SSE's Response To Slowing Growth: A £3 Billion Spending Reduction

Table of Contents

The £3 Billion Spending Reduction: Details and Breakdown

The sheer scale of SSE's cost-cutting – a £3 billion reduction – is striking. This represents a significant percentage of SSE's overall budget, indicating a proactive approach to navigating the current economic headwinds. While the exact proportion is yet to be fully disclosed, industry analysts estimate it represents approximately 15-20% of their previously planned expenditure. The cuts are designed to improve operational efficiency and bolster the company's financial resilience. Specific areas targeted for reduction include:

-

Renewable Energy Investments: A slowdown in investments in new wind farm projects and other renewable energy initiatives. While SSE remains committed to its sustainability goals, the reduction reflects a prioritization of existing projects over new, potentially riskier ventures. This includes a potential delay or scaling back of several offshore wind farm projects initially planned.

-

Operational Costs: Streamlining of operational processes, aiming for greater efficiency and cost savings across various departments, including administrative and support functions. This could involve staff reductions or outsourcing certain operations.

-

Capital Expenditure: A substantial reduction in capital expenditure, primarily affecting non-essential projects and delaying or canceling investments in certain infrastructure upgrades. This includes a reassessment of planned grid infrastructure enhancements.

SSE's Chief Executive, in a recent statement, emphasized the need for "prudent financial management" in the face of current market uncertainty. The company aims to maintain its dividend payouts while ensuring long-term financial stability through these strategic cost-cutting measures.

Impact on SSE's Future Investments and Growth Strategy

The £3 billion spending reduction will undoubtedly impact SSE's long-term growth strategy. While the company remains dedicated to renewable energy, the reduced investment could slow down its expansion in this crucial sector. The focus will likely shift towards maximizing returns on existing assets and optimizing operational efficiency. This could lead to a more conservative investment approach in the short term, potentially hindering SSE's ambitions for rapid growth in renewable energy generation.

The impact on jobs is a key concern. While SSE hasn't announced widespread layoffs, streamlining operational processes and project cancellations could lead to some job losses or a hiring freeze. The company will likely emphasize reskilling and retraining initiatives to help affected employees transition to new roles within the organization. The long-term effects on SSE’s sustainability commitments are also being debated. Critics argue that reduced investment in new renewables could undermine its green energy goals.

Investor and Market Reaction to the Cost-Cutting Measures

The announcement of the £3 billion spending reduction provoked a mixed reaction in the market. Initially, SSE's share price experienced a slight dip, reflecting investor concerns about the potential impact on future growth. However, the longer-term reaction has been more positive. Many financial analysts view the cost-cutting measures as a necessary step to enhance SSE's financial stability and protect shareholder value in a challenging economic environment. This shows investor confidence in SSE’s management and its ability to navigate through tough times. Several analysts have maintained their positive outlook on SSE's stock, highlighting the strategic nature of the cost-cutting plan. There is currently no visible threat to SSE’s credit rating.

Comparison to Other Energy Companies' Strategies

SSE's response is in line with the broader trend among energy companies grappling with slowing growth. Many major players in the sector have implemented similar cost-cutting measures, including reducing capital expenditure, streamlining operations, and delaying or canceling projects. However, the scale of SSE's reduction is noteworthy. Some competitors have prioritized mergers and acquisitions, while others have focused on exploring new energy sources. This highlights a diversity in approaches within the industry to address the economic downturn.

Conclusion: Navigating the Challenges: SSE's Path Forward

SSE's decision to implement a £3 billion spending reduction reflects the significant challenges facing the energy sector. The cost-cutting measures, while impacting future investments, are intended to improve the company's financial resilience and protect its long-term sustainability. The market reaction, initially cautious, has shown signs of acceptance, suggesting confidence in SSE's ability to manage this challenging period. While potential downsides exist, particularly concerning job security and the pace of renewable energy expansion, the strategy appears designed to navigate the current economic climate and position SSE for future growth. To learn more about SSE's financial strategy and cost-cutting initiatives, visit the official SSE investor relations website. Understanding SSE's growth plans is crucial for investors and industry observers alike.

Featured Posts

-

Severe Thunderstorms Bring Flash Flood Warning To Hampshire And Worcester

May 25, 2025

Severe Thunderstorms Bring Flash Flood Warning To Hampshire And Worcester

May 25, 2025 -

Craig Mc Ilquham Hells Angels A Memorial Service Report

May 25, 2025

Craig Mc Ilquham Hells Angels A Memorial Service Report

May 25, 2025 -

Country Living Awaits Your Escape To The Country Starts Here

May 25, 2025

Country Living Awaits Your Escape To The Country Starts Here

May 25, 2025 -

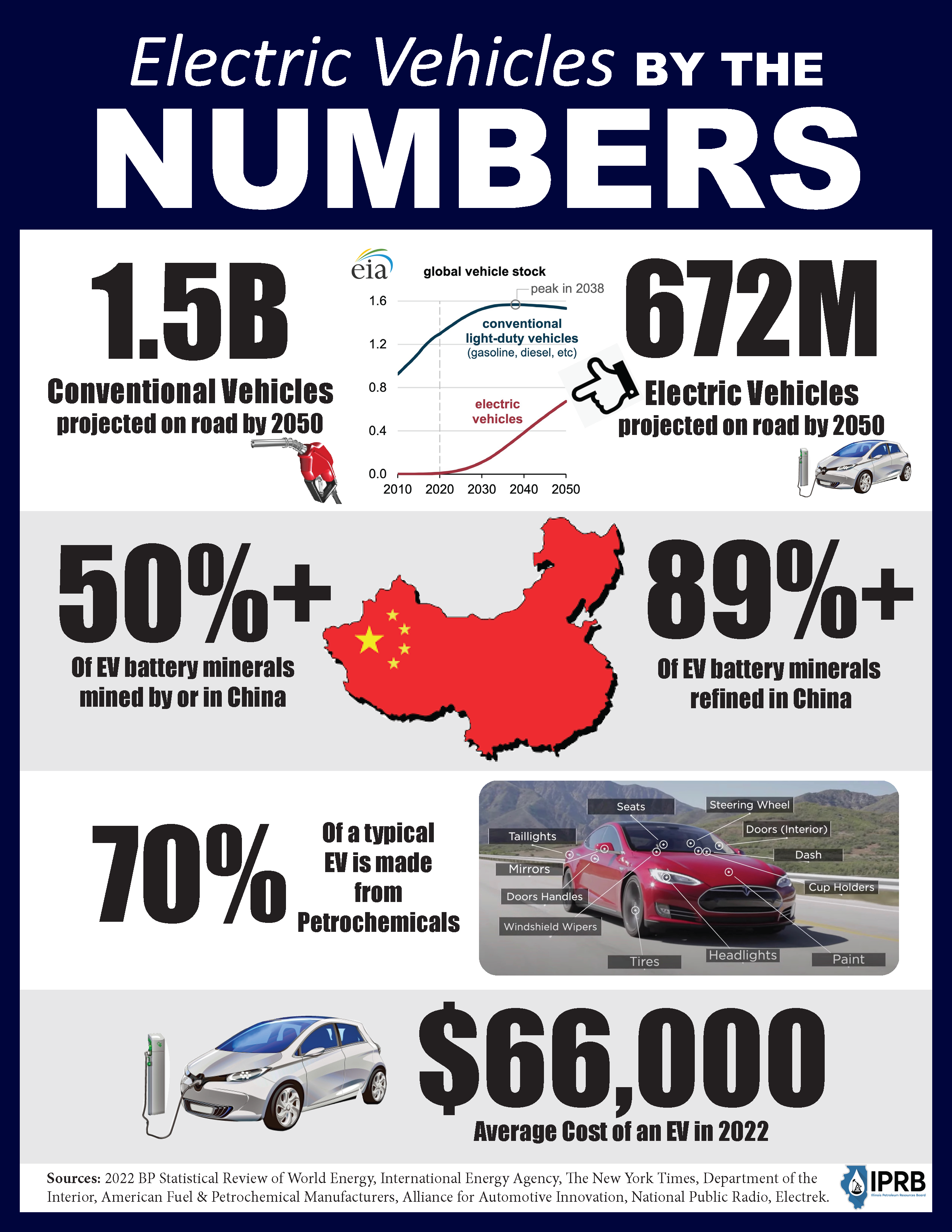

Car Dealers Renew Their Opposition To Electric Vehicle Mandates

May 25, 2025

Car Dealers Renew Their Opposition To Electric Vehicle Mandates

May 25, 2025 -

Finding Affordable Housing Can We Avoid A Market Crash Gregor Robertsons Perspective

May 25, 2025

Finding Affordable Housing Can We Avoid A Market Crash Gregor Robertsons Perspective

May 25, 2025