Should You Buy Palantir Stock Before May 5th? Wall Street's Surprising Consensus

Table of Contents

Palantir's Recent Performance and Upcoming Earnings Report (May 5th)

The upcoming earnings report on May 5th will be crucial in shaping investor sentiment towards Palantir stock. Analyzing recent performance and expectations provides crucial context.

Q1 2024 Earnings Expectations:

Analyst predictions for Palantir's Q1 2024 earnings vary. While precise figures remain speculative until the official release, many expect continued revenue growth, though perhaps at a slower pace than in previous quarters. Profitability remains a key focus, with analysts closely watching operating margin and free cash flow. A positive surprise could significantly boost the stock price, while a negative surprise might trigger a sell-off.

- Key Financial Metrics to Watch:

- Revenue growth year-over-year (YoY) and quarter-over-quarter (QoQ)

- Operating margin

- Free cash flow

- Customer growth and retention rates

Recent Contract Wins and Business Developments:

Palantir has secured several significant contracts recently, bolstering confidence in its future growth. These wins, spanning various sectors including government and commercial clients, showcase the expanding reach of its data analytics platform. Geographic diversification is also a key factor, with Palantir actively expanding its international presence.

- Key Recent Developments:

- [Insert specific examples of recent contract wins and partnerships, including names of clients and contract values if publicly available. Link to relevant news articles].

- Expansion into new geographic markets and industries.

Wall Street's Divided Opinions on Palantir Stock

Despite the upcoming earnings report, Wall Street analysts remain divided on Palantir's future. This divergence creates uncertainty for investors.

Bullish Arguments:

Analysts bullish on Palantir highlight its substantial long-term growth potential. The expanding market for data analytics, coupled with Palantir's strong position in government contracts (particularly in defense and intelligence), fuels optimistic projections.

- Reasons for Bullish Outlook:

- Significant market opportunity in data analytics and AI.

- Strong government contract pipeline and recurring revenue streams.

- Potential for significant growth in commercial markets.

- Technological innovation and product development.

Bearish Arguments:

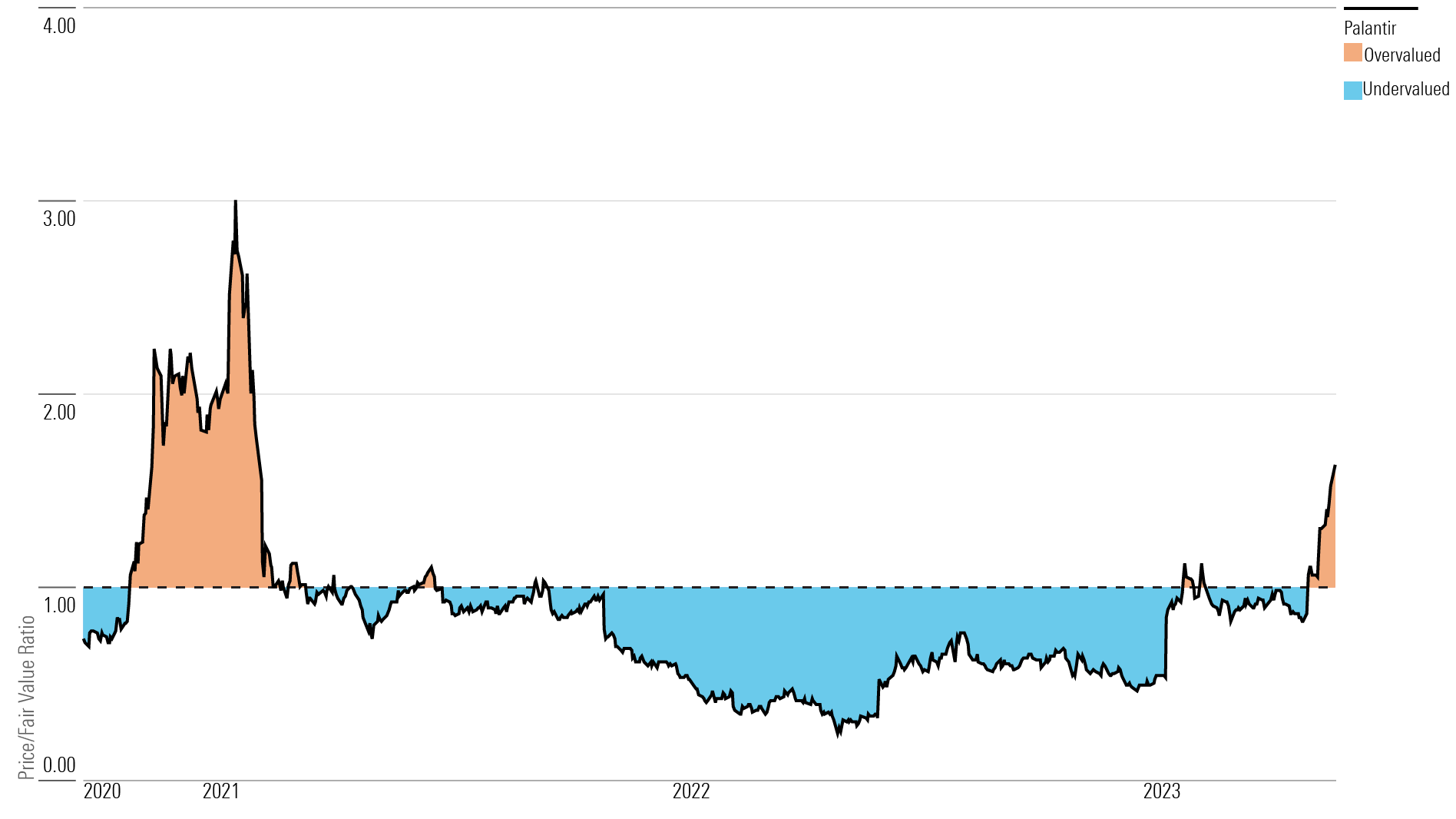

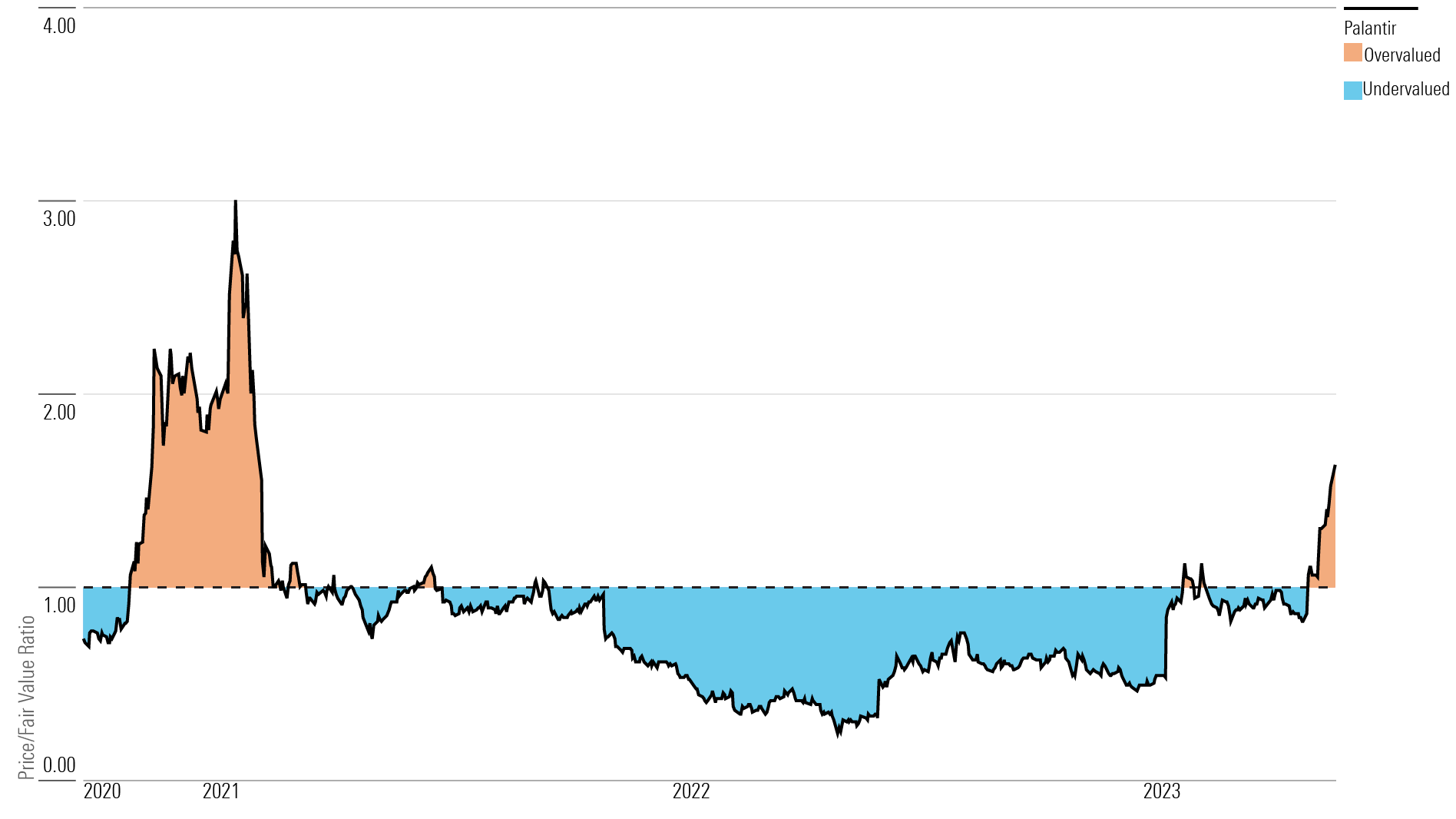

Conversely, bearish analysts raise concerns about Palantir's valuation, intense competition in the data analytics space, and its reliance on government contracts. The long-term sustainability of its business model is questioned by some.

- Reasons for Bearish Outlook:

- High valuation compared to its peers.

- Significant competition from established tech giants and emerging startups.

- Dependence on government contracts for a substantial portion of revenue.

- Concerns about profitability and path to consistent profitability.

The Surprising Consensus:

While opinions diverge, a surprising consensus exists: the upcoming earnings report will be pivotal. The level of agreement on the importance of the May 5th announcement highlights the uncertainty surrounding Palantir's stock. This underscores the need for investors to carefully analyze the results.

Factors to Consider Before Investing in Palantir Stock

Before investing in Palantir stock, consider these critical factors:

Risk Tolerance:

Palantir stock is inherently volatile. Its price can fluctuate significantly based on earnings reports, market sentiment, and geopolitical events. Investing in Palantir requires a higher risk tolerance than many other investments.

Long-Term vs. Short-Term Investment Strategy:

Palantir is arguably better suited for a long-term investment strategy. Short-term gains are possible, but significant volatility might outweigh the potential rewards for short-term traders. The May 5th earnings report will significantly impact short-term investors more than long-term investors.

Diversification:

Never put all your eggs in one basket. Palantir should be part of a diversified investment portfolio, not your sole investment.

Conclusion:

The decision of whether to buy Palantir stock before May 5th is complex, heavily influenced by Wall Street's surprisingly divided yet impactful consensus and your own risk tolerance. While potential for significant growth exists due to expanding government contracts and the burgeoning data analytics market, risks associated with competition and valuation should be carefully considered. Thoroughly analyze the upcoming earnings report and weigh the bullish and bearish arguments before making any investment decisions. Ultimately, the choice of whether or not to buy Palantir stock rests on your individual investment goals and risk assessment. Remember to conduct thorough due diligence before investing in any stock, including Palantir. Should you buy Palantir stock? The answer, ultimately, depends on you.

Featured Posts

-

Jayson Tatum Injury Update Bone Bruise And Game 2 Availability

May 09, 2025

Jayson Tatum Injury Update Bone Bruise And Game 2 Availability

May 09, 2025 -

New Dna Test Results In Madeleine Mc Cann Case A 23 Year Olds Claim Examined

May 09, 2025

New Dna Test Results In Madeleine Mc Cann Case A 23 Year Olds Claim Examined

May 09, 2025 -

Nyt Strands Game 374 Hints And Solutions For March 12

May 09, 2025

Nyt Strands Game 374 Hints And Solutions For March 12

May 09, 2025 -

Young Thugs Loyalty Vow To Mariah The Scientist New Snippet Surfaces

May 09, 2025

Young Thugs Loyalty Vow To Mariah The Scientist New Snippet Surfaces

May 09, 2025 -

High Potential Episode Count Will There Be A Season 2

May 09, 2025

High Potential Episode Count Will There Be A Season 2

May 09, 2025