Should You Buy Apple Stock At $200? A $254 Price Prediction Analyzed

Table of Contents

Apple's Current Market Position and Financial Health

Apple's current market position is a crucial factor in evaluating the $254 Apple stock price prediction. The company holds a dominant market share in several key sectors, including smartphones (iPhone), wearables (Apple Watch and AirPods), and services (App Store, iCloud, Apple Music). This diversified revenue stream contributes significantly to its strong financial performance. Apple's recent financial reports showcase consistent revenue and earnings growth, indicating a healthy and robust business model.

- Market Capitalization: Apple boasts a massive market capitalization, placing it among the world's most valuable companies, significantly outpacing many of its competitors.

- Key Financial Ratios: Analyzing Apple's P/E ratio and dividend yield provides valuable insight into its valuation and profitability relative to the market. While the P/E ratio might fluctuate based on market sentiment, Apple’s consistent dividend payments offer a degree of stability for investors.

- Recent Product Launches: The impact of recent product launches, such as the iPhone 14 and new MacBook models, on Apple's revenue and growth rates is a significant indicator of future potential. Successful new product cycles typically translate to increased sales and higher stock prices. Analyzing Apple financials reveals strong performance in this area.

Factors Supporting the $254 Price Prediction

The optimistic $254 Apple stock forecast isn't without merit. Several bullish factors suggest potential for significant stock price appreciation. These factors include upcoming product releases, expansion into new markets, and continued growth in Apple's lucrative services sector.

- Upcoming Product Launches: The anticipated release of the iPhone 15, along with new Mac models and the potential launch of AR/VR devices, could be major catalysts for Apple stock growth. Successful new products typically drive sales and boost investor confidence.

- Growth in Services Revenue: Apple's services segment, encompassing the App Store, iCloud, Apple Music, and Apple TV+, has shown impressive growth and offers a recurring revenue stream less susceptible to the cyclical nature of hardware sales. This contributes to the overall stability of Apple's financials.

- Expansion into Emerging Markets: Further penetration into rapidly growing emerging markets offers significant upside potential for Apple’s long-term growth. The expansion of Apple's ecosystem in these regions could unlock substantial revenue streams in the coming years.

- Strategic Acquisitions and Partnerships: Strategic acquisitions and partnerships can further enhance Apple's product offerings and market reach, fueling its growth trajectory and contributing to the positive outlook for Apple stock.

Potential Risks and Challenges Facing Apple

While the $254 Apple stock price prediction looks promising, it's crucial to acknowledge the potential risks and challenges that could impact Apple's growth and affect your Apple stock investment.

- Competition from Android Manufacturers: Intense competition from Android manufacturers, particularly in the mid-range and budget smartphone markets, presents a constant challenge to Apple’s market share.

- Supply Chain Vulnerabilities: Global supply chain disruptions and geopolitical risks can impact Apple's production capacity and lead to delays in product launches. This uncertainty introduces inherent risk to the Apple stock outlook.

- Economic Slowdown: An economic slowdown or recession can significantly impact consumer spending, potentially reducing demand for Apple's premium products. This could affect Apple's revenue growth and impact Apple stock price.

- Regulatory Scrutiny: Increasing regulatory scrutiny and antitrust concerns pose potential challenges for Apple, particularly regarding its App Store policies and market dominance. This regulatory uncertainty introduces risks for investors considering Apple stock.

Comparing the $254 Prediction to Analyst Consensus

To get a well-rounded perspective on the $254 Apple stock price prediction, it's essential to compare it with the average price target set by financial analysts. While the $254 prediction represents a significant upside, it's crucial to consider the broader range of analyst forecasts.

- Average Analyst Price Target: The average price target for Apple stock from a range of analysts will provide a benchmark for evaluating the $254 prediction. This average should be compared against the $254 figure, considering the variation and source credibility.

- Range of Price Targets: Understanding the range of price targets provided by different analysts helps to appreciate the variability of opinions and potential outcomes. The range highlights uncertainty inherent in predicting future stock prices.

- Factors Influencing Analyst Predictions: Various factors, including macroeconomic conditions, industry trends, and company-specific developments, influence analyst predictions. Understanding these factors provides greater context to the analysis.

Conclusion: Should You Buy Apple Stock at $200? A Final Verdict

Deciding whether to buy Apple stock at $200 requires careful consideration of the arguments presented. While the $254 price prediction and positive analyst sentiment are compelling, potential risks such as increased competition, supply chain issues, and economic downturns must not be overlooked. The potential for significant growth is balanced by inherent investment risks.

Before investing in Apple stock, or any stock for that matter, conduct thorough due diligence. Review Apple's financial reports, read analyst reviews, and assess your own risk tolerance. Remember, there's no guaranteed outcome, and the $254 prediction is just one potential scenario. Investing in Apple stock should be part of a well-diversified investment strategy, tailored to your individual financial goals and risk appetite. Consider researching further and developing a robust Apple stock investment strategy.

Featured Posts

-

M6 Crash Live Updates And Traffic Delays

May 24, 2025

M6 Crash Live Updates And Traffic Delays

May 24, 2025 -

Finding Peace Amidst The Pandemic A Seattle Womans Green Space Refuge

May 24, 2025

Finding Peace Amidst The Pandemic A Seattle Womans Green Space Refuge

May 24, 2025 -

Avrupa Borsalarinda Karisik Bir Guen Kazanclar Ve Kayiplar

May 24, 2025

Avrupa Borsalarinda Karisik Bir Guen Kazanclar Ve Kayiplar

May 24, 2025 -

Michael Caine On Filming A Sex Scene With Mia Farrow An Unforgettable Experience

May 24, 2025

Michael Caine On Filming A Sex Scene With Mia Farrow An Unforgettable Experience

May 24, 2025 -

Borsa Europea Attenzione Fed Banche Deboli Italgas In Luce

May 24, 2025

Borsa Europea Attenzione Fed Banche Deboli Italgas In Luce

May 24, 2025

Latest Posts

-

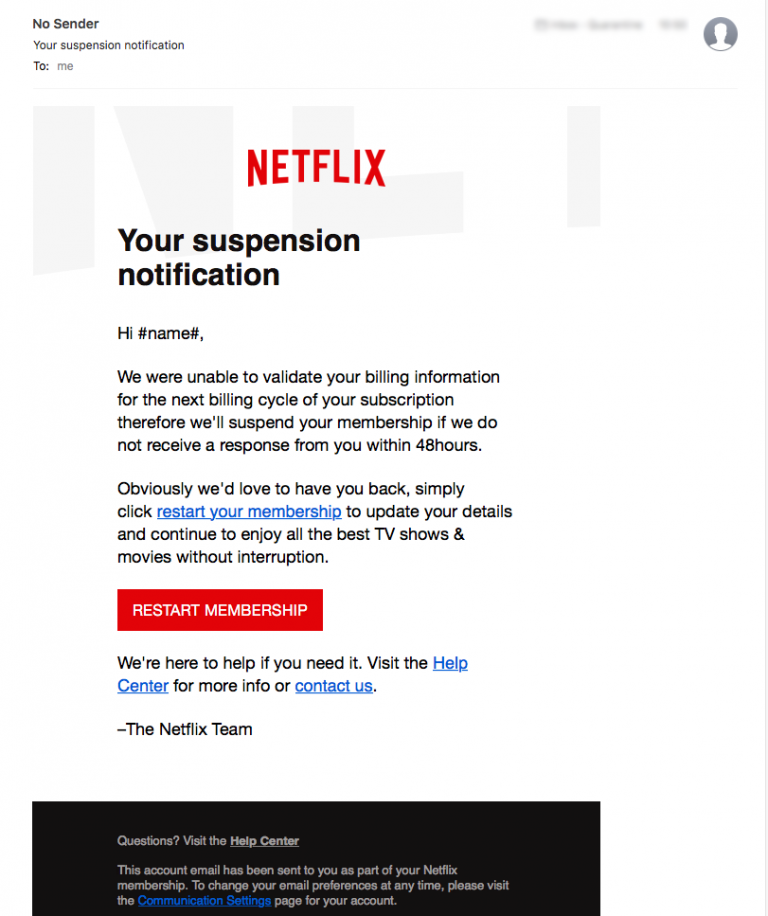

Federal Investigation Millions Lost In Corporate Email Data Breach

May 24, 2025

Federal Investigation Millions Lost In Corporate Email Data Breach

May 24, 2025 -

Office365 Executive Inboxes Targeted Millions Stolen In Cybercrime Ring

May 24, 2025

Office365 Executive Inboxes Targeted Millions Stolen In Cybercrime Ring

May 24, 2025 -

Open Ais 2024 Event Streamlined Voice Assistant Development

May 24, 2025

Open Ais 2024 Event Streamlined Voice Assistant Development

May 24, 2025 -

Trump Administrations Impact On Museum Funding And Cultural Institutions

May 24, 2025

Trump Administrations Impact On Museum Funding And Cultural Institutions

May 24, 2025 -

Analyzing The Long Term Effects Of Trumps Museum Funding Cuts

May 24, 2025

Analyzing The Long Term Effects Of Trumps Museum Funding Cuts

May 24, 2025