Solid Corporate Earnings: Are We Heading For A Correction?

Table of Contents

High Valuations and Market Sentiment

Market valuation is a crucial indicator of potential corrections. A high valuation suggests the market is pricing in future growth at an optimistic, perhaps unsustainable, level. One key metric used to assess valuation is the Price-to-Earnings (P/E) ratio. This ratio compares a company's stock price to its earnings per share; a high P/E ratio generally indicates that investors are paying a premium for each dollar of earnings. Currently, certain sectors exhibit remarkably high P/E ratios, suggesting potential overvaluation. Furthermore, current market sentiment seems overly optimistic, fueled by a prolonged period of low interest rates and strong corporate performance. This exuberance, while understandable, can inflate asset prices beyond their intrinsic value, leaving the market vulnerable to a sharp correction.

- High P/E ratios in certain sectors signal overvaluation, leaving them susceptible to price drops.

- Investor exuberance can lead to unsustainable price increases, creating a bubble that eventually bursts.

- Increased market volatility, characterized by significant price swings, is often a precursor to a correction.

The Impact of Persistent Inflation and Rising Interest Rates

Inflation and interest rates have an inverse relationship with stock prices. Persistent inflation erodes purchasing power, reducing consumer spending and potentially impacting corporate profits. Simultaneously, rising interest rates increase borrowing costs for businesses, reducing profitability and potentially slowing economic growth. The Federal Reserve's (Fed) monetary policy plays a crucial role here. To combat inflation, the Fed often raises interest rates, a move that can cool down the economy but also trigger a market downturn by making borrowing more expensive and reducing the attractiveness of equities.

- Inflation erodes purchasing power and reduces corporate profits, leading to lower earnings and potentially lower stock prices.

- Higher interest rates increase the cost of debt financing for businesses, impacting profitability and potentially leading to reduced investment and slower growth.

- The Fed's actions to combat inflation, while necessary to maintain price stability, could unintentionally trigger a market correction.

Geopolitical Risks and Their Influence on Market Stability

Geopolitical risks, such as war, trade disputes, and political instability, significantly impact investor confidence and market stability. Uncertainty surrounding these events creates volatility, as investors react to changing news and perceptions of risk. An unexpected escalation of conflicts or the imposition of significant sanctions can trigger a sharp market decline, as investors seek safety in less volatile assets. The interconnectedness of the global economy means that disruptions in one region can quickly ripple throughout the world, impacting markets globally.

- Uncertainty surrounding geopolitical events creates market volatility, making it difficult to predict market movements.

- Escalation of conflicts can lead to significant market declines, as investors flee to safer assets.

- Sanctions and trade wars disrupt global supply chains and economic growth, negatively impacting corporate profits and investor sentiment.

Analyzing Sector-Specific Performance and Vulnerability

Market sectors exhibit varying degrees of performance and vulnerability to corrections. The technology sector, for example, has historically been sensitive to interest rate changes, as higher rates can impact valuations of high-growth companies with significant future earnings potential. Similarly, the real estate sector can be vulnerable to interest rate hikes, as these affect mortgage rates and consumer demand for housing. An overreliance on specific sectors can increase overall market risk; a correction within one sector could trigger a broader market downturn.

- Some sectors may be overvalued compared to others, making them more prone to price corrections.

- Certain sectors are more sensitive to interest rate changes, making them vulnerable to rising borrowing costs.

- Overreliance on specific sectors can increase market risk, as a correction in one area can trigger a cascade effect.

Conclusion: Solid Corporate Earnings and the Potential for Correction

While current corporate earnings reports are undeniably strong, several significant risks suggest a market correction remains a considerable possibility. High valuations, persistent inflation, rising interest rates, and ongoing geopolitical risks all contribute to a heightened risk environment. Investors must carefully consider these factors and diversify their portfolios to mitigate potential losses. Staying informed about corporate earnings, market trends, and geopolitical developments is crucial for making informed investment decisions and navigating a potentially volatile market. Learn more about managing your portfolio in the face of potential market corrections to protect your investments.

Featured Posts

-

Fog Rolling In San Diego County Braces For Cooler Weather And Potential Rain

May 30, 2025

Fog Rolling In San Diego County Braces For Cooler Weather And Potential Rain

May 30, 2025 -

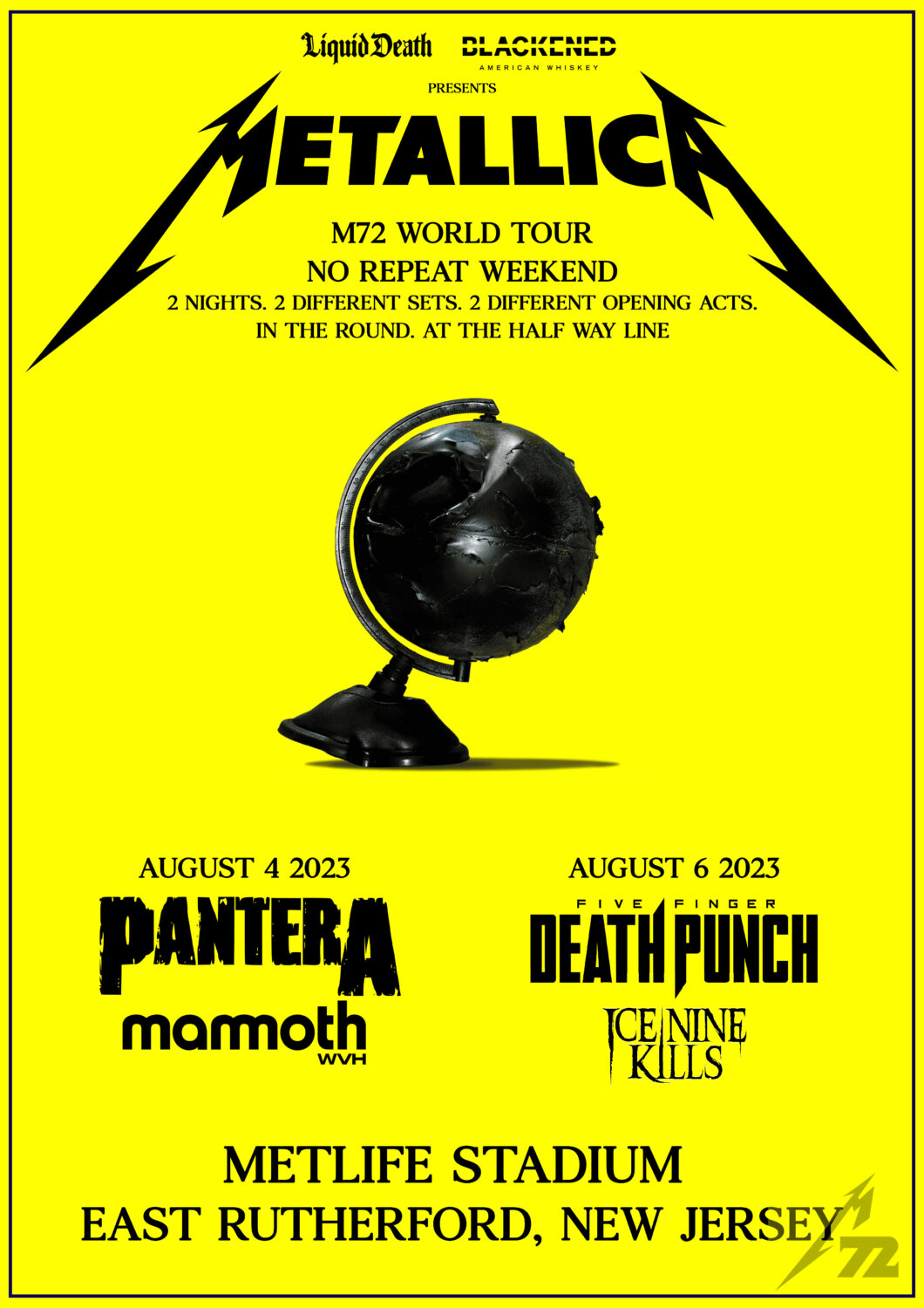

M72 World Tour 2026 Metallicas Uk And European Leg Announced

May 30, 2025

M72 World Tour 2026 Metallicas Uk And European Leg Announced

May 30, 2025 -

Edward Burke Jr The Hamptons Leading Dwi Defense Attorney

May 30, 2025

Edward Burke Jr The Hamptons Leading Dwi Defense Attorney

May 30, 2025 -

Oasis Tour Ticket Scandal Assessing Ticketmasters Alleged Breach Of Consumer Protection Laws

May 30, 2025

Oasis Tour Ticket Scandal Assessing Ticketmasters Alleged Breach Of Consumer Protection Laws

May 30, 2025 -

Trump Contra Ticketmaster Y La Reventa Nueva Orden Ejecutiva Para Proteger A Los Consumidores

May 30, 2025

Trump Contra Ticketmaster Y La Reventa Nueva Orden Ejecutiva Para Proteger A Los Consumidores

May 30, 2025