Should You Follow Wedbush's Bullish Apple Stock Prediction?

Table of Contents

Wedbush Securities is a well-respected financial services firm known for its in-depth research and analysis. Their Apple stock prediction carries significant weight within the investment community. However, the core question remains: Is Wedbush's prediction realistic, and should investors act on it?

Understanding Wedbush's Apple Stock Prediction

Wedbush's recent Apple stock prediction forecasted a significant price target, projecting a substantial increase in the Apple stock price within a specified timeframe. While the exact figures may vary depending on the report you consult, the core message remains consistently bullish.

The rationale behind Wedbush's optimistic Apple stock forecast centers on several key factors:

- New Product Launches: Anticipation for innovative new products, like the next generation of iPhones and potential advancements in augmented reality (AR) and virtual reality (VR) technology, fuel their bullish outlook. The success of these launches is expected to drive significant revenue growth.

- Strong Sales Figures: Wedbush's analysis points to consistently strong sales figures for Apple's existing product lines, demonstrating robust consumer demand and market dominance.

- Market Share Growth: Continued market share growth across various sectors, including smartphones, wearables, and services, contributes to the positive Apple stock forecast.

- Services Revenue Growth: The increasing revenue from Apple's services segment (like iCloud, Apple Music, and the App Store) is a key driver of their positive Apple stock prediction.

Key supporting arguments from Wedbush's report often include:

- Strong brand loyalty and premium pricing power.

- Effective supply chain management despite global challenges.

- Expansion into new and emerging markets.

Analyzing the Risks and Potential Downsides

While Wedbush's Apple stock prediction is positive, it's crucial to consider potential downsides. Several factors could negatively impact Apple's stock price:

- Increased Competition: Intense competition from companies like Samsung, Google, and other tech giants poses a constant threat.

- Supply Chain Disruptions: Geopolitical instability and unexpected events can disrupt Apple's carefully managed supply chain, impacting production and sales.

- Economic Downturn: A global economic recession could significantly reduce consumer spending on discretionary items like Apple products.

- Negative Regulatory Changes: Increased regulatory scrutiny and potential changes in trade policies could negatively impact Apple's profitability and stock price.

Alternative analyst opinions paint a more cautious picture:

- Some analysts express concern about slowing growth in mature markets.

- Others point to valuation concerns, suggesting the current Apple stock price might be overvalued.

Potential risks and downsides summarized:

- Economic uncertainty

- Increased competition

- Supply chain vulnerabilities

- Regulatory hurdles

Evaluating Apple's Current Financial Performance and Future Outlook

Apple's recent financial reports showcase consistent revenue growth and strong earnings. However, it's important to analyze these numbers in context. While revenue growth is impressive, the rate of growth may be slowing compared to previous years.

- Apple Revenue Growth: While still positive, the rate of revenue growth needs to be compared to previous quarters and years to understand the trend.

- Apple Earnings: Analyzing Apple's earnings per share (EPS) provides a clearer picture of profitability.

- Key Product Lines: Assessing the performance of individual product lines (iPhones, Macs, iPads, wearables) is crucial to understand the drivers of overall revenue.

- Future Products: Apple's innovation pipeline and future product announcements play a crucial role in driving investor sentiment and future growth.

Key financial metrics and their implications:

- Analyzing revenue growth year-over-year and quarter-over-quarter is crucial.

- Profit margins offer insights into Apple's pricing power and cost management.

- Debt levels and cash flow provide information on financial health and flexibility.

Making an Informed Investment Decision

Investing in Apple stock, or any stock for that matter, requires a well-defined investment strategy. Diversification is key to mitigating risk. Don't put all your eggs in one basket.

- Diversification: Spread your investments across different asset classes to reduce overall portfolio risk.

- Risk Tolerance: Understand your personal risk tolerance before investing in any stock, particularly one as volatile as Apple.

- Investment Goals: Align your investment strategy with your long-term financial goals.

Further research resources:

- Reliable financial news sources (e.g., Wall Street Journal, Bloomberg, Financial Times)

- Apple's SEC filings (for detailed financial information)

Key considerations for making an investment decision:

- Thorough due diligence is paramount.

- Consider your personal risk tolerance and financial goals.

- Seek professional advice from a qualified financial advisor if needed.

Conclusion: Should You Follow Wedbush's Bullish Apple Stock Prediction? A Final Verdict

While Wedbush's bullish Apple stock prediction is compelling, driven by factors such as new product launches and strong sales figures, investors should carefully weigh the potential risks before making any significant investment. Competition, economic uncertainty, and supply chain issues all pose potential downsides.

Reiterating the importance of thorough research and considering personal risk tolerance is crucial. Don't base your investment decision solely on a single analyst's prediction. Before making any decisions regarding Apple stock, conduct your own in-depth research and consult with a qualified financial advisor. Remember, understanding the nuances of the Apple stock prediction is crucial for successful investing. Consider diversifying your portfolio and align your investment strategy with your personal risk tolerance and long-term financial goals.

Featured Posts

-

Herstel Op Beurzen Na Uitstel Trump Alle Aex Fondsen In Het Groen

May 25, 2025

Herstel Op Beurzen Na Uitstel Trump Alle Aex Fondsen In Het Groen

May 25, 2025 -

Ferrari 296 Speciale O Hibrido Que Redefine O Desempenho

May 25, 2025

Ferrari 296 Speciale O Hibrido Que Redefine O Desempenho

May 25, 2025 -

The Ultimate Guide To Escaping To The Country

May 25, 2025

The Ultimate Guide To Escaping To The Country

May 25, 2025 -

Jordan Bardella And The 2027 French Presidential Race

May 25, 2025

Jordan Bardella And The 2027 French Presidential Race

May 25, 2025 -

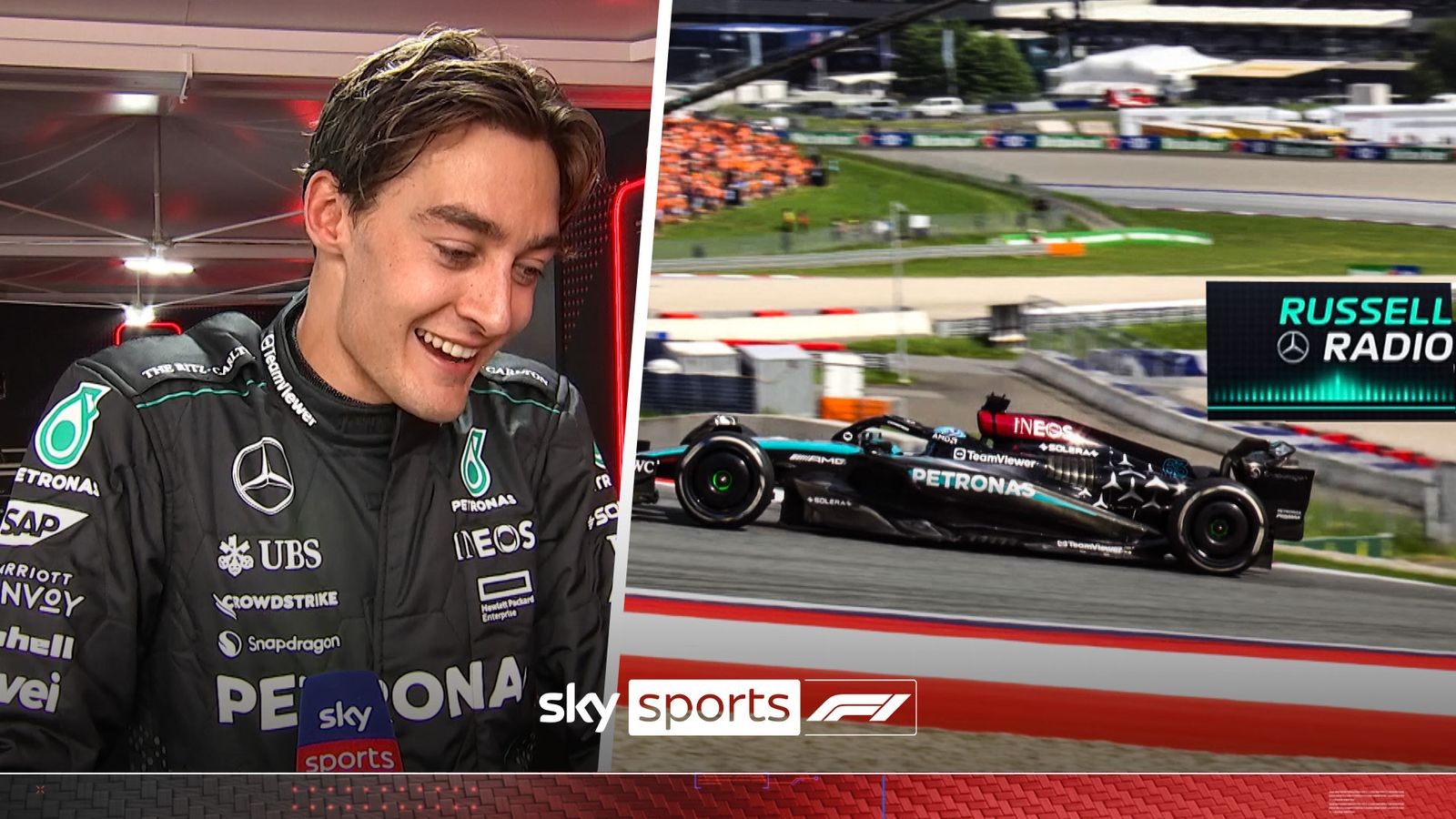

Toto Wolffs Counter To George Russell Dissecting The Underrated Debate

May 25, 2025

Toto Wolffs Counter To George Russell Dissecting The Underrated Debate

May 25, 2025