feat.

- Positive Global Cues: Positive developments in global markets, such as strong performance in other major indices (e.g., Dow Jones, Nasdaq), often influence the Indian market.

- Domestic Economic Data: Positive economic indicators released recently, such as robust GDP growth figures, inflation data, or industrial production numbers, could have fueled investor confidence.

- Sector-Specific Performance: The strong performance of certain key sectors, such as the ones detailed in the next section, contributes to the overall index growth.

Bullet Points outlining specific positive economic indicators or news:

- Stronger-than-expected quarterly earnings reports from major companies.

- Positive government policy announcements.

- Increased foreign investment inflows.

Adani Ports and Eternal Industries: Top Market Movers

Adani Ports and Eternal Industries emerged as the top market movers today, experiencing substantial gains. Understanding the reasons behind their exceptional performance is crucial to understanding the broader market rally.

- Adani Ports Stock Performance: Detailed analysis of Adani Ports' stock price movement, percentage change, and volume traded. Reasons for the surge (e.g., positive news about new projects, strong quarterly results, increased investor interest).

- Eternal Industries Stock Performance: Similar detailed analysis of Eternal Industries' stock performance, including price movement, percentage change, and volume traded. Reasons for the gain should be explained (e.g., positive industry outlook, successful product launch, strategic partnerships).

- Impact on Market Sentiment: The strong performance of these two companies significantly bolstered overall market sentiment, contributing to the broader rally.

Sector-wise Performance: Winners and Losers

Analyzing sector-wise performance offers a more granular understanding of the market's dynamics.

- Top Performing Sectors: Identify the sectors that performed exceptionally well (e.g., Banking, IT, FMCG). Explain the factors behind their strong performance (e.g., positive regulatory changes, strong demand, successful product launches).

- Underperforming Sectors: Highlight sectors that underperformed and discuss potential reasons for their weaker showing (e.g., global economic slowdown impacting specific industries, regulatory headwinds).

Bullet Points presenting data concisely:

- Banking sector up X%

- IT sector up Y%

- FMCG sector up Z%

- Real Estate sector down A%

Expert Opinions and Market Outlook

Market analysts and experts offer valuable insights into the current market situation and future predictions.

- Analyst Quotes: Include quotes from reputable financial analysts summarizing their perspectives on the current market rally and its potential sustainability.

- Short-Term Outlook: Summarize the short-term outlook for the Sensex and Nifty based on expert opinions.

- Long-Term Outlook: Discuss the long-term prospects, highlighting potential risks and uncertainties.

- Potential Risks: Mention potential factors that could negatively impact the market, such as global economic uncertainties, geopolitical events, or domestic policy changes.

Conclusion: Sensex and Nifty's Promising Future?

Today's significant surge in the Sensex and Nifty indices, with the Sensex gaining over 500 points and the Nifty surpassing 17400, paints a positive picture for the Indian stock market. The exceptional performance of companies like Adani Ports and Eternal Industries further bolsters this positive sentiment. While sector-wise performance varied, the overall market outlook, as suggested by experts, remains cautiously optimistic. However, staying informed about market trends and potential risks is crucial for making sound investment decisions. Continue following the Sensex and Nifty performance, and consider subscribing to our updates for timely insights into the ever-evolving Indian stock market landscape. Stay informed and make smart investment choices!

Featured Posts

-

Ozhidaemoe Pokholodanie I Snegopady V Permi I Permskom Krae V Kontse Aprelya 2025 Goda

May 09, 2025

Ozhidaemoe Pokholodanie I Snegopady V Permi I Permskom Krae V Kontse Aprelya 2025 Goda

May 09, 2025 -

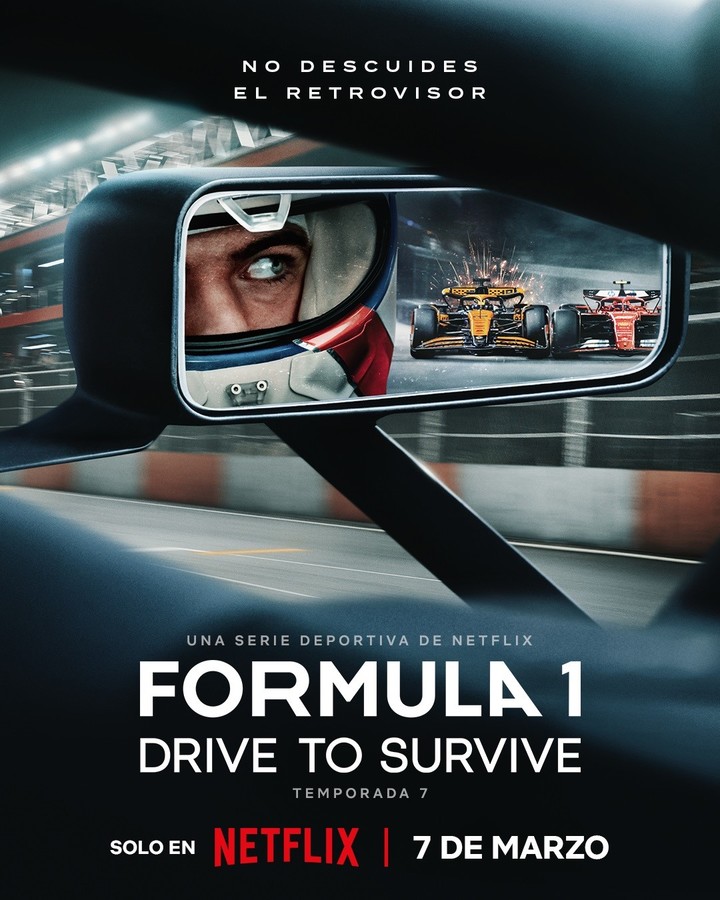

Netflixs Drive To Survive Jack Doohan And Briatores Power Struggle

May 09, 2025

Netflixs Drive To Survive Jack Doohan And Briatores Power Struggle

May 09, 2025 -

Canadas Housing Crisis The Impact Of Steep Down Payments

May 09, 2025

Canadas Housing Crisis The Impact Of Steep Down Payments

May 09, 2025 -

Billionaires Top Pick The Etf Predicted To Soar 110 By 2025

May 09, 2025

Billionaires Top Pick The Etf Predicted To Soar 110 By 2025

May 09, 2025 -

Psg 11 Lojtaret Kyc Qe Shkelqejne

May 09, 2025

Psg 11 Lojtaret Kyc Qe Shkelqejne

May 09, 2025