Significant Dutch Investment: US Money Managers Face Pressure From $65 Billion Stake

Table of Contents

The Scale of the Investment and its Source

The sheer magnitude of the $65 billion Dutch investment is staggering. To put this into perspective, consider that this figure potentially represents a significant percentage of the total assets under management (AUM) for many smaller to mid-sized US money management firms. This significant Dutch investment dwarfs previous foreign investments in the sector, marking a watershed moment. While the precise sources of this investment are still emerging, analysts point towards a confluence of factors, including the strength of the Dutch economy and the attractiveness of the relatively stable, albeit competitive, US market. Potential investors could include large Dutch pension funds, sovereign wealth funds, and private equity firms.

- Specific numbers: Estimates suggest this $65 billion injection represents a [insert percentage]% increase in foreign investment within the US money management sector, instantly making Dutch interests a major player.

- Sources of funding: The robust financial health of Dutch institutions, including their highly-rated pension funds and significant reserves, provides ample capital for such large-scale investments.

- Strategic implications: For the Dutch economy, this significant investment signifies a diversification of assets and a strategic foothold in one of the world’s largest financial markets. It could also boost the Netherlands' reputation as a global financial center.

Pressure on US Money Managers

The significant Dutch investment is placing immense pressure on US money management firms. The influx of capital translates to intensified competition, forcing US companies to sharpen their strategies to remain competitive. This increased competition is pushing firms to explore new avenues for growth and refine existing investment approaches. The pressure to perform is amplified, demanding efficiency and innovation to attract and retain investors in this newly altered landscape.

- Counteracting strategies: US firms are responding with a variety of strategies, including enhanced risk management, the development of niche investment products, and a focus on superior client service.

- Mergers and acquisitions: The increased competition might also spur a wave of mergers and acquisitions, with smaller firms seeking to consolidate to better compete with the newly established Dutch giants.

- Job displacement: While the overall effect remains uncertain, some restructuring within US firms is possible, leading to potential job displacement or re-skilling initiatives to accommodate evolving market demands.

Potential Market Impacts and Long-Term Effects

The ripples from this significant Dutch investment extend far beyond the US money management industry. The implications are potentially broad-reaching, affecting interest rates, market volatility, and even influencing future investment trends globally. The increased competition for assets could, in theory, drive down returns for some investors, although it might also lead to a greater focus on innovation and value creation.

- Future investment trends: The Dutch investment could pave the way for increased foreign investment in the US money management sector, attracting further capital from other European and international sources.

- Interest rates and volatility: While the direct impact is debatable, such a large capital injection could theoretically put downward pressure on interest rates, at least in the short term. Market volatility may increase initially due to heightened competition.

- Cross-border investment: The success of this significant Dutch investment is highly likely to encourage similar cross-border investment activities, making internationalization a more prominent feature of the global financial landscape.

Regulatory and Political Implications

This significant Dutch investment has unavoidable regulatory and political implications. US regulators will likely scrutinize the investment to ensure compliance with existing regulations and to prevent any potential anti-competitive practices. The political climate will also play a role, with potential debates around the benefits and drawbacks of foreign investment in the US financial sector.

- Regulatory challenges: US money managers might face increased regulatory scrutiny and reporting requirements in response to the Dutch investment.

- Political fallout: The investment could spark political debate about national economic sovereignty and the role of foreign capital in the US financial system.

- Future legislation: This event might lead to new legislation or regulatory changes to either facilitate or restrict large-scale foreign investment in the future.

Conclusion

The significant Dutch investment of $65 billion in the US money management sector represents a major paradigm shift. The scale of this investment is transformative, injecting intense competition and forcing US firms to adapt and innovate. The impact extends beyond the immediate players, influencing market dynamics, regulations, and the political landscape. Staying updated on the evolving dynamics of this significant Dutch investment and its ongoing repercussions for US money managers is crucial for navigating the future of financial markets. Understanding the intricacies of this significant Dutch investment is essential for any stakeholder in the US financial ecosystem.

Featured Posts

-

Market Turmoil Etf Investments Surge To New Highs

May 28, 2025

Market Turmoil Etf Investments Surge To New Highs

May 28, 2025 -

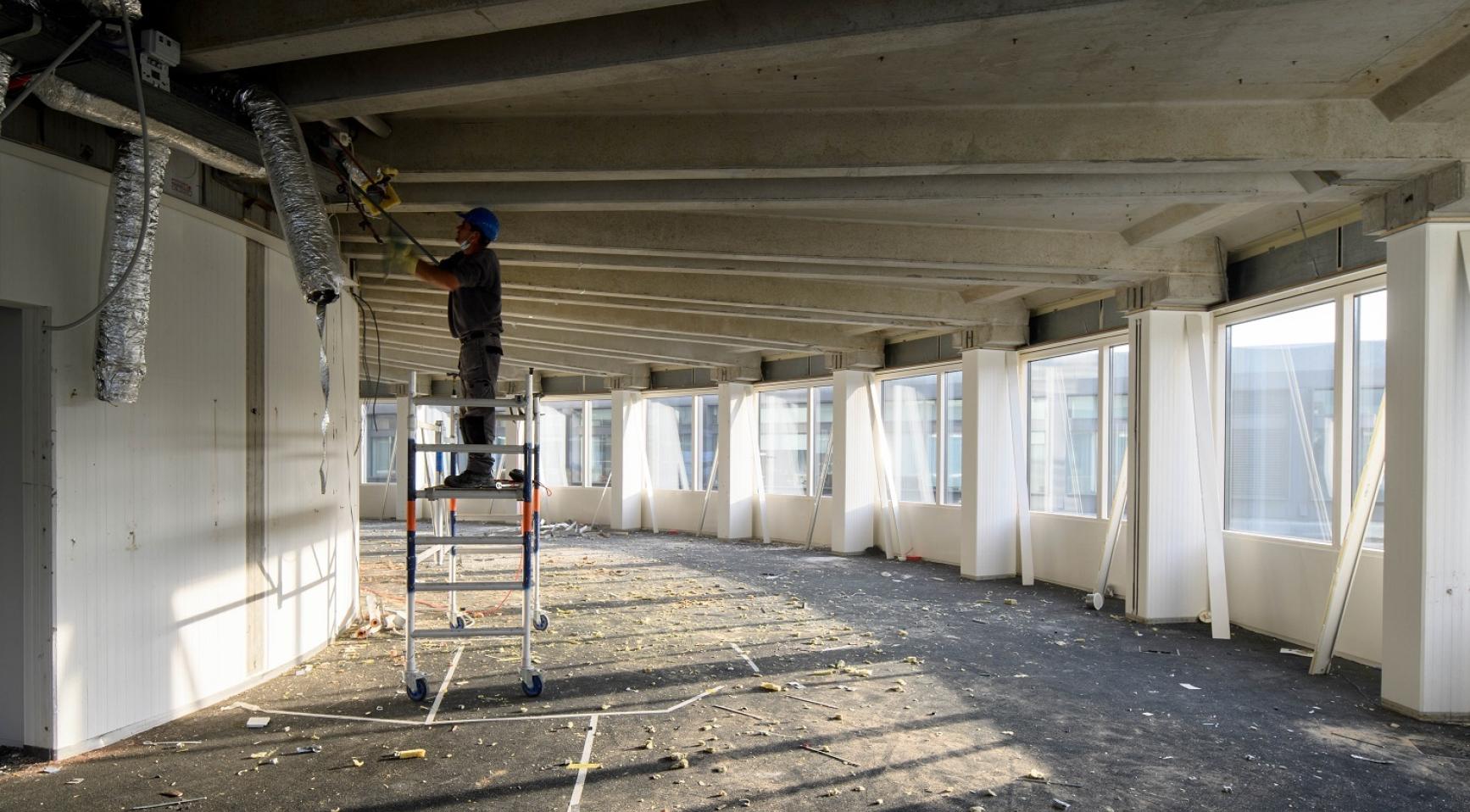

Dutch Conversion Of Vacant Office Buildings And Shops Into Homes Why Progress Is Stalling

May 28, 2025

Dutch Conversion Of Vacant Office Buildings And Shops Into Homes Why Progress Is Stalling

May 28, 2025 -

Pacers Mathurin Cavaliers Hunter Game 4 Ejection

May 28, 2025

Pacers Mathurin Cavaliers Hunter Game 4 Ejection

May 28, 2025 -

Millions Stolen In Office365 Executive Account Hack Fbi Investigation

May 28, 2025

Millions Stolen In Office365 Executive Account Hack Fbi Investigation

May 28, 2025 -

Ana Peleteiro Y Otros 12 Atletas Espanoles Al Mundial De Atletismo En Pista Cubierta De Nanjing

May 28, 2025

Ana Peleteiro Y Otros 12 Atletas Espanoles Al Mundial De Atletismo En Pista Cubierta De Nanjing

May 28, 2025

Latest Posts

-

Integracion Setlist Fm Y Ticketmaster Beneficios Para La Experiencia Del Fan

May 30, 2025

Integracion Setlist Fm Y Ticketmaster Beneficios Para La Experiencia Del Fan

May 30, 2025 -

Setlist Fm Se Integra Con Ticketmaster Ventajas Para Los Usuarios

May 30, 2025

Setlist Fm Se Integra Con Ticketmaster Ventajas Para Los Usuarios

May 30, 2025 -

Setlist Fm Se Une A Ticketmaster Nueva Experiencia Para Los Fans De Musica

May 30, 2025

Setlist Fm Se Une A Ticketmaster Nueva Experiencia Para Los Fans De Musica

May 30, 2025 -

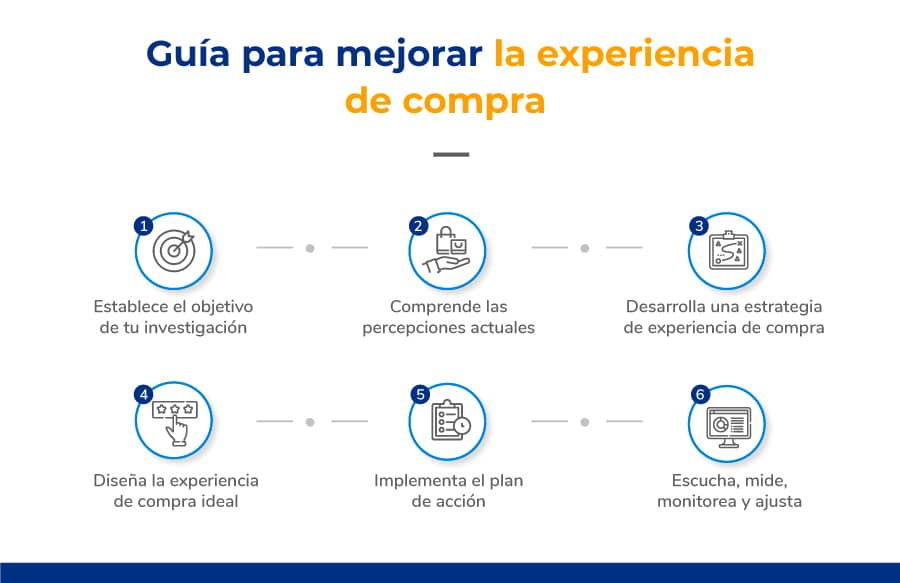

Nueva Alianza Setlist Fm Mejora La Experiencia De Compra En Ticketmaster

May 30, 2025

Nueva Alianza Setlist Fm Mejora La Experiencia De Compra En Ticketmaster

May 30, 2025 -

Ticketmaster Y Setlist Fm Integracion Para Una Mejor Experiencia De Conciertos

May 30, 2025

Ticketmaster Y Setlist Fm Integracion Para Una Mejor Experiencia De Conciertos

May 30, 2025