Sovereign Bond Markets: The Latest Insights From Swissquote Bank

Table of Contents

Current Global Economic Landscape and its Impact on Sovereign Bond Yields

The global economic landscape is currently characterized by a complex interplay of factors significantly influencing sovereign bond yields. High inflation in many countries, fueled by supply chain disruptions and increased energy prices, is a major concern. The risk of recession looms large in several developed economies, prompting central banks to adopt aggressive monetary policies. Simultaneously, geopolitical events, such as the ongoing conflict in Ukraine, introduce significant uncertainty and volatility into the market.

These factors interact in complex ways to shape sovereign bond yields. Let's examine some key impacts:

- Impact of inflation on bond prices: High inflation erodes the purchasing power of future bond payments, leading to a decrease in bond prices and an increase in yields. Investors demand higher yields to compensate for the anticipated loss of value.

- Central bank policies and their effect on interest rates: Central banks, like the Federal Reserve in the US and the European Central Bank, are raising interest rates to combat inflation. This directly impacts bond yields, as newly issued bonds typically reflect prevailing interest rates. Higher interest rates generally lead to higher bond yields.

- Geopolitical risks and their influence on bond market volatility: Geopolitical uncertainty creates market anxiety, leading to increased volatility in bond markets. Investors often flock to safe-haven assets like sovereign bonds from stable economies, driving up demand and potentially lowering yields. Conversely, increased risk aversion can cause a sell-off in bonds from less stable regions.

- Examples of specific countries and their bond yields: For example, US Treasury yields have risen significantly in response to the Fed's tightening monetary policy, while German Bund yields, though rising, have remained relatively low, reflecting Germany’s perceived stability. The UK gilt market has experienced significant volatility recently, reflecting Brexit-related uncertainties. Keywords: global economy, inflation, interest rates, central banks, monetary policy, geopolitical risk, bond yields, sovereign debt.

Analyzing Key Sovereign Bond Markets: US Treasuries, German Bunds, and UK Gilts

Understanding the dynamics of major sovereign bond markets is essential for effective investment strategies. Let's analyze three key players: US Treasuries, German Bunds, and UK Gilts.

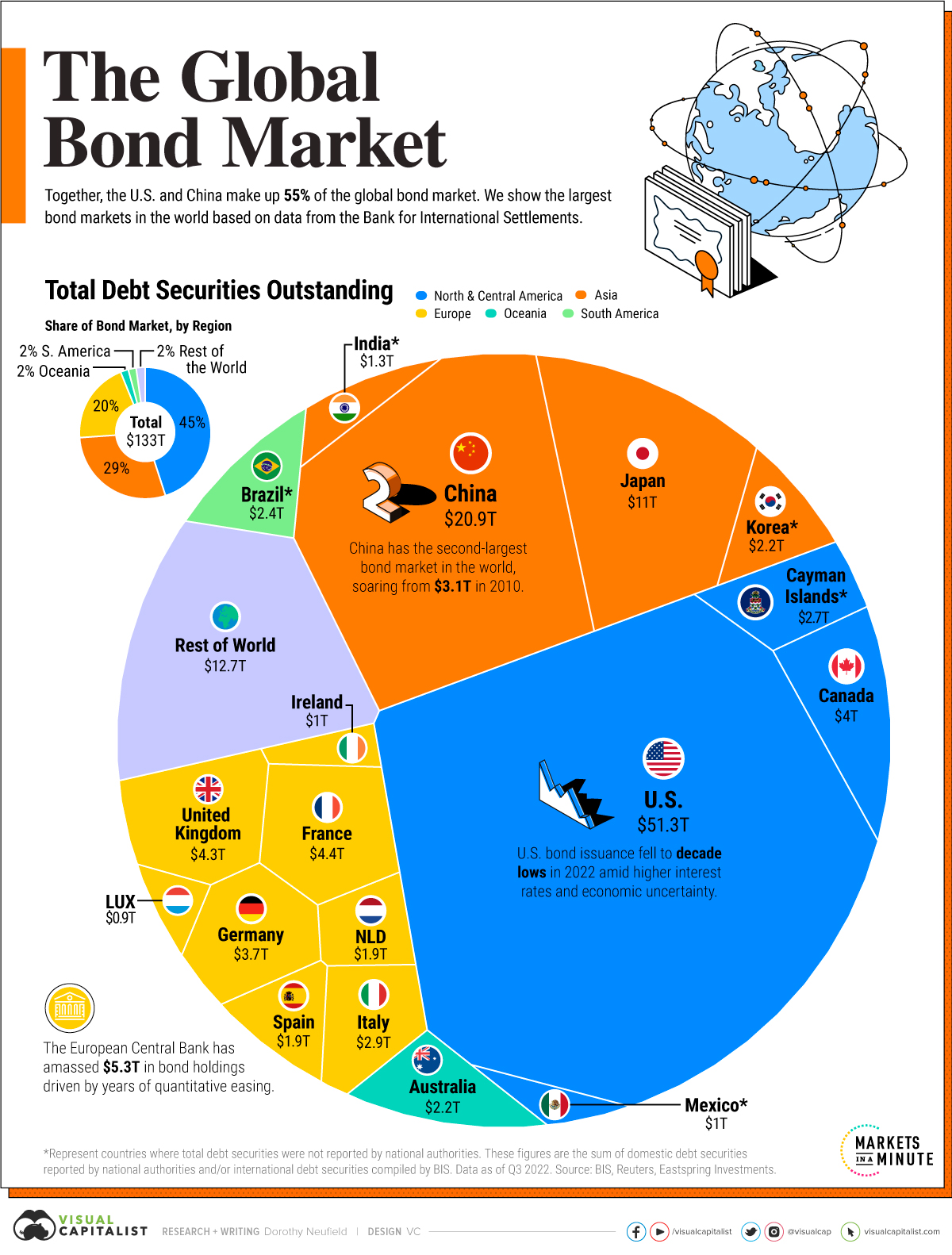

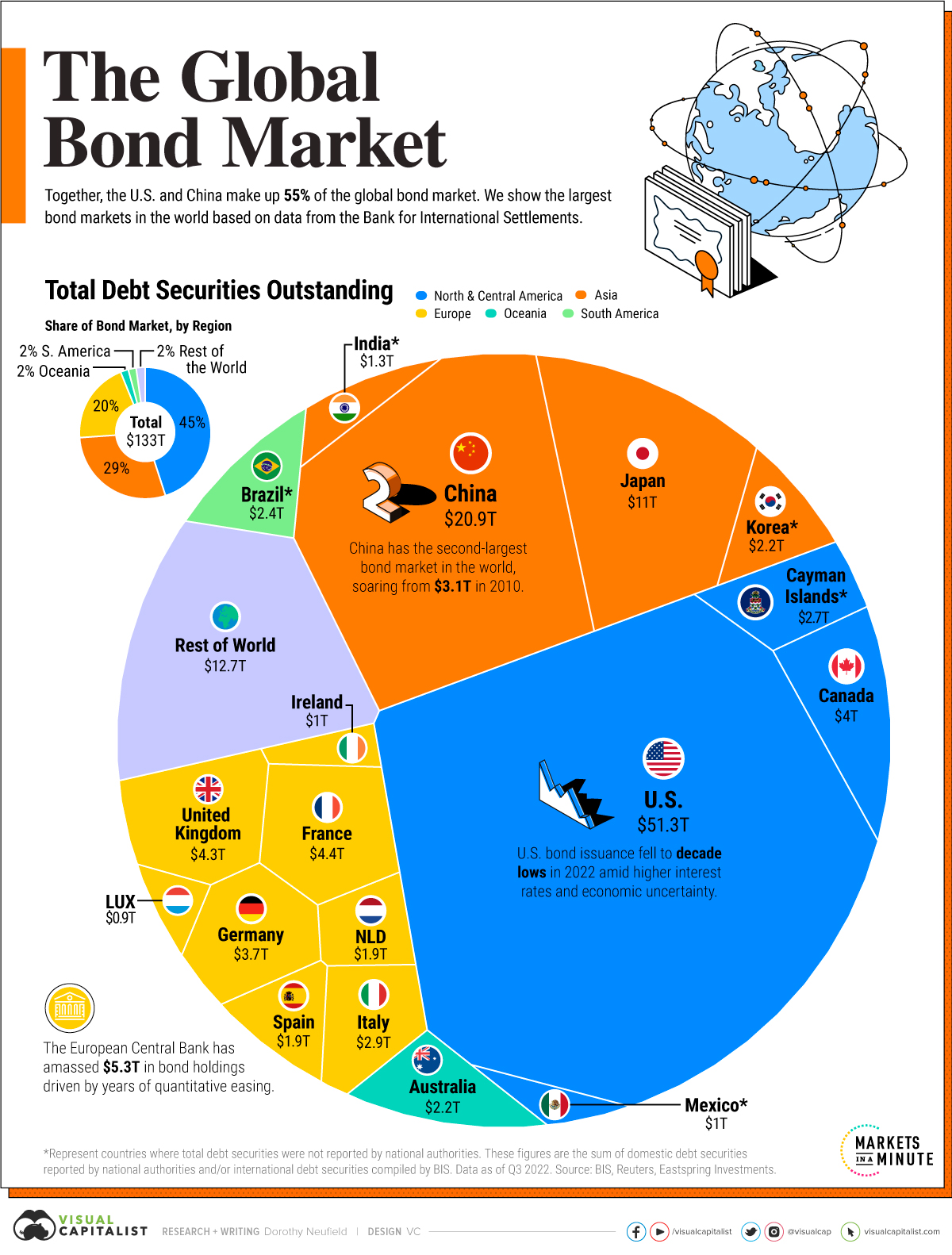

- US Treasury market analysis: The US Treasury market remains the world's largest and most liquid sovereign bond market. The yield curve, which plots yields of Treasuries with different maturities, is closely watched as an indicator of future economic growth. Recent trends show a steepening yield curve, suggesting expectations of future interest rate hikes.

- German Bund market analysis: German Bunds are widely considered safe-haven assets due to Germany's economic stability and the perceived strength of the Eurozone. Their yields generally remain lower than those of US Treasuries, reflecting their lower perceived risk.

- UK Gilt market analysis: The UK gilt market has experienced considerable volatility since Brexit, reflecting uncertainties surrounding the UK's economic future. Recent performance has been influenced by both global economic factors and domestic policy decisions.

These markets offer different risk-reward profiles. US Treasuries offer liquidity but potentially lower yields, while German Bunds provide safety but with lower returns. UK Gilts present a higher-risk/higher-reward proposition, subject to increased volatility. Keywords: US Treasuries, German Bunds, UK Gilts, yield curve, safe haven assets, Brexit, bond market performance.

Swissquote Bank's Perspective on Sovereign Bond Investment Strategies

Swissquote Bank provides comprehensive analysis of the sovereign bond market, offering valuable insights for investors. Based on current market conditions, Swissquote Bank suggests considering the following:

- Diversification strategies for sovereign bond portfolios: Diversification across different sovereign bond issuers and maturities is crucial to mitigate risk. A diversified portfolio can help to reduce the impact of negative events affecting a specific country or currency.

- Risk management techniques for investing in sovereign bonds: Effective risk management requires careful consideration of factors such as interest rate risk, inflation risk, and currency risk. Swissquote Bank advises investors to use tools such as hedging strategies to mitigate these risks.

- Potential opportunities and risks in the current market: While the current market presents challenges, it also offers potential opportunities for savvy investors. Swissquote Bank's experts identify specific areas with promising prospects, while highlighting potential pitfalls. Investors should always consult with a financial advisor before making any investment decisions. Keywords: investment strategy, portfolio diversification, risk management, sovereign bond investment, Swissquote analysis.

Technological Advancements and their Influence on Sovereign Bond Trading

Technology is transforming the sovereign bond trading landscape. Fintech innovations are enhancing market access, increasing efficiency, and creating new opportunities.

- Automated trading platforms and their advantages: Automated trading platforms provide speed and efficiency in executing trades, minimizing transaction costs. They also allow for the implementation of sophisticated trading strategies.

- The role of big data and analytics in bond market analysis: Big data and advanced analytics enable investors to analyze vast amounts of market data to identify trends, predict future movements, and make informed investment decisions.

- The impact of blockchain technology on bond issuance and trading: Blockchain technology has the potential to streamline bond issuance and trading processes, increasing transparency and efficiency. It offers opportunities for improved record-keeping and reduced settlement times. Keywords: fintech, automated trading, big data, blockchain, bond trading technology, market efficiency.

Conclusion: Invest Wisely in Sovereign Bond Markets with Swissquote Bank

The sovereign bond market presents a complex yet potentially rewarding landscape for investors. Understanding the interplay of global economic factors, key market players, and technological advancements is crucial for making informed decisions. Swissquote Bank, with its deep expertise and analytical capabilities, provides the necessary resources and insights to help you navigate this important market. To learn more about sovereign bond investment opportunities and leverage Swissquote Bank's expertise for your investment strategy, visit the Swissquote Bank website today. Keywords: sovereign bond investing, Swissquote Bank, bond market analysis, investment opportunities.

Featured Posts

-

Arusero La Opinion De Alfonso Arus Sobre Melody Representante De Espana En Eurovision 2025

May 19, 2025

Arusero La Opinion De Alfonso Arus Sobre Melody Representante De Espana En Eurovision 2025

May 19, 2025 -

Jennifer Lawrence And Cooke Maroney Spotted Out New Baby Speculation

May 19, 2025

Jennifer Lawrence And Cooke Maroney Spotted Out New Baby Speculation

May 19, 2025 -

Exploring The Silhouettes And Fabrics Of Balmains Fall Winter 2025 26 Collection

May 19, 2025

Exploring The Silhouettes And Fabrics Of Balmains Fall Winter 2025 26 Collection

May 19, 2025 -

E Commerce In The Mobile Age Trends And Predictions

May 19, 2025

E Commerce In The Mobile Age Trends And Predictions

May 19, 2025 -

Photos Jennifer Lawrence And Husband Take A Relaxing Walk

May 19, 2025

Photos Jennifer Lawrence And Husband Take A Relaxing Walk

May 19, 2025