Should Investors Buy Palantir After A 30% Market Correction?

Table of Contents

Analyzing Palantir's Current Financial Performance and Valuation

Revenue Growth and Profitability

Palantir's recent financial reports reveal a mixed picture. While revenue growth has been positive, showing consistent increases year-over-year, the company's path to profitability remains a key focus for investors. Analyzing key financial metrics is essential:

- Revenue: Consistent growth, but the rate of growth needs careful examination compared to previous quarters and years.

- Operating Income: This metric will showcase the company's operational efficiency and profitability trends. Investors should compare current figures to past performance and analyst projections.

- Net Income: Analyzing the bottom line provides a clear picture of Palantir’s overall profitability. Understanding the factors contributing to net income, both positive and negative, is crucial.

- Future Guidance: Management's outlook on future revenue growth and profitability is a critical factor to consider when assessing the investment opportunity.

Comparing these metrics to previous quarters and years and benchmarking against analyst expectations provides a more comprehensive understanding of Palantir's financial performance.

Valuation Metrics

Determining if Palantir is currently undervalued requires a careful assessment of its valuation relative to its peers and historical multiples. Key metrics include:

- Price-to-Earnings (P/E) Ratio: This classic valuation metric needs comparison to competitors within the data analytics sector and consideration of industry averages. A lower P/E ratio than its peers might indicate undervaluation.

- Price-to-Sales (P/S) Ratio: This is particularly relevant for high-growth companies like Palantir that might not yet be profitable. Comparing this ratio to industry averages and competitors provides context.

- Future Growth Potential: The potential for future revenue growth significantly impacts valuation. Investors need to project future earnings and revenue to get a more accurate picture.

- Discounted Cash Flow (DCF) Analysis: A more sophisticated valuation method that discounts future cash flows to their present value, providing a more robust assessment of the intrinsic value of Palantir's stock.

Debt and Cash Position

A strong balance sheet is vital for any company, and Palantir is no exception. Investors should scrutinize:

- Debt-to-Equity Ratio: This indicates the company's reliance on debt financing and its ability to manage its debt obligations.

- Cash Flow from Operations: Positive cash flow from operations demonstrates the company’s ability to generate cash from its core business activities.

- Cash Reserves: Sufficient cash reserves provide a financial cushion against economic downturns and allow the company to invest in future growth opportunities.

Assessing Palantir's Growth Potential and Long-Term Prospects

Government Contracts and Commercial Expansion

Palantir’s revenue significantly relies on government contracts, but its long-term growth depends on expanding its commercial client base. Key factors to assess include:

- Recent Contract Wins: Analyzing recent contract wins provides insight into the company's success in securing new business and its ability to maintain its government contracts.

- Pipeline of Future Contracts: Understanding the company's pipeline of potential contracts provides insight into future revenue streams.

- Market Penetration Strategies in the Commercial Space: Success in the commercial market will hinge on Palantir’s ability to effectively target and penetrate new sectors.

Technological Innovation and Competitive Advantage

Palantir’s technological edge is a critical component of its long-term success. Investors should examine:

- Key Technological Advancements: Continuous innovation in data analytics and AI is crucial for maintaining a competitive advantage.

- Intellectual Property: Strong intellectual property protection safeguards Palantir’s proprietary technology and provides a competitive moat.

- Competitive Landscape Analysis: Identifying and analyzing key competitors is critical for understanding Palantir’s market positioning and its ability to compete effectively.

- Potential Disruptions: Evaluating potential disruptions from emerging technologies and competitors is essential for a realistic assessment of Palantir's long-term outlook.

Long-Term Market Opportunity

The overall growth of the big data and AI market is crucial to Palantir's success. Investors need to consider:

- Market Size Projections: Analyzing market size projections provides insights into the potential market opportunity for Palantir.

- Palantir's Market Share: Estimating Palantir's current and projected market share indicates its potential to capture a significant portion of the growing market.

- Potential for Expansion into New Markets: Identifying new markets for Palantir's technology is crucial for assessing its future growth potential.

Considering the Risks Involved in Investing in Palantir

Market Volatility and Economic Uncertainty

Investing in stocks inherently involves risk, especially during periods of economic uncertainty. Investors need to consider:

- Impact of Macroeconomic Factors: Inflation, interest rates, and overall economic conditions significantly influence stock market performance.

- Market Sentiment Towards Tech Stocks: Changes in investor sentiment towards technology stocks can lead to significant price fluctuations.

Competition and Technological Disruption

The data analytics and AI market is highly competitive. Palantir faces risks from:

- Key Competitors: Identifying and assessing the competitive threats posed by other companies in the industry.

- Potential for Disruptive Technologies: Emerging technologies could potentially disrupt Palantir's existing business model.

- Palantir's Ability to Adapt and Innovate: The company's ability to adapt to changing market dynamics and technological advancements will directly impact its long-term success.

Dependence on Government Contracts

Palantir's reliance on government contracts presents specific risks:

- Contract Renewal Risks: The loss of key government contracts could significantly impact revenue and profitability.

- Diversification Strategies: Palantir’s ability to diversify its revenue streams beyond government contracts is essential to mitigating this risk.

- Potential for Reduced Government Spending: Changes in government priorities or budget cuts could negatively affect Palantir's revenue.

Conclusion: Should You Buy Palantir Stock Now?

Palantir's stock price correction presents a complex investment decision. While the company exhibits revenue growth and operates in a large and growing market, its path to profitability and its reliance on government contracts present significant risks. The current valuation, relative to its peers and future growth potential, needs careful evaluation. For aggressive investors with a long-term horizon and a high-risk tolerance, Palantir's current valuation might present an attractive entry point, despite the inherent risks. However, a thorough understanding of the company's financials, competitive landscape, and the broader economic environment is crucial. Before making any investment decisions regarding Palantir stock or other similar tech stocks, conduct your own thorough due diligence. Consult reputable financial news websites and Palantir's investor relations pages for up-to-date information.

Featured Posts

-

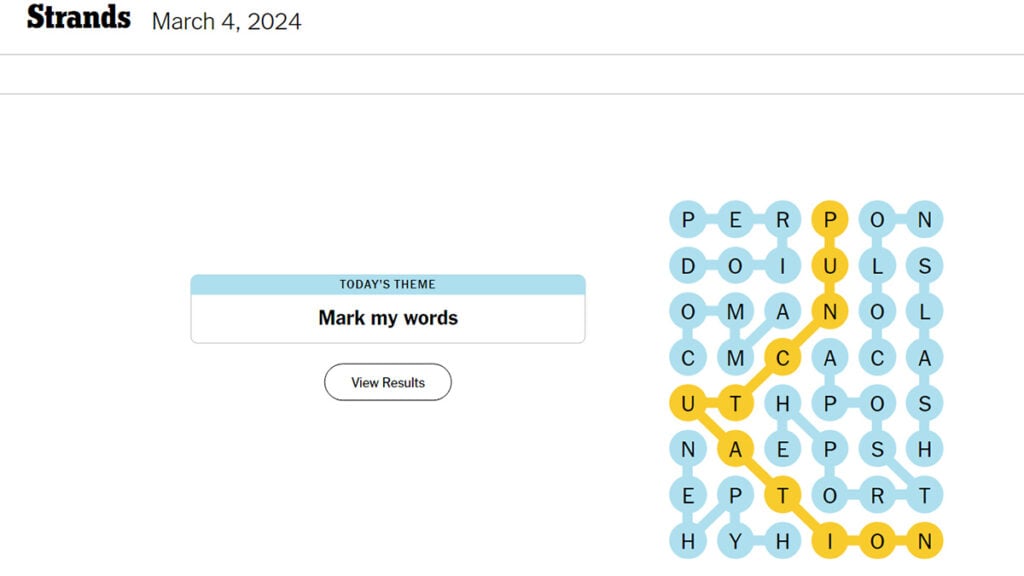

Nyt Strands Hints And Answers Saturday March 15 Game 377

May 09, 2025

Nyt Strands Hints And Answers Saturday March 15 Game 377

May 09, 2025 -

March 15 Nyt Strands Puzzle 377 Hints And Answers

May 09, 2025

March 15 Nyt Strands Puzzle 377 Hints And Answers

May 09, 2025 -

Bbc Strictly Come Dancing Wynne Evanss Statement On Potential Return

May 09, 2025

Bbc Strictly Come Dancing Wynne Evanss Statement On Potential Return

May 09, 2025 -

Exec Office365 Breach Crook Makes Millions Feds Say

May 09, 2025

Exec Office365 Breach Crook Makes Millions Feds Say

May 09, 2025 -

82000

May 09, 2025

82000

May 09, 2025