SSE Cuts £3 Billion Spending: Impact On Growth And Future Plans

Table of Contents

Impact on SSE's Renewable Energy Investments

The £3 billion reduction in spending will undoubtedly impact SSE's ambitious renewable energy plans. This has significant implications for the UK's, and potentially wider, transition to a low-carbon energy future.

Reduced Investment in Wind and Solar Projects

- Potential Project Delays or Cancellations: Specific projects, particularly those in the early stages of development, are likely to face delays or even outright cancellation. This could include planned wind farms in Scotland and onshore solar projects across the UK.

- Impact on Net-Zero Targets: SSE's commitment to net-zero emissions by 2045 could be jeopardized. The reduced investment may hinder its ability to meet its ambitious renewable energy targets and contribute to national decarbonization efforts.

- Job Creation Concerns: The scaling back of renewable energy projects will directly impact job creation within the burgeoning renewable energy sector. Fewer projects mean fewer opportunities for skilled workers in construction, maintenance, and operation.

- SSE's Official Statement: While SSE has cited economic pressures as the primary driver for the spending cuts, further clarity on which specific projects have been affected and the reasoning behind each decision is crucial for stakeholders.

Effect on Grid Infrastructure Development

The cuts could significantly impact SSE's investments in upgrading and expanding the electricity grid infrastructure.

- Delayed Grid Upgrades: Essential upgrades and expansions necessary to accommodate the increasing influx of renewable energy sources are likely to be delayed.

- Challenges in Connecting New Renewable Energy Sources: Delays in grid development will hinder the connection of new wind and solar farms, leading to potential bottlenecks and inefficiencies in the energy system.

- Reliability and Resilience Concerns: Underinvestment in grid infrastructure could compromise the reliability and resilience of the UK's energy system, increasing vulnerability to disruptions and power outages.

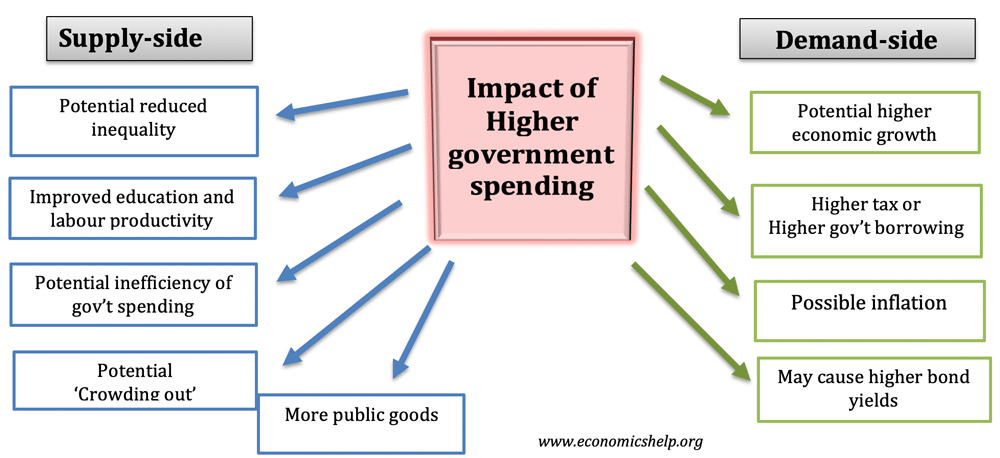

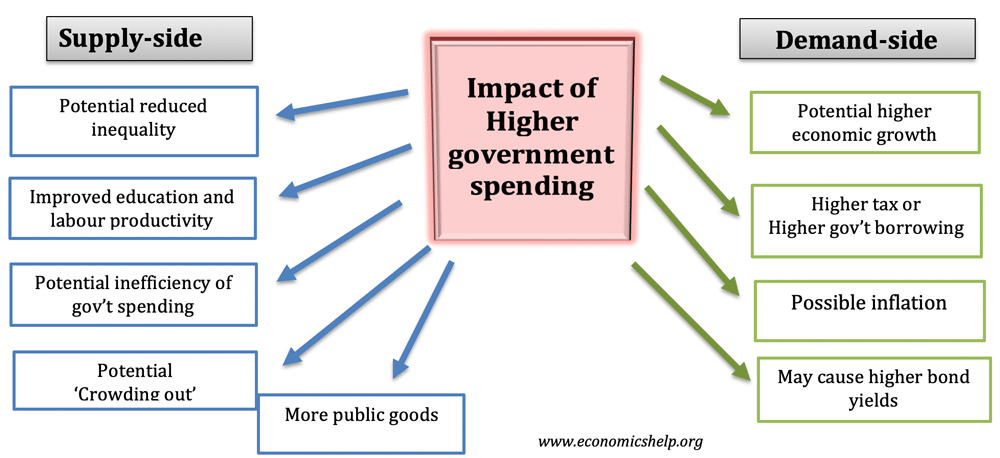

Financial Implications and Shareholder Value

The spending cuts present a complex picture for SSE's financial outlook, presenting both short-term gains and long-term risks.

Short-Term Financial Benefits

- Improved Profitability and Cash Flow: In the short term, the reduced capital expenditure will likely lead to improved profitability and stronger cash flow.

- Impact on Credit Ratings: While short-term financial improvements are possible, sustained cuts could affect SSE’s credit rating, making future borrowing more expensive.

- Immediate Share Price Impact: The market's reaction to the announcement of SSE cuts £3 billion spending will be crucial in determining the immediate impact on the share price. A positive short-term impact may be offset by long-term concerns.

Long-Term Growth Concerns

- Reduced Market Competitiveness: The decreased investment in renewable energy and grid infrastructure could reduce SSE's competitiveness in the long run, potentially hindering its market share.

- Missed Opportunities: Delaying investment in emerging technologies could leave SSE at a disadvantage compared to competitors who continue to invest in innovation.

- Long-Term Growth Risks: While short-term financial benefits might be attractive, the long-term risks associated with underinvestment in crucial areas could significantly hamper future growth prospects.

SSE's Revised Strategic Plan and Future Outlook

SSE's response to the £3 billion spending cut will shape its future strategic direction.

Revised Growth Strategy

- Shifted Priorities: SSE might reallocate resources to focus on areas offering quicker returns or those deemed less capital-intensive, such as energy efficiency programs or customer service enhancements.

- Strategic Partnerships: The company may seek strategic partnerships or collaborations to mitigate the impact of reduced internal investment.

- Focus on Operational Efficiency: Improving operational efficiency and cost-cutting measures will likely become paramount.

Potential Impact on Customers

- Customer Service: Reduced investment could lead to potential cuts in customer service resources, potentially impacting response times and customer satisfaction.

- Energy Prices: The long-term impact on energy prices remains uncertain, although potential inefficiencies in the energy system could lead to price volatility.

- Communication Strategy: SSE needs a transparent communication strategy to manage customer expectations and address concerns arising from the spending cuts.

Analyzing the Long-Term Effects of SSE Cuts £3 Billion Spending

In conclusion, SSE's £3 billion spending cuts present a mixed bag. While there are short-term financial benefits, the long-term implications for renewable energy investment, grid infrastructure, and the company's overall growth strategy are significant and warrant close monitoring. The decision’s impact on customer service, energy prices, and the UK's transition to net-zero must also be carefully considered. The key takeaway is that while financial prudence is important, underinvestment in critical areas could ultimately hinder SSE's long-term competitiveness and sustainability. To stay informed about the evolving situation and the broader implications of SSE cuts £3 billion spending and similar industry-wide actions, subscribe to our updates, follow reputable news sources, and participate in online discussions. Understanding the ramifications of these significant cost-cutting measures is crucial for both investors and energy consumers alike.

Featured Posts

-

Little Britain Cancelled In 2020 Gen Zs Unexpected Obsession Explained

May 22, 2025

Little Britain Cancelled In 2020 Gen Zs Unexpected Obsession Explained

May 22, 2025 -

Peppa Pigs Real Name Revealed Fans React To Shocking Discovery

May 22, 2025

Peppa Pigs Real Name Revealed Fans React To Shocking Discovery

May 22, 2025 -

Us Export Controls Nvidia Ceos Assessment And Praise For Trump

May 22, 2025

Us Export Controls Nvidia Ceos Assessment And Praise For Trump

May 22, 2025 -

Trans Australia Run Is The Record About To Fall

May 22, 2025

Trans Australia Run Is The Record About To Fall

May 22, 2025 -

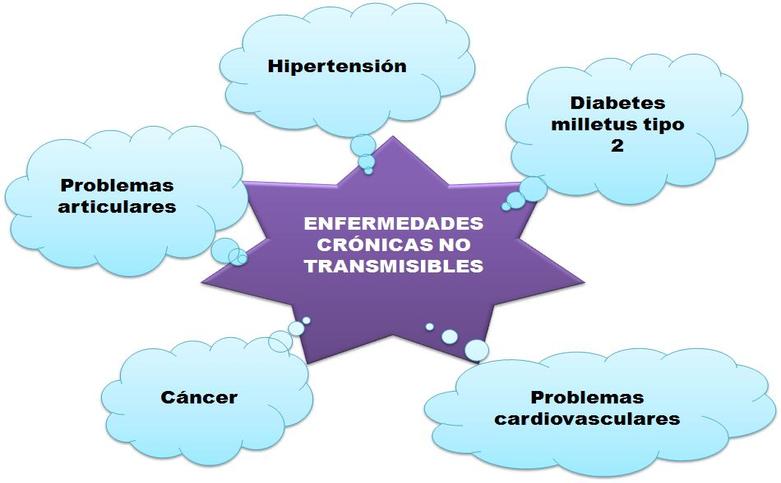

Adios Enfermedades Cronicas El Superalimento Para Una Vida Larga Y Saludable

May 22, 2025

Adios Enfermedades Cronicas El Superalimento Para Una Vida Larga Y Saludable

May 22, 2025

Latest Posts

-

Vidmova Ukrayini U Chlenstvi V Nato Geopolitichni Naslidki Ta Prognozi

May 22, 2025

Vidmova Ukrayini U Chlenstvi V Nato Geopolitichni Naslidki Ta Prognozi

May 22, 2025 -

Selena Gomezs Blake Lively Claim A Wake Up Call For Taylor Swift Amidst Legal Troubles

May 22, 2025

Selena Gomezs Blake Lively Claim A Wake Up Call For Taylor Swift Amidst Legal Troubles

May 22, 2025 -

Vidmova Ukrayini Vid Nato Realni Zagrozi Ta Politichni Naslidki

May 22, 2025

Vidmova Ukrayini Vid Nato Realni Zagrozi Ta Politichni Naslidki

May 22, 2025 -

Nato Nun Tuerkiye Ve Italya Ya Verdigi Ortak Goerev

May 22, 2025

Nato Nun Tuerkiye Ve Italya Ya Verdigi Ortak Goerev

May 22, 2025 -

Exclusive The It Ends With Us Legal Battle And Its Impact On Taylor Swift And Blake Lively

May 22, 2025

Exclusive The It Ends With Us Legal Battle And Its Impact On Taylor Swift And Blake Lively

May 22, 2025