Significant Shopify Stock Increase: Nasdaq 100 Impact

Table of Contents

Analyzing the Reasons Behind Shopify's Stock Price Increase

Several factors contributed to the recent surge in Shopify's stock price. Understanding these contributing elements is crucial to grasping the magnitude of this market event and its potential future trajectory.

Strong Quarterly Earnings and Revenue Growth

Shopify's recent quarterly earnings report significantly exceeded analysts' expectations, fueling the Shopify stock increase. This robust performance was driven by:

- Exceptional Revenue Growth: The company reported a [Insert Percentage]% increase in revenue compared to the same quarter last year, reaching [Insert Dollar Amount] in total revenue.

- Shopify Payments Success: A significant portion of this growth stemmed from the increasing adoption of Shopify Payments, indicating strong merchant loyalty and a thriving ecosystem.

- Shopify Plus Expansion: The enterprise-level Shopify Plus platform also showed impressive growth, indicating the company's success in attracting larger businesses.

- Strong Profit Margins: [Insert data on profit margins demonstrating improved profitability]

Positive Market Sentiment and Investor Confidence

Beyond the impressive financials, several other factors boosted investor confidence and contributed to the Shopify stock increase:

- New Product Launches: The introduction of [mention specific new products or features] enhanced the platform's capabilities and attracted new merchants.

- Strategic Partnerships: Collaborations with [mention key partners] expanded Shopify's reach and strengthened its market position.

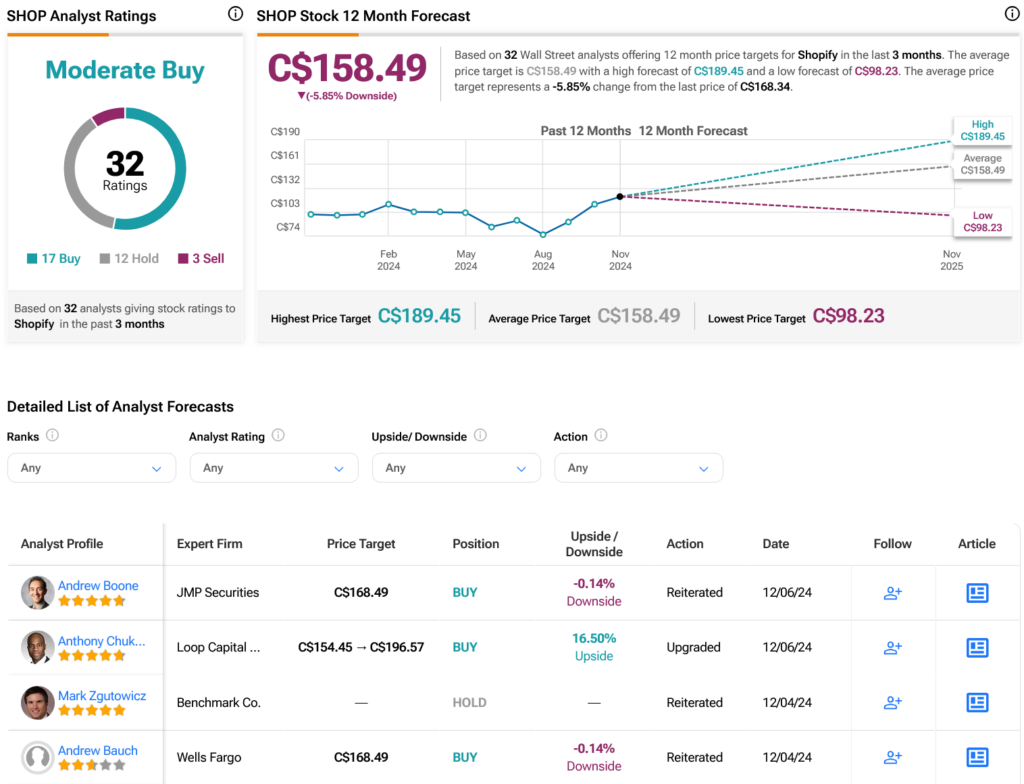

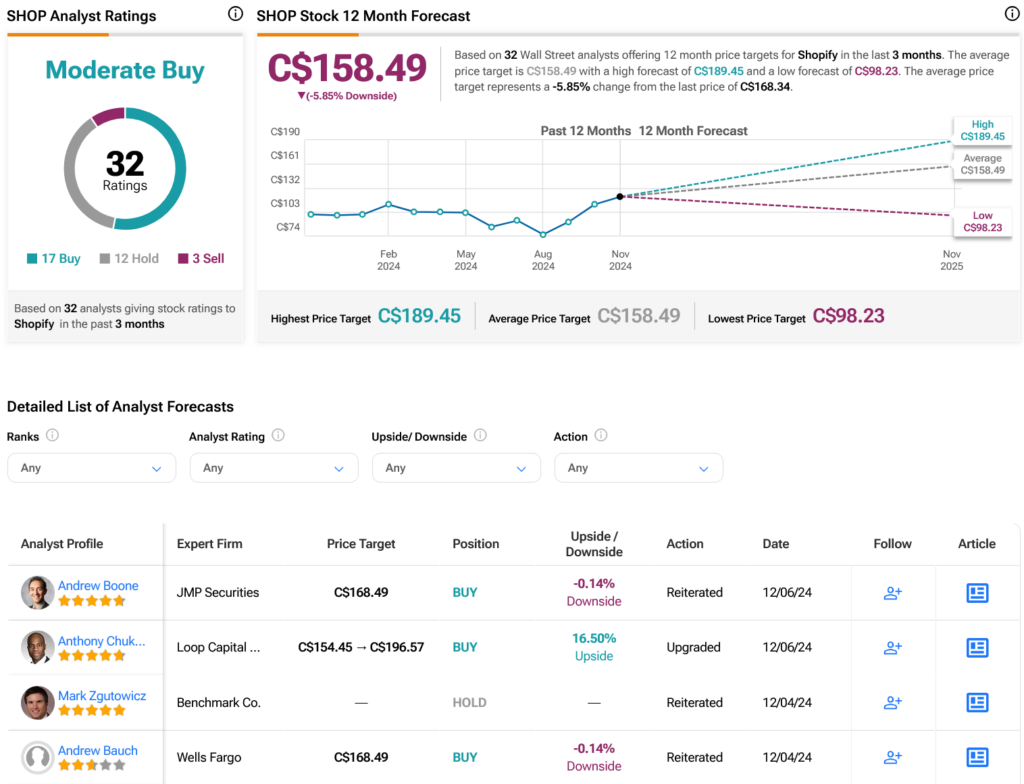

- Positive Analyst Upgrades: Several prominent financial analysts upgraded their ratings for Shopify stock, further fueling the positive market sentiment.

- Macroeconomic Factors: [Discuss any relevant macroeconomic trends, e.g., continued growth in e-commerce, that positively impacted investor sentiment towards Shopify.]

Increased Adoption of Shopify's E-commerce Platform

The ongoing and accelerating adoption of Shopify's e-commerce platform by businesses of all sizes is a key driver of the Shopify stock increase.

- Small Business Growth: The platform's ease of use and affordability continue to attract a large number of small and medium-sized businesses.

- Large Enterprise Adoption: Shopify's scalable infrastructure and robust features are increasingly appealing to larger enterprises seeking to enhance their online presence.

- Successful Case Studies: Numerous successful case studies showcasing the platform's effectiveness in driving sales and growth contribute to its positive reputation.

- Global Expansion: Shopify's continued expansion into new markets further strengthens its position as a leading e-commerce platform.

The Impact of the Shopify Stock Increase on the Nasdaq 100

The substantial Shopify stock increase has had a noticeable impact on the Nasdaq 100, reflecting its significant weighting within the index and influencing investor sentiment across the broader tech sector.

Weight and Influence within the Nasdaq 100

Shopify holds a considerable weight within the Nasdaq 100 index. Consequently, a significant price increase in Shopify stock directly translates to a positive impact on the overall index performance. [Include a chart or graph illustrating Shopify's weighting and its impact on the Nasdaq 100].

Spillover Effects on Other Tech Stocks

The positive performance of Shopify has had a ripple effect, impacting investor sentiment toward other e-commerce and technology stocks within the Nasdaq 100. Investors may view this as a sign of overall strength in the tech sector. [Discuss correlations between Shopify's performance and other relevant Nasdaq 100 components].

Potential for Future Growth and Volatility

While the recent Shopify stock increase is promising, investors should consider both the potential for continued growth and the inherent volatility of the stock market.

- Future Catalysts: [Discuss potential future catalysts for further growth, e.g., new product launches, market share gains].

- Potential Risks: [Discuss potential risks, e.g., increased competition, economic downturns].

- Volatility: Investors should be prepared for potential price fluctuations.

Conclusion: Understanding the Significance of the Shopify Stock Increase and its Future Implications

The significant Shopify stock increase is a result of strong financial performance, positive market sentiment, and the growing adoption of its e-commerce platform. This surge has positively impacted the Nasdaq 100 index, influencing investor sentiment towards the broader tech sector. Monitoring Shopify's stock performance and understanding its impact on the market remains crucial for investors. The future trajectory of Shopify's stock price will depend on various factors, including continued innovation, competitive landscape, and macroeconomic conditions.

To learn more about navigating the complexities of the Nasdaq 100 and making smart investment decisions based on Shopify stock price fluctuations, explore our resources [link to relevant resource/website]. Stay informed about future significant Shopify stock increases and their impact on your investment portfolio.

Featured Posts

-

Disneys Woke Snow White Flops Did Insulting Half The Country Backfire

May 14, 2025

Disneys Woke Snow White Flops Did Insulting Half The Country Backfire

May 14, 2025 -

Safety First Walmart Recalls Defective Ride On Toys And Power Banks

May 14, 2025

Safety First Walmart Recalls Defective Ride On Toys And Power Banks

May 14, 2025 -

Captain America Brave New World Disney Release Date Announced

May 14, 2025

Captain America Brave New World Disney Release Date Announced

May 14, 2025 -

Young Scotty Mc Creery Jr Early Singing Talent Echoes George Strait

May 14, 2025

Young Scotty Mc Creery Jr Early Singing Talent Echoes George Strait

May 14, 2025 -

Box Office Disaster How Disneys Snow White Remake Failed To Connect With Viewers

May 14, 2025

Box Office Disaster How Disneys Snow White Remake Failed To Connect With Viewers

May 14, 2025

Latest Posts

-

Did Trumps Tariffs Cripple The Fintech Ipo Market The Affirm Afrm Example

May 14, 2025

Did Trumps Tariffs Cripple The Fintech Ipo Market The Affirm Afrm Example

May 14, 2025 -

Trump Tariffs And Their Impact On The Fintech Ipo Market An Affirm Afrm Perspective

May 14, 2025

Trump Tariffs And Their Impact On The Fintech Ipo Market An Affirm Afrm Perspective

May 14, 2025 -

Analyzing The Impact Of Trumps Tariffs On Affirm Holdings Afrm Ipo

May 14, 2025

Analyzing The Impact Of Trumps Tariffs On Affirm Holdings Afrm Ipo

May 14, 2025 -

The Impact Of Trump Era Trade Policies On Fintech Ipos Analyzing Affirm Afrm

May 14, 2025

The Impact Of Trump Era Trade Policies On Fintech Ipos Analyzing Affirm Afrm

May 14, 2025 -

How Trump Tariffs Shut The Door On Affirm Holdings Afrm Ipo And Other Fintechs

May 14, 2025

How Trump Tariffs Shut The Door On Affirm Holdings Afrm Ipo And Other Fintechs

May 14, 2025