Significant HMRC Tax Return Rule Changes Impacting Thousands From This Week

Table of Contents

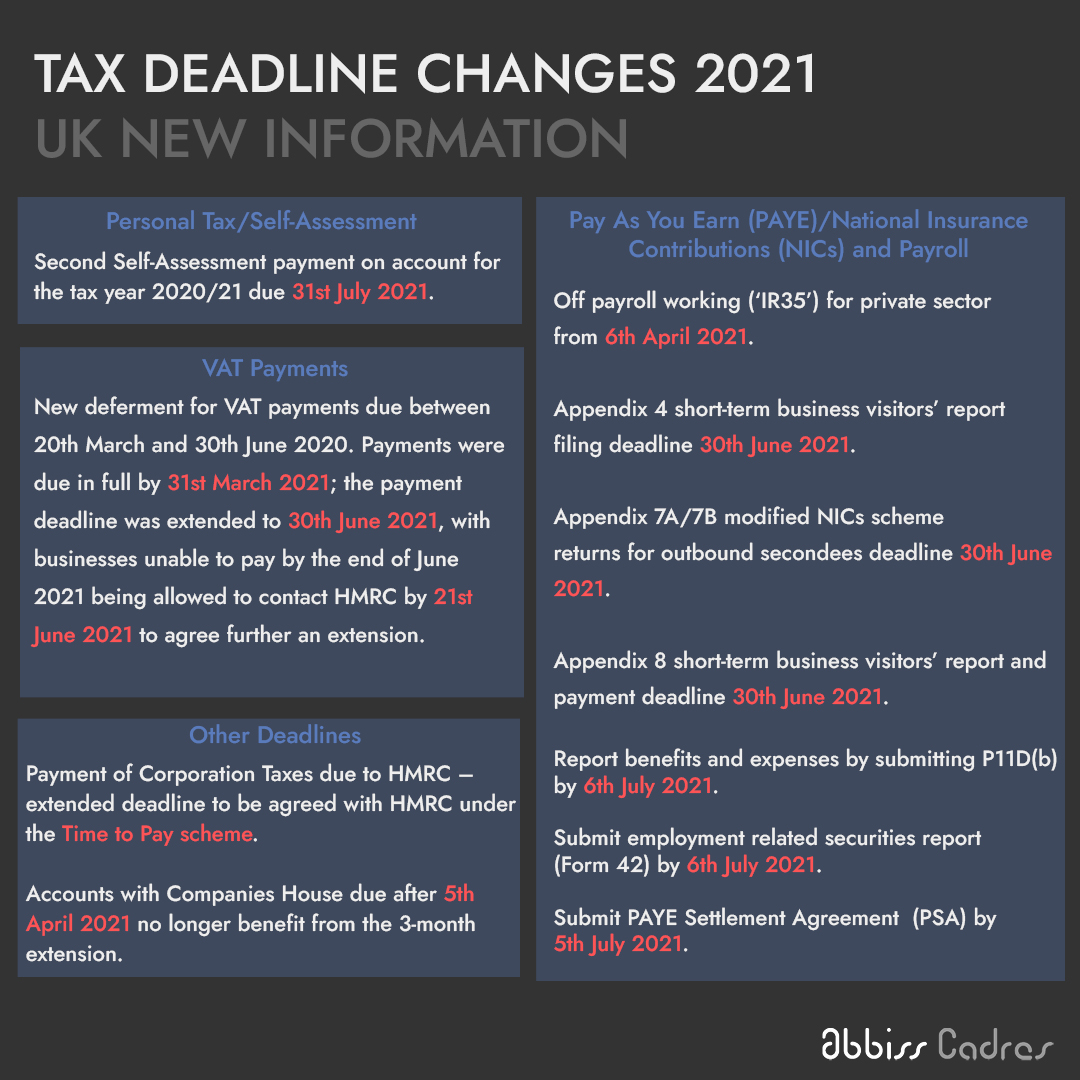

This week sees significant changes to HMRC tax return rules impacting thousands of individuals and businesses across the UK. These alterations affect everything from filing deadlines to allowable expenses, potentially leading to substantial financial consequences if not understood. This article outlines the crucial changes you need to know to ensure compliance and avoid penalties related to your HMRC tax return.

Changes to the Self-Assessment Tax Return Deadline

Extended Deadline for Some?

While the standard deadline remains crucial, it's important to note that some taxpayers may qualify for extensions. For example, individuals affected by exceptional circumstances such as severe illness or natural disasters might be granted additional time to file their HMRC tax return. However, applying for an extension requires proactive engagement with HMRC and providing substantial evidence to support the claim. Do not assume an extension will be automatically granted.

- New Deadline: The standard self-assessment tax return deadline is [Insert correct deadline here]. Failure to submit by this date will result in penalties.

- Penalties for Late Submission: Late filing penalties are automatically applied and can be substantial, accumulating daily. These penalties significantly impact your overall tax liability.

- Resources for Late Submission Applications: If you anticipate needing an extension, visit the HMRC website for guidance and application forms. Acting promptly is vital.

- Implications of Missing the Deadline: Missing the deadline not only incurs penalties but also creates potential issues with future tax filings and can negatively affect your credit rating.

New Rules Regarding Allowable Expenses

Restrictions on Business Expenses

HMRC has implemented stricter rules on allowable business expenses. This impacts several categories, leading to reduced tax relief for some.

- Examples of Expenses No Longer Fully Deductible: The changes particularly affect travel expenses (potentially limiting the deductibility of certain types of travel), entertainment expenses (with stricter limits on what's considered allowable), and representation expenses.

- Rationale Behind the Changes: These changes aim to combat tax avoidance and ensure a fairer tax system for all. HMRC is focusing on clarifying what constitutes legitimate business expenditure.

- Link to Relevant HMRC Guidance Documents: [Insert link to relevant HMRC guidance].

Changes to Capital Allowances

Businesses investing in new equipment or assets will also face altered capital allowance rules. These rules impact how much tax relief you can claim on your investments.

- Affected Types of Assets: The changes may affect specific types of assets, such as plant and machinery, depending on their classification and intended use.

- Changes in Allowance Percentages or Qualifying Criteria: Allowance percentages or qualifying criteria may be adjusted, potentially reducing the tax benefits of certain investments.

- Link to Relevant HMRC Guidance: [Insert link to relevant HMRC guidance].

Updated Reporting Requirements for Digital Businesses

New Reporting Standards for Online Sales

The digital economy is experiencing increased scrutiny, leading to revised reporting standards for online sales and digital transactions.

- New Forms or Reporting Methods: You may need to use new forms or reporting methods to accurately reflect your digital income stream.

- Increased Scrutiny on Digital Income: HMRC is employing advanced data-matching techniques to ensure all digital income is correctly declared.

- Software Solutions that Can Aid in Compliance: Utilizing accounting software specifically designed to manage digital transactions can greatly improve compliance and reduce errors.

Impact on Cryptocurrency Transactions

The treatment of cryptocurrency transactions has changed, leading to clear tax implications for gains and losses.

- How Crypto Transactions Are Now Treated: Cryptocurrency transactions are now considered taxable events, meaning profits and losses must be accurately reported.

- Tax Implications for Gains and Losses: Capital gains tax may apply to profits generated from cryptocurrency trading. Losses can generally be offset against other capital gains.

- Need for Accurate Record-Keeping: Meticulous record-keeping of all cryptocurrency transactions is vital for compliance and accurate tax reporting.

Increased HMRC Scrutiny and Enforcement

Enhanced Data-Matching Techniques

HMRC is leveraging advanced data analytics to identify inconsistencies and potential tax evasion within tax returns.

- Potential Risks for Those Who Fail to Comply: Failure to accurately report income or expenses increases the risk of an audit and subsequent penalties.

- Increased Likelihood of Audits: HMRC is undertaking more audits based on the data analysis, focusing on high-risk areas.

- Importance of Accurate Record-Keeping: Maintaining detailed and accurate records is crucial to demonstrate compliance and minimize the risk of penalties.

Increased Penalties for Non-Compliance

Penalties for non-compliance with the new HMRC tax return rules have become significantly stricter.

- Different Penalty Levels (Late Filing, Inaccurate Returns, etc.): Penalties vary depending on the severity and nature of the non-compliance, ranging from late filing penalties to substantial fines for inaccurate returns and deliberate tax evasion.

- Financial Implications of Non-Compliance: The financial implications of non-compliance can be severe, potentially including substantial fines, interest charges, and even legal action.

Conclusion

The significant changes to HMRC tax return rules necessitate immediate attention from all UK taxpayers. Understanding these alterations—regarding deadlines, allowable expenses, and reporting requirements—is crucial to avoid penalties and ensure compliance. The increased scrutiny from HMRC underscores the importance of accuracy and proper record-keeping.

Call to Action: Don't get caught out by the new HMRC tax return rule changes. Review your tax affairs and ensure you are fully compliant. Seek professional advice if needed and stay updated on further HMRC announcements regarding HMRC tax return rules and regulations.

Featured Posts

-

Robin Roberts Reacts To Gma Layoffs A Look At The Future Of Good Morning America

May 20, 2025

Robin Roberts Reacts To Gma Layoffs A Look At The Future Of Good Morning America

May 20, 2025 -

Understanding Bangladesh Through Bangladeshinfo Com

May 20, 2025

Understanding Bangladesh Through Bangladeshinfo Com

May 20, 2025 -

Hamilton Ve Leclerc In Diskalifiyesi Ferrari Icin Bueyuek Darbe

May 20, 2025

Hamilton Ve Leclerc In Diskalifiyesi Ferrari Icin Bueyuek Darbe

May 20, 2025 -

Nyt Mini Crossword Answers Today March 20 2025 Hints And Clues

May 20, 2025

Nyt Mini Crossword Answers Today March 20 2025 Hints And Clues

May 20, 2025 -

Tragedy On Railroad Bridge Two Adults Killed Children Affected

May 20, 2025

Tragedy On Railroad Bridge Two Adults Killed Children Affected

May 20, 2025

Latest Posts

-

Avauskokoonpano Yllaetys Kamara Ja Pukki Vaihdossa

May 20, 2025

Avauskokoonpano Yllaetys Kamara Ja Pukki Vaihdossa

May 20, 2025 -

Huuhkajat Avauskokoonpanossa Kolme Muutosta Kaellman Penkille

May 20, 2025

Huuhkajat Avauskokoonpanossa Kolme Muutosta Kaellman Penkille

May 20, 2025 -

Jacob Friisin Avauskokoonpano Julkistettu Kamara Ja Pukki Vaihdossa

May 20, 2025

Jacob Friisin Avauskokoonpano Julkistettu Kamara Ja Pukki Vaihdossa

May 20, 2025 -

Huuhkajien Avauskokoonpano Naein Se Muuttuu

May 20, 2025

Huuhkajien Avauskokoonpano Naein Se Muuttuu

May 20, 2025 -

Kolme Muutosta Huuhkajien Avauskokoonpanoon Kaellman Ulos

May 20, 2025

Kolme Muutosta Huuhkajien Avauskokoonpanoon Kaellman Ulos

May 20, 2025