Slowing Growth Forces SSE To Slash Spending By £3 Billion

Table of Contents

Reasons Behind SSE's £3 Billion Spending Cut

SSE's decision to slash its spending by £3 billion is a multifaceted response to a confluence of economic and industry-specific challenges. Key factors include:

-

Increased inflation and rising interest rates: Soaring inflation and subsequent interest rate hikes have dramatically increased the cost of borrowing and investment, making many previously viable projects economically unfeasible. This directly impacts SSE's capital expenditure plans, forcing a reassessment of its financial commitments.

-

Uncertainty surrounding future energy demand and price fluctuations: The volatile nature of the global energy market, characterized by unpredictable price swings and fluctuating demand, introduces significant risk into long-term investment planning. SSE's need to ensure financial stability necessitates a cautious approach to capital allocation.

-

Government policy changes affecting renewable energy project viability: Changes in government regulations and support schemes for renewable energy projects have created uncertainty and impacted the profitability of some investments. This uncertainty has forced SSE to re-evaluate the viability of its renewable energy portfolio and adjust its investment strategy accordingly.

-

Need to strengthen SSE's financial position and improve profitability: The need to bolster its financial position and enhance profitability is paramount. By reducing spending, SSE aims to improve its overall financial health and withstand potential future economic downturns. This is a proactive measure to ensure the long-term sustainability of the business.

-

Focus on core business areas and high-return investments: The spending cuts allow SSE to concentrate resources on its core business strengths and high-return investments. This strategic refocusing aims to maximize returns and ensure efficient allocation of capital within a challenging economic environment. This prioritization of high-return projects is a key element of SSE's revised investment strategy.

The interplay between these macroeconomic factors and SSE's specific financial performance has necessitated this significant reduction in planned spending. The company is clearly prioritizing financial stability and long-term sustainability over aggressive expansion in the current climate.

Impact on SSE's Projects and Future Plans

The £3 billion spending cut will inevitably have a significant impact on SSE's projects and future plans. We can anticipate:

-

Project delays and scaling back: Several projects, both renewable and conventional, are likely to experience delays or be scaled back significantly. While specific projects haven't been publicly named yet, delays in large-scale infrastructure projects, particularly within the renewable energy sector, are highly probable.

-

Changes to the company's long-term investment strategy: SSE's long-term investment strategy will be fundamentally reshaped, prioritizing projects with quicker returns and lower capital expenditure requirements. This will involve a more cautious and selective approach to investment opportunities.

-

Potential job losses or restructuring: The reduction in spending could lead to job losses or restructuring within the company, although the exact extent of this is yet to be determined. Efficiency improvements and workforce adjustments are likely to be explored to align the company's structure with the new financial realities.

-

Focus shift towards more profitable and less capital-intensive ventures: SSE is likely to shift its focus towards ventures requiring less capital investment and offering quicker returns. This may involve divesting from certain projects and prioritizing areas with higher profitability.

The implications of these changes are far-reaching, affecting not only SSE's short-term financial performance but also its ability to meet its long-term strategic goals, especially within the renewable energy sector. The long-term impact on SSE’s growth prospects remains to be seen.

Wider Implications for the UK Energy Sector

SSE's dramatic spending cut has significant implications for the broader UK energy sector.

-

Potential impact on other energy companies and their investment decisions: This decision could influence other energy companies to adopt similar cost-cutting measures, impacting the overall level of investment in the sector and potentially slowing down the energy transition.

-

Consequences for the UK's transition to renewable energy sources: Reduced investment in renewable energy projects could hinder the UK's progress towards its renewable energy targets, potentially impacting the nation's energy security and climate change goals.

-

Impact on investor confidence in the UK energy sector: The situation may negatively impact investor confidence in the UK energy sector, potentially making it more difficult to attract the necessary capital for future projects.

-

Effect on energy security and price stability: While the short-term effect may be a reduction in energy price volatility, the long-term effect on energy security and stability remains uncertain. A slower pace of renewable energy development could compromise the UK's energy independence and increase reliance on volatile global markets.

The ripple effect of SSE’s decision will undoubtedly be felt across the energy market, influencing competitive dynamics, shaping government policies, and impacting the long-term trajectory of the UK energy sector's development.

Conclusion

SSE's decision to slash spending by £3 billion is a significant event, reflecting the challenging economic conditions and uncertainty within the UK energy sector. The reasons behind this drastic measure are complex, encompassing macroeconomic factors like inflation and interest rate hikes, along with industry-specific challenges such as volatile energy prices and changing government policies. This decision will impact SSE's project portfolio, investment strategy, and potentially its workforce. Furthermore, it will ripple outwards, affecting investor confidence, the renewable energy transition, and the overall stability of the UK energy market. The long-term consequences remain uncertain, but the immediate impact is undeniable. Stay informed about the evolving situation in the UK energy market and SSE's response to these economic challenges. Follow our updates on future developments regarding SSE's spending cuts and their impact on the energy sector. Learn more about how other energy companies are adapting to similar pressures and how this impacts the broader energy transition and UK energy policy.

Featured Posts

-

Pivdenniy Mist Aktualna Informatsiya Pro Remontni Roboti

May 22, 2025

Pivdenniy Mist Aktualna Informatsiya Pro Remontni Roboti

May 22, 2025 -

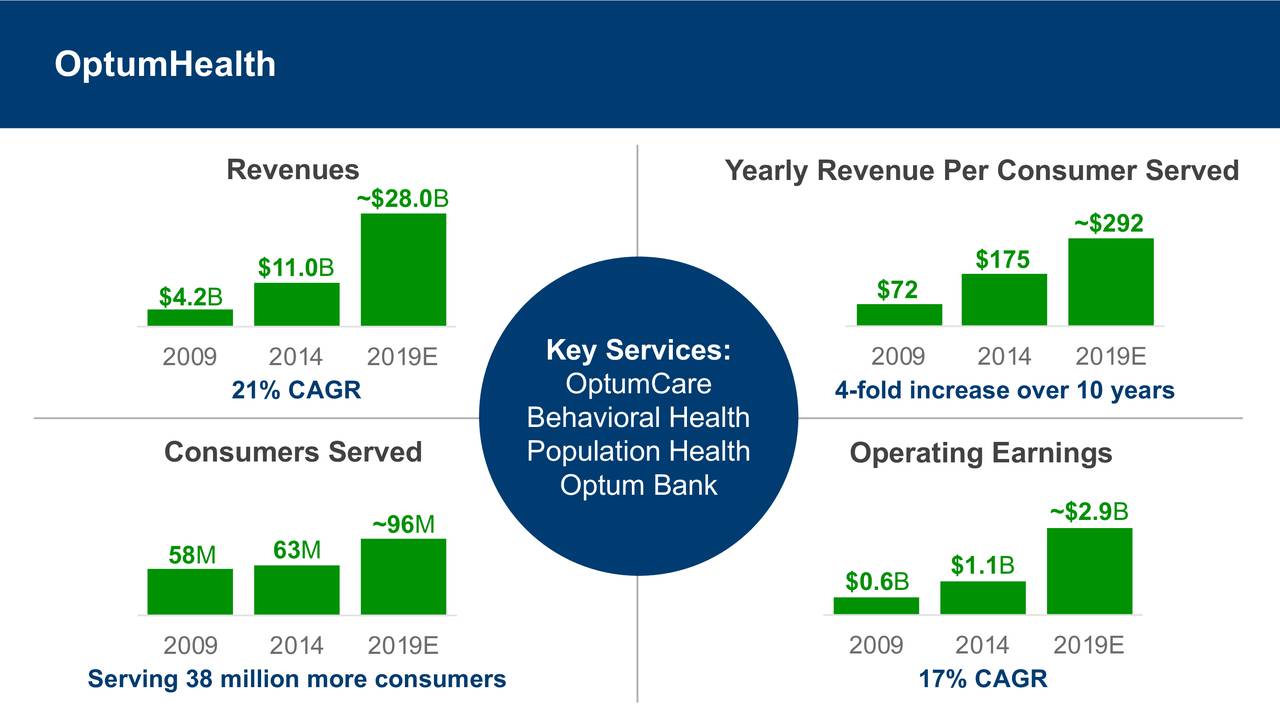

Rebuilding United Health The Ceos Strategic Plan

May 22, 2025

Rebuilding United Health The Ceos Strategic Plan

May 22, 2025 -

Alfa Romeo Junior 1 2 Turbo Speciale Avis Et Essai Par Le Matin Auto

May 22, 2025

Alfa Romeo Junior 1 2 Turbo Speciale Avis Et Essai Par Le Matin Auto

May 22, 2025 -

Understanding Google Searchs Ai Mode Benefits And Challenges

May 22, 2025

Understanding Google Searchs Ai Mode Benefits And Challenges

May 22, 2025 -

The Power Of Music Exploring The Sound Perimeter Of Human Connection

May 22, 2025

The Power Of Music Exploring The Sound Perimeter Of Human Connection

May 22, 2025

Latest Posts

-

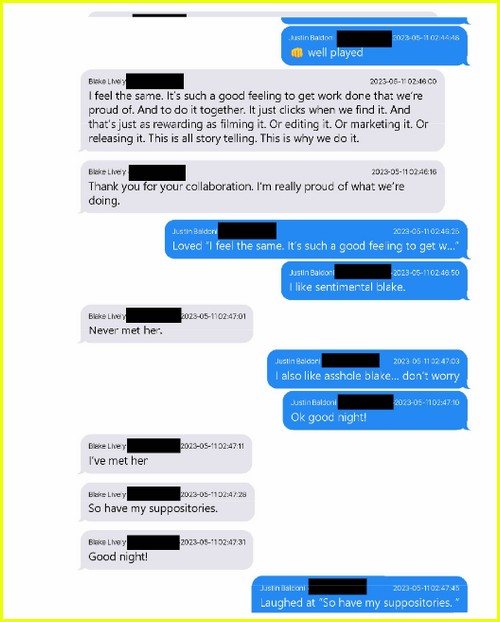

Selena Gomezs Wake Up Call To Taylor Swift The Blake Lively Claim And Justin Baldoni Lawsuit

May 22, 2025

Selena Gomezs Wake Up Call To Taylor Swift The Blake Lively Claim And Justin Baldoni Lawsuit

May 22, 2025 -

Chi Sprostit Vidmova Ukrayini U Vstupi Do Nato Plani Rosiyi Schodo Podalshoyi Agresiyi

May 22, 2025

Chi Sprostit Vidmova Ukrayini U Vstupi Do Nato Plani Rosiyi Schodo Podalshoyi Agresiyi

May 22, 2025 -

Enerji Guevenligi Nato Genel Sekreteri Rutte Ile Ispanyol Basbakan Sanchez In Goeruesmesi

May 22, 2025

Enerji Guevenligi Nato Genel Sekreteri Rutte Ile Ispanyol Basbakan Sanchez In Goeruesmesi

May 22, 2025 -

Vidmova Nato Priynyati Ukrayinu Shlyakh Do Podalshoyi Rosiyskoyi Agresiyi

May 22, 2025

Vidmova Nato Priynyati Ukrayinu Shlyakh Do Podalshoyi Rosiyskoyi Agresiyi

May 22, 2025 -

Tuerkiye Nin Nato Daki Artan Etkisi Ittifakin Yeni Denge Noktasi

May 22, 2025

Tuerkiye Nin Nato Daki Artan Etkisi Ittifakin Yeni Denge Noktasi

May 22, 2025