Should I Invest In D-Wave Quantum (QBTS)? A Stock Market Analysis

Table of Contents

Understanding D-Wave Quantum and its Technology

What is D-Wave Quantum?

D-Wave Quantum is a leading company in the quantum computing industry, focusing on a unique approach called quantum annealing. Unlike gate-based quantum computers which operate on qubits in a different way, D-Wave's systems are designed to solve specific optimization problems by finding the lowest energy state of a quantum system. This business model targets specific applications where this approach provides advantages.

- Brief history of D-Wave Quantum: Founded in 1999, D-Wave has been a pioneer in the development and commercialization of quantum computers. They've released several generations of their annealing-based systems.

- Explanation of quantum annealing technology and its applications: Quantum annealing leverages the principles of quantum mechanics to find optimal solutions for complex problems faster than classical computers. Applications include logistics optimization, materials science, financial modeling, and artificial intelligence.

- Comparison to gate-based quantum computing: While gate-based quantum computers are more general-purpose, D-Wave's quantum annealing approach excels in specific optimization tasks. The choice between these approaches depends on the application.

- Key partnerships and collaborations: D-Wave has collaborated with numerous organizations across various industries, showcasing the real-world applicability of their quantum annealing technology and strengthening their D-Wave Quantum business model. These partnerships provide valuable insights and accelerate development.

Analyzing QBTS Stock Performance and Valuation

Recent Stock Performance and Trends

Analyzing the QBTS stock price requires examining its historical performance. While past performance isn't indicative of future results, it provides valuable context. Look for trends, highs, and lows to understand the volatility of the QBTS stock.

- Examine QBTS stock chart patterns (if applicable): Technical analysis of the QBTS stock chart can reveal patterns and potential future price movements. Note that this should be considered alongside fundamental analysis.

- Discuss any recent news or announcements affecting the stock price: Press releases, partnerships, technological advancements, or regulatory changes can significantly influence the QBTS stock price. Stay updated on relevant news.

- Analyze the company's financial statements (revenue, expenses, profitability): Review D-Wave's financial reports to understand its revenue streams, expenses, and profitability. This provides a clearer picture of the company's financial health.

- Compare QBTS valuation metrics (P/E ratio, market capitalization) to competitors: Comparing QBTS's valuation metrics to those of other companies in the quantum computing sector helps assess its relative value and potential for growth. Understanding the D-Wave Quantum valuation is crucial for investment decisions.

Assessing the Risks and Rewards of Investing in QBTS

Potential Risks

Investing in QBTS, like any early-stage technology company, involves significant risks.

- Market risks associated with the quantum computing industry: The quantum computing market is still emerging, making it subject to significant volatility and uncertainty.

- Competitive landscape and threats from other quantum computing companies: D-Wave faces competition from other companies developing different quantum computing technologies. This competition presents challenges to the company's market share.

- Technological challenges and potential delays in development: Quantum computing is complex, and unforeseen technical hurdles could delay development or impact product performance.

- Regulatory risks: Government regulations and policies could impact the quantum computing industry and D-Wave Quantum’s operations.

Potential Rewards

Despite the risks, the potential rewards of investing in QBTS are substantial.

- Long-term growth potential of the quantum computing market: The quantum computing market is projected to experience significant growth, presenting long-term opportunities for D-Wave.

- First-mover advantage for D-Wave in quantum annealing: D-Wave's early entry into the quantum computing market gives them a potential first-mover advantage.

- Potential for disruptive innovation and significant market share: If D-Wave's technology proves successful, it could disrupt various industries and capture significant market share.

Comparing QBTS to Other Quantum Computing Investments

Competitive Analysis

To evaluate QBTS, it's crucial to compare it to other publicly traded quantum computing companies.

- Compare their technologies, market capitalization, and growth prospects: Compare QBTS with companies like IonQ and Rigetti Computing, considering their technological approaches, market valuations, and growth potential.

- Discuss their respective strengths and weaknesses: Analyze the advantages and disadvantages of each company's technology, business model, and market positioning.

- Analyze their investment potential relative to QBTS: Determine which company presents a more compelling investment opportunity based on your risk tolerance and investment goals.

Conclusion

Investing in D-Wave Quantum (QBTS) presents both significant potential rewards and substantial risks. The company is a pioneer in quantum annealing, a promising technology with various applications. However, the quantum computing market is highly volatile, competitive, and still in its early stages of development. The QBTS stock price is subject to considerable fluctuation. Our analysis highlights the need for careful consideration of the QBTS investment risk before committing capital. Considering the comparison between QBTS and other quantum computing stocks like IonQ and Rigetti is crucial for a well-informed decision.

Call to Action: Before making any investment decisions regarding D-Wave Quantum (QBTS) or any other quantum computing stock, conduct thorough due diligence and consider consulting with a qualified financial advisor. Remember that investing in the stock market always carries risk, and the quantum computing market is particularly volatile. Therefore, carefully assess your risk tolerance before considering investing in D-Wave Quantum (QBTS). Do further research on D-Wave Quantum (QBTS) and other relevant quantum computing stocks before making any investment decisions.

Featured Posts

-

Germanys Thrilling Victory Over Italy Secures Nations League Final Four Spot

May 21, 2025

Germanys Thrilling Victory Over Italy Secures Nations League Final Four Spot

May 21, 2025 -

Huuhkajat Kaellmanin Maalit Ja Kokonaisvaltainen Kehitys

May 21, 2025

Huuhkajat Kaellmanin Maalit Ja Kokonaisvaltainen Kehitys

May 21, 2025 -

Key Findings From The Old North State Report May 9 2025

May 21, 2025

Key Findings From The Old North State Report May 9 2025

May 21, 2025 -

Stream Peppa Pig Online Best Free And Legal Options

May 21, 2025

Stream Peppa Pig Online Best Free And Legal Options

May 21, 2025 -

Trans Australia Run A Record In Jeopardy

May 21, 2025

Trans Australia Run A Record In Jeopardy

May 21, 2025

Latest Posts

-

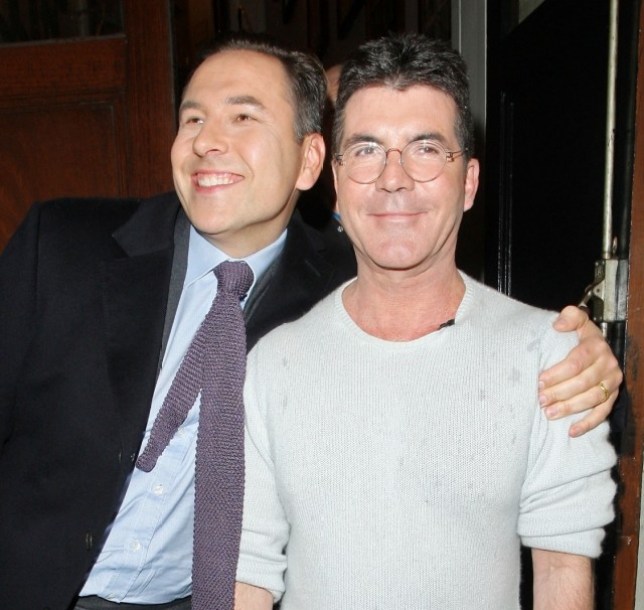

Britains Got Talent Feud David Walliams Attacks Simon Cowell

May 22, 2025

Britains Got Talent Feud David Walliams Attacks Simon Cowell

May 22, 2025 -

The David Walliams Simon Cowell Feud A Britains Got Talent Timeline

May 22, 2025

The David Walliams Simon Cowell Feud A Britains Got Talent Timeline

May 22, 2025 -

Juergen Klopp Nereye Gidiyor Son Dakika Transfer Haberleri

May 22, 2025

Juergen Klopp Nereye Gidiyor Son Dakika Transfer Haberleri

May 22, 2025 -

Why Do Gen Z Love Little Britain Despite Its Cancellation

May 22, 2025

Why Do Gen Z Love Little Britain Despite Its Cancellation

May 22, 2025 -

Is This The End David Walliams And Simon Cowells Britains Got Talent Dispute

May 22, 2025

Is This The End David Walliams And Simon Cowells Britains Got Talent Dispute

May 22, 2025