Should You Buy Palantir Technologies Stock In 2024?

Table of Contents

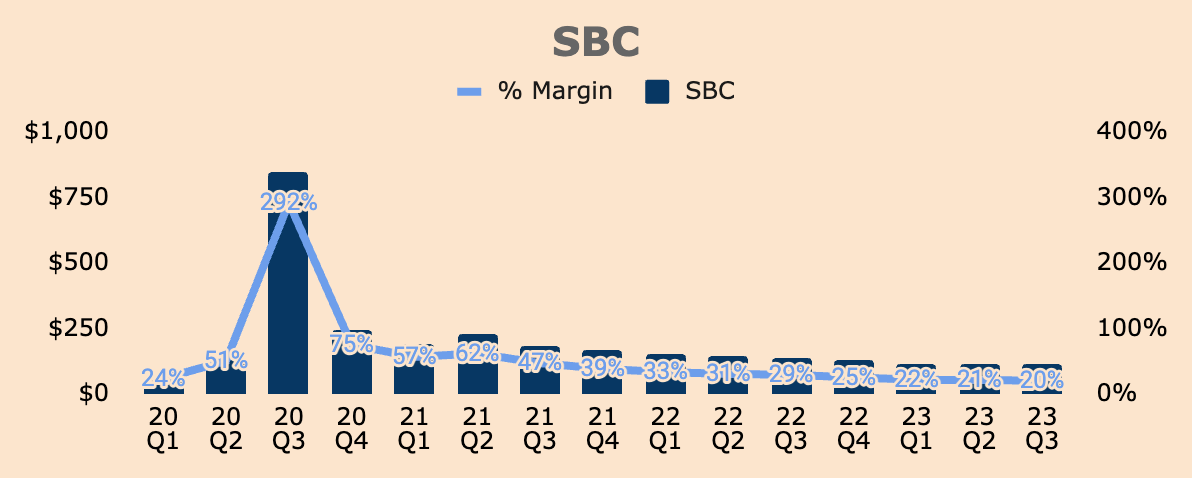

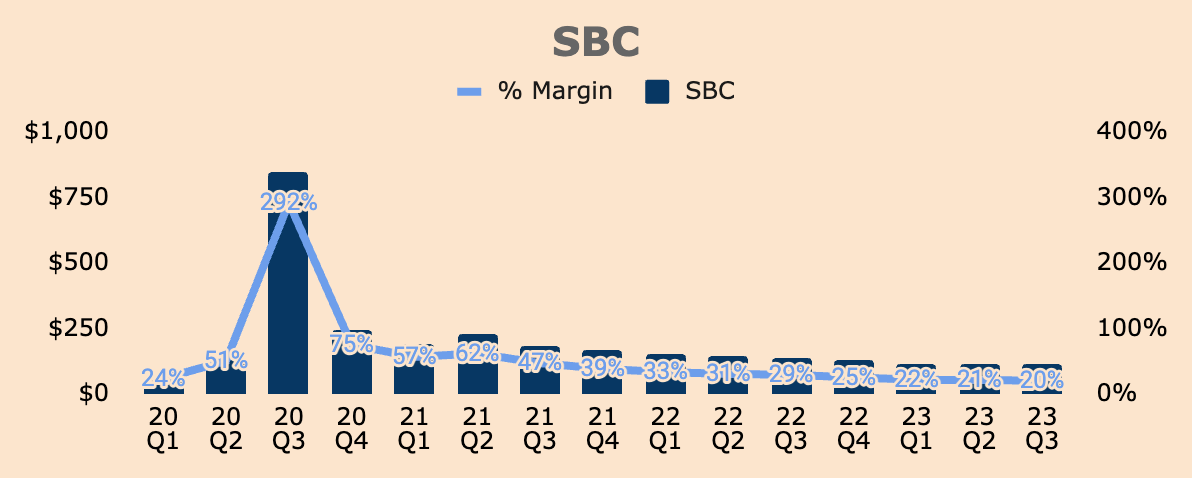

Palantir's Financial Performance and Future Projections

Assessing Palantir's financial health is crucial before considering investment. While the company hasn't yet achieved consistent profitability, its revenue growth has been impressive. Analyzing recent quarterly reports reveals a mixed picture. Examining key financial metrics like revenue, earnings per share (EPS), and the price-to-earnings ratio (P/E) provides a clearer understanding.

- Q3 2023 Revenue: (Insert actual Q3 2023 revenue figures here – this information needs to be updated when the article is published).

- Projected Revenue Growth for 2024: (Insert analyst projections or company guidance for 2024 revenue growth here – this requires up-to-date research).

- Current P/E Ratio: (Insert current P/E ratio here – this needs to be updated at publication).

While revenue growth is encouraging, investors should scrutinize the path to profitability. The company's guidance for future growth needs careful consideration, as projections can be influenced by various factors, including macroeconomic conditions and competition.

Palantir's Competitive Landscape and Market Position

Palantir operates in a fiercely competitive big data analytics market. Key competitors include established players like Databricks and Snowflake, each with its own strengths and weaknesses. Palantir's competitive advantage lies in its strong foothold in government contracts and its proprietary technology, Gotham and Foundry. However, expanding into the commercial sector and maintaining market share against aggressive competitors presents a significant challenge.

- Competitor A (Databricks): Strength – Open-source platform and strong developer community; Weakness – Less focus on government clients.

- Competitor B (Snowflake): Strength – Scalable data warehouse; Weakness – Potentially higher costs for certain applications.

The future success of Palantir stock depends largely on its ability to maintain its government contracts while aggressively pursuing expansion into the commercial sector and demonstrating a clear competitive advantage over its rivals in this rapidly evolving market.

Risks Associated with Investing in Palantir Stock

Investing in PLTR stock carries inherent risks. A primary concern is Palantir's substantial reliance on government contracts, exposing it to potential budget cuts or shifts in government priorities. The company also faces intense competition in the big data analytics market, putting pressure on pricing and profitability. Furthermore, macroeconomic factors such as inflation and interest rate hikes can significantly impact the company’s stock price.

- High Dependence on Government Contracts: This creates vulnerability to changes in government spending.

- Intense Competition in the Big Data Market: Constant pressure from established and emerging competitors.

- Potential for Slowing Revenue Growth: Maintaining high growth rates in a competitive market is challenging.

- Geopolitical Risks: International relations can impact government contracts and market access.

These risks need careful consideration before making any investment decision.

Palantir's Growth Strategy and Innovation

Palantir's growth strategy hinges on product innovation, market expansion, and strategic partnerships. The company is actively developing AI-powered analytics solutions, expanding its commercial client base, and forging alliances to increase its reach. The success of these initiatives will significantly influence Palantir's future financial performance.

- Expansion into new commercial markets: Diversification beyond government contracts is crucial for long-term growth.

- Development of AI-powered analytics solutions: Leveraging AI to enhance its offerings and maintain a competitive edge.

- Strategic partnerships to expand reach: Collaborations to access new markets and technologies.

These growth strategies show promise, but their success is not guaranteed.

Conclusion: Should You Buy Palantir Technologies Stock in 2024?

Investing in Palantir Technologies stock presents both exciting opportunities and considerable risks. While Palantir shows significant revenue growth and innovative potential, its reliance on government contracts and the competitive landscape create uncertainty. The path to profitability remains a key factor to watch. Weighing the potential rewards against the substantial risks is crucial.

Our recommendation is to proceed cautiously. While Palantir's innovative technology and strategic moves are promising, the substantial risks associated with the company warrant thorough due diligence before investing. A balanced portfolio approach is recommended.

Before making any decisions on whether to buy Palantir stock in 2024, conduct your own thorough due diligence and consult with a financial advisor. Remember that this analysis is not financial advice, and the information provided is based on publicly available data and current market conditions, which are subject to change. Always consider your individual risk tolerance and financial goals when making investment decisions related to Palantir Technologies (PLTR) stock.

Featured Posts

-

Man Learns Costly Lesson After Paying 3 000 For Babysitting Facing 3 600 Daycare Bill

May 09, 2025

Man Learns Costly Lesson After Paying 3 000 For Babysitting Facing 3 600 Daycare Bill

May 09, 2025 -

How Harry Styles Reacted To A Hilariously Bad Snl Impression

May 09, 2025

How Harry Styles Reacted To A Hilariously Bad Snl Impression

May 09, 2025 -

Stock Market Live Sensex Nifty Record Sharp Gains Detailed Analysis

May 09, 2025

Stock Market Live Sensex Nifty Record Sharp Gains Detailed Analysis

May 09, 2025 -

Bristol Airport Stalking Arrest Polish Womans Madeleine Mc Cann Claim Investigated

May 09, 2025

Bristol Airport Stalking Arrest Polish Womans Madeleine Mc Cann Claim Investigated

May 09, 2025 -

Rakesh Sharma Post Space Career And Legacy Of Indias First Astronaut

May 09, 2025

Rakesh Sharma Post Space Career And Legacy Of Indias First Astronaut

May 09, 2025