Should Investors Buy Palantir Stock Ahead Of May 5th Earnings?

Table of Contents

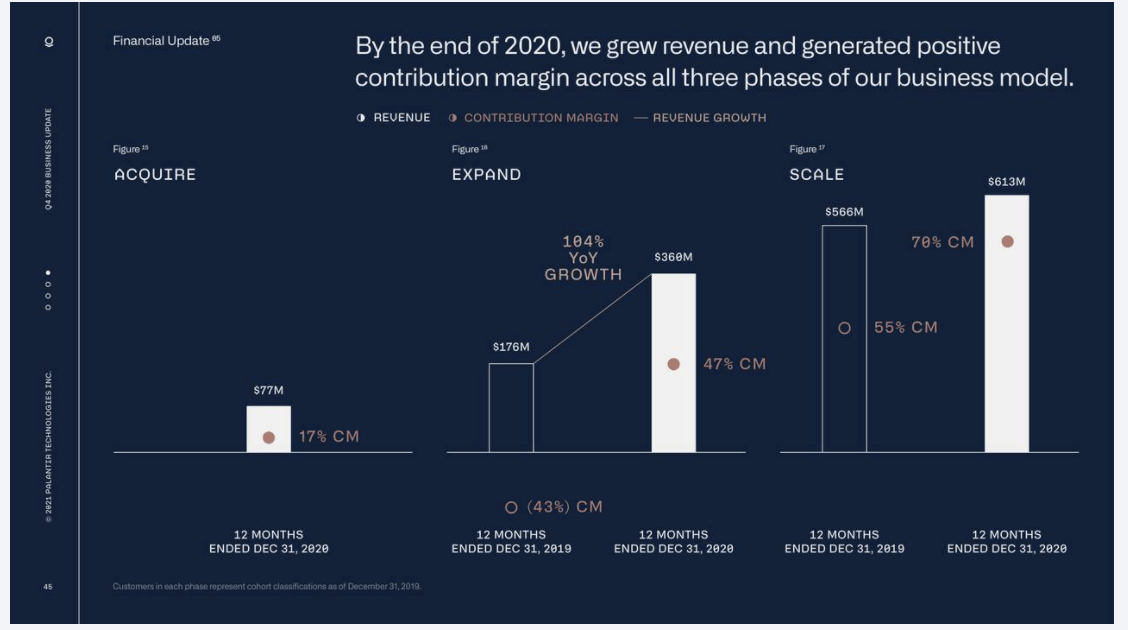

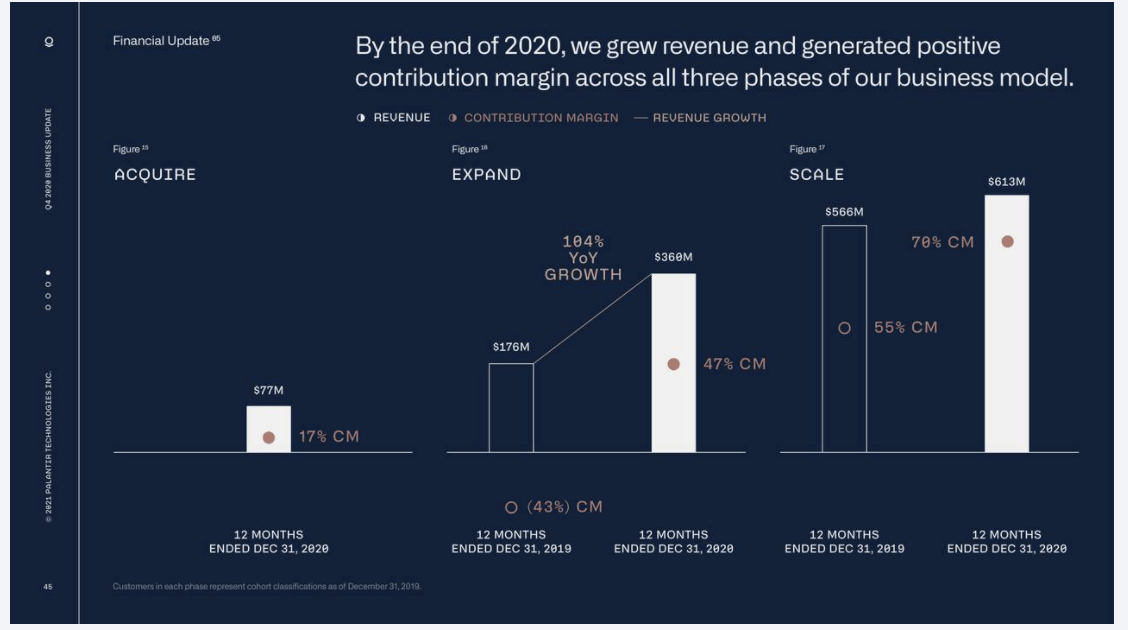

Palantir's Recent Performance and Future Outlook

Palantir's stock performance has been a rollercoaster, reflecting the complexities of its business model and the broader market conditions. Understanding its recent trajectory is crucial for assessing whether buying Palantir stock now is a sound strategy.

Q4 2022 Earnings and Key Metrics

Palantir's Q4 2022 earnings report revealed [insert actual Q4 2022 data here, e.g., a revenue increase of X%]. While this suggests [positive or negative interpretation based on actual data], it's crucial to examine other key metrics for a holistic understanding. Let's look at some critical data points:

- Revenue growth percentage: [Insert actual data]

- Net income/loss: [Insert actual data]

- Key contract wins/losses: [Detail significant contract wins and losses]

- Customer acquisition: [Discuss trends in customer growth]

- Operating margin: [Analyze operating margin trends]

Comparing these figures to previous quarters and analyst expectations provides a clearer picture of Palantir's progress and potential for future growth.

Government vs. Commercial Revenue

Palantir's revenue is derived from both government and commercial clients. Analyzing the breakdown of these revenue streams is vital for projecting future growth.

- Percentage of revenue from government vs. commercial clients: [Insert actual data and breakdown]

- Potential impact of government spending: [Analyze potential impact of changes in government spending on Palantir's revenue]

- Growth projections for each sector: [Discuss growth projections for both sectors based on available data and analysis]

Understanding the relative strength and growth potential of each sector is key to assessing Palantir's long-term prospects.

Competition and Market Share

The data analytics market is fiercely competitive. Palantir faces challenges from established players and emerging competitors.

- Major competitors: [List key competitors, e.g., AWS, Microsoft, Google]

- Palantir's unique selling propositions: [Highlight Palantir's competitive advantages, e.g., specialized expertise in data integration and analysis]

- Market trends affecting its position: [Discuss market trends that might impact Palantir's market share]

Analyzing Palantir's competitive position is essential for evaluating the sustainability of its growth.

Analyzing the May 5th Earnings Report Expectations

The upcoming earnings report will be crucial in shaping investor sentiment towards Palantir stock. Understanding analyst predictions and key factors to watch will help you prepare for the announcement.

Analyst Predictions and Price Targets

Analyst predictions for Palantir's May 5th earnings vary. However, the consensus generally points towards [summarize the consensus view, e.g., moderate revenue growth and potential for profitability].

- Range of EPS estimates: [Provide a range of EPS estimates from various analysts]

- Average revenue projection: [State the average revenue projection from analysts]

- Price target ranges: [Outline the range of price targets set by analysts]

Key Factors to Watch in the Earnings Call

Beyond the numbers, the earnings call will provide valuable insights into Palantir's future trajectory. Key factors to pay close attention to include:

- Guidance for the next quarter/year: [Explain the importance of management's guidance for future performance]

- Updates on key partnerships: [Discuss the importance of strategic partnerships for Palantir's growth]

- New product launches: [Highlight the potential impact of new product launches on revenue and market share]

- Potential acquisitions: [Analyze the potential impact of any acquisitions on Palantir's business]

- Discussion of any challenges/risks: [Explain the importance of understanding potential challenges and risks facing Palantir]

Risk Factors and Potential Downsides of Investing in Palantir Stock

While Palantir presents significant growth potential, it's essential to acknowledge the inherent risks before investing in Palantir stock.

Valuation Concerns

Palantir's valuation relative to its revenue and growth rate compared to its peers is a critical consideration.

- P/S ratio: [Analyze Palantir's price-to-sales ratio compared to industry averages]

- Growth rate compared to industry: [Compare Palantir's growth rate to its competitors]

- Potential for future price corrections: [Discuss the potential for price corrections based on valuation metrics]

Dependence on Government Contracts

A significant portion of Palantir's revenue comes from government contracts. This dependence creates vulnerability to changes in government spending or policy.

- Percentage of revenue from government contracts: [State the percentage of revenue derived from government contracts]

- Potential risks related to contract renewals: [Analyze the risks associated with contract renewals]

- Geopolitical factors: [Discuss potential geopolitical factors that could impact government contracts]

Overall Market Conditions

Broader market conditions, such as interest rate hikes and inflation, can significantly impact Palantir's stock price.

- Impact of inflation: [Analyze the impact of inflation on Palantir's business and stock price]

- Interest rate increases: [Discuss how interest rate increases affect investor sentiment and stock valuations]

- Overall market sentiment: [Analyze the impact of overall market sentiment on Palantir's stock price]

Conclusion: Should You Buy Palantir Stock Before Earnings?

Investing in Palantir stock before the May 5th earnings report requires careful consideration. While Palantir demonstrates strong growth potential in the data analytics market, its reliance on government contracts, valuation, and sensitivity to broader market conditions present inherent risks. The upcoming earnings report will offer crucial insights, but it's vital to analyze the information presented within the context of these risks. There is no definitive answer to whether you should buy Palantir stock before earnings; the decision rests on your individual risk tolerance and investment strategy.

Call to Action: Before making any investment decisions regarding Palantir stock, conduct thorough due diligence. Review Palantir's financial filings, read analyst reports, and stay informed about market trends. Understand the nuances of PLTR stock and Palantir shares before committing your capital. Only invest what you can afford to lose. Remember, informed investment decisions regarding Palantir stock are key to successful investing.

Featured Posts

-

Golden Nayts Vyigryvaet U Minnesoty V Overtayme Pley Off

May 10, 2025

Golden Nayts Vyigryvaet U Minnesoty V Overtayme Pley Off

May 10, 2025 -

Draisaitls Injury Update On Edmonton Oilers Leading Scorer

May 10, 2025

Draisaitls Injury Update On Edmonton Oilers Leading Scorer

May 10, 2025 -

Increased Advocacy For Transgender Equality Coverage By The Bangkok Post

May 10, 2025

Increased Advocacy For Transgender Equality Coverage By The Bangkok Post

May 10, 2025 -

Beyond Epstein Examining The Us Attorney Generals Daily Fox News Appearances

May 10, 2025

Beyond Epstein Examining The Us Attorney Generals Daily Fox News Appearances

May 10, 2025 -

How To Be A Better Ally On International Transgender Day Of Visibility

May 10, 2025

How To Be A Better Ally On International Transgender Day Of Visibility

May 10, 2025