Should You Invest In Uber Technologies (UBER)?

Table of Contents

Uber's Business Model and Market Position

Uber's core business revolves around its multifaceted platform: ride-sharing (its original and still dominant service), Uber Eats (food delivery), and Uber Freight (logistics). This diversification provides a degree of resilience, but also exposes the company to the complexities of multiple markets. Uber boasts significant market share in ride-hailing, particularly in many urban centers globally. However, the competitive landscape is fiercely contested. Lyft remains a major player in ride-sharing, while DoorDash and other companies dominate various niches within food delivery. Uber's global presence and ambitious expansion strategies are key components of its growth strategy.

- Market dominance in ride-sharing: Uber holds a leading position in many global markets, but faces ongoing pressure from competitors.

- Growth potential in food delivery and freight: These segments represent avenues for future growth and diversification, although they also present unique challenges.

- Competition from established players and new entrants: The ride-hailing and delivery markets are highly competitive, necessitating continuous innovation and adaptation.

- Geographic diversification and international expansion: Expansion into new markets offers opportunities for growth, but also involves navigating diverse regulatory environments and cultural nuances. Understanding Uber's global expansion strategies is crucial for a comprehensive UBER investment analysis.

Financial Performance and Growth Prospects

Analyzing Uber's financial performance requires a careful examination of its revenue, profitability, and cash flow. While Uber has demonstrated significant revenue growth, achieving consistent profitability has been a challenge. Investors should scrutinize key financial ratios such as the P/E ratio and revenue growth rates to gauge the company's valuation and growth trajectory. Future projections rely heavily on the continued success of its diverse offerings and the overall economic climate.

- Revenue growth analysis over the past years: Examining historical revenue data helps determine the trend and stability of Uber's financial performance.

- Profitability trends and path to profitability: Understanding Uber's profitability (or lack thereof) is crucial for assessing its long-term viability as an investment.

- Debt levels and financial health: A strong balance sheet is essential for navigating economic downturns and fostering future growth.

- Future growth expectations based on market trends: Analysts' projections and market forecasts play a significant role in determining the potential returns of an UBER investment.

Risks and Challenges Facing Uber

Investing in Uber Technologies (UBER) involves understanding the inherent risks. Regulatory hurdles vary significantly across different regions, posing continuous challenges. Driver relations and labor costs are persistent concerns, impacting profitability and potentially leading to operational disruptions. Technological advancements and the entrance of new competitors pose an ongoing threat to market share. Furthermore, the ride-sharing market is inherently sensitive to economic downturns.

- Regulatory challenges and compliance issues: Navigating diverse and evolving regulations in numerous countries presents significant operational and legal risks.

- Driver relations and labor costs: Maintaining positive driver relations and managing labor costs are key factors affecting profitability and operational efficiency.

- Technological advancements and competition: Continuous innovation is crucial to stay ahead of competitors and maintain market share in a rapidly evolving technological landscape.

- Economic sensitivity of the ride-sharing market: Economic downturns can significantly impact demand for ride-sharing and delivery services, affecting Uber's revenue and profitability.

Alternative Investment Options in the Transportation Sector

Before committing to an Uber stock investment, considering alternative investment options in the transportation or technology sectors is prudent. Companies like Lyft (another major player in ride-sharing) and Tesla (a leader in electric vehicles) represent different investment profiles, each with its unique set of risks and potential rewards. Comparing these options against Uber allows for a more diversified investment strategy.

- List of comparable companies (e.g., Lyft, Tesla): Assessing various companies allows investors to find the best fit for their portfolio.

- Comparison of valuation, growth potential, and risk profiles: A comparative analysis helps determine which investment presents the optimal risk-reward balance.

- Diversification benefits for investors: Diversification is a key tenet of sound investment strategy, minimizing overall portfolio risk.

Conclusion: Should You Invest in Uber Technologies (UBER)?

Investing in Uber Technologies involves weighing the potential for significant growth against considerable risks. The company's diversification into food delivery and freight offers promising avenues for expansion, but intense competition and regulatory uncertainty remain significant headwinds. Thorough due diligence, including a comprehensive review of Uber's financial statements, competitive landscape, and regulatory environment, is paramount. Remember to consult reputable financial resources and consider your personal risk tolerance and financial goals before making any investment decisions regarding Uber stock. Conducting your own thorough UBER stock analysis is crucial before making any commitments. Consider exploring Lyft stock, Tesla stock, or other transportation stocks as part of a broader investment strategy. Only invest in Uber stock (or any stock) if it aligns with your individual financial plan.

Featured Posts

-

Analyzing Warner Bros Pictures Cinema Con 2025 Presentation

May 17, 2025

Analyzing Warner Bros Pictures Cinema Con 2025 Presentation

May 17, 2025 -

Your Guide To Moto News Gncc Mx Sx Flat Track And Enduro

May 17, 2025

Your Guide To Moto News Gncc Mx Sx Flat Track And Enduro

May 17, 2025 -

Fortnites Cowboy Bebop Skins How Much Does The Faye Valentine And Spike Spiegel Bundle Cost

May 17, 2025

Fortnites Cowboy Bebop Skins How Much Does The Faye Valentine And Spike Spiegel Bundle Cost

May 17, 2025 -

Paysandu 0 1 Bahia Reporte Completo Del Partido

May 17, 2025

Paysandu 0 1 Bahia Reporte Completo Del Partido

May 17, 2025 -

Exclusive Bonuses Discover The Best Crypto Casinos For 2025 And Easy Withdrawals

May 17, 2025

Exclusive Bonuses Discover The Best Crypto Casinos For 2025 And Easy Withdrawals

May 17, 2025

Latest Posts

-

Pregnant Cassie And Alex Fine A Look At Their Mob Land Premiere Appearance

May 18, 2025

Pregnant Cassie And Alex Fine A Look At Their Mob Land Premiere Appearance

May 18, 2025 -

Pregnant Cassie Ventura And Alex Fines Mob Land Premiere Red Carpet Photos

May 18, 2025

Pregnant Cassie Ventura And Alex Fines Mob Land Premiere Red Carpet Photos

May 18, 2025 -

Pregnant Cassie And Husband Alex Fine Make First Public Appearance At Mob Land Premiere

May 18, 2025

Pregnant Cassie And Husband Alex Fine Make First Public Appearance At Mob Land Premiere

May 18, 2025 -

Cassie Ventura And Alex Fines Red Carpet Appearance Pregnant Cassies Debut

May 18, 2025

Cassie Ventura And Alex Fines Red Carpet Appearance Pregnant Cassies Debut

May 18, 2025 -

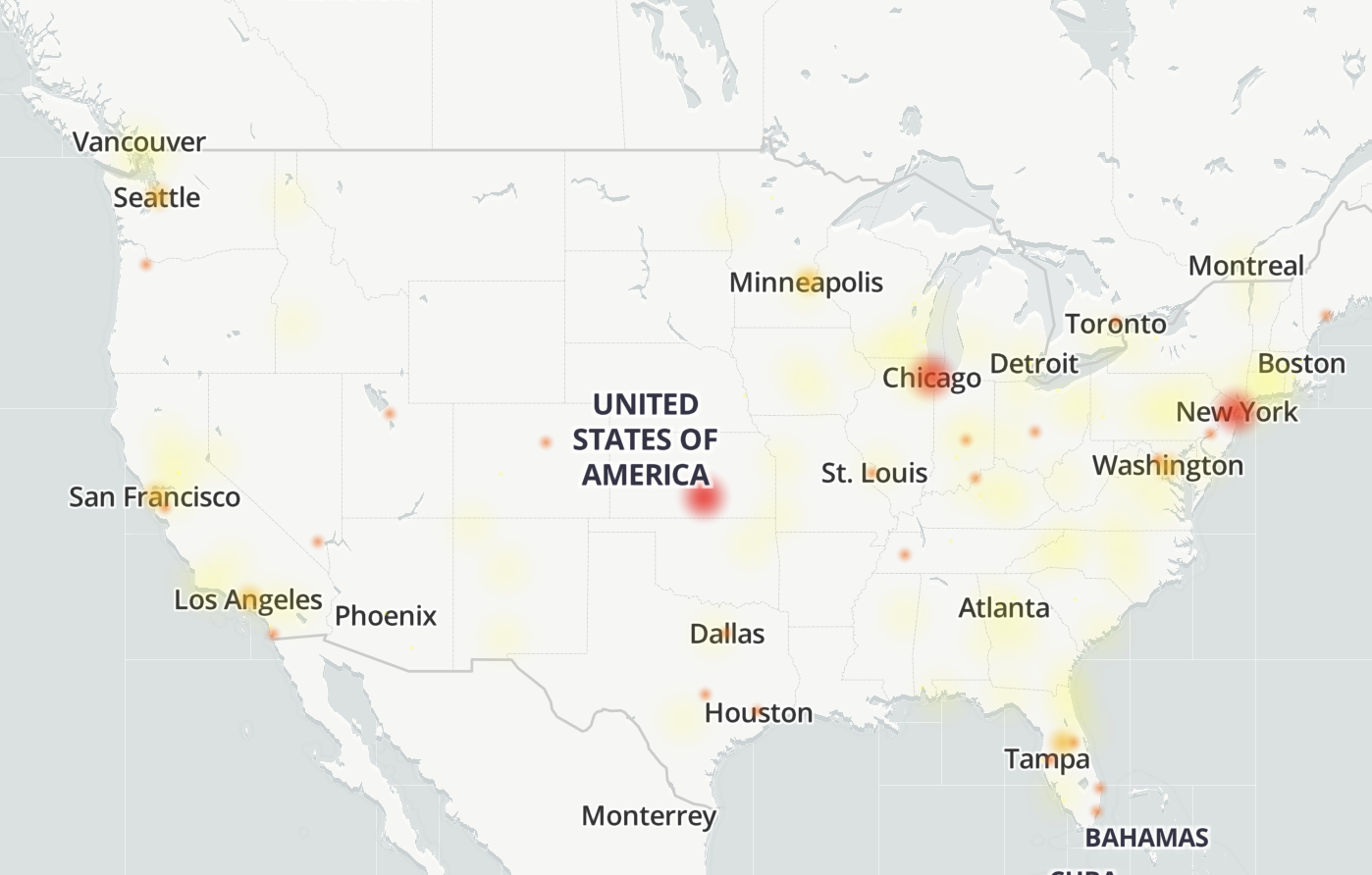

Thousands Report Reddit Down Across The Globe

May 18, 2025

Thousands Report Reddit Down Across The Globe

May 18, 2025