Significant Spending Reduction At SSE: £3 Billion Cut Announced

Table of Contents

The Scale of the SSE Spending Cuts

The £3 billion figure represents a monumental shift in SSE's financial strategy. While the exact percentage reduction compared to previous years' spending hasn't been explicitly stated, analysts suggest it's a significant proportion of their overall budget, potentially impacting various aspects of their operations. The sheer scale of these SSE spending cuts underscores the severity of the challenges facing the energy industry and the company's determination to navigate them.

-

Breakdown of the £3 Billion Cut: The £3 billion reduction is expected to be spread across several departments. Initial reports suggest significant cuts in capital expenditure (CAPEX), focusing on delaying or scaling back non-essential projects. Operational costs are also likely to be significantly reduced, potentially impacting staffing levels and procurement strategies. The exact breakdown remains unclear pending further official announcements from SSE.

-

Comparison to Competitors: While many energy companies are implementing cost-cutting measures, the scale of SSE's reduction surpasses most competitors' announcements. This highlights the unique pressures facing SSE and its proactive approach to addressing them. Further analysis is required to compare the strategic impact of these cuts with those undertaken by rivals.

-

Impact on Long-Term Investment Strategy: The substantial SSE spending cuts raise concerns about the company's long-term investment strategy, particularly regarding its commitment to renewable energy projects. While some projects might proceed, others may face delays or cancellations, potentially affecting the company's decarbonization targets and long-term growth prospects.

Reasons Behind the SSE Spending Reduction

The decision to implement such significant SSE spending cuts stems from a confluence of factors impacting the energy industry.

-

Increased Regulatory Pressures and Compliance Costs: The energy sector faces increasingly stringent regulations, leading to higher compliance costs. SSE, like other energy providers, is likely absorbing a substantial portion of these increased costs, necessitating budget adjustments.

-

Fluctuating Energy Prices and Market Volatility: The volatile nature of energy markets, with fluctuating prices and unpredictable demand, has created uncertainty and prompted the need for financial prudence. The SSE spending cuts reflect the company's efforts to mitigate the risks associated with this volatility.

-

Pressure from Shareholders to Improve Profitability and Efficiency: Shareholders are demanding improved profitability and operational efficiency from SSE. The substantial cost-cutting measures are likely a direct response to this pressure, aiming to bolster the company's financial performance and shareholder returns.

-

Impact of the Transition to Renewable Energy Sources: The transition to renewable energy sources requires significant upfront investment. The SSE spending cuts may indicate a recalibration of their renewable energy investment strategy, prioritizing projects with a quicker return on investment or focusing on specific, high-potential ventures.

Impact of the Spending Cuts on SSE's Operations

The implementation of these SSE spending cuts will undoubtedly have significant consequences for the company's day-to-day operations.

-

Potential Job Losses and Restructuring: Cost reductions of this magnitude often lead to job losses and restructuring within the organization. While SSE hasn't confirmed specific numbers, workforce reductions are a likely outcome of the announced SSE spending cuts.

-

Impact on Investment in New Technologies and Renewable Energy Projects: Investment in new technologies and renewable energy projects may be slowed or scaled back, potentially affecting the company's long-term growth and sustainability goals.

-

Effect on Customer Services: Reduced operational budgets may impact customer service quality, potentially leading to longer wait times or reduced support services. Careful management will be crucial to avoid significant negative impacts on customer satisfaction.

-

Potential Delays or Cancellations of Planned Projects: Several planned projects may face delays or even cancellations as a result of the significant reduction in capital expenditure. This could have repercussions for the company's overall strategic objectives.

Investor and Market Reaction to the SSE Spending Cuts

The announcement of the £3 billion SSE spending cuts has sparked mixed reactions from investors and analysts.

-

Stock Market Performance: The immediate market reaction has been varied, with some analysts predicting a short-term negative impact on SSE's stock price, while others remain cautiously optimistic about the long-term implications. Further observation of market trends will be critical.

-

Analyst Comments and Predictions: Analysts are divided in their assessments. Some commend SSE's proactive approach to addressing market challenges, while others express concerns about the potential negative consequences of such deep cuts.

-

Credit Rating Agency Assessments: Credit rating agencies will carefully scrutinize SSE's revised financial plan and assess the potential impact on its creditworthiness. This evaluation could influence borrowing costs and investor confidence.

-

Comparison to Market Reaction to Similar Announcements: The market reaction to SSE's announcement needs to be compared with other energy companies facing similar challenges. This comparative analysis will provide valuable insights into investor sentiment and market expectations.

Conclusion

This article has examined the significant £3 billion spending reduction announced by SSE. The cuts, driven by various market pressures and the need for improved efficiency, are expected to have far-reaching consequences for the company's operations, its workforce, and its investor relations. The impact of these SSE spending cuts will unfold over time, necessitating continued monitoring of the company's performance and the wider energy market. Understanding the implications of these SSE spending cuts is crucial for investors and stakeholders alike. The long-term effects on the company’s strategy, innovation, and customer service remain to be seen.

Call to Action: Stay informed about the ongoing developments concerning SSE's spending cuts and their impact on the energy sector by regularly checking back for updates on our website. Learn more about the implications of the SSE spending cuts and their broader impact on the energy market.

Featured Posts

-

Vybz Kartels Sold Out Brooklyn Shows A Triumphant Return

May 22, 2025

Vybz Kartels Sold Out Brooklyn Shows A Triumphant Return

May 22, 2025 -

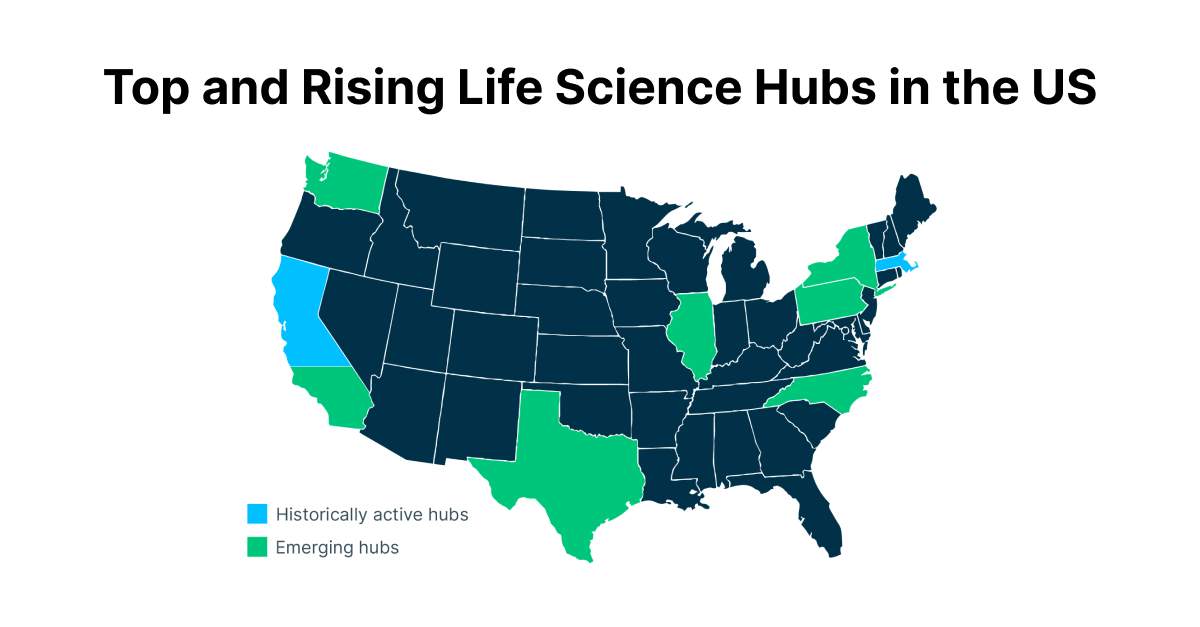

The Countrys Newest Business Hubs Investment Opportunities And Trends

May 22, 2025

The Countrys Newest Business Hubs Investment Opportunities And Trends

May 22, 2025 -

Skin Bleaching And Self Acceptance Vybz Kartels Story

May 22, 2025

Skin Bleaching And Self Acceptance Vybz Kartels Story

May 22, 2025 -

Naybilshi Fintekh Kompaniyi Ukrayini Za Dokhodami 2024 Roku

May 22, 2025

Naybilshi Fintekh Kompaniyi Ukrayini Za Dokhodami 2024 Roku

May 22, 2025 -

Superalimentos Por Que Este Supera Al Arandano En Beneficios Para La Salud

May 22, 2025

Superalimentos Por Que Este Supera Al Arandano En Beneficios Para La Salud

May 22, 2025

Latest Posts

-

Taylor Swift Caught In The Crossfire Navigating The Blake Lively And Justin Baldoni Legal Drama

May 22, 2025

Taylor Swift Caught In The Crossfire Navigating The Blake Lively And Justin Baldoni Legal Drama

May 22, 2025 -

Ukrayina Ta Nato Ostanni Novini Ta Pozitsiya Yevrokomisara

May 22, 2025

Ukrayina Ta Nato Ostanni Novini Ta Pozitsiya Yevrokomisara

May 22, 2025 -

Ukrayina Ta Nato Scho Oznachaye Vidmova Vid Chlenstva

May 22, 2025

Ukrayina Ta Nato Scho Oznachaye Vidmova Vid Chlenstva

May 22, 2025 -

Taylor Swifts Involvement In The Blake Lively And Justin Baldoni Legal Dispute An Exclusive Look

May 22, 2025

Taylor Swifts Involvement In The Blake Lively And Justin Baldoni Legal Dispute An Exclusive Look

May 22, 2025 -

Yevrokomisar Pro Perspektivi Chlenstva Ukrayini V Nato Analiz Peregovoriv

May 22, 2025

Yevrokomisar Pro Perspektivi Chlenstva Ukrayini V Nato Analiz Peregovoriv

May 22, 2025