Software Stocks And Tariffs: Why Microsoft Stands Out

Table of Contents

Microsoft's Diversified Revenue Streams: A Buffer Against Tariff Impacts

Microsoft's success is rooted in its remarkably diversified revenue model. This diversification acts as a powerful shield against the negative impacts of tariffs, reducing reliance on any single product or geographic region.

Cloud Computing (Azure): A Globally Distributed Asset

Microsoft Azure, the company's cloud computing platform, is a prime example of this diversification. Its global infrastructure, with data centers spanning numerous countries, minimizes the impact of tariffs on specific regions.

- Reduced dependence on hardware imports: Azure's distributed nature allows for localized hardware sourcing, reducing vulnerability to import tariffs.

- Global data center network: This expansive network ensures business continuity and minimizes disruption from regional trade restrictions.

- Subscription-based model mitigates risks: The recurring revenue model of Azure offers predictability and stability, mitigating the impact of fluctuating tariffs on hardware or services.

Productivity and Business Processes (Office 365, Dynamics 365): Recurring Revenue Powerhouse

Microsoft's productivity and business process solutions, including Office 365 and Dynamics 365, further enhance its resilience. The subscription-based nature of these offerings provides a crucial buffer against tariff volatility.

- Subscription model: Predictable recurring revenue streams insulate Microsoft from the short-term fluctuations associated with tariff changes.

- Broad global adoption: The widespread use of these products globally diversifies revenue sources, reducing reliance on any single market.

- Less dependence on physical product sales: The shift towards cloud-based software minimizes reliance on physical product sales, reducing exposure to import tariffs on hardware.

Gaming (Xbox): A Globally Connected Ecosystem

Microsoft's gaming division, Xbox, also contributes to its overall resilience. The digital distribution model and global online gaming community minimize the impact of tariffs on physical game sales.

- Digital distribution: The majority of Xbox game sales are digital, reducing dependence on physical disc manufacturing and import tariffs.

- Global online gaming community: This diverse player base across numerous countries reduces reliance on any single market.

- Less reliance on physical game sales: This significantly minimizes the impact of tariffs on physical game production and distribution.

LinkedIn: B2B Focus Mitigates Consumer-Based Tariff Effects

LinkedIn, Microsoft's professional networking platform, demonstrates the benefits of a B2B focus. Its revenue model is less susceptible to the fluctuations affecting consumer-based products and services.

- Professional networking: LinkedIn's focus on business-to-business transactions minimizes vulnerability to consumer-driven tariff impacts.

- Subscription model: Similar to other Microsoft services, its subscription model provides revenue predictability.

- Global reach: A global user base further diversifies revenue streams.

Microsoft's Global Supply Chain Strategy: Minimizing Tariff Disruptions

Microsoft's proactive approach to supply chain management further strengthens its position. The company employs several strategies to minimize the disruptive effects of tariffs.

Strategic Partnerships: Geographic Diversification and Flexibility

Microsoft leverages strategic partnerships to diversify its manufacturing and distribution networks, mitigating supply chain vulnerabilities.

- Examples of key partnerships: Collaborations with various manufacturers and distributors allow for flexibility and geographic diversification.

- Geographic diversification of manufacturing: Spreading manufacturing across multiple countries reduces reliance on any single region.

- Flexible supply chain management: Microsoft's agile approach allows it to adapt quickly to changing trade conditions.

Manufacturing and Distribution: A Software-Centric Approach

Microsoft's focus on software, rather than heavily hardware-dependent products, significantly reduces its exposure to tariffs on physical goods.

- Focus on software: The intangible nature of software minimizes the impact of tariffs on physical goods.

- Reduced reliance on hardware manufacturing: Microsoft outsources much of its hardware manufacturing, allowing for flexibility and reduced risk.

- Efficient distribution networks: Well-established global distribution networks ensure smooth product delivery, even in the face of trade uncertainties.

Intellectual Property Protection: A Key Competitive Advantage

Microsoft's robust intellectual property portfolio provides a significant competitive advantage and safeguards its revenue streams from tariff impacts.

- Strong patent portfolio: Protects its innovative technologies and ensures a competitive edge.

- Licensing agreements: Generate revenue streams independent of physical product sales.

- Software's intangible nature: Software is less susceptible to physical import restrictions and tariffs compared to hardware.

Microsoft's Strong Financial Position: Weathering Economic Uncertainty

Microsoft's impressive financial standing provides a crucial buffer against economic uncertainty, including the impact of tariffs.

Cash Reserves and Investments: A Strong Financial Foundation

The company's substantial cash reserves allow it to navigate economic downturns and pursue strategic acquisitions and R&D investments.

- Ability to weather economic downturns: Ample cash reserves ensure financial stability during periods of uncertainty.

- Strategic acquisitions: Cash reserves facilitate strategic acquisitions to expand market share and capabilities.

- Investments in R&D: Continued investment in research and development fuels future growth and innovation.

Profitability and Growth: A Consistent Track Record

Microsoft's consistent profitability and growth trajectory underscore its resilience and adaptability.

- Consistent revenue growth: Demonstrates sustained market demand and business strength.

- Strong profit margins: Indicates efficient operations and pricing strategies.

- Market leadership: Reinforces its strong competitive position.

Investor Confidence: A Vote of Confidence in Microsoft's Stability

Investor confidence in Microsoft contributes significantly to its ability to navigate tariff challenges.

- Strong stock performance: Reflects investor confidence and market valuation.

- Positive analyst ratings: Affirm the company's strong fundamentals and growth prospects.

- Investor perception of stability: Microsoft's reputation for stability attracts investors seeking a safe haven in uncertain times.

Conclusion: Investing in Software Stocks: Why Microsoft Remains a Top Choice

Microsoft's resilience in the face of software stocks and tariffs is a result of its diversified revenue streams, robust global supply chain, and strong financial position. Its strategic focus on software, cloud computing, and recurring revenue models minimizes its vulnerability to trade-related disruptions. The company's consistent profitability, strong investor confidence, and global reach further reinforce its position as a leading player in the tech sector. When considering investments in software stocks, Microsoft's ability to navigate economic uncertainty makes it a compelling choice. Further research into software stocks and tariffs, specifically focusing on factors like revenue diversification and global reach, will allow for informed investment decisions. Consider adding Microsoft to your diversified portfolio to benefit from its enduring strength in the face of global trade uncertainties.

Featured Posts

-

Viet Jet Faces Financial Reckoning After Court Ruling

May 15, 2025

Viet Jet Faces Financial Reckoning After Court Ruling

May 15, 2025 -

Indian Bank Fd

May 15, 2025

Indian Bank Fd

May 15, 2025 -

Top Baby Names 2024 A Look At The Most Popular Choices

May 15, 2025

Top Baby Names 2024 A Look At The Most Popular Choices

May 15, 2025 -

Hasinas Party Faces Election Ban In Bangladesh

May 15, 2025

Hasinas Party Faces Election Ban In Bangladesh

May 15, 2025 -

Anchor Brewing Company Shuttering What Does This Mean For Craft Beer

May 15, 2025

Anchor Brewing Company Shuttering What Does This Mean For Craft Beer

May 15, 2025

Latest Posts

-

Vont Weekend April 4 6 2025 At 104 5 The Cat Photo Recap

May 15, 2025

Vont Weekend April 4 6 2025 At 104 5 The Cat Photo Recap

May 15, 2025 -

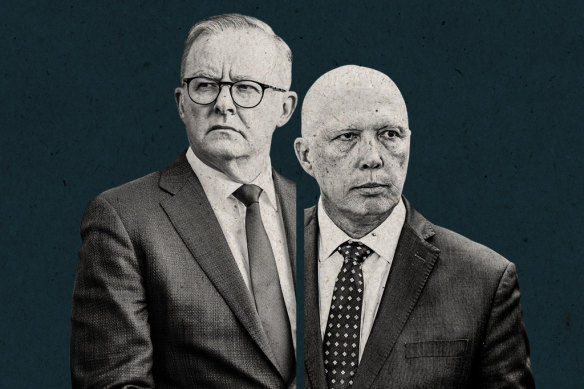

Key Policy Differences Albanese And Duttons Visions For Australia

May 15, 2025

Key Policy Differences Albanese And Duttons Visions For Australia

May 15, 2025 -

Co Parenting Success Ayesha Howard And Anthony Edwards Shared Living Arrangement

May 15, 2025

Co Parenting Success Ayesha Howard And Anthony Edwards Shared Living Arrangement

May 15, 2025 -

Election 2024 Analyzing The Major Policy Platforms Of Albanese And Dutton

May 15, 2025

Election 2024 Analyzing The Major Policy Platforms Of Albanese And Dutton

May 15, 2025 -

Albanese And Dutton Face Off Comparing Their Key Policy Proposals

May 15, 2025

Albanese And Dutton Face Off Comparing Their Key Policy Proposals

May 15, 2025