Should You Buy Palantir Stock After A 30% Decline?

Table of Contents

Analyzing Palantir's Recent Performance and the Reasons for the Decline

Financial Performance Review

Palantir's recent financial reports offer a mixed bag. While the company has demonstrated consistent revenue growth, profitability remains a challenge. Analyzing Palantir financials requires a careful look at key performance indicators (KPIs).

- Revenue Growth: While Palantir has shown consistent revenue growth, the rate of growth may be slowing compared to previous years. Specific figures need to be checked against recent quarterly earnings reports.

- Profitability: Palantir is not yet consistently profitable, meaning the profit margin remains relatively low. Investors should carefully consider this factor when evaluating PLTR revenue and overall financial health.

- Comparison to Benchmarks: Comparing Palantir's financial performance to industry benchmarks within the big data analytics sector is crucial to assess its relative strength and potential for future profitability.

The key here is understanding whether the current revenue growth justifies the company's valuation and future projections. Analyzing "Palantir financials" requires digging into the details presented in each earnings report.

Macroeconomic Factors

Macroeconomic headwinds have significantly impacted Palantir's stock price. The rising interest rate environment, fueled by persistent inflation, has negatively affected investor sentiment towards growth stocks like Palantir.

- Interest Rate Hikes: Higher interest rates increase the cost of borrowing, making investments in growth stocks less attractive as the risk-free rate of return increases.

- Inflation Impact: Inflation erodes the purchasing power of future earnings, making it harder to justify high valuations for companies with uncertain profitability like Palantir.

- Economic Downturn Fears: Recessionary fears often lead investors to favor safer, more established companies, pushing down the prices of riskier growth stocks. Therefore, "market conditions" heavily influence the PLTR stock price.

Competitive Landscape

Palantir operates in a competitive landscape within the big data analytics industry. While the company possesses unique strengths, it faces challenges from established players and emerging competitors.

- Major Competitors: Palantir competes with established tech giants like Microsoft, Amazon, and Google, as well as specialized analytics firms. Understanding the "data analytics competitors" and their strategies is crucial.

- Competitive Advantages: Palantir's proprietary technology and strong relationships with government agencies are key competitive advantages.

- Market Share: Analyzing Palantir's market share and its ability to gain traction in the commercial sector is essential for assessing its future growth potential.

Assessing Palantir's Long-Term Growth Potential

Government Contracts and Future Outlook

Government contracts form a significant portion of Palantir's revenue. The outlook for future government spending will heavily influence Palantir's growth trajectory.

- Existing and Potential Contracts: Securing new government contracts is essential for Palantir's sustained revenue growth. Analyzing "government contracts" and their renewal rates is critical.

- Long-Term Government Spending Trends: Understanding long-term trends in defense spending and other government initiatives is crucial for projecting Palantir's future revenue streams. The "public sector" remains a key area for Palantir's growth.

Commercial Sector Expansion

Palantir's success in expanding its commercial client base will be a key determinant of its long-term growth.

- Key Commercial Clients: Attracting and retaining major commercial clients across diverse sectors will drive revenue and profitability. Tracking "commercial clients" and their satisfaction is vital.

- Market Penetration: Palantir needs to demonstrate its ability to penetrate new markets and expand its customer base within existing sectors to achieve sustained growth. Assessing "market penetration" strategies will provide valuable insights.

Technological Innovation and Future Product Development

Palantir's investment in research and development (R&D) is crucial for maintaining its technological leadership and introducing innovative products and services.

- New Product Developments: The successful launch of new products and services will be essential for attracting new clients and increasing revenue.

- Technological Capabilities: Maintaining a competitive edge in "future technologies" and adapting to the ever-evolving big data landscape is crucial for long-term success.

Valuing Palantir Stock and Determining a Fair Price

Discounted Cash Flow Analysis

A discounted cash flow (DCF) analysis is a common method for valuing companies. While a detailed DCF analysis requires expertise, a simplified approach can provide a general valuation range.

- Key Assumptions: Assumptions about future revenue growth, profitability, and discount rate significantly influence the DCF valuation.

- Valuation Range: A DCF analysis will yield a range of possible valuations for Palantir stock.

- Caveats: DCF analysis is inherently subject to uncertainty and should be used in conjunction with other valuation methods. Understanding the "stock valuation" involves carefully reviewing all these factors.

Comparison to Peers

Comparing Palantir's valuation metrics to those of its competitors can help determine whether it is currently undervalued or overvalued.

- Valuation Metrics: Key metrics such as the Price-to-Earnings (P/E) ratio provide insights into the relative valuation of Palantir compared to its peers.

- Relative Valuation: Analyzing "relative valuation" compared to similar companies in the "big data analytics" sector provides a valuable benchmark. Considering "undervalued stock" opportunities is crucial here.

Conclusion: Should You Buy Palantir Stock After a 30% Decline?

The 30% decline in Palantir stock presents a complex investment proposition. While the company demonstrates revenue growth and has a strong position in government contracts, concerns remain about profitability and the impact of macroeconomic factors. A thorough analysis of "Palantir financials" and its competitive landscape suggests that a "Palantir investment" is not without risk. The DCF analysis and peer comparison offer a range of potential valuations, but the inherent uncertainties of future growth and profitability warrant caution.

Therefore, while the decline might represent a potential buying opportunity for some investors with a high-risk tolerance and long-term outlook, it's not a clear-cut "buy." We recommend a cautious approach. Thorough due diligence is crucial. Carefully consider your investment goals and risk tolerance before making any decisions regarding Palantir stock or any other volatile stock. Further research into PLTR stock performance and future prospects is highly recommended before committing to a Palantir investment.

Featured Posts

-

Dakota Dzhonson I Zolotaya Malina Samiy Provalniy Film Goda

May 09, 2025

Dakota Dzhonson I Zolotaya Malina Samiy Provalniy Film Goda

May 09, 2025 -

Dijon Violences Conjugales Le Boxeur Bilel Latreche Juge En Aout

May 09, 2025

Dijon Violences Conjugales Le Boxeur Bilel Latreche Juge En Aout

May 09, 2025 -

Odinokiy Prezident Zelenskiy Na 9 Maya Bez Podderzhki Soyuznikov

May 09, 2025

Odinokiy Prezident Zelenskiy Na 9 Maya Bez Podderzhki Soyuznikov

May 09, 2025 -

Varm Vinter Forer Til Faerre Apne Skisentre

May 09, 2025

Varm Vinter Forer Til Faerre Apne Skisentre

May 09, 2025 -

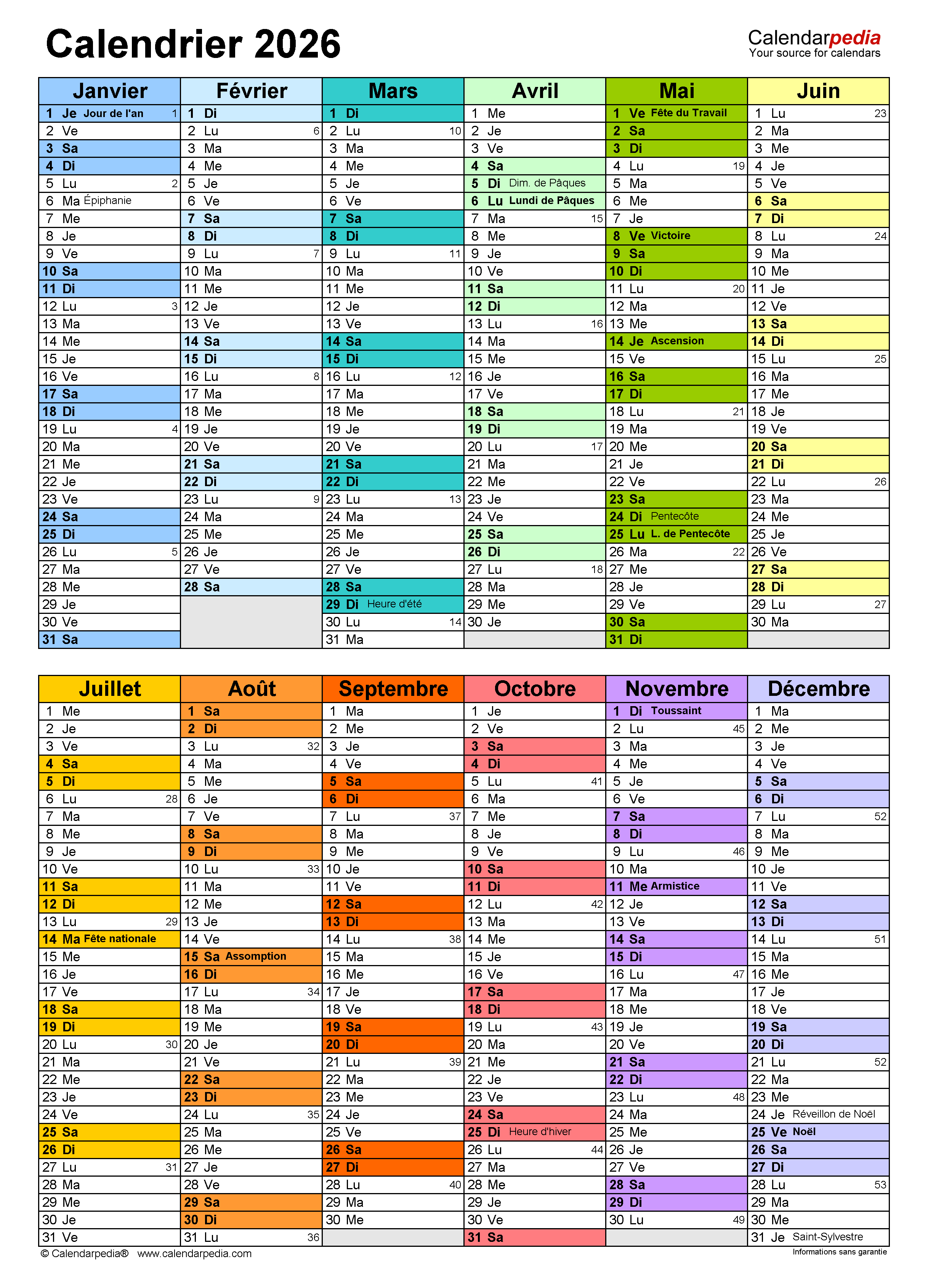

Municipales Dijon 2026 Quel Role Pour Les Ecologistes

May 09, 2025

Municipales Dijon 2026 Quel Role Pour Les Ecologistes

May 09, 2025